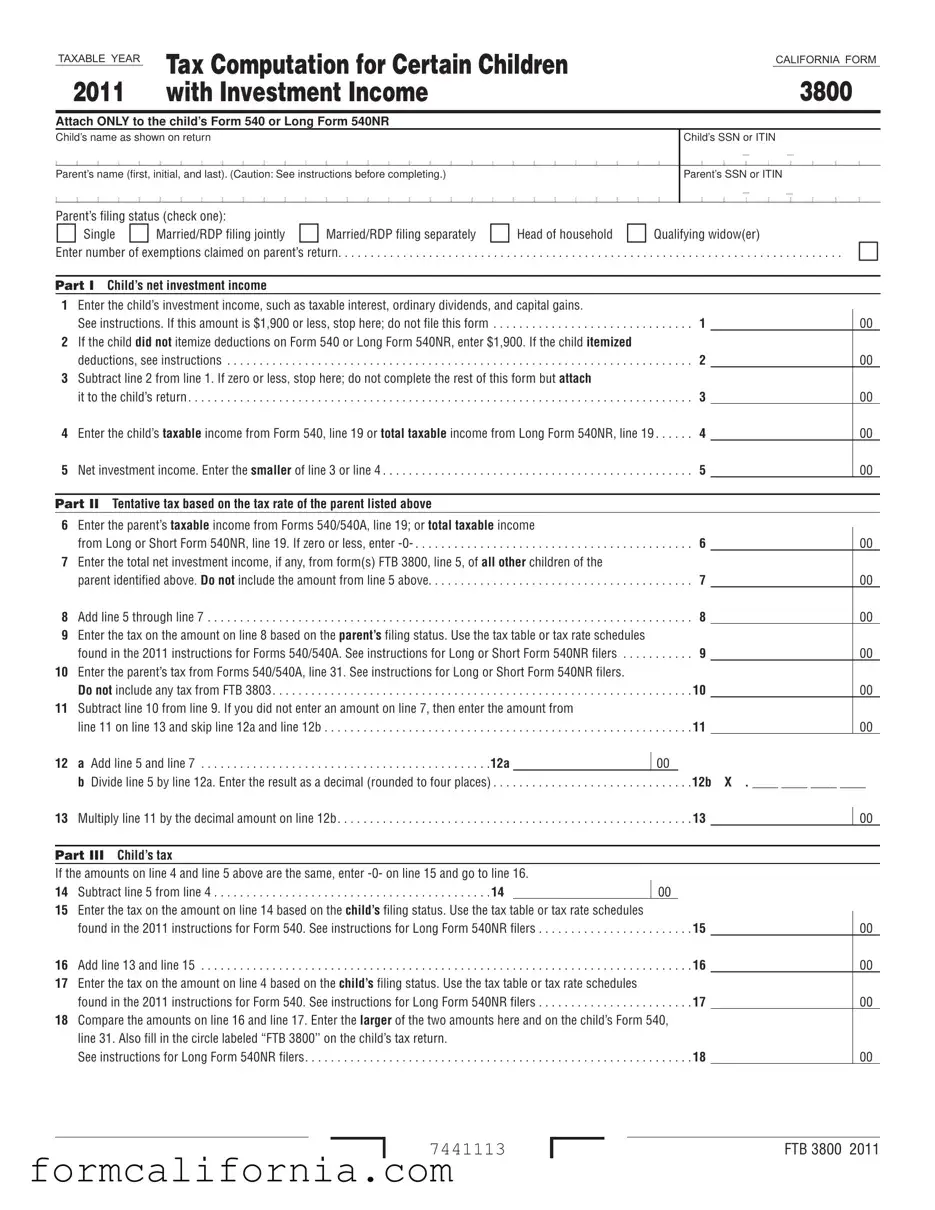

Blank California 3800 PDF Form

Navigating the specifics of the California 3800 form, officially titled "Tax Computation for Certain Children with Investment Income," is an essential endeavor for parents or guardians managing investment income for children under specific age and income criteria. This form, applicable within the state of California, is designed to calculate taxes on investment income exceeding $1,900, for children who are either 18 years and below or students under the age of 24 by the end of the tax year 2011. It attaches to either Form 540, the California Resident Income Tax Return, or Long Form 540NR, the California Nonresident or Part-Year Resident Income Tax Return, depending on the residency status of the child. Its structure encourages accuracy in declaring the child's investment income, like dividends and interest, alongside the parent's financial information to potentially apply the parent's tax rate to the child's investment income where beneficial. Specifically, it requires detailed entries regarding the child's net investment income, the tentative tax based on the parent's tax rate, and eventually, the tax calculation applicable to the child. In addition, it accommodates families with more than one child earning investment income and provides guidelines for parents who might choose to include their child’s income on their return. This underscores the form’s importance in aligning with California’s conforming laws to the Small Business and Work Opportunity Act of 2007, aiming to provide a straightforward method for determining tax obligations for children’s investment income.

