Blank California 3725 PDF Form

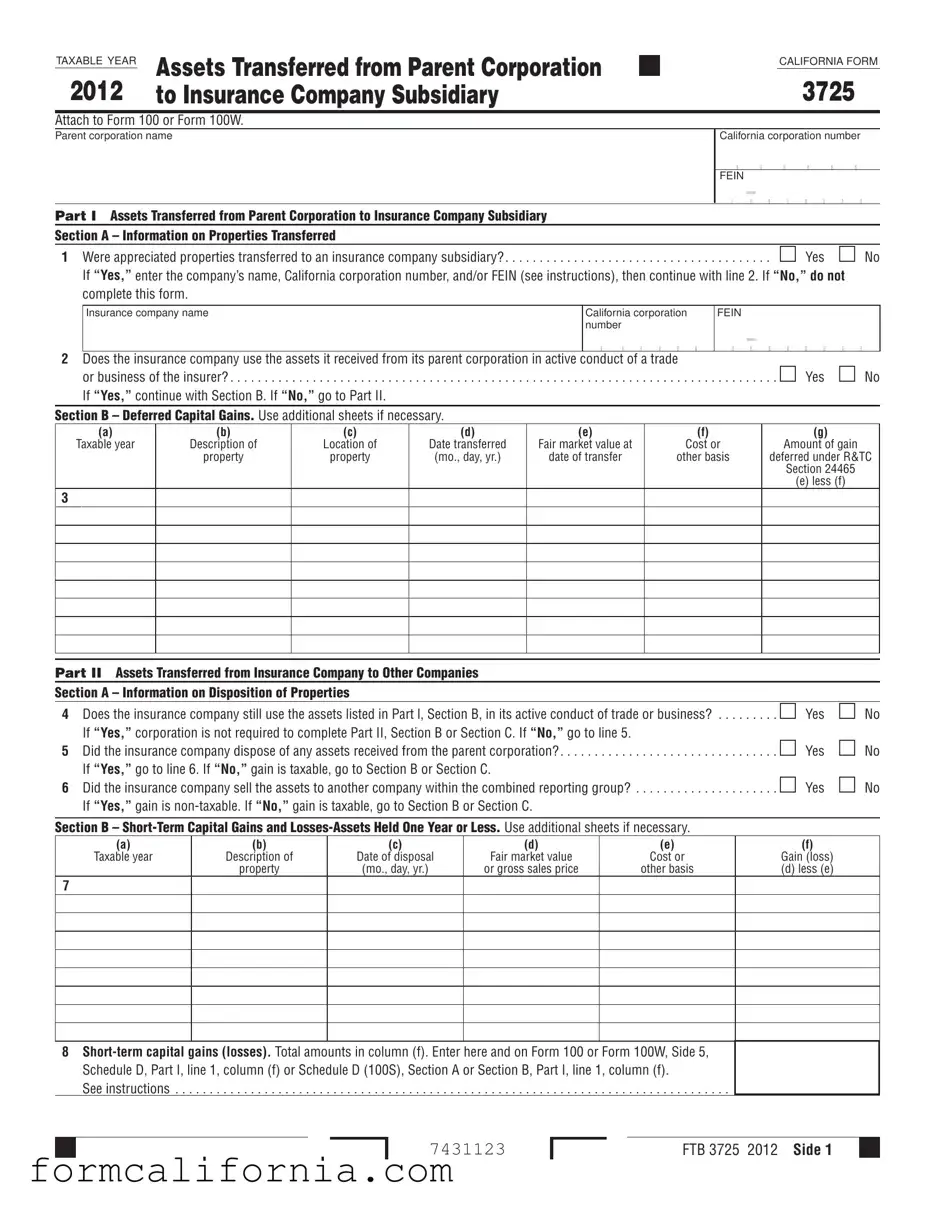

The California Form 3725 plays a critical role in the financial operations of businesses in the state, particularly for parent corporations with insurance company subsidiaries. This form is an essential document for tracking assets transferred from a parent corporation to its insurance company subsidiary and is instrumental in calculating capital gains or losses on those assets. It becomes applicable when a parent corporation, as per the 2012 tax year stipulations, transfers appreciated properties to its insurance subsidiary, aiming to defer the gain on such transfers under specific conditions outlined by the California Revenue and Taxation Code (R&TC) Section 24465. Conditions demand that the transferred property must be actively used in the insurer's trade or business, among others, to qualify for deferred gain treatment. Additionally, the form assists in identifying whether assets, post-transfer, are still used in active trade or business by the insurance company, a critical factor in determining tax obligations. It also encompasses sections that detail the process for reporting both short-term and long-term capital gains or losses, explicitly tying the financial implications of asset transfers and disposals within and outside the commonly controlled group. Through Form 3725, parent corporations are provided with a structured approach to managing and reporting significant asset movements, ensuring compliance with state tax regulations while leveraging deferment provisions under specific conditions.

Document Preview Example

TAXABLE YEAR |

Assets Transferred from Parent Corporation |

|

CALIFORNIA FORM |

|

2012 |

3725 |

|||

to Insurance Company Subsidiary |

||||

Attach to Form 100 or Form 100W.

Parent corporation name

California corporation number

