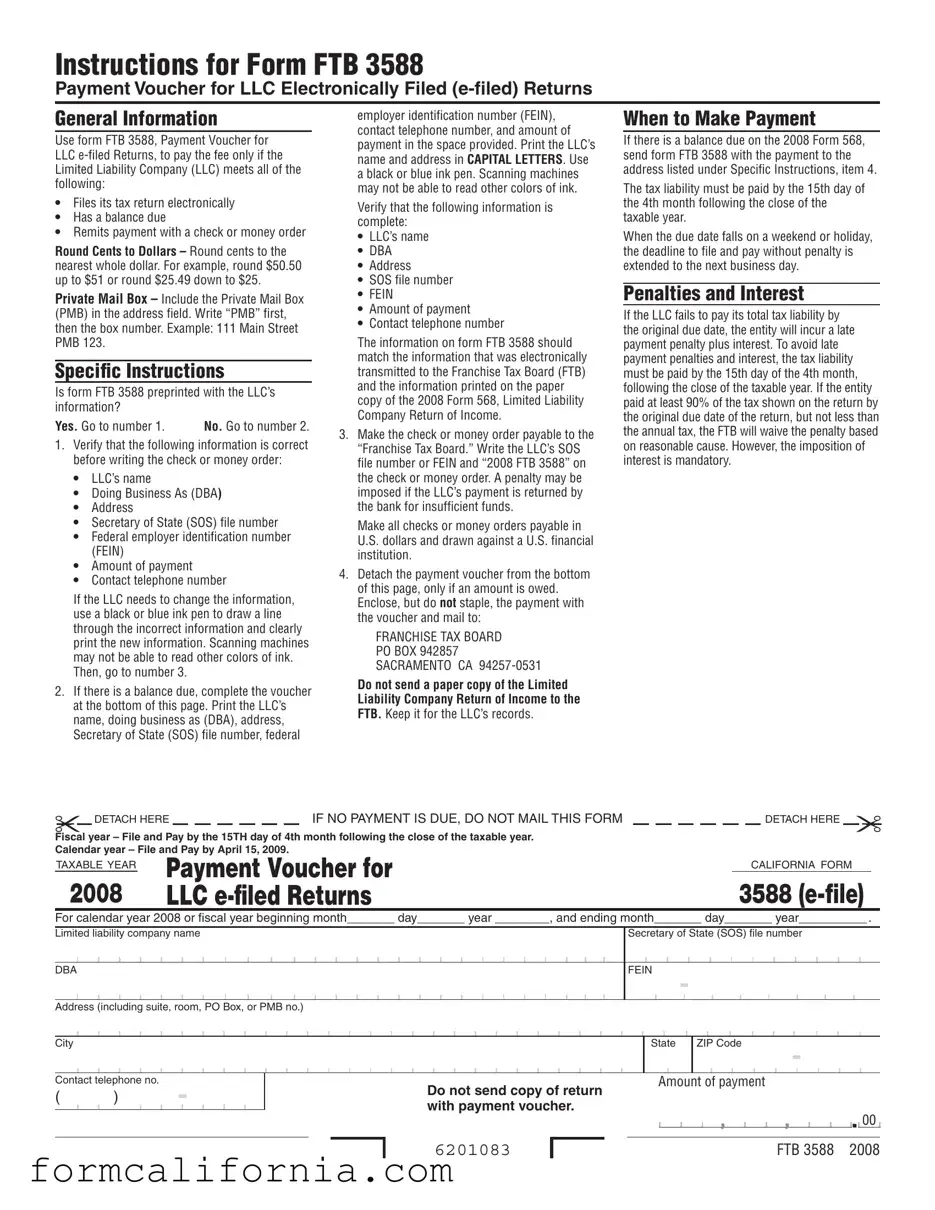

Blank California 3588 PDF Form

For Limited Liability Companies (LLCs) in California that choose to file their tax returns electronically, understanding the nuances of Form FTB 3588, the Payment Voucher for LLC e-filed Returns, is crucial. This form serves as the conduit for making balance due payments alongside e-filed returns, operating under specific stipulations such as including the exact balance due, rounding cents to the nearest dollar, and ensuring all LLC information is accurate and current. To facilitate a seamless transaction, the form requires the LLC's name, Doing Business As (DBA) name, address, Secretary of State (SOS) file number, Federal Employer Identification Number (FEIN), and a contact telephone number, all printed in capital letters for clarity. The meticulous design of the form, coupled with detailed instructions, highlights the state's effort to streamline tax payments and record-keeping for LLCs. Moreover, the form outlines procedures for making corrections, payment methods, and the importance of timely submissions to avoid penalties and interest, underscoring the critical role of Form FTB 3588 in the tax filing process for electronically filed returns of LLCs in California.