Document Preview Example

|

TAXABLE YEAR |

|

Tax Computation for Certain Children |

|

|

|

|

|

|

|

|

|

|

|

|

|

CALIFORNIA FORM |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2011 |

|

|

|

with Investment Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

3800 |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach ONLY to the child’s Form 540 or Long Form 540NR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Child’s name as shown on return |

Child’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Parent’s name (first, initial, and last). (Caution: See instructions before completing.) |

Parent’s SSN or ITIN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parent’s filing status (check one):

Single Married/RDP filing jointly Married/RDP filing separately Head of household Qualifying widow(er)

Enter number of exemptions claimed on parent’s return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I Child’s net investment income

1Enter the child’s investment income, such as taxable interest, ordinary dividends, and capital gains.

See instructions. If this amount is $1,900 or less, stop here; do not file this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2If the child did not itemize deductions on Form 540 or Long Form 540NR, enter $1,900. If the child itemized

deductions, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3Subtract line 2 from line 1. If zero or less, stop here; do not complete the rest of this form but attach

it to the child’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

00

00

4 Enter the child’s taxable income from Form 540, line 19 or total taxable income from Long Form 540NR, line 19 . . . . . . 4

00

5 Net investment income. Enter the smaller of line 3 or line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

Part II Tentative tax based on the tax rate of the parent listed above

6Enter the parent’s taxable income from Forms 540/540A, line 19; or total taxable income

from Long or Short Form 540NR, line 19. If zero or less, enter

7Enter the total net investment income, if any, from form(s) FTB 3800, line 5, of all other children of the

parent identified above. Do not include the amount from line 5 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add line 5 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9Enter the tax on the amount on line 8 based on the parent’s filing status. Use the tax table or tax rate schedules

found in the 2011 instructions for Forms 540/540A. See instructions for Long or Short Form 540NR filers . . . . . . . . . . . 9

10Enter the parent’s tax from Forms 540/540A, line 31. See instructions for Long or Short Form 540NR filers.

Do not include any tax from FTB 3803 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Subtract line 10 from line 9. If you did not enter an amount on line 7, then enter the amount from

line 11 on line 13 and skip line 12a and line 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

00

00

00

00

00

12 a |

Add line 5 and line 7 |

12a |

00 |

b |

Divide line 5 by line 12a. Enter the result as a decimal (rounded to four places) |

. . . . . .12b X . ____ ____ ____ ____ |

|

13 Multiply line 11 by the decimal amount on line 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Part III Child’s tax

If the amounts on line 4 and line 5 above are the same, enter

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14 Subtract line 5 from line 4 |

14 |

|

00 |

15Enter the tax on the amount on line 14 based on the child’s filing status. Use the tax table or tax rate schedules

found in the 2011 instructions for Form 540. See instructions for Long Form 540NR filers . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Add line 13 and line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17Enter the tax on the amount on line 4 based on the child’s filing status. Use the tax table or tax rate schedules

found in the 2011 instructions for Form 540. See instructions for Long Form 540NR filers . . . . . . . . . . . . . . . . . . . . . . . . 17

18Compare the amounts on line 16 and line 17. Enter the larger of the two amounts here and on the child’s Form 540, line 31. Also fill in the circle labeled “FTB 3800’’ on the child’s tax return.

See instructions for Long Form 540NR filers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

00

00

00

00

00

7441113

FTB 3800 2011

Instructions for Form FTB 3800

Tax Computation for Certain Children with Investment Income

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

For taxable years beginning on or after January 1, 2010, California conforms to the provision of the Small Business and Work Opportunity Act of 2007 which increased the age of children to 18 and under or

a student under age 24 for elections made by parents reporting their child’s interest and dividends.

Registered Domestic Partners (RDP) – For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified. When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

Purpose

For certain children, investment income over $1,900 is taxed at the parent’s rate if the parent’s rate is higher. Use form FTB 3800, Tax Computation for Certain Children with Investment Income, to figure the child’s tax.

Complete form FTB 3800 if all of the following apply:

•The child is 18 and under or a student under age 24 at the end of 2011. A child born on January 1, 1994, is considered to be age 18 at the end of 2011. A child born on January 1, 1988, is considered to be age 24 at the end of 2011.

•The child had investment income taxable by California of more than $1,900.

•At least one of the child’s parents was alive at the end of 2011.

If the child uses form FTB 3800, file Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or

If the child does not file form FTB 3800, figure the tax in the normal manner on the child’s Forms 540/540A, or Long or Short Form 540NR.

