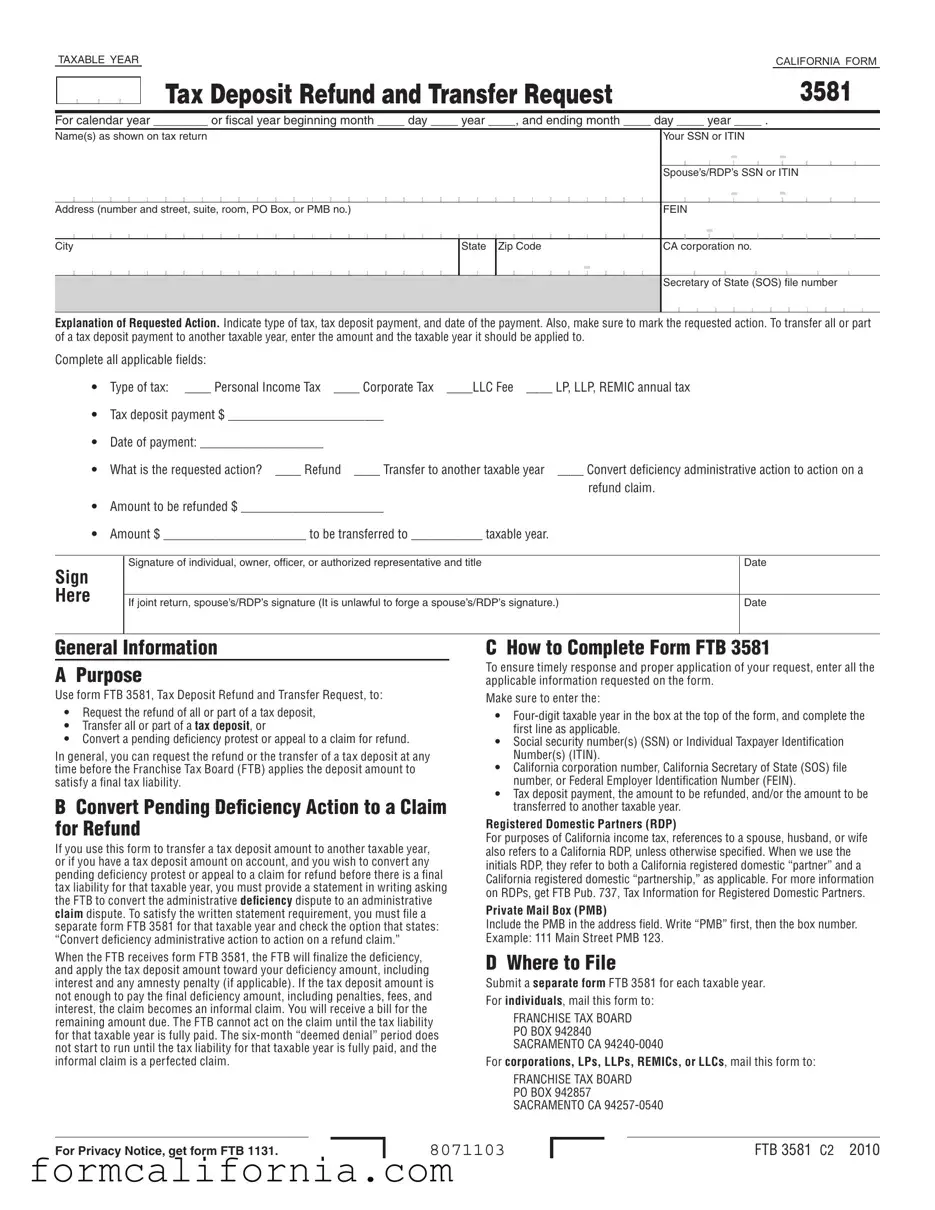

Blank California 3581 PDF Form

The California Form 3581, titled Tax Deposit Refund and Transfer Request, serves a vital role for taxpayers looking to manage their payments more effectively. Designed for use by individuals, corporations, and other entities, this form enables the request for refunds or the transfer of tax deposit amounts to different taxable years. It is applicable for both the calendar and fiscal years, requiring detailed information including social security numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs), corporate or entity identification numbers, and specifics regarding the tax deposit payment in question. Other critical features of the form include options to convert a pending deficiency protest or appeal into a claim for refund, ensuring taxpayers can navigate their financial responsibilities with flexibility. This form also accommodates Registered Domestic Partners (RDP) in recognition of their status under California tax law, providing clear instructions on how to complete and where to submit it to ensure a timely and proper response from the Franchise Tax Board (FTB). Additionally, the form advises on the inclusion of Private Mail Box (PMB) details, if applicable, ensuring the FTB can communicate effectively with taxpayers. Overall, Form 3581 is an essential document for those seeking to adjust their tax liabilities or recover funds, reflecting California's efforts to provide a comprehensive and user-friendly tax management system.

Document Preview Example

TAXABLE YEARCALIFORNIA FORM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Deposit Refund and Transfer Request |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3581 |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For calendar year ________ or fiscal year beginning month ____ day ____ year ____, and ending month ____ day ____ year ____ . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Name(s) as shown on tax return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Address (number and street, suite, room, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

City |

|

|

|

|

|

|

|

|

|

|

State |

Zip Code |

CA corporation no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secretary of State (SOS) file number |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Explanation of Requested Action. Indicate type of tax, tax deposit payment, and date of the payment. Also, make sure to mark the requested action. To transfer all or part of a tax deposit payment to another taxable year, enter the amount and the taxable year it should be applied to.

Complete all applicable fields:

• Type of tax: ____ Personal Income Tax ____ Corporate Tax ____LLC Fee ____ LP, LLP, REMIC annual tax

•Tax deposit payment $ ________________________

•Date of payment: ___________________

• What is the requested action? ____ Refund ____ Transfer to another taxable year ____ Convert deficiency administrative action to action on a

refund claim.

•Amount to be refunded $ ______________________

