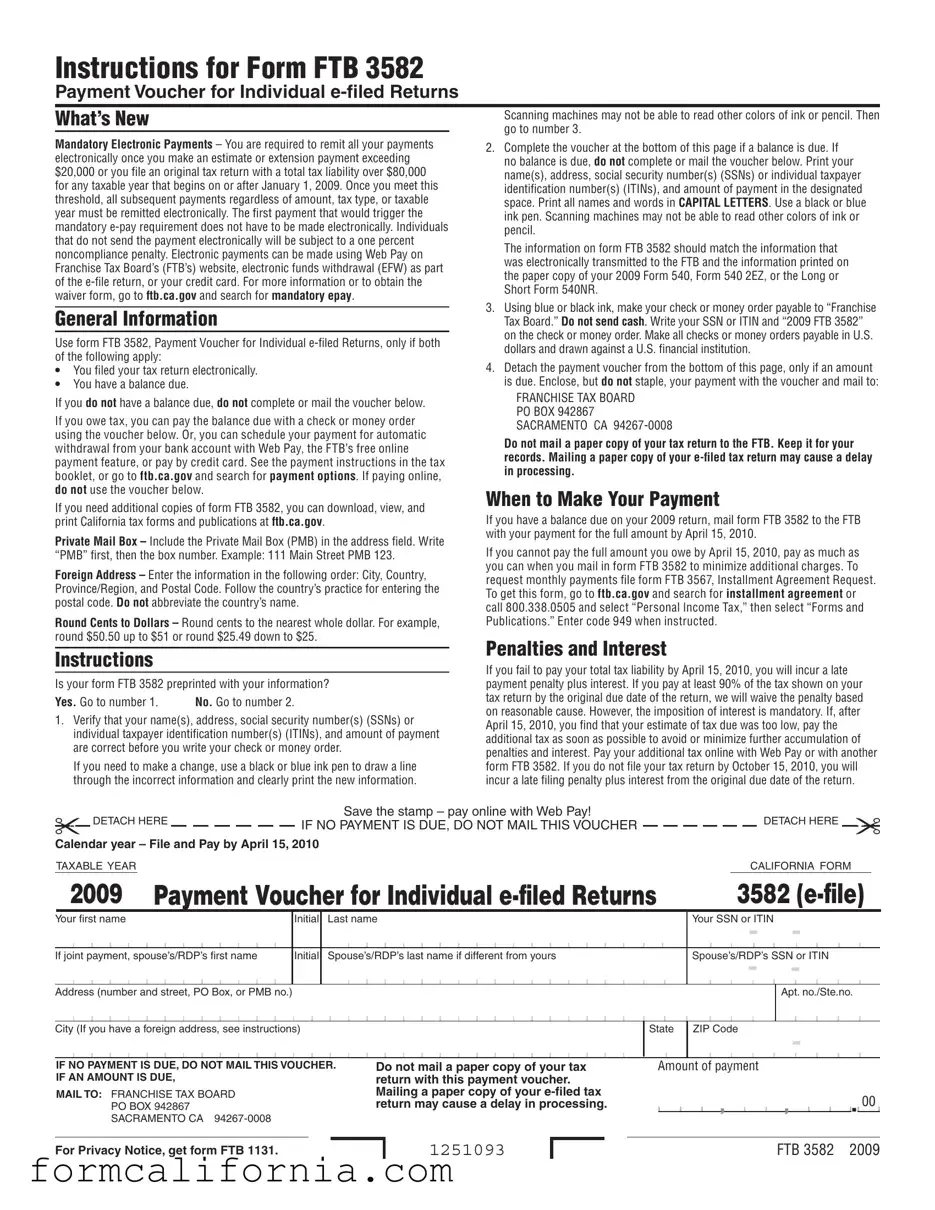

Blank California 3582 PDF Form

The California 3582 form is crucial for individuals who have filed their tax returns electronically and have a balance due. This payment voucher assists in ensuring that payments are made correctly and efficiently to the Franchise Tax Board (FTB). In recent updates, the form has highlighted the importance of electronic payments, especially for those who cross certain thresholds in either their estimate or extension payments, or original tax return liabilities. The necessity for accurate and legible information, including the use of specific ink colors to avoid scanning issues, underscores the form’s role in the smooth processing of tax payments. Furthermore, the form accommodates various payment methods, including check, money order, and several electronic options, providing flexibility to taxpayers. The inclusion of detailed guidelines, such as how to correctly fill out and mail the voucher, and the penalties for non-compliance, makes the California 3582 form an essential document for complying with state tax obligations. Its instructions also cater to individuals with foreign addresses and those needing to make adjustments to preprinted information, ensuring all taxpayers can navigate their payment submission effectively.

Document Preview Example

Instructions for Form FTB 3582

Payment Voucher for Individual

What’s New |

Scanning machines may not be able to read other colors of ink or pencil. Then |

|

go to number 3. |

||

|

Mandatory Electronic Payments – You are required to remit all your payments electronically once you make an estimate or extension payment exceeding $20,000 or you file an original tax return with a total tax liability over $80,000 for any taxable year that begins on or after January 1, 2009. Once you meet this threshold, all subsequent payments regardless of amount, tax type, or taxable year must be remitted electronically. The first payment that would trigger the mandatory

General Information

Use form FTB 3582, Payment Voucher for Individual

•You filed your tax return electronically.

•You have a balance due.

If you do not have a balance due, do not complete or mail the voucher below.

If you owe tax, you can pay the balance due with a check or money order using the voucher below. Or, you can schedule your payment for automatic withdrawal from your bank account with Web Pay, the FTB’s free online payment feature, or pay by credit card. See the payment instructions in the tax booklet, or go to ftb.ca.gov and search for payment options. If paying online, do not use the voucher below.