FEIN

Part I Assets Transferred from Parent Corporation to Insurance Company Subsidiary

Section A – Information on Properties Transferred

Were appreciated properties transferred to an insurance company subsidiary? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No If “Yes,” enter the company’s name, California corporation number, and/or FEIN (see instructions), then continue with line 2. If “No,” do not complete this form.

Insurance company name

California corporation number

FEIN

2 Does the insurance company use the assets it received from its parent corporation in active conduct of a trade |

Yes No |

or business of the insurer? |

|

If “Yes,” continue with Section B. If “No,” go to Part II. |

|

Section B – Deferred Capital Gains. Use additional sheets if necessary.

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

Taxable year |

Description of |

Location of |

Date transferred |

Fair market value at |

Cost or |

Amount of gain |

|

property |

property |

(mo., day, yr.) |

date of transfer |

other basis |

deferred under R&TC |

|

|

|

|

|

|

Section 24465 |

|

|

|

|

|

|

(e) less (f) |

3

Part II Assets Transferred from Insurance Company to Other Companies

Section A – Information on Disposition of Properties

|

|

|

|

4 |

Does the insurance company still use the assets listed in Part l, Section B, in its active conduct of trade or business? |

Yes |

No |

|

If “Yes,” corporation is not required to complete Part II, Section B or Section C. If “No,” go to line 5. |

Yes |

No |

5 |

Did the insurance company dispose of any assets received from the parent corporation? |

||

|

If “Yes,” go to line 6. If “No,” gain is taxable, go to Section B or Section C. |

Yes |

No |

6 |

Did the insurance company sell the assets to another company within the combined reporting group? |