•Amount $ ______________________ to be transferred to ___________ taxable year.

Sign Here

Signature of individual, owner, officer, or authorized representative and title |

Date |

|

|

If joint return, spouse’s/RDP’s signature (It is unlawful to forge a spouse’s/RDP’s signature.) |

Date |

|

|

General Information

A Purpose

Use form FTB 3581, Tax Deposit Refund and Transfer Request, to:

•Request the refund of all or part of a tax deposit,

•Transfer all or part of a tax deposit, or

•Convert a pending deficiency protest or appeal to a claim for refund.

In general, you can request the refund or the transfer of a tax deposit at any time before the Franchise Tax Board (FTB) applies the deposit amount to satisfy a final tax liability.

BConvert Pending Deficiency Action to a Claim for Refund

If you use this form to transfer a tax deposit amount to another taxable year, or if you have a tax deposit amount on account, and you wish to convert any pending deficiency protest or appeal to a claim for refund before there is a final tax liability for that taxable year, you must provide a statement in writing asking the FTB to convert the administrative deiciency dispute to an administrative claim dispute. To satisfy the written statement requirement, you must file a separate form FTB 3581 for that taxable year and check the option that states: “Convert deficiency administrative action to action on a refund claim.”

When the FTB receives form FTB 3581, the FTB will finalize the deficiency, and apply the tax deposit amount toward your deficiency amount, including interest and any amnesty penalty (if applicable). If the tax deposit amount is not enough to pay the final deficiency amount, including penalties, fees, and interest, the claim becomes an informal claim. You will receive a bill for the remaining amount due. The FTB cannot act on the claim until the tax liability for that taxable year is fully paid. The

C How to Complete Form FTB 3581

To ensure timely response and proper application of your request, enter all the applicable information requested on the form.

Make sure to enter the:

•

•Social security number(s) (SSN) or Individual Taxpayer Identification Number(s) (ITIN).

•California corporation number, California Secretary of State (SOS) file number, or Federal Employer Identification Number (FEIN).

•Tax deposit payment, the amount to be refunded, and/or the amount to be transferred to another taxable year.

Registered Domestic Partners (RDP)

For purposes of California income tax, references to a spouse, husband, or wife also refers to a California RDP, unless otherwise specified. When we use the initials RDP, they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

Private Mail Box (PMB)

Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

D Where to File

Submit a separate form FTB 3581 for each taxable year.

For individuals, mail this form to:

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA

For corporations, LPs, LLPs, REMICs, or LLCs, mail this form to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA

For Privacy Notice, get form FTB 1131.