If you need additional copies of form FTB 3582, you can download, view, and print California tax forms and publications at ftb.ca.gov.

Private Mail Box – Include the Private Mail Box (PMB) in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country, Province/Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

Round Cents to Dollars – Round cents to the nearest whole dollar. For example, round $50.50 up to $51 or round $25.49 down to $25.

Instructions

Is your form FTB 3582 preprinted with your information?

Yes. Go to number 1. |

No. Go to number 2. |

1.Verify that your name(s), address, social security number(s) (SSNs) or individual taxpayer identification number(s) (ITINs), and amount of payment are correct before you write your check or money order.

If you need to make a change, use a black or blue ink pen to draw a line through the incorrect information and clearly print the new information.

2.Complete the voucher at the bottom of this page if a balance is due. If no balance is due, do not complete or mail the voucher below. Print your name(s), address, social security number(s) (SSNs) or individual taxpayer identification number(s) (ITINs), and amount of payment in the designated space. Print all names and words in CAPITAL LETTERS. Use a black or blue ink pen. Scanning machines may not be able to read other colors of ink or pencil.

The information on form FTB 3582 should match the information that was electronically transmitted to the FTB and the information printed on the paper copy of your 2009 Form 540, Form 540 2EZ, or the Long or Short Form 540NR.

3.Using blue or black ink, make your check or money order payable to “Franchise Tax Board.” Do not send cash. Write your SSN or ITIN and “2009 FTB 3582” on the check or money order. Make all checks or money orders payable in U.S. dollars and drawn against a U.S. financial institution.

4.Detach the payment voucher from the bottom of this page, only if an amount is due. Enclose, but do not staple, your payment with the voucher and mail to:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA

Do not mail a paper copy of your tax return to the FTB. Keep it for your records. Mailing a paper copy of your

When to Make Your Payment

If you have a balance due on your 2009 return, mail form FTB 3582 to the FTB with your payment for the full amount by April 15, 2010.