Parents of children 18 and under or a student under age 24 at the end of 2011, may elect to include the child’s investment income on the parent’s tax return. To make this election, the child must have had income only from interest and dividends. The election is not available if estimated tax payments were made in the child’s name. Get form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends, for more information. If parents make this election, the child will not have to file a California tax return or form FTB 3800.

If you elect to report your child’s income on your federal income tax return, but not on your California income tax return, be sure to make an adjustment on your Schedule CA (540 or 540NR), line 21f.

Specific Line Instructions

Parent’s Name and Social Security Number (SSN) or Individual Taxpayer Identiication Number (ITIN)

If federal Form 8615, Tax for Certain Children Who Have Investment Income of More Than $1,900, was filed with the child’s federal tax return, enter the name and SSN or ITIN of the same parent who was identified at the top of federal Form 8615.

If the child’s parents were married to each other or in an RDP and filed a joint 2011 California tax return, enter the name and SSN or ITIN of the parent who is listed first on the joint return.

If the parents were married or in an RDP but filed separate California tax returns, enter the name and SSN or ITIN of the parent with the higher taxable income.

If the parents were unmarried, treated as unmarried for tax purposes, or separated either by a divorce or separate maintenance decree, enter the name and SSN or ITIN of the parent who had custody of the child for most of 2011.

Exception. If the custodial parent remarried or entered into an RDP and filed a joint return with the new spouse/RDP, enter the name and SSN or ITIN of the person listed first on the joint return, even if that person is not the child’s parent. If the custodial parent and the new spouse/RDP filed separate California tax returns, enter the name and SSN or ITIN of the person with the higher taxable income, even if that person is not the child’s parent.

If the child’s parents were unmarried but lived together during the year with the child, enter the name and SSN or ITIN of the parent who had the higher taxable income.

Part I Child’s Net Investment Income

Line 1 – Enter the child’s investment income. Include income such as taxable interest, dividends, capital gains, rents, annuities, and income received as a beneficiary. In most cases, this will be the same as the amount entered on federal Form 8615, include only income taxable by California. Also, include investment income that was not taxed on the child’s federal tax return but is taxable under California law. For more information, get the instructions for Schedule CA (540 or 540NR), line 8 and line 9.

If the child had earned income (defined below), use the following worksheet to figure the amount to enter on form FTB 3800, line 1.

1.Enter the amount of the child’s adjusted gross income from Form 540, line 17 or

Long Form 540NR, line 17, whichever applies . . . . . . 1 __________

2.Enter the child’s earned income . . . . . . . . . . . . . . . . . . 2 __________

(wages, tips, and other payments received for personal services performed)

3.Subtract line 2 from line 1. Enter the result

here and on form FTB 3800, line 1 . . . . . . . . . . . . . . . 3 __________

Line 2 – If the child itemized deductions, enter the greater of:

$950 plus the portion of the amount on Form 540 or Long Form 540NR, line 18, that is directly connected with the production of the investment income shown on form FTB 3800, line 1 or $1,900.

Part II Tentative Tax Based on Parent’s Tax Rate

If the parent used Form 540 2EZ, refigure your tax by referring to the tax table for Forms 540/540A in order to complete this part. Using Form 540 2EZ will not produce the correct result.

Line 6 – Enter the taxable income from Forms 540/540A, line 19; or total taxable income from Long or Short Form 540NR, line 19 of the parent whose name is shown at the top of form FTB 3800. If the parent’s taxable income is less than zero, enter

Line 7 – If the individual identified as the parent on this form FTB 3800 is also identified as the parent on any other form FTB 3800, add the amounts, if any, from line 5 on each of the other forms FTB 3800 and enter the total on line 7.

Line 9 – Use the California tax table or tax rate schedules in the 2011 instructions for Forms 540/540A to find the tax for the amount on line 8, based on the parent’s filing status.

FTB 3800 2011 Page 1

Long or Short Form 540NR Filers: To figure a revised California adjusted gross income and a tentative tax based on the parent’s tax rate, complete the following worksheet.

AEnter the child’s portion of the net investment income that must be included in the child’s

|

CA adjusted gross income |

____________ |

B |

Enter parent’s CA adjusted gross income from |

|

|

Long or Short Form 540NR, Line 32 |

____________ |

C |

Add line A and line B |

____________ |

D |

Enter the child’s investment income |

|

|

(form FTB 3800, line 5) |

____________ |

E |

Enter parent’s adjusted gross income from all |

|

|

sources from Long or Short Form 540NR, line 17. . . |

____________ |

|

If the parents have other children for whom form |

|

|

FTB 3800 was completed, add the other children’s |

|

|

net investment income to the parent’s CA adjusted |

|

|

gross income on line B and to the parent’s adjusted |

|

|

gross income from all sources on line E. |

|

F |

Add line D and line E |

____________ |

G |

Divide line C by line F (not to exceed 1.0) |

____________ |

HEnter the parent’s total itemized deductions or standard deduction from Long or Short