8071103

FTB 3581 C2 2010

Document Specs

| Fact | Description |

|---|---|

| Purpose of Form 3581 | Used to request a refund or transfer of a tax deposit, or convert a pending deficiency protest or appeal to a claim for refund in California. |

| Eligibility for Refund or Transfer | A refund or transfer of a tax deposit can be requested at any time before the Franchise Tax Board applies the deposit to satisfy a final tax liability. |

| Conversion of Deficiency | To convert a deficiency protest or appeal to a claim for refund, a separate written statement is required along with the checking of the specified option in the form. |

| How to Complete the Form | Accurate and complete entry of applicable information, including the taxable year, SSN or ITIN, California corporation or SOS file number, FEIN, and details of the tax deposit payment, is necessary for proper processing. |

| Mailing Addresses | There are separate mailing addresses for individual filers and entities like corporations, LPs, LLPs, REMICs, or LLCs. |

Detailed Instructions for Writing California 3581

Filling out the California Form 3581 is a key step in managing your tax deposits, whether you aim to request a refund, transfer funds to another tax year, or convert a deficiency protest into a claim for a refund. Effective completion and submission of this form ensure your financial planning and tax compliance align precisely with your intentions. The process requires attention to detail, especially in providing accurate information related to your tax account and the specific actions you wish to take regarding your tax deposits. Follow these structured steps closely to ensure a smooth and successful submission.

- At the top of the form, enter the four-digit taxable year for which the form is being filed. If dealing with a fiscal year, provide the start and end dates, including month, day, and year.

- Fill in your name(s) as they appear on your tax return. This includes any joint filer, such as a spouse/RDP's name.

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If applicable, include your spouse’s/RDP's SSN or ITIN.

- Enter your complete address, including number and street, suite, room, PO Box, or PMB number.

- If you are filing for a corporation or other entity, provide the entity's Federal Employer Identification Number (FEIN), California corporation number, or Secretary of State (SOS) file number.

- In the section titled "Explanation of Requested Action," mark the appropriate box to indicate the type of tax. Then, enter the amount of the tax deposit payment and the date of the payment.

- Specify the requested action: whether you want a refund, to transfer the deposit to another taxable year, or to convert a deficiency administrative action. If you opt to transfer, indicate the amount and the specific taxable year it should be applied to.

- If you're requesting a refund, ensure to fill in the amount to be refunded. For transfers, state the amount to be transferred and the applicable taxable year.

- Sign the form. If it's a joint return, both you and your spouse/RDP must sign. Include the date next to each signature.

- Review the General Information section for any additional instructions or requirements, especially if your situation involves specific considerations like RDPs or PMBs.

- Finally, mail the completed form to the appropriate address listed in the instructions. Use the address for individuals or the address for corporations, LPs, LLPs, REMICs, or LLCs, based on your filing status.

Upon receipt of your completed Form 3581, the California Franchise Tax Board (FTB) will process your request. This involves reviewing your tax account, finalizing any pending issues, and executing your requested action, whether it's a refund, a transfer, or a conversion related to a deficiency. Understanding the processing timeline and any subsequent steps, such as resolving a deficient amount or confirming the transfer to another taxable year, is crucial. Patience and proactive follow-up, if necessary, will help ensure your tax matters are resolved to your satisfaction.

Things to Know About This Form

What is the purpose of Form FTB 3581?

The purpose of Form FTB 3581, known as the Tax Deposit Refund and Transfer Request, encompasses several important functions related to tax deposits made to the California Franchise Tax Board (FTB). It is used by taxpayers who seek to do one of the following: request a refund of all or part of a tax deposit before a final tax liability is satisfied, transfer all or part of a tax deposit to another taxable year, or convert a pending deficiency protest or appeal into a claim for refund. This flexibility allows taxpayers to manage their tax deposits more effectively according to their individual needs and circumstances.

How can someone convert a pending deficiency action to a claim for refund?