If you cannot pay the full amount you owe by April 15, 2010, pay as much as you can when you mail in form FTB 3582 to minimize additional charges. To request monthly payments file form FTB 3567, Installment Agreement Request. To get this form, go to ftb.ca.gov and search for installment agreement or call 800.338.0505 and select “Personal Income Tax,” then select “Forms and Publications.” Enter code 949 when instructed.

Penalties and Interest

If you fail to pay your total tax liability by April 15, 2010, you will incur a late payment penalty plus interest. If you pay at least 90% of the tax shown on your tax return by the original due date of the return, we will waive the penalty based on reasonable cause. However, the imposition of interest is mandatory. If, after April 15, 2010, you find that your estimate of tax due was too low, pay the additional tax as soon as possible to avoid or minimize further accumulation of penalties and interest. Pay your additional tax online with Web Pay or with another form FTB 3582. If you do not file your tax return by October 15, 2010, you will incur a late filing penalty plus interest from the original due date of the return.

|

DETACH HERE |

Save the stamp – pay online with Web Pay! |

|

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER |

|||

|

Calendar year – File and Pay by April 15, 2010

TAXABLE YEAR

DETACH HERE

CALIFORNIA FORM

2009 Payment Voucher for Individual |

|

|

3582 |

|||||||||||||||||||||||||||||||||||||||||||||

Your first name |

Initial |

Last name |

|

|

|

|

|

Your SSN |

- |

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint payment, spouse’s/RDP’s first name |

Initial |

Spouse’s/RDP’s last name if different from yours |

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no./Ste.no. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions) |

|

State |

ZIP Code |

- |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER. IF AN AMOUNT IS DUE,

MAIL TO: FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA

Do not mail a paper copy of your tax return with this payment voucher. Mailing a paper copy of your

Amount of payment

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

For Privacy Notice, get form FTB 1131.

1251093

FTB 3582 2009

Document Specs

| Fact Number | Fact Detail |

|---|---|

| 1 | The California Form FTB 3582 is a payment voucher for individual e-filed returns. |

| 2 | Form FTB 3582 is used only if the filer has e-filed their tax return and has a balance due. |

| 3 | Payments can be made via check, money order, Web Pay, electronic funds withdrawal, or credit card. |

| 4 | Once a taxpayer meets the threshold of a $20,000 estimate or extension payment or a total tax liability over $80,000, all subsequent payments must be made electronically. |

| 5 | A one percent noncompliance penalty applies to individuals not adhering to the mandatory electronic payment requirement. |

| 6 | Checks or money orders should be payable in U.S. dollars and drawn against a U.S. financial institution. |

| 7 | The voucher and payment, if a balance is due, should be mailed to the Franchise Tax Board, PO BOX 942867, Sacramento, CA 94267-0008. |

| 8 | If paying online or if no payment is due, the voucher should not be mailed. |

| 9 | Penalties and interest apply for late payments or failure to pay the full tax liability by the due date. |

| 10 | The governing laws for Form FTB 3582 and related penalties are established by the California Revenue and Taxation Code and administrated by the California Franchise Tax Board. |

Detailed Instructions for Writing California 3582

After electronically filing your tax return in California and finding out you have a balance due, the Form FTB 3582 serves as your payment voucher. This document helps ensure your payment is applied correctly to your account. Avoiding errors and ensuring the correct completion of this form are crucial, as it influences the timely processing of your payment. Whether you're paying via check, money order, or planning to set up an automatic withdrawal, each step of filling out the Form FTB 3582 is pivotal. Below are the steps you'll need to follow to ensure your payment is processed without issue.

- If your form FTB 3582 is preprinted with your information, check that your name(s), address, social security number(s) (SSNs) or individual taxpayer identification number(s) (ITINs), and the amount of payment are accurate. Should any corrections be needed, use a black or blue ink pen, draw a line through the incorrect information, and clearly print the updated information.