|

Form 540NR, line 18 |

____________ |

I |

Multiply line H by line G |

____________ |

J |

Subtract line I from line C |

____________ |

K |

Subtract line H from line F |

____________ |

LFind the tax on the amount on line K for the parent’s filing status (Use the tax table or tax rate schedules in the 2011 instructions for

|

Long or Short Form 540NR) |

____________ |

M |

Divide line L by line K |

____________ |

N |

Multiply line J by line M. Enter the result on form |

|

|

FTB 3800, line 9 |

____________ |

Line 10 – Enter the tax shown on the tax return of the parent identified at the top of form FTB 3800 from Forms 540/540A, line 31.

If the parent filed a joint tax return, enter on line 10 the tax shown on that tax return even if the parent’s spouse/RDP is not the child’s parent.

Long Form 540NR Filers: If the parent’s tax amount on Long

Form 540NR, line 37 does not include an amount from form FTB 3803, then enter the parent’s tax amount from Long Form 540NR, line 37.

If the parent’s tax amount on Long Form 540NR, line 37 includes an amount from form FTB 3803, revise the parent’s tax by completing the following worksheet.

A |

Enter the tax from the parent’s |

|

|

Long Form 540NR, line 31 |

____________ |

B |

Enter the tax from form FTB 3803 |

____________ |

C |

Subtract line B from line A |

____________ |

D |

Enter the amount from the parent’s |

|

|

Long Form 540NR, line 19 |

____________ |

E |

Divide line C by line D |

____________ |

F |

Enter the amount from the parent’s |

|

|

Long Form 540NR, line 35 |

____________ |

G |

Multiply line F by line E. Enter the result |

|

|

on form FTB 3800, line 10 |

____________ |

Part III Child’s Tax

Line 15 – Use the California tax table or tax rate schedules in the 2011 instructions for Form 540 to find the tax for the amount on line 14 based on the child’s filing status.

Long Form 540NR Filers: To figure a revised California adjusted gross income for the child and the child’s tax, complete the following worksheet.

A Enter the child’s CA adjusted gross income |

|

from Long Form 540NR, line 32 |

____________ |

BEnter the portion of the child’s net investment income that must be included in the child’s

|

CA adjusted gross income |

____________ |

C |

Subtract line B from line A |

____________ |

D |

Enter the child’s adjusted gross income from all |

|

|

sources from Long Form 540NR, line 17 |

____________ |

E |

Enter the child’s investment income |

|

|

(form FTB 3800, line 5) |

____________ |

F |

Subtract line E from line D |

____________ |

G |

Divide line C by line F (not to exceed 1.0) |

____________ |

HEnter the child’s total itemized deductions or standard deduction from Long or Short

|

Form 540NR, line 18 |

____________ |

I |

Multiply line H by line G |

____________ |

J |

Subtract line I from line C |

____________ |

K |

Subtract line H from line F |

____________ |

LFind the tax on the amount on line K for the child’s filing status (Use the tax table or tax rate schedules in the 2011 instructions for

|

Long Form 540NR) |

____________ |

M |

Divide line L by line K |

____________ |

N |

Multiply line J by line M. Enter the result on |

|

|

form FTB 3800, line 15 |

____________ |

Line 17 – Use the California tax table or tax rate schedules found in the 2011 instructions for Form 540 to find the tax for the amount on line 4, based on the child’s filing status.

Long Form 540NR Filers: |

|

A Enter the amount from form FTB 3800, line 4 |

____________ |

BFind the tax for the amount on line A, by using the tax table or tax rate schedules in the 2011 instructions for Long Form 540NR based on

|

the child’s filing status |

____________ |

C |

Divide line B by line A |

____________ |

D |

Enter the amount from the child’s |

|

|

Long Form 540NR, line 35 |

____________ |

E |

Multiply line D by line C. Enter the result on |

|

|

form FTB 3800, line 17 |

____________ |

Line 18 – Compare the amounts on line 16 and line 17 and enter the larger of the two amounts on line 18. Be sure to fill in the circle labeled “FTB 3800” on Form 540, line 31 of the child’s tax return.

Long Form 540NR Filers: Divide the child’s Long Form 540NR, line 35 by the child’s Long Form 540NR, line 19 to determine the child’s percentage. Divide the larger of line 16 or line 17, by the percentage. Enter the amount on line 18 and on the child’s Long Form 540NR, line 31. Be sure to the fill in the circle labeled “FTB 3800” on the child’s Long Form 540NR.

Note: The amount entered on 540NR, line 31 reflects your tax on total taxable income before applying the California tax rate to your California source income. Follow the instructions for Long Form 540NR to determine your final California tax.