Document Preview Example

Instructions for Form FTB 3588

Payment Voucher for LLC Electronically Filed

General Information

Use form FTB 3588, Payment Voucher for LLC

•Files its tax return electronically

•Has a balance due

•Remits payment with a check or money order

Round Cents to Dollars – Round cents to the nearest whole dollar. For example, round $50.50 up to $51 or round $25.49 down to $25.

Private Mail Box – Include the Private Mail Box (PMB) in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Specific Instructions

Is form FTB 3588 preprinted with the LLC’s information?

Yes. Go to number 1. |

No. Go to number 2. |

1.Verify that the following information is correct before writing the check or money order:

•LLC’s name

•Doing Business As (DBA)

•Address

•Secretary of State (SOS) file number

•Federal employer identification number (FEIN)

•Amount of payment

•Contact telephone number

If the LLC needs to change the information, use a black or blue ink pen to draw a line through the incorrect information and clearly print the new information. Scanning machines may not be able to read other colors of ink. Then, go to number 3.

2.If there is a balance due, complete the voucher at the bottom of this page. Print the LLC’s name, doing business as (DBA), address, Secretary of State (SOS) file number, federal

employer identification number (FEIN), contact telephone number, and amount of payment in the space provided. Print the LLC’s name and address in CAPITAL LETTERS. Use a black or blue ink pen. Scanning machines may not be able to read other colors of ink.

Verify that the following information is complete:

•LLC’s name

•DBA

•Address

•SOS file number

•FEIN

•Amount of payment

•Contact telephone number

The information on form FTB 3588 should match the information that was electronically transmitted to the Franchise Tax Board (FTB) and the information printed on the paper copy of the 2008 Form 568, Limited Liability Company Return of Income.

3.Make the check or money order payable to the “Franchise Tax Board.” Write the LLC’s SOS file number or FEIN and “2008 FTB 3588” on the check or money order. A penalty may be imposed if the LLC’s payment is returned by the bank for insufficient funds.

Make all checks or money orders payable in U.S. dollars and drawn against a U.S. financial institution.

4.Detach the payment voucher from the bottom of this page, only if an amount is owed. Enclose, but do not staple, the payment with the voucher and mail to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA

Do not send a paper copy of the Limited Liability Company Return of Income to the FTB. Keep it for the LLC’s records.

When to Make Payment

If there is a balance due on the 2008 Form 568, send form FTB 3588 with the payment to the address listed under Specific Instructions, item 4.

The tax liability must be paid by the 15th day of the 4th month following the close of the taxable year.

When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

Penalties and Interest

If the LLC fails to pay its total tax liability by the original due date, the entity will incur a late payment penalty plus interest. To avoid late payment penalties and interest, the tax liability must be paid by the 15th day of the 4th month, following the close of the taxable year. If the entity paid at least 90% of the tax shown on the return by the original due date of the return, but not less than the annual tax, the FTB will waive the penalty based on reasonable cause. However, the imposition of interest is mandatory.

|

DETACH HERE |

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM |

DETACH HERE |

|

|

|

Fiscal year – File and Pay by the 15TH day of 4th month following the close of the taxable year. Calendar year – File and Pay by April 15, 2009.

TAXABLE YEAR |

Payment Voucher for |

|

|

2008 |

LLC |

CALIFORNIA FORM

3588

For calendar year 2008 or fiscal year beginning month_______ day_______ year ________, and ending month_______ day_______ year__________ .

Limited liability company name

DBA

Secretary of State (SOS) file number

FEIN

-

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Contact telephone no.

()-

Do not send copy of return with payment voucher.