- If the form is not preprinted, or if a balance is due, complete the voucher at the bottom of this page. Do not proceed if no balance is due. In the designated spaces, print your name(s), address, social security number(s) or individual taxpayer identification number(s), and the amount of payment. Ensure all names and words are in CAPITAL LETTERs using a black or blue ink pen, as scanning machines might not recognize other colors.

- Make your check or money order payable to “Franchise Tax Board” using blue or black ink only. Cash payments are not accepted. On your check or money order, be sure to write your SSN or ITIN and “2009 FTB 3582”. Checks or money orders must be in U.S. dollars and drawn against a U.S. financial institution.

- Detach the payment voucher from the bottom of this page only if there is an amount due. Enclose your payment with the voucher in an envelope. It’s important not to staple the payment to the voucher. Mail your payment and voucher to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO, CA 94267-0008. Remember, a paper copy of your tax return should not be mailed with this voucher to avoid processing delays.

It's essential to understand that Form FTB 3582 is specifically for electronic filers who owe taxes. Correctly filling out and submitting this form ensures the state of California processes your payment efficiently, without unnecessary delays. Timely payment is also key to avoiding potential penalties and interest on any amounts due.

Things to Know About This Form

What is Form FTB 3582?

Form FTB 3582 is a Payment Voucher for Individual e-filed Returns used by the California Franchise Tax Board (FTB). It is designed for taxpayers who have filed their tax returns electronically and have a balance due. This form allows for the payment of taxes owed via check, money order, or electronically.

Who needs to use Form FTB 3582?

This form is necessary for individuals who have e-filed their California tax return and owe taxes. If there is no balance due, this form should not be used.

How can payments be made using Form FTB 3582?

Payments can be made in several ways:

- By check or money order using the voucher included with Form FTB 3582.

- Via the Franchise Tax Board's Web Pay service for direct automatic withdrawal from a bank account.

- By credit card through the options provided on the FTB's website.

When is the payment due for Form FTB 3582?

The payment due date for the balance owing on your 2009 tax return is April 15, 2010. To avoid penalties and interest, pay the full amount owed by this date. If you're unable to pay in full, pay as much as you can to reduce additional charges.

What happens if I don't pay the full amount by the due date?

If you fail to pay the total tax liability by April 15, 2010, you will incur a late payment penalty and interest. Paying at least 90% of the tax owed by the original due date can help avoid the penalty for reasonable cause, but interest charges are mandatory.

Is it mandatory to make electronic payments?

Yes, it becomes mandatory to remit all payments electronically once you either make an estimate or extension payment exceeding $20,000 or file an original tax return with over $80,000 in total tax liability for any taxable year starting January 1, 2009, onward. If you fail to comply with this electronic payment requirement, you'll face a one percent noncompliance penalty.

Can I amend my payment information on Form FTB 3582?

If your form is not pre-printed with your information or if you need to make changes, use a black or blue ink pen to modify details like your name(s), address, social security number(s) (SSNs) or individual taxpayer identification number(s) (ITINs), and amount of payment. Make sure to print all information clearly in CAPITAL LETTERS.

What should I do if I have a foreign address?

For taxpayers with a foreign address, enter your address information in the following order: City, Country, Province/Region, and Postal Code, adhering to the postal code practice of your country without abbreviating the country’s name.

How do I obtain additional copies of Form FTB 3582?

You can download, view, and print additional copies of Form FTB 3582 by visiting the California Franchise Tax Board's website at ftb.ca.gov.

What should I do with my paper tax return if I've used Form FTB 3582?

Do not mail a paper copy of your tax return with the FTB 3582 payment voucher. Mailing a paper copy of your e-filed return may delay processing. Keep it for your records instead.

Common mistakes

When filling out the California Form FTB 3582, Payment Voucher for Individual e-filed Returns, there are several mistakes commonly made. These errors can delay processing and potentially lead to penalties. It is crucial to avoid these pitfalls for a smooth processing of your tax payments.