Page 2 FTB 3800 2011

Document Specs

| Fact | Detail |

|---|---|

| Purpose of Form 3800 | Used to calculate tax for certain children with investment income over $1,900 at the parent's rate. |

| Eligibility Criteria | Applies to children who are 18 and under or students under age 24, with investment income taxable by California over $1,900, and whose at least one parent was alive at the end of the tax year. |

| Governing Laws | Based on provisions of the Small Business and Work Opportunity Act of 2007 and conforms to the Internal Revenue Code (IRC) as of January 1, 2009, and the California Revenue and Taxation Code (R&TC). |

| Connection to Other Forms | Must be attached to Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or Part-Year Resident Income Tax Return, of the child. |

Detailed Instructions for Writing California 3800

Filling out California Form 3800 is essential for computing the correct tax amount for certain children with investment income over $1,900. This form must be attached to either Form 540 or Long Form 540NR when filed. The process requires accurate information about the child's and parent's financial details, ensuring that the tax computation aligns with California's tax laws. Here’s how to accurately complete Form 3800:

- Begin with the child’s full name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Input the parent's full name, SSN or ITIN, and mark the appropriate filing status. This information should reflect the parent with a higher taxable income if parents are filing separately.

- Enter the number of exemptions claimed on the parent’s tax return.

- Under Part I - Child’s net investment income, input the child's investment income on line 1. If this figure is $1,900 or less, the form need not be filed.

- If the child did not itemize deductions, enter $1,900 on line 2. Adjust this amount if the child itemized deductions, as per the form's instructions.

- Calculate and enter the child’s net investment income by subtracting line 2 from line 1 on line 3.

- Input the child's taxable income from Form 540, Line 19, or from Long Form 540NR, Line 19 on line 4.

- On line 5, indicate the net investment income, which is the smaller amount between line 3 or line 4.

- Under Part II, enter the parent’s taxable income on line 6 from their respective forms as instructed.

- Add the total net investment income from other children, if applicable, on line 7 and proceed to fill line 8 accordingly.

- Calculate the tentative tax based on the parent's tax rate as instructed for line 9.

- Enter the parent's tax from their tax forms on line 10 and subtract this amount from line 9’s result on line 11.

- Complete the calculations as instructed for lines 12a and 12b, then multiply line 11 by the decimal on line 12b for line 13.

- Under Part III - Child’s Tax, follow the specific instructions based on whether the child's income amounts on lines 4 and 5 are the same. Calculate and fill lines 14 to 18 as per the form guidance.

- Compare the amounts from lines 16 and 17 to determine the entry for line 18, which will then be reported on the child’s Form 540.

After completing the form, review all information for accuracy to ensure the child’s tax computation adheres to current laws and regulations. Attach the completed Form 3800 to the child’s California tax return, either Form 540 or Long Form 540NR, before submission.

Things to Know About This Form

What is California Form 3800?

California Form 3800, known as the Tax Computation for Certain Children with Investment Income, is used to calculate the tax on investment income over $1,900 for children under the age of 18, or students under age 24, using the parent's tax rate if it's higher. This form attaches to the child's Form 540 or Long Form 540NR when filed. The form considers various types of investment income and requires detailed information about the child's and parents' income and tax status.

Who needs to file California Form 3800?

This form must be completed for any child who:

- Was 18 years or younger, or a student under 24 years, by the end of the taxable year 2011.

- Had investment income taxable by California of more than $1,900.

- Had at least one parent alive at the end of 2011.

How do I determine if my child's investment income should be taxed at my rate?

The need to tax a child's investment income at a parent's rate arises if the child's investment income exceeds $1,900. Form 3800 facilitates this process by incorporating the parent's taxable income to calculate the child's tax, potentially at a higher rate. Part II of the form is dedicated to this calculation, requiring information on the parent's taxable income and combined investment income of all qualified children. This tax treatment aims to prevent shifting income to children to take advantage of their lower tax rates.

Can I report my child's investment income on my own tax return?

Yes, parents have the option to report their child's investment income on their (the parent's) own tax return under certain conditions. This option is available if the child's income consists only of interest and dividends and totals less than $10,000. However, this election is not available if estimated tax payments were made in the child's name or if the child is subject to backup withholding. Form FTB 3803 must be completed to make this election. Note that by choosing this option, the child is not required to file a California tax return or Form 3800 for that year.

What information do I need to file California Form 3800?

To accurately complete Form 3800, gather the following information:

- The child’s investment income details, including taxable interest, dividends, capital gains, etc.

- The child's total taxable income from Form 540 or Long Form 540NR.

- The parent's tax information, including taxable income and tax rate.