Amount of payment

,

,

,

. 00

. 00

6201083 |

|

|

FTB 3588 2008 |

Document Specs

| Fact | Detail |

|---|---|

| Form Designation | FTB 3588 Payment Voucher for LLC Electronically Filed (e-filed) Returns |

| Primary Use | To pay the fee for Limited Liability Companies (LLCs) that file their tax returns electronically and have a balance due |

| Requirement for Use | LLC must file tax return electronically, have a balance due, and remit payment via check or money order |

| Information Verification | Verifies LLC's name, DBA, address, Secretary of State file number, FEIN, amount of payment, and contact number |

| Payment Method | Check or money order payable to the "Franchise Tax Board" |

| Penalties and Interest | Possible penalties for late payment or insufficient funds, but interest imposition is mandatory for late payment |

| Payment Deadline | 15th day of the 4th month following the close of the taxable year, with adjustments for weekends and holidays |

| Submission Address | Franchise Tax Board, PO BOX 942857, SACRAMENTO CA 94257-0531 |

| Required Writing Instruments | Use a black or blue ink pen for manual corrections to ensure scanning machines can read the information |

| Rounding Policy | Round cents to the nearest whole dollar on payments |

| Governing Law | Managed under the laws of the State of California by the Franchise Tax Board |

Detailed Instructions for Writing California 3588

After filing tax returns electronically, limited liability companies (LLCs) in California with a balance due need to complete Form FTB 3588 to make their payment. This form ensures the payment is credited correctly to the LLC. The process is straightforward, requiring attention to detail to ensure all the preprinted or manually entered information is correct. Below are the steps needed to fill out and submit Form FTB 3588 properly.

- Check if the form is preprinted with your LLC's information. If it is and all the data is accurate (LLC’s name, DBA, Address, SOS file number, FEIN, amount of payment, contact telephone number), proceed to step 3. If any information is incorrect, use a black or blue pen to draw a line through the errors and clearly print the updated information beside it.

- If the form is not preprinted or if you don't have preprinted information:

- Fill out the voucher at the bottom of the page with your LLC’s name, DBA, address (include PMB if applicable), Secretary of State (SOS) file number, federal employer identification number (FEIN), contact telephone number, and the amount of payment.

- Ensure to print the LLC’s name and address in CAPITAL LETTERS using a black or blue pen for legibility by scanning machines.

- Write a check or money order payable to “Franchise Tax Board.” Clearly write your LLC’s SOS file number or FEIN, along with “2008 FTB 3588” on the check or money order. This step is crucial for ensuring your payment is correctly applied.

- Detach the payment voucher carefully if an amount is owed. Enclose the payment with the voucher in an envelope. Do not staple the check or the voucher. Then, mail it to the address provided: FRANCHISE TAX BOARD PO BOX 942857 SACRAMENTO CA 94257-0531.

- Keep the upper portion of the form, along with a copy of your electronic filing and any other relevant documents, for your records. Do not send any portion of the e-filed returns or additional documentation unless requested.

It’s important to send your payment by the due date to avoid penalties and interest. For calendar year filers, this is typically April 15. For fiscal year filers, the due date is the 15th day of the 4th month after the end of your fiscal year. If you've paid at least 90% of your tax due by the original deadline and not less than the annual tax, the Franchise Tax Board may waive the late payment penalty for reasonable cause. However, interest charges on unpaid tax amounts are mandatory and accrue until the full payment is made.

Things to Know About This Form

What is the purpose of Form FTB 3588?

Form FTB 3588, known as the Payment Voucher for LLC Electronically Filed (e-filed) Returns, is specifically designed for Limited Liability Companies (LLCs) that have chosen to file their tax returns electronically. It is utilized when these LLCs need to make a payment to cover any balance due on their tax liabilities. This form ensures that payments are properly processed and linked to the LLC's tax account.

Who needs to file Form FTB 3588?

Any Limited Liability Company (LLC) that meets all of the following criteria must use Form FTB 3588:

- The LLC files its tax return electronically.

- There is a balance due on the tax return.

- The LLC opts to remit payment via check or money order.

How should payments be made when using Form FTB 3588?

Payments through Form FTB 3588 should be made via check or money order. It's crucial to ensure that these payments are made in U.S. dollars and drawn against a U.S. financial institution. Remember to round cents to the nearest whole dollar on your payment amount.

What information is preprinted on Form FTB 3588, and what if it's incorrect?

The form is preprinted with the LLC's basic details, including the LLC’s name, Doing Business As (DBA), address, Secretary of State (SOS) file number, Federal Employer Identification Number (FEIN), and the payment amount. If any information is incorrect, it should be crossed out with a line, and the correct information clearly written beside it, using black or blue ink to ensure readability by scanning machines.

Is there a specific time frame for sending Form FTB 3588 with payment?