If “Yes,” gain is

Section B –

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

Taxable year |

Description of |

Date of disposal |

Fair market value |

Cost or |

Gain (loss) |

|

property |

(mo., day, yr.) |

or gross sales price |

other basis |

(d) less (e) |

7

8

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7431123

FTB 3725 2012 Side

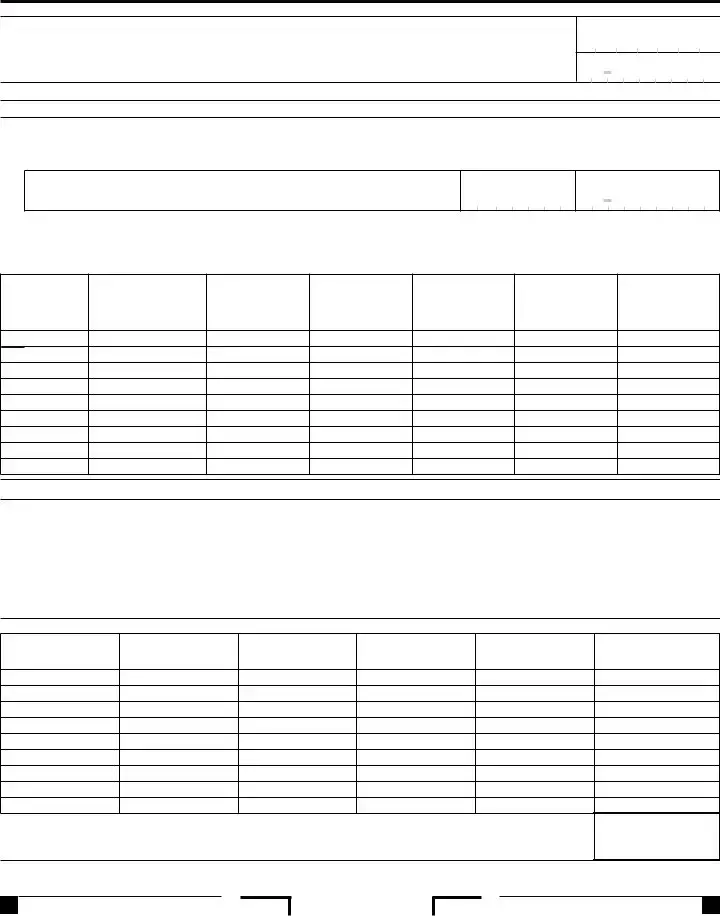

Section C –

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

Taxable year |

Description of |

Date of disposal |

Fair market value |

Cost or |

Gain (loss) |

|

property |

(mo., day, yr.) |

or gross sales price |

other basis |

(d) less (e) |

9

0

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

General Information

A Purpose

Use form FTB 3725, Assets Transferred from Parent Corporation to Insurance Company Subsidiary, to track the assets transferred from a parent corporation to an insurance company subsidiary. In addition, use this form to figure capital gains (losses) if the parent corporation transferred assets to an insurance company subsidiary beginning on or after June 23 2004.

California Revenue and Taxation Code (R&TC) Section 24465 provides that when a parent corporation transfers appreciated property to an insurance company subsidiary, the gain is deferred if the property transferred to the insurer is used in the active conduct of

a trade or business of the insurer. The gain must be recognized as income if any of the following apply:

•The transferred property is no longer owned by an insurer in the taxpayer’s commonly controlled group (or a member of the taxpayer’s combined reporting group).

•The property is no longer used in the active conduct of the insurer’s trade or business (or the trade or business of another member in the taxpayer’s combined reporting group).

•The holder of the property is no longer held by an insurer in the commonly controlled group of the transferor (or a member of the taxpayer’s combined reporting group).

R&TC Section 24465 applies to transactions entered into on or after June 23, 2004.

B Definitions

1.Appreciated property – Appreciated property means property whose fair market value (FMV), as of the date of the transfer, exceeds its adjusted basis as of that date.

2.Commonly controlled group – Commonly controlled group exists when stock possessing more than 50% of the voting power is owned, or constructively owned,

by a common parent corporation (or chains of corporations connected through the common parent) or by members of the same family, see R&TC Section 25105. Also, a commonly controlled group includes corporations that are stapled entities,

see R&TC Section 25105(b)(3). Special rules are provided in R&TC Section 25105 for partnerships, trusts, and transfers of voting power by proxy, voting trust, written shareholder agreement, etc.

Speciic Line Instructions

Part I – Assets Transferred from Parent Corporation to Insurance Company Subsidiary

Section A – Information on

Properties Transferred

Line – Enter the insurance company’s California corporation number or federal employer identification number (FEIN). If the insurance company does not have one of these numbers, enter “not applicable” and continue with line 2.

Section B – Deferred Capital Gains

Line 3, column (b) – Description of property. Describe the assets the parent corporation transferred to an insurance company subsidiary.