- Incorrect or Incomplete Information: One significant mistake is not verifying that the preprinted information on the form (such as names, addresses, SSNs/ITINs, and amount of payment) is correct. Alterations should be made with a black or blue ink pen, and incorrect information should be clearly corrected on the form.

- Using the Wrong Ink Color: Fill out the form using a blue or black ink pen only. The use of other ink colors can lead to scanning issues, preventing the form from being processed accurately by scanning machines.

- Mailing with Payment Not Required: Another error involves mailing the voucher when no payment is due. This form should only be sent if there is a balance due after filing the return electronically.

- Failure to Detach the Payment Voucher: The payment voucher at the bottom of the form must be detached and mailed with the payment if a balance is due. Not detaching the voucher can lead to processing delays.

- Incorrect Payment Details: Making a check or money order payable to an entity other than "Franchise Tax Board" or not writing the SSN/ITIN and "2009 FTB 3582" on the check or money order can result in misapplied payments.

- Omitting Web Pay: When paying online through Web Pay, the voucher should not be used. A common mistake is sending the voucher even when the payment has been scheduled or made online.

It's crucial to adhere strictly to the specific instructions provided for Form FTB 3582 to ensure that your payment is processed efficiently and correctly. Taking care to avoid these common errors can help taxpayers avoid unnecessary headaches and ensure compliance with California's tax laws.

Documents used along the form

When dealing with the complexities of tax filing, especially in situations necessitating the use of Form FTB 3582 for individual e-filed returns in California, it's common to encounter a suite of supplementary documents. These additional forms and documents each serve unique purposes, assisting taxpayers in navigating the specifics of their financial situations, ensuring compliance, and optimizing their filings. Highlighted below is a succinct overview of commonly accompanying documents that taxpayers might need alongside Form FTB 3582.

- Form 540: California Resident Income Tax Return, used for reporting individual income earned.

- Form 540 2EZ: A shorter version of the Form 540 for individuals with straightforward financial situations.

- Form 540NR: Nonresident or Part-Year Resident Income Tax Return, for individuals who are not permanent residents but have earned income in California.

- Form 3567: Installment Agreement Request, for taxpayers seeking to arrange a payment plan for outstanding tax liabilities.

- Form 3519: Payment for Automatic Extension for Individuals, for taxpayers who need more time to file their state income tax return.

- Form 3500: Exemption Application, for qualifying organizations seeking exemption from California income tax.

- Form 3522: LLC Tax Voucher, used by limited liability companies to pay the annual tax fee to the state.

- Form 100: California Corporation Franchise or Income Tax Return, required for corporate entities operating within the state.

- Form 592: Resident and Nonresident Withholding Statement, used to report amounts withheld from payments to nonresidents for services performed in California.

- Form 109: California Exempt Organization Business Income Tax Return, for income earned by an exempt organization from unrelated business activities.

Each document plays a vital role in providing a complete and accurate picture of an individual's or entity's tax responsibilities. Whether it's detailing income, requesting extensions, clarifying resident status, or adhering to specific tax obligations for organizations, these forms collectively ensure that taxpayers can fulfill their obligations comprehensively. It's essential for taxpayers to familiarize themselves with these documents to ensure a smooth tax filing process and to maintain compliance with California's tax requirements.

Similar forms

The IRS Form 1040-ES, Estimated Tax for Individuals, is quite similar to the California 3582 form as both are used for submitting tax payments, although the 1040-ES is for federal taxes. They share the requirement for taxpayers to estimate their due taxes and make payments accordingly. Where the 3582 form is used alongside e-filed returns for those who owe state taxes in California, the 1040-ES is utilized by individuals to pay estimated federal taxes quarterly. This similarity lies in facilitating taxpayers to pay any owed taxes in a structured manner to avoid lump-sum payments during the tax season.

Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, shares characteristics with the California 3582 form by providing a mechanism for taxpayers to address their filing and payment duties. While Form 4868 is used to request an extension for filing federal tax returns, the 3582 form is specifically for making payments on state tax dues in California for e-filers. Both forms address the need to communicate with tax authorities regarding one's tax obligations and to avoid penalties for late filings or payments.