Payment must be submitted by the 15th day of the 4th month following the close of the taxable year for the LLC. If the due date falls on a weekend or holiday, the deadline is extended to the next business table day. Timely payment helps avoid penalties and interest.

What should you do if the LLC’s payment is returned for insufficient funds?

If the LLC's payment is returned due to insufficient funds, a penalty may be imposed. It is important to ensure that there are adequate funds in the account before making the payment to avoid such penalties.

What are the penalties and interest for late payment?

LLCs that fail to pay their total tax liability by the due date will face a late payment penalty and interest. Penalties can be avoided if the LLC pays at least 90% of the tax shown on the return by the original due date. However, interest charges are mandatory and cannot be waived.

Where should Form FTB 3588 and its payment be mailed?

Completed forms along with the check or money order should be sent to:

- FRANCHISE TAX BOARD

- PO BOX 942857

- SACRAMENTO CA 94257-0531

Common mistakes

When filling out the California Form 3588, Payment Voucher for LLC Electronically Filed (e-filed) Returns, individuals often make a variety of mistakes. To ensure accuracy and avoid possible penalties, be aware of the common errors:

- Not rounding cents to the nearest whole dollar - The form instructions specify that cents should be rounded to the nearest whole dollar, which is a step that's frequently overlooked.

- Incorrect or missing Private Mail Box (PMB) information - If you use a PMB, you must include "PMB" followed by the box number in the address field. This detail is often omitted or filled incorrectly.

- Using the wrong ink - The form must be completed using black or blue ink. This is because scanning machines may not be able to read other colors, yet people sometimes use different ink colors.

- Failure to verify preprinted information - Preprinted forms will have the LLC's information such as name, address, and payment amount. It's crucial to verify this information for accuracy.

- Not making corrections properly - If the preprinted information is incorrect, you should draw a line through the incorrect information and clearly print the new information. Not doing so or doing it improperly can lead to processing issues.

- Incomplete or incorrect payment information - When completing the voucher manually, all required fields must be filled out accurately, which includes the LLC’s name, DBA, address, Secretary of State (SOS) file number, Federal Employer Identification Number (FEIN), and contact information.

- Incorrect payee on checks or money orders - Payments should be made to the “Franchise Tax Board,” and some mistakenly write the check or money order to another entity.

- Not including the SOS file number or FEIN on the payment - For proper credit to the LLC’s account, the SOS file number or FEIN and “2008 FTB 3588” must be written on the check or money order.

- Mailing the form with no payment due or sending a paper copy of the return - If no payment is due, the form should not be mailed. Additionally, a paper copy of the LLC return should not be sent to the FTB; it is to be kept for the LLC’s records.

Making sure to avoid these common errors can help facilitate a smoother processing of your LLC's payment voucher and avoid unnecessary delays or penalties.

Documents used along the form

When preparing and submitting the Form FTB 3588, Payment Voucher for LLC Electronically Filed (e-filed) Returns in California, there are several other forms and documents that may also be needed to ensure compliance with state regulations and tax obligations. These additional forms play a crucial role in addressing specific financial and operational details of the LLC. Here is a list of other frequently used forms and documents along with a brief description of each.

- Form 568, Limited Liability Company Return of Income: This is the primary tax return form for LLCs in California and provides details on income, deductions, and tax liability of the LLC.

- Form 3522, LLC Annual Tax Voucher: LLCs use this form to pay their annual tax, which is required to maintain good standing with the California Franchise Tax Board.

- Form 565, Partnership Return of Income: If the LLC is classified as a partnership for tax purposes, this form is used to report income and losses to the state.

- Schedule K-1 (568): This schedule is part of Form 568 and is used to report each member’s share of the LLC’s income, deductions, credits, etc.

- Form 3536, Estimated Fee for LLCs: LLCs that anticipate owing a certain amount in taxes must file this form to pay estimated fees throughout the tax year.

- Form 3500, Exemption Application: If an LLC qualifies for tax-exempt status, this form is used to apply with the California Franchise Tax Board.

- Statement of Information (Form LLC-12): This document provides the state with current information about the LLC, including address and management structure, and must be filed regularly.

- Articles of Organization (Form LLC-1): The foundational document for any LLC in California, filed with the Secretary of State to legally establish the company.

- Form 1099-NEC: LLCs that pay non-employee compensation exceeding $600 to a single payee in a tax year are required to file this form for each payee.