Line 3, column (e) – Fair market value at date of transfer. FMV is the price that the property would sell for in the open market.

Line 3, column (f) – Cost or other basis. In general, the cost or other basis is the cost of the property plus purchase commissions and improvements minus depreciation, amortization, and depletion. Enter the cost or adjusted basis of the asset for California purpose.

Part II – Assets Transferred from Insurance Company to Other Companies

Section B –

Section C –

Report

Line 7 and Line 9, column (b) – Description of property. Describe the assets that the insurance company sells to another company; or the transferred assets that the insurance company does not use in its active trade or business.

Line 7 and Line 9, column (d) – Fair market value or gross sales price. Enter the FMV of the assets as of the date that the insurance company no longer uses the assets in its active trade or business. Or, enter the gross sales price of the assets if the insurance company sells the assets to another company.

Line 8 –

Line 0 –

Side 2 FTB 3725 2012

7432123

Document Specs

| Fact | Detail |

|---|---|

| Form Number | California Form 3725 |

| Purpose | To track and calculate capital gains or losses for assets transferred from a parent corporation to an insurance company subsidiary. |

| Applicable Law | California Revenue and Taxation Code (R&TC) Section 24465 |

| Key Requirement | Form 3725 is required if appreciated property is transferred to an insurance company subsidiary and is used in active trade or business. |

| Effective Date | Applies to transactions entered into on or after June 23, 2004. |

| Capital Gains or Losses | Gains or losses must be recognized if the property is no longer owned or used by the insurer in active trade or sold outside the commonly controlled group. |

| Attachment |

Detailed Instructions for Writing California 3725

Filling out the California Form 3725 is a crucial step for corporations that have transferred assets from a parent corporation to an insurance company subsidiary. This process helps in tracking assets and calculating capital gains or losses resulting from such transfers. The form is necessary for ensuring compliance with the California Revenue and Taxation Code Section 24465, which mandates the recognition of gain under specific conditions. Here are the steps to fill out Form 3725 accurately.

- Start with Part I: Fill out the basic information about the parent corporation, including the parent corporation name, California corporation number, and the Federal Employer Identification Number (FEIN).

- Section A – Information on Properties Transferred:

- Answer whether appreciated properties were transferred to an insurance company subsidiary. If 'Yes,' provide the insurance company’s name, California corporation number, and/or FEIN, then proceed to line 2. If 'No,' skip the rest of the form.

- Indicate whether the insurance company uses the assets in active conduct of a trade or business. If 'Yes,' move to Section B.

- Section B – Deferred Capital Gains: Use additional sheets if necessary and provide details for each asset transferred, including the taxable year, description of property, location, date transferred, fair market value at the date of transfer, cost or other basis, and amount of gain deferred under R&TC Section 24465.

- Proceed to Part II if the insurance company has transferred assets to other companies or if the assets are no longer used in its active trade or business.

- Part II – Assets Transferred from Insurance Company to Other Companies:

- Answer the question about the current use of assets. If 'Yes,' no need to complete Part II, Section B or C.

- Indicate whether any assets were disposed of. If 'Yes,' provide details in the subsequent sections as appropriate.

- Specify if the assets were sold to another company within the combined reporting group. Depending on the answer, gain may be taxable or non-taxable, and proceed to the relevant sections.

- Section B and C: Fill in details about short-term and long-term capital gains or losses, including the taxable year, description of property, date of disposal, fair market value or gross sales price, cost or other basis, and gain (loss).

- Total the amounts of short-term and long-term capital gains (losses) and enter these totals in the appropriate lines as directed on the form.

- Ensure to attach a copy of Form 3725 to Form 100 or Form 100W when submitting your tax return. Also, note on Schedule D under the description of property, "FTB 3725," as instructed on the form.

By closely following these steps, you can accurately complete the California Form 3725 and ensure your corporation remains in compliance with state tax laws regarding the transfer of assets between a parent corporation and its insurance company subsidiary.

Things to Know About This Form

What is the California Form 3725 used for?