To convert a pending deficiency action (such as a protest or an appeal) to a claim for refund, the taxpayer must submit a written statement to the FTB. This is achieved by filing Form FTB 3581 for the specific taxable year in question and selecting the option that states, “Convert deficiency administrative action to action on a refund claim.” Upon receipt, the FTB will finalize the deficiency and apply the tax deposit amount towards the deficiency amount, including any interest and amnesty penalty if applicable. If the tax deposit is insufficient to cover the full deficiency amount, including penalties, fees, and interest, the claim will be considered an informal claim, and the taxpayer will be billed for the remaining amount due. The FTB will only act on the claim once the tax liability for that year is fully paid, transforming the informal claim into a perfected claim.

What are the steps to complete Form FTB 3581 correctly?

To ensure that Form FTB 3581 is correctly completed and that the request is processed without delay, it is crucial to provide all the required information. Steps include:

- Entering the four-digit taxable year at the top of the form.

- Completing the first line with the appropriate date range for the fiscal year, if applicable.

- Providing the Social Security Number(s) (SSN), Individual Taxpayer Identification Number(s) (ITIN), California corporation number, California Secretary of State (SOS) file number, or Federal Employer Identification Number (FEIN), as applicable.

- Specifying the type of tax, the tax deposit payment amount, the date of payment, and detailing the requested action - whether it is a refund, transfer to another taxable year, or conversion of a deficiency action to a refund claim.

These steps help to ensure that the request is clearly understood and can be executed as intended by the FTB.

Who needs to sign Form FTB 3581?

Form FTB 3581 must be signed by the individual, owner, officer, or authorized representative who is filing the form. If the form is for a joint return, it also requires the signature of the spouse or Registered Domestic Partner (RDP). It is illegal to forge a spouse’s or RDP’s signature. These signatures are a vital part of the submission, serving as a declaration that the information provided on the form is accurate and truthful to the best of the signer's knowledge. Proper completion and signing of the form help to avoid any potential delays or issues with processing.

Where should Form FTB 3581 be mailed?

The completed Form FTB 3581 should be mailed to specific addresses depending on the type of taxpayer submitting the form. Individuals need to send it to:

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-0040

Meanwhile, corporations, LPs, LLPs, REMICs, or LLCs should mail their completed forms to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA 94257-0540

Submitting the form to the correct address is important for timely and proper processing.

How does the form accommodate Registered Domestic Partners (RDPs)?

For purposes of California income tax, references on the form to a spouse, husband, or wife also include a California Registered Domestic Partner (RDP), unless specified otherwise. The form is designed to be inclusive, acknowledging the state's recognition of RDPs for tax purposes. Taxpayers in RDP relationships should provide the relevant Social Security Numbers or Individual Taxpayer Identification Numbers for both partners where requested on the form. Additionally, they are entitled to the same considerations as spouses in fulfilling the form's requirements. This inclusivity ensures that all Californians are treated equitably under state tax laws.

Common mistakes

-

Not accurately completing the date section for the applicable tax year. This includes not filling in or incorrectly stating the calendar or fiscal year the refund or transfer request pertains to. It's critical to specify the correct start and end dates of the fiscal year if it doesn't align with the calendar year. Incorrect dates can lead to processing delays or the request being applied to the wrong year.

-

Omitting or misreporting identification numbers. Failing to provide or inaccurately entering Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs), the California corporation number, Secretary of State (SOS) file number, or Federal Employer Identification Number (FEIN) can significantly hinder the Franchise Tax Board's (FTB) ability to process the request efficiently.

-

Incorrectly stating the amount to be refunded or transferred. People often make errors by entering the wrong amount or leaving the "Amount to be refunded" or "Amount to be transferred" sections blank. Accurate figures are crucial for the FTB to action the request correctly.

-

Neglecting to specify the type of tax or requested action. It is a common mistake to overlook or incorrectly mark the type of tax (such as Personal Income Tax, Corporate Tax) and the specific requested action (refund, transfer to another taxable year, etc.). This information guides the FTB on how to process the form appropriately.

-

Inadequate signature or dating of the form. The form requires the signature of the individual, owner, officer, or authorized representative and, if a joint return, the spouse’s/RDP’s signature. Failure to sign or date the form as required can lead to the FTB rejecting the request due to incomplete documentation.