- Investment income and tax information for any other children for whom Form 3800 is being filed, if applicable.

Common mistakes

When it comes to navigating tax forms, the process can be intricate and sometimes overwhelming. The California Form 3800, designed for calculating the tax on certain children's investment income, is no exception. To ensure precision and avoid common pitfalls, here’s an educational snapshot of 10 frequent mistakes people make while filling out this form:

- Overlooking the Taxable Income Threshold: Many forget that Form 3800 is only necessary if the child’s investment income exceeds $1,900. This initial step is crucial to determine the need for completing the form.

- Not Attaching to the Correct Form: Form 3800 must be attached to the child’s Form 540 or Long Form 540NR. Failing to attach it to the appropriate return can lead to processing delays or errors in tax calculation.

- Incorrect Parent Information: The parent's name, SSN or ITIN, and filing status need to accurately reflect those on the parent’s return. Mistakes here can affect the tax calculations.

- Misunderstanding Investment Income: Properly reporting all taxable interest, dividends, capital gains, rents, and other applicable income is essential. Omitting or inaccurately reporting investment income can lead directly to incorrect tax outcomes.

- Itemized Deductions Confusion: If the child itemized deductions, correctly calculating the deduction related to investment income is a common stumbling block. It's important to follow the specific instructions based on whether the child itemized or not.

- Overlooking Other Children’s Investment Income: For families with multiple children filling out Form 3800, parents must accurately include and calculate each child’s investment income. This aggregated approach can complicate the process.

- Incorrect Taxable Income Entry: Parents’ taxable income must be correctly entered in Part II. Using the wrong year’s information or misinterpreting what constitutes taxable income can skew the tax rate applied.

- Calculating the Child’s Tax Incorrectly: Part III demands careful attention to calculate the child’s tax accurately, based on the smaller of the child's net investment income or taxable income, and applying the correct tax tables or schedules.

- Not Using the Correct Tax Table or Rate Schedules: The tax must be computed using the tax table or rate schedules found in the instructions for the forms mentioned in the 3800 form. Using outdated or incorrect tables can lead to incorrect tax amounts.

- Failing to Compare Final Tax Amounts Correctly: Before concluding, one must compare the tax amounts on line 16 and line 17 to enter the larger on line 18, ensuring the child’s tax return reflects the accurate tax responsibility.

Understanding and navigating these common pitfalls is key to accurately completing California Form 3800. Doing so ensures compliance with state tax laws and secures the financial well-being of the families involved. Remember, when in doubt, seeking advice from a tax professional can offer clarity and peace of mind through the process.

Documents used along the form

When handling California Form 3800, which calculates the tax for certain children with investment income, individuals often find themselves needing additional documentation to accurately complete and accompany this form. The collaborative nature of tax filing necessitates the integration of various forms and documents, each serving a distinct purpose yet contributing collectively to the comprehensive tax narrative of the taxpayer.

- Form 540 or Long Form 540NR: These are California Resident Income Tax Return and California Nonresident or Part-Year Resident Income Tax Return, respectively. These forms are fundamental as Form 3800 is an attachment to either, contingent on the residency status of the filer.

- Form FTB 3803, Parents' Election to Report Child’s Interest and Dividends: This form is crucial for parents who opt to include their child's investment income on their own tax returns instead of filing separately for the child, affecting the need for Form 3800.

- Schedule CA (540 or 540NR): This schedule is utilized for adjustments to income, allowing taxpayers to reconcile differences between federal and state taxable income. It may be essential for accurately reporting investment income on Form 3800.

- Form 8615, Tax for Certain Children Who Have Investment Income of More Than $1,900: Although a federal form, it is pertinent in situations where the child's investment income necessitates tax computation at the parent's rate, paralleling the function of Form 3800.

- FTB Pub. 737, Tax Information for Registered Domestic Partners: This publication provides guidance for registered domestic partners in California, including how to report income, deductions, and credits. It's valuable for understanding the tax implications of investment income for children of registered domestic partners.

- Form 540 2EZ: While not directly connected to the tax calculation for children with investment income, this form may be referenced for parental tax information if simpler filing options were exercised. It offers a streamlined process for those with straightforward tax situations.

Each document or form plays an integral role in ensuring that the tax liability is determined accurately and in compliance with the law. Whether it involves reporting additional sources of income, adjusting for state-specific tax provisions, or electing for simplified reporting methods, the interconnectedness of these forms underscores the complexity inherent in tax preparation. For individuals navigating the intricacies of Form 3800 and associated documentation, awareness and understanding of each component greatly facilitate the process, ensuring both accuracy and adherence to regulatory obligations.