The California Form 3725, also known as the Assets Transferred from Parent Corporation to Insurance Company Subsidiary form, is primarily used to track the transfer of assets from a parent corporation to an insurance company subsidiary. It also calculates capital gains or losses if a parent corporation transferred assets to an insurance company subsidiary starting from June 23, 2004, onwards. The purpose aligns with California Revenue and Taxation Code (R&TC) Section 24465, ensuring gains are deferred if the transferred property is actively used in the insurer's business.

Who needs to file California Form 3725?

Parent corporations that have transferred appreciated assets to their insurance company subsidiaries beginning on or after June 23, 2004, need to file Form 3725. This filing is necessary as part of their tax returns if the assets are used in the active conduct of the business by the insurance subsidiary and are located within California.

What are appreciated properties in the context of Form 3725?

In the context of Form 3725, appreciated properties refer to assets whose fair market value, at the time of transfer, exceeds their adjusted basis. Essentially, these are properties that have increased in value from the time they were acquired by the parent corporation to the time they were transferred to the insurance company subsidiary.

What is a commonly controlled group?

A commonly controlled group exists when more than 50% of the voting power of stock is owned directly, or constructively, by a common parent corporation, or by chains of corporations connected through a common parent, or by members of the same family. This definition extends to corporations known as stapled entities and includes special rules for partnerships, trusts, and transfers of voting power.

How does one report the gain or loss from the transferred assets?

Gains or losses from transferred assets are reported on Form 3725 and then summarized on the parent corporation's Form 100 or Form 100W. Short-term and long-term capital gains or losses must be calculated based on how long the parent corporation held the assets before their transfer. The corresponding totals are then entered in the designated sections on Schedule D of the tax return, underscoring the nature of the gain or loss.

What happens if the insurance company subsidiary sells the transferred assets?

If the insurance company subsidiary sells the transferred assets to another company, the tax treatment of the gain depends on whether the sale is to a company within the same combined reporting group. If the sale is within the group, the gain is not taxable; otherwise, it is taxable. The details of such transactions are recorded in Part II, Sections B and C of Form 3725, concerning short-term and long-term gains or losses.

Are there situations where a gain from transferred assets must be recognized immediately?

Yes, gains must be recognized as income immediately if the transferred property ceases to be owned by an insurer in the taxpayer’s commonly controlled group, is no longer used in the active conduct of the insurer’s trade or business, or the holding entity of the property becomes detached from the commonly controlled group.

Where does one attach Form 3725?

Form 3725 should be attached to the parent corporation’s Form 100 or Form 100W tax return. When filing, it is crucial to include details about short-term and long-term capital gains or losses on Schedule D of the return, referencing 'FTB 3725' for clarity and compliance.

Common mistakes

Not accurately determining whether properties transferred are appreciated properties. When filing form 3725, one common mistake involves inaccurately identifying whether the transferred assets to an insurance company subsidiary qualify as appreciated properties. The form specifies the need to report appreciated properties—those whose fair market value exceeds their adjusted basis at the time of transfer. Misidentifying these can lead to incomplete or incorrect reporting, significantly affecting deferment of capital gains.

Omitting essential identifying information such as the insurance company’s California corporation number or federal employer identification number (FEIN). This oversight can result in processing delays or complications in appropriately tracking the assets transferred, which is critical for compliance and verification processes.

Failing to accurately report the fair market value and the cost or other basis of the transferred property. These values are crucial for calculating the deferred gain under R&TC Section 24465. Inaccuracies or estimates can lead to miscalculations, potentially resulting in tax discrepancies and liabilities for the parent corporation.

Not using additional sheets when necessary, especially in Section B – Deferred Capital Gains, and in reporting Short-Term and Long-Term Capital Gains and Losses. This form requires detailed reporting for each property transferred. Failure to provide comprehensive details on additional sheets when the space provided on the form is insufficient may lead to incomplete disclosures, hindering accurate gain or loss computation.