Documents used along the form

When navigating the complexities of tax matters, particularly for those in California needing to manage their financial obligations accurately, the Form 3581 plays a crucial role. This document, known as the Tax Deposit Refund and Transfer Request, serves individuals and entities by allowing refunds or the reallocation of tax deposits to different taxable years. However, to ensure that these processes are carried out smoothly and effectively, additional forms and documents often accompany Form 3581. Here is an overview of some of these essential documents and their functions.

- Form 540: California Resident Income Tax Return. This form is used by California residents to file their state income tax return. It provides the necessary information about an individual's income, deductions, and credits for the taxable year.

- Form 540NR: California Nonresident or Part-Year Resident Income Tax Return. Nonresidents or those who have resided in California for only part of the year use this form to report income earned within the state and calculate the tax owed.

- Form 100: California Corporation Franchise or Income Tax Return. This document is for corporations operating in California, detailing their income, deductions, and tax liability for the fiscal year.

- Form 100S: California S Corporation Franchise or Income Tax Return. S Corporations use this form to report income and deductions, with the profits and losses flowing through to shareholders.

- Form 568: Limited Liability Company Return of Income. LLCs file this form to report their income, deductions, and gains or losses to the state of California.

- Form 3522: LLC Tax Voucher. This payment voucher is used by LLCs to pay the annual tax to the California Franchise Tax Board.

- Form 109: California Exempt Organization Business Income Tax Return. Nonprofit organizations and other exempt entities use this form to report unrelated business income.

- Form 199: California Exempt Organization Annual Information Return. This form allows nonprofit organizations to provide financial information, including revenue and expenses, to the state.

- Form 588: Nonresident Withholding Waiver Request. Individuals or entities who receive income from California sources but are not residents may use this form to request a waiver from the state's withholding requirements.

- Form 590: Withholding Exemption Certificate. This certificate is given to a payer by a payee to certify that the income is exempt from withholding.

Understanding and utilizing these forms alongside Form 3581 requires attention to detail and adherence to regulatory guidelines. Together, these documents facilitate the accurate reporting and processing of tax-related matters in California, ensuring compliance and helping individuals and businesses manage their financial responsibilities effectively. Whether seeking a refund, making a payment, or transferring funds between taxable years, the meticulous completion and submission of these documents are vital components of financial management and tax compliance in the state.

Similar forms

The Form 1040X, or Amended U.S. Individual Income Tax Return, resembles the California Form 3581 in many ways. Both forms allow taxpayers to adjust their tax liability or claim refunds for overpayments. The 1040X is used by individuals to correct previously filed Form 1040s, making adjustments to income, filing status, or credits similar to how Form 3581 requests action on tax deposit refunds or transfers across tax years.

Form 843, Claim for Refund and Request for Abatement, shares similarities with Form 3581 as both are used to request refunds or correct tax liabilities. Form 843 is applied at the federal level to request refunds or abate penalties or interest from various taxes, including income, gift, or estate taxes, much like Form 3581 is used within California to manage tax deposits related to personal income or business taxes.

The Application for Automatic Extension of Time to File U.S. Individual Tax Return, or Form 4868, though different in its primary function from California Form 3581, has a comparable purpose in managing tax liabilities. Form 4868 is used to extend the filing deadline of an individual’s tax return, indirectly affecting the taxpayer's financial obligations, similar to how Form 3581 can transfer tax deposits to future taxable years, affecting the timing and application of tax payments.

Form 8809, Application for Extension of Time to File Information Returns, is akin to Form 3581 in the sense that it deals with adjusting deadlines related to tax liabilities. While Form 8809 applies to information returns and not directly to tax payments or refunds, its role in managing the timing of tax-related obligations captures a similar essence to Form 3581’s function of transferring or refunding tax deposits.

Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, parallels the California Form 3581. Form 7004 is utilized by businesses to extend the filing dates for numerous tax returns, which indirectly modifies the timeline for tax liabilities. In comparison, Form 3581 directly affects the financial aspect by allowing the transfer or refund of tax deposits for businesses like corporations and LLCs.

The Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, has a connection with Form 3581 through its provision for employers to correct previously reported tax information. Like Form 3581, which may involve the correction of tax deposit amounts for businesses, Form 941-X provides a way to adjust tax liabilities or claim refunds, but specifically for payroll taxes.