The California FTB 3567, Installment Agreement Request, shares a purpose with the 3582 form in that it offers taxpayers a way to manage their tax liabilities. The 3567 form is specifically designed for individuals who cannot pay their full tax bill and need to arrange payment over time. This is similar to the 3582's role in facilitating payments for tax dues, albeit the 3582 is not an installment plan request but a payment voucher accompanying an e-filed return. Both forms assist taxpayers in addressing their tax obligations directly with the state's Franchise Tax Board.

Another document with a similar function is the IRS Form 9465, Installment Agreement Request, paralleling the California 3582 form's role in dealing with taxes due. Form 9465 is for taxpayers who need to make arrangements for paying their federal taxes over time. Though the 3582 form doesn't set up an installment plan, it does ensure that payments for e-filed returns are processed correctly, aligning with how both forms help manage tax payments—either by installment or in full to comply with tax laws.

The IRS Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, is akin to the 3582 form as it relates to tax administration procedures. Form 7004 allows businesses extra time to file their tax returns, much like how the 3582 voucher gives individuals a way to submit their state tax payments in California. Although serving different tax filer groups and purposes, both forms facilitate tax compliance within designated deadlines.

Form 8822, Change of Address, indirectly relates to the California 3582 by involving taxpayer information updates. While Form 8822 is specifically for notifying the IRS about a change of address, ensuring communications and tax documents are correctly sent, the 3582 form also requires accurate taxpayer information, including address details, for payment processing. Despite their differing main purposes, both documents emphasize the importance of current taxpayer information in the administration of tax obligations.

The California Form 540, California Resident Income Tax Return, is directly related to the 3582 form as they are part of the state's tax filing and payment process. While Form 540 is for reporting income, deductions, and credits to calculate tax liability, the 3582 serves as the payment voucher for those who file their returns electronically and have a balance due. Their usage is intertwined, with the completion of Form 540 potentially necessitating the use of 3582 for payment submission.

Lastly, IRS Form 1099, used for reporting various types of income other than wages, salaries, and tips, is comparable to the California 3582 form because it involves the process of reporting financial activities pertinent to tax obligations. The 1099 forms require recipients to report additional income on their tax returns, potentially affecting the amount due and necessitating the 3582 payment voucher for those in California. Both forms are integral to ensuring accurate tax reporting and compliance.

Dos and Don'ts

Filling out the California Form 3582 can be straightforward if you follow some basic do's and don'ts. This form is essential for individuals who have e-filed their tax returns and owe a balance to the state. Correctly completing this form ensures your payment is processed accurately and efficiently.

Do:- Use black or blue ink when completing the form to ensure that scanning machines can read your information correctly.

- Verify all preprinted information for accuracy, including your name(s), address, social security number(s) (SSNs) or individual taxpayer identification numbers (ITINs), and the amount of payment. Make corrections if necessary.

- Round cents to the nearest dollar, simplifying the payment amount. This means if you owe $50.50, you should round up to $51; if you owe $25.49, round down to $25.

- Detach the payment voucher if you are mailing a payment. Enclose the payment along with the voucher, but do not staple them together.

- Mail the voucher if you do not have a payment due. The form is only necessary when you owe a balance to the state.

- Use any ink color other than blue or black to complete the voucher. Using different colors or pencil can lead to scanning errors.

Send cash.Make your check or money order payable to "Franchise Tax Board." Write your SSN or ITIN and "2009 FTB 3582" on the payment method for accurate processing.- Mail a paper copy of your tax return with the voucher. Only the payment voucher and your check or money order should be mailed if you owe a balance.

By adhering to these guidelines, you can help ensure that your tax payment is processed without delays, thereby avoiding potential penalties or interest charges. Remember to always check the latest updates from the California Franchise Tax Board as processes and requirements may change.