Incorrectly indicating or neglecting the status of asset usage in the active conduct of trade or business by the insurance company. Whether the insurance company continues to use the assets in its active business operations impacts the tax treatment of gains or losses. Misreporting this status can lead to improper tax calculations and non-compliance with R&TC Section 24465.

In summary, attention to detail and thorough understanding of the form's requirements are paramount when completing the California Form 3725. These errors can result in incorrect tax calculations, potential penalties, and complications in the deferment of capital gains. Ensuring accurate and complete reporting supports compliance and optimizes the financial outcomes for corporations involved in asset transfers.

Documents used along the form

When preparing the California Form 3725 for Assets Transferred from Parent Corporation to Insurance Company Subsidiary, various supporting documents and forms often complement the filing process to ensure compliance and accuracy in reporting. These documents play a crucial role in providing detailed information about the transactions, supporting the claims made on the Form 3725, and ensuring that all reporting requirements are met.

- Form 100 or Form 100W: These are the California Corporation Franchise or Income Tax Return forms. Form 3725 is attached to either of these forms, depending on the filing requirements of the parent corporation. Form 100 is for C Corporations, while Form 100W is for Water's-Edge Filers.

- Schedule D (100S): This schedule is used to report the capital gains and losses from the sale or exchange of capital assets. It is relevant when assets transferred to an insurance company subsidiary are subsequently sold, and the gains or losses need to be reported on the parent corporation's tax return.

- California Corporation Number Registration Document: This document verifies the California corporation number, an essential identifier for the parent company and insurance subsidiary on Form 3725.

- Federal Employer Identification Number (FEIN) Documentation: Documentation verifying the FEIN for both the parent corporation and the insurance company subsidiary is necessary, as this number is required on Form 3729.

- Asset Transfer Agreements: Detailed documents outlining the terms, conditions, and specifics of the assets transferred from the parent corporation to the insurance company subsidiary. These agreements provide the basis for the information reported on Form 3725.

- Asset Valuation Reports: Professional appraisals or valuation reports establishing the fair market value of the transferred assets at the time of transfer. These are necessary to accurately fill out the fair market value sections of Form 3725.

- Capital Accounts Statements: These statements detail the cost or other basis and the depreciation, amortization, and adjustments to the assets' value over time, information necessary for accurately completing Part I, Section B of Form 3725.

Together, these documents form a comprehensive filing package that supports the information reported on the California Form 3725. Ensuring that these documents are accurate and readily available is essential for a smooth and compliant filing process. Their importance cannot be overstated, as they provide the substantiation and detail required by the California Franchise Tax Board for transactions involving the transfer of assets from parent corporations to insurance company subsidiaries.

Similar forms

The California Form 3520, Power of Attorney, shares similarities with Form 3725 in its specificity to California state tax matters. While Form 3725 deals with the transfer of assets between a parent corporation and its insurance company subsidiary, Form 3520 is utilized to authorize an individual to represent the taxpayer before the California Franchise Tax Board. Both forms are essential in managing tax responsibilities and ensuring compliance with California's tax laws, emphasizing the need for accurate representation and reporting in financial transactions.

Form 568, Limited Liability Company Return of Income, is akin to Form 3725 due to its role in reporting and managing tax obligations for specific business entities within California. Form 3725 addresses the transfers of assets between parent corporations and insurance subsidiaries, while Form 568 caters to the income reporting requirements of limited liability companies. Both serve as critical instruments for entities operating under California law to disclose their financial activities, ensuring adherence to state tax regulations.

The California Form 100, Corporation Franchise or Income Tax Return, is closely related to Form 3725, as both pertain to corporate tax obligations in California. Form 3725 supplements Form 100 when a parent corporation transfers assets to an insurance company subsidiary, requiring detailed reporting of such transfers. Form 100, on the other hand, provides a broader overview of a corporation's income and taxes due to the state. Together, they facilitate comprehensive tax reporting for corporations engaged in asset transfers, ensuring all relevant transactions are accounted for accurately.