Similar forms

The California Form 3800 is akin to the federal Form 8615, "Tax for Certain Children Who Have Investment Income of More Than $2,200." Both forms are designed to calculate tax on a child's investment income at the parents' tax rate if that rate is higher than the child's. This approach, commonly referred to as the "kiddie tax," is aimed to prevent parents from shifting income to their children to take advantage of a lower tax rate. While each form operates within its respective tax system—federal for Form 8615 and California state for Form 3800—their purpose and calculation method are remarkably similar, focusing on aligning the tax rate applied to a child's investment income with that of their parents' higher tax rate.

Comparable to Form 3800 is the Form 1040, U.S. Individual Income Tax Return, particularly for instances where taxpayers are computing tax on investment income. While Form 1040 covers a broad spectrum of income types and tax calculations for individuals, part of its use aligns with Form 3800 when reporting a child's investment income on the parent's return. The 1040 form encompasses all taxable income and allows for various adjustments, deductions, and credits, providing a comprehensive tax calculation platform which includes, but is not limited to, aspects of children's investment income taxation as addressed in Form 3800.

Form 540, California Resident Income Tax Return, is another document closely associated with Form 3800. Form 540 serves as the primary income tax form for California residents, capturing all sources of income, deductions, and credits to calculate the state income tax liability. When a child's investment income necessitates the use of Form 3800, the results of the 3800 calculations directly impact the tax liability reported on Form 540. This interconnection ensures that the child's income is taxed appropriately, reflecting either the child's tax rate or the parent's if using the 3800 form's "kiddie tax" methodology.

Additionally, the Form 540NR, California Nonresident or Part-Year Resident Income Tax Return, shares similarities with Form 3800 when nonresident or part-year residents are required to report their children's investment income. Like Form 540, Form 540NR accounts for income earned within the state of California, and the inclusion of Form 3800's calculations for certain children's investment income ensures accurate taxation in line with state laws. The overlap between these forms guarantees that nonresident and part-year residents comply with California's tax regulations on all applicable income.

The Form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends, is directly related to Form 3800, offering an alternative approach for reporting a child's investment income. Instead of filing Form 3800, parents may choose to report their child's interest and dividends directly on their own tax returns by using Form 3803. This option simplifies the process by consolidating the income reporting and tax calculation but is restricted to children's income solely from interest and dividends, highlighting a tailored yet distinct option comparable to the functions of Form 3800.

Form 540 2EZ, California Resident Income Tax Return for Single and Joint Filers with No Dependents, though simpler and more streamlined compared to the comprehensive Form 540, intersects with Form 3800 in its utility for taxpayers reporting investment income. When certain conditions are met, including the reporting of a child's investment income on a parent's return, Form 3800's calculations may supplement those in Form 540 2EZ. However, due to the simplified nature of Form 540 2EZ, intricate tax situations like those addressed by Form 3800 may necessitate transitioning to the more detailed Form 540 to accurately reflect a taxpayer’s financial situation and obligations.

Finally, the relationship between Form 3800 and the Schedule CA (540 or 540NR), California Adjustments – Residents or Nonresidents, is notable. Schedule CA allows taxpayers to make adjustments to their federal adjusted gross income (AGI) and taxable income for California tax purposes. When investment income of a child is calculated on Form 3800 and needs to be reported on the parent's return, Schedule CA may be used to reconcile any differences between federal and state tax treatment of this income. This ensures that taxpayers accurately report their income for state taxation, accommodating for instances where California tax law diverges from federal regulations.

Dos and Don'ts

When it comes to filling out California Form 3800, there are certain do's and don'ts you should be aware of to ensure the process is smooth and error-free. Here's a helpful guide:

Do:- Review the child’s investment income carefully. Ensure that all taxable interest, dividends, capital gains, and other investment income amounts are accurate and complete.

- Confirm the child’s age and student status. Form 3800 is specific to children who are either 18 and under or students under age 24 at the end of the tax year. Verify that the child meets these criteria.

- Verify the parent’s information. Double-check that the parent’s name, SSN or ITIN, and filing status are correctly entered. If the child's parents are married/RDP filing jointly, ensure the parent listed is the one with the higher taxable income if filing separately.

- Calculate investment income and deductions accurately. If the child did not itemize deductions, don’t forget to enter $1,900 on line 2 as specified, or calculate accordingly if they did itemize.

- Overlook the investment income limit. If the child’s investment income is $1,900 or less, do not file this form. This threshold is crucial in determining the need to file Form 3800.

- Ignore the parent's taxable income. When filling out Part II, ensure that the parent's taxable income is accurately reported, as it affects the child’s tentative tax calculation.

- Miscalculate the child’s net investment income. Be meticulous with line 3, subtracting line 2 from line 1. This calculation influences whether further parts of the form need completion.

- Forget to attach Form 3800 to the child’s tax return. If required, this form should be attached to the child's Form 540 or Long Form 540NR, as it contains crucial data for tax computation.