In addition to the FTB 3588, managing the mentioned forms and documents allows a Limited Liability Company (LLC) in California to stay compliant with various state tax laws and regulations. It’s essential for LLCs to understand the purposes of these forms, alongside their filing deadlines, to maintain good standing in the state and avoid penalties. Seeking guidance from a tax professional or legal advisor is recommended to navigate the specifics of each form and ensure all legal obligations are met.

Similar forms

The Form 1040-V, Payment Voucher for Individual Income Tax Returns, is quite similar to the California FTB 3588 form. Both serve as payment vouchers for taxpayers who file their returns electronically but choose to make their payment via check or money order. Like the FTB 3588, the 1040-V includes fields for essential information, such as the taxpayer’s name, identification number, and the amount being paid, ensuring that the payment is credited to the correct account.

The Form 540-V, Payment Voucher for Resident Returns, is another document similar to the FTB 3588, but it is used for personal income tax payments in California. Both forms are designed to accompany payments when the corresponding tax return is filed electronically. They share common fields for taxpayer information, including the tax year, identification number, and payment amount, facilitating the accurate processing of payments by the tax authorities.

Form 8109, Federal Tax Deposit Coupon, shares resemblances with the FTB 3588, as both are involved in the tax payment process, albeit for different tax types. The Form 8109 was used by businesses to make deposits for various federal taxes before the electronic Federal Tax Payment System (EFTPS) became mandatory. Similar to the FTB 3588, it included sections for identifying the taxpayer and specifying the type and amount of payment.

The Estimated Tax Payment Voucher for Individuals, often Form 1040-ES, parallels the FTB 3588 in its purpose of facilitating payments separate from the main tax return filing process. Taxpayers use it to send estimated tax payments throughout the year. Like the FTB 3588, it requires taxpayer identification information and the payment amount to ensure proper credit to the taxpayer’s account.

Form 8821, Tax Information Authorization, while not a payment voucher, shares the theme of taxpayer information management with the FTB 3588. This form authorizes individuals or organizations to review another's tax information, necessitating accurate taxpayer details similar to those required on the FTB 3588 to ensure the correct handling and privacy of tax data.

The Sales and Use Tax Return forms used by businesses to report and pay sales tax to state tax authorities bear a functional resemblance to the FTB 3588. These forms require detailed business information and payment details to process sales tax payments properly, similar to how the FTB 3588 collects LLC details and payment information for accurate tax payment processing.

Form W-2, Wage and Tax Statement, and Form W-3, Transmittal of Wage and Tax Statements, although primarily for reporting wages and tax withholdings rather than making payments, involve the careful reporting of taxpayer identification and financial information. This parallels the importance of accurately completing the FTB 3588 to ensure proper credit of LLC tax payments.

Dos and Don'ts

When completing the California Form FTB 3588, Payment Voucher for LLC Electronically Filed Returns, it is essential to adhere to a set of do's and don'ts to ensure the process is done correctly and efficiently. Following these guidelines can help avoid mistakes that might lead to delayed processing times or potential penalties.

- Do verify the LLC’s information is accurate if the form is preprinted, including the name, DBA (Doing Business As), address, Secretary of State (SOS) file number, Federal Employer Identification Number (FEIN), and contact telephone number. Mistakes in these details can lead to processing delays or misapplied payments.

- Don't use pens with any ink color other than black or blue. Scanners and processing machines are optimized for these colors, and using other colors might result in unreadable submissions.

- Do round cents to the nearest whole dollar amount when noting the payment amount. This simplifies the payment process and helps avoid confusion.

- Do make the check or money order payable to the "Franchise Tax Board." Correctly addressed payments ensure that your payment is processed correctly and in a timely manner.

- Don’t forget to write the LLC’s SOS file number or FEIN and "2008 FTB 3588" on the check or money order. This information helps in correctly applying your payment to your LLC’s account.

- Do detach the payment voucher from the bottom of the page only if you owe an amount. Including the voucher with your payment helps associate your payment with your electronically filed return.

- Don’t staple the payment to the voucher. Staples can cause issues with the processing equipment and delay the processing of your payment.

- Don’t send a paper copy of the return with the payment voucher. The Form FTB 3588 is specifically designed for use with electronically filed returns, and including a paper copy of the return can lead to processing errors.

- Do mail your payment voucher and payment to the specified address if you have a balance due. Timely and correctly addressed submissions are crucial to avoid late payment penalties and interest.

By following these guidelines, the process of submitting the Form FTB 3588 should be straightforward, helping ensure your LLC meets its tax obligations without unnecessary delay or complications.