Form 100W, California Corporation Franchise or Income Tax Return — Water's-Edge Filers, similarly to the 3725, is tailored for corporations that have opted for water's-edge election in California. While Form 3725 is used to report asset transfers to insurance subsidiaries, Form 100W serves water's-edge filers in declaring their income and computing tax based on their domestic and international business operations limited to a water's-edge basis. Both forms are pivotal for corporations in ensuring compliance with the state's nuanced tax requirements and elections.

The California Form 199, California Exempt Organization Annual Information Return, while designed for tax-exempt organizations, shares a common purpose with Form 3725 in terms of reporting obligations to the California Franchise Tax Board. Form 3725 focuses on asset transfers involving a corporate parent and an insurance subsidiary, whereas Form 199 is geared towards exempt organizations reporting their annual financial information. Both emphasize the importance of transparency and detailed accounting in maintaining compliance with state tax laws.

Form 109, California Exempt Organization Business Income Tax Return, is another document with similarities to Form 3725, as it is relevant for tax-exempt organizations in California reporting their unrelated business income. While Form 3725 details asset transfers between parent corporations and insurance subsidiaries, Form 109 targets the business income aspects of exempt organizations. Both forms play a crucial role in delineating specific tax responsibilities and ensuring that all entities are accurately reported and taxed according to California law.

The California Schedule D (100, 100W, 540, 540NR, or 109), Capital Gain or Loss, is directly connected with Form 3725 through its treatment of capital gains and losses. Schedule D is used in conjunction with Form 3725 to report the detailed outcomes of asset transfers, specifically gains or losses realized from such transactions. While Schedule D handles the broader spectrum of capital gains or losses, Form 3725 offers a specialized focus on transactions involving a parent corporation and its insurance company subsidiary, ensuring precise tax reporting.

Form 541, California Fiduciary Income Tax Return, relates to Form 3725 through its focus on trust and estate taxation in California. Whereas Form 3725 is concerned with the corporate and insurance sectors, Form 541 captures the income, deductions, and credits of trusts and estates. Both documents are integral to the comprehensive landscape of tax reporting and compliance within the state, highlighting the necessity of detailed and accurate financial disclosures across different entities and transactions.

Finally, the California Schedule R, Apportionment and Allocation of Income, parallels Form 3725 in its role in specifying how businesses divide income for tax purposes. Schedule R is necessary for companies operating in multiple jurisdictions, much like Form 3725 is required for detailing asset transfers within corporate families. Both forms aid in clarifying the allocation of income or assets in complex business structures, ensuring tax compliance with California's intricate tax laws and regulations.

Dos and Don'ts

Filling out the California Form 3725, which is used for tracking assets transferred from a parent corporation to an insurance company subsidiary, requires attention to detail and an understanding of specific guidelines. Here are some important dos and don'ts to help ensure the process is handled accurately:

- Do carefully read the general information and definitions provided in the form instructions to fully understand the purpose behind the form and the specifics of the terms used.

- Do ensure that all information regarding the parent corporation name, California corporation number, and FEIN is accurately entered in Part I of the form.

- Do describe the transferred assets in detail in Section A, including a comprehensive description, the location of the property, and fair market value at the time of transfer.

- Do maintain records of the cost or other basis of the transferred property as well as any gains deferred under R&TC Section 24465, as this information is critical for accurate reporting.

- Do attach additional sheets if necessary, especially when reporting on deferred capital gains in Section B or when detailing short-term and long-term capital gains and losses. This ensures that all necessary information is provided.

- Do not leave sections incomplete. If a question does not apply, make sure to mark it appropriately rather than skipping it, to avoid the appearance of an oversight.

- Do not forget to sign and date the form and attach it to Form 100 or Form 100W, as incomplete or incorrectly assembled documentation can result in processing delays or questions from the tax authority.