Misconceptions

There are several misconceptions about the California Form 3800, Tax Computation for Certain Children with Investment Income, that merit correction and clarification. Here’s a detailed look at these misunderstandings:

- Misconception 1: The California Form 3800 is required for all children with investment income.

Form 3800 is designed specifically for children who have more than $1,900 in investment income and meet certain other criteria related to their age and parental status at the end of the tax year. Children with investment income of $1,900 or less are not required to file this form.

- Misconception 2: Parents' tax information is not important for completing Form 3800.

On the contrary, a child's tax on Form 3800 may be calculated using the parent's tax rate if it would result in a higher tax. Therefore, accurate information about the parents’ taxable income and filing status is crucial for correctly completing Form 3800.

- Misconception 3: Form 3800 is only applicable if the child's parents are married.

Form 3800 can be used regardless of the parents' marital status. It requires the information of the parent with higher taxable income or, if filing jointly, the first parent listed on the joint return. This is true for parents whether they are married, single, or registered domestic partners.

- Misconception 4: All types of the child’s income must be reported on Form 3800.

Form 3800 is specifically for reporting a child's net investment income. While it does ask for the child's total taxable income for certain calculations, the primary focus is on investment income, such as interest, dividends, and capital gains, not on wages or earned income.

- Misconception 5: The child's investment income does not impact the parents' taxable income.

While the child's investment income is reported on Form 3800, it can affect the calculation of the tax based on the parent’s taxable income, especially if the child's income is taxed at the parent’s rate.

- Misconcession 6: Filing Form 3800 is independent of reporting on the child's or parents' main tax return.

Form 3800 must be attached to the child's Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Hence, it is not an independent or optional submission but an integral part of the child’s or parent’s tax filing when applicable.

- Misconception 7: Parents can opt to report their child’s investment income on their own return without implications.

Parents have the option to report their child's investment income on their tax return using Form 3803, Parents' Election to Report Child's Interest and Dividends, under certain conditions. However, this election can have tax implications and is not available if estimated tax payments were made in the child’s name, highlighting the need for careful consideration.

- Misconception 8: Any parent’s information can be used if the child’s parents are divorced.

The parent whose information should be used on Form 3800 is specifically designated based on custody arrangements and taxable income, rather than either parent’s information being acceptable.

- Misconception 9: Form 3800 only affects the child’s tax return.

While primarily concerned with the child's investment income, Form 3800's requirement to use the parent's tax rate can lead to an increase in the family's overall tax liability, affecting both the child's and parents' financial situation.

In conclusion, understanding the specifics and implications of California Form 3800 is critical for accurately reporting certain children’s investment income and ensuring compliance with state tax regulations.

Key takeaways

When managing the California Form 3800, Tax Computation for Certain Children with Investment Income, it's important to grasp the key aspects and criteria for its use. Here are essential takeaways to consider:

- Form 3800 is applied to certain children with investment income greater than $1,900, using the parent's tax rate if higher.

- This form should be attached only to a child's Form 540 or Long Form 540NR, reflecting California resident or nonresident/part-year resident income tax returns.

- The form is necessary if the child is under 18 or a student under 24 by the end of the taxable year, and has more than $1,900 in investment income.

- Investment income includes taxable interests, ordinary dividends, capital gains, rents, annuities, and beneficiary income, but only the amount that is taxable by California.

- To complete the form accurately, both the child's and one parent's names and Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs) are required.

- If a child did not itemize deductions, a standard deduction of $1,900 is applicable; this amount changes if the child itemized deductions.

- Parents filing jointly should list the parent first whose SSN or ITIN matches the one provided on federal Form 8615, if applicable.

- The child's tax is computed based on the net investment income or the child’s taxable income, whichever is smaller, and then adjusted through the parent's taxable income.

- For families with multiple children filing Form 3800, parents’ taxable income and children's combined investment income affect the calculation.

- In scenarios where the child's taxable and investment incomes are the same, a specific section within the form allows for the simplification of tax calculation.

- Ultimately, the tax to be reported on the child’s Form 540 is the larger outcome of two possible calculations provided within the Form 3800.

- Note that for children and parents who are nonresidents or part-year residents of California, additional instructions and calculations are provided to adjust for their specific situations.

Understanding these key points ensures accurate completion and submission of Form 3800, aiding in the appropriate tax treatment of certain children's investment income in California.

Discover More PDFs

What Is a Dmv Sr1 Form - Required by California law for accidents with over $1,000 in damages or any injuries, to be filed within 10 days of the incident.

California 3528 A - Details crucial information, including escrow and property details, required to process and approve the tax credit.

Ftb 3803 - Eligible for use when a child's income consists solely of interest and dividends and falls below a specific income threshold.