Misconceptions

Understanding the California Form FTB 3588 can be complicated, and many misconceptions surround its use and purpose. It's crucial to dispel these myths to ensure that Limited Liability Companies (LLCs) comply correctly with tax regulations. Here are some common misunderstandings:

Form FTB 3588 is only for LLCs that owe taxes: While it's true that this form is used to submit payment for taxes due, it's specifically designed for LLCs that have filed their returns electronically and have a balance due. It's not a general tax form for all LLCs.

The form must be submitted by all LLCs: In reality, only LLCs that meet specific criteria—such as having filed electronically and having a balance due—need to submit this form with their payment.

Payments can be made in any form: The instructions clearly state that payments must be made by check or money order. Digital or electronic payments are not acknowledged with this form.

Any ink color is acceptable for corrections: For changes to be properly scanned and recognized, corrections on the form must be made with black or blue ink only, as scanners may not accurately read other colors.

The form can be sent without a payment voucher if there is no balance due: If no payment is due, the form should not be mailed. Detach and mail the voucher only if a payment is owed.

It's acceptable to staple the payment to the voucher: To ensure smooth processing, payments should be enclosed with the voucher but not stapled.

LLC information doesn't need to match exactly: The information on Form FTB 3588 should match the electronically transmitted data and the printed copy of Form 568 exactly to avoid processing errors.

Late payment penalties are negotiable: The form clearly states that if the total tax liability is not paid by the due date, late payment penalties and interest will be imposed, which are mandatory and not subject to negotiation unless 90% of the tax shown on the return was paid by the original due date.

The form covers all tax years: This form is specific to the tax year it is designed for. For example, the instance provided relates to the 2008 tax year, and a new form must be used for each subsequent year.

Clarifying these misconceptions ensures that LLCs handle their tax payments accurately and in compliance with California's tax laws. Properly understanding and utilizing Form FTB 3588 can save time and prevent costly errors during the tax submission process.

Key takeaways

Understanding the nuances of Form FTB 3588, the Payment Voucher for LLC Electronically Filed Returns, is crucial for any Limited Liability Company (LLC) in California that needs to remit payment for taxes owed after filing electronically. Here are several key takeaways that will guide you through using this form effectively.

- Electronic Filing Prerequisite: This form is specifically designed for LLCs that have opted to file their tax returns electronically and have a balance due. It's not applicable to LLCs that file their returns through other means.

- Rounding Off Amounts: When filling out this form, round cents to the nearest whole dollar. This simplification helps streamline the payment process and ensures consistency in the amount reported and paid.

- Address and PMB Details: Include your Private Mail Box (PMB) number in the address field if applicable. Clearly labeling the PMB first and then the number ensures that your payment is correctly routed and associated with your LLC’s account.

- Ensuring Accuracy: If the form is preprinted with your LLC's information, verify all details for accuracy. Mismatches or inaccuracies can lead to processing delays. If you find incorrect information, correct it neatly in black or blue ink to ensure that the scanning machines recognize your inputs.

- Completing the Voucher: In case your form is not preprinted, you must complete the voucher section at the bottom of the page yourself. Make sure to print legibly in CAPITAL LETTERS using black or blue ink, which is essential for the scanning technology used by the Franchise Tax Board (FTB).

- Payment Instructions: Checks or money orders should be made payable to the "Franchise Tax Board." It's important to write the LLC’s Secretary of State (SOS) file number or Federal Employer Identification Number (FEIN) and "2008 FTB 3588" on your payment method to ensure it is correctly applied to your account.

- Deadline and Penalties: Payment must be submitted by the 15th day of the 4th month following the close of the taxable year. Missing this deadline can lead to penalties and interest. However, if at least 90% of the total tax shown on the return is paid by the original due date, the entity might be able to avoid penalties, though interest may still accrue.

Adhering to these guidelines will help ensure that your LLC’s payment is processed efficiently and accurately, avoiding unnecessary delays or additional charges. Always keep a copy of your filed return and any correspondence with the FTB for your records, even though you should not send a copy of the return with the payment voucher.

Discover More PDFs

What Is Probate in California - Accompanying the form, an Inventory and Appraisal of decedent’s real property interests must be conducted by a probate referee.

Ca Llc 12R - LLCs must accurately report the entity number issued by the California Secretary of State at registration, essential for correct identification and processing of the Statement of Information.