By following these guidelines, the process of completing and filing California Form 3725 can be streamlined, reducing the likelihood of errors and ensuring compliance with state tax regulations.

Misconceptions

When it comes to filing taxes, understanding the specifics of each form is crucial to ensure compliance and optimize your tax situation. In California, Form 3725, for tracking assets transferred from a parent corporation to an insurance company subsidiary, is surrounded by misconceptions that need clarification:

- Misconception #1: Form 3725 is for any type of asset transfer. In reality, Form 3725 is specifically designed for tracking the transfer of appreciated assets from a parent corporation to an insurance company subsidiary. This form plays a pivotal role in deferring gains on such transfers, provided certain conditions are met, including the continued use of these assets in the active conduct of the insurance company's trade or business.

- Misconvention #2: Any corporation can file Form 3725. Only parent corporations that transfer appreciated property to their insurance company subsidiaries and need to track capital gains or losses are required to file this form. It’s a common mistake to think that any type of company involved in asset transfer can use this form.

- Misconception #3: Filing Form 3725 is optional if the assets are still used in the business. It's imperative to understand that even if the transferred assets are still used in the active conduct of the insurer's business, maintaining accurate and complete records via Form 3725 is mandatory. This form ensures compliance with California Revenue and Taxation Code (R&TC) Section 24465, thereby deferring capital gains taxes until certain criteria are met.

- Misconception #4: Form 3725 only applies to transactions within California. While Form 3725 is a California-specific form, it's not solely for intra-state transactions. The key factor is not the location of the transaction but the fact that the parent corporation and its insurance company subsidiary are part of a commonly controlled group as defined under R&TC Section 25105. This form is crucial for any parent corporation and insurance company subsidiary involving such asset transfers, regardless of their physical locations.

Understanding the nuances and requirements of Form 3725 is essential for legal compliance and the strategic management of capital gains and losses. It’s important to address these common misconceptions to ensure accurate and beneficial filing practices.

Key takeaways

Understanding the California Form 3725 is essential for parent corporations transferring assets to an insurance company subsidiary, ensuring compliance with tax regulations and capital gains management. Here are key takeaways:

- The form is designed for parent corporations that transfer assets to their insurance company subsidiaries, aiding in tracking these transactions and calculating capital gains or losses.

- It's necessary to attach Form 3725 to either Form 100 or Form 100W when filing.

- Form usage is confined to transactions that started on or after June 23, 2004, as per the California Revenue and Taxation Code (R&TC) Section 24465.

- The form helps determine if transferred properties qualify for deferred capital gains, based on their usage in the active conduct of the insurer's trade or business.

- Appreciated properties—those with a fair market value exceeding their cost basis at the time of transfer—are the primary focus of this form.

- Entities must report whether the insurance company continues to use the assets in its active business or if it has disposed of them, affecting the tax treatment of gains.

- There's a distinction between short-term and long-term capital gains or losses based on the duration the parent corporation held the assets before their transfer.

- Special attention should be given to accurately detailing the description, location, and financial specifics (like the fair market value and cost basis) of transferred properties.

- If the insurance company disposes of the assets to a third party or no longer uses them in its trade or business, specific sections of the form must be completed to calculate the taxable gains.

- To accurately complete the form, entities must understand the definitions provided by R&TC, such as "commonly controlled group" and "appreciated property".

- Proper documentation and attachment of Form 3725 to the relevant tax return are crucial for compliance, including notation under column (a) of Schedule D with "FTB 3725".

Adhering to these points ensures that parent corporations accurately report and potentially defer capital gains on assets transferred to insurance company subsidiaries, aligning with California’s tax regulations.

Discover More PDFs

De140 - With spaces for detailed addresses and contact information, the form ensures clear communication channels between the court and involved parties.

California Sales Tax Certificate - State-specific provisions may require additional documentation or compliance checks beyond this certificate.

Statement of Facts Ca Dmv - It’s a mechanism for updating voter registration directly through the DMV, streamlining civic participation.