The Change of Address Form 8822 closely resembles the utility of the California Form 3581's section requiring the taxpayer's address. Both forms ensure the proper handling and mailing of documents or refunds between the taxpayer and the taxing authority. While Form 8822 is strictly for address updates with the IRS, ensuring the correct delivery of notices and refunds, Form 3581 includes address information as part of broader transactional functions like refund requests or tax payment transfers.

Dos and Don'ts

When completing the California Form 3581, Tax Deposit Refund and Transfer Request, it's important to follow some key dos and don'ts to ensure your request is processed efficiently and accurately. Here are six critical points to consider:

- Do accurately fill in all the required fields, including your name, social security number (SSN) or individual taxpayer identification number (ITIN), and address. Ensuring this information is correct is crucial for the processing of your form.

- Do include the precise amount of the tax deposit payment, the amount you wish to be refunded, and/or the amount to be transferred to another taxable year. Specificity in these amounts helps avoid delays in processing.

- Do specify the type of tax, the date of the payment, and clearly indicate the requested action: whether it's a refund, a transfer to another taxable year, or converting a deficiency administrative action to action on a refund claim.

- Don't leave the taxable year fields blank. It is vital to insert the pertinent four-digit taxable year at the top of the form to direct your request to the correct fiscal period.

- Don't forget to sign the form. If filing jointly, ensure both parties sign, as submitting the form without the required signatures may result in it being returned or not processed.

- Don't ignore the need to include a written statement if converting a pending deficiency protest or appeal to a claim for refund. Filing a separate Form FTB 3581 for that specific request and marking the appropriate checkbox is essential for processing.

Adhering to these guidelines can facilitate a smoother process in handling your Tax Deposit Refund and Transfer Request with the California Franchise Tax Board.

Misconceptions

Understanding the nuances of tax documents can often lead to confusion and misunderstandings. The California Form 3581, titled Tax Deposit Refund and Transfer Request, is no exception. Here are seven common misconceptions about this particular form and the truths behind each.

Form 3581 is only for requesting tax refunds: While it's true that one use of Form 3581 is to request tax refunds, it serves a broader purpose. Taxpayers can also use it to transfer all or part of a tax deposit to another taxable year or convert a pending deficiency action into a refund claim action. This versatility makes it an important form for various tax-related requests, not just refunds.

Form 3581 should be filed after a final tax liability is assessed: Actually, the request for the refund or transfer of a tax deposit must be made before the Franchise Tax Board (FTB) applies the deposit amount to satisfy any final tax liability. This timing is crucial for taxpayers looking to manage their deposits efficiently.

Any taxpayer can file Form 3581: While many taxpayers can use Form 3581, it's specifically designed for individuals, corporations, LLCs, LPs, LLPs, and REMICs that have made a tax deposit with the FTB. It's important to understand the form’s intended audience to ensure proper use.

Tax deposit amounts can be transferred without restrictions: When transferring a tax deposit to another taxable year, the process must meet specific conditions, such as submitting a written request. This must also be done before there’s a final tax liability, which limits the flexibility some might expect.

Filing Form 3581 is a complex process: The form is relatively straightforward. By carefully entering all the required information, including taxable year, social security numbers, and the amount to be refunded or transferred, taxpayers can successfully submit their request. The form's design is to ensure clarity and simplicity in managing tax deposits.

Form 3581 is only for use by individuals: This is a misunderstanding. The form is also applicable to corporations, LLCs, partnerships, and other entities, as long as they have made a tax deposit with the FTB. Understanding that Form 3581 is not exclusively for individual use is essential for businesses managing their tax liabilities.

Registered Domestic Partners (RDPs) cannot use Form 3581: On the contrary, Form 3581 explicitly acknowledges the status of Registered Domestic Partners. References to spouses in the context of California income tax also apply to California RDPs, making it fully inclusive and accessible for all domestic partnerships recognized by the state.

Clearing up these misconceptions helps ensure that taxpayers can effectively navigate their tax responsibilities, making informed decisions about managing their tax deposits. Whether seeking a refund, transferring funds to another taxable year, or converting a deficiency action, understanding the versatility and applicability of Form 3581 is key to maximizing its benefits.

Key takeaways

When dealing with the form FTB 3581 for Tax Deposit Refund and Transfer Request in California, understanding the key points can help streamline the process whether you're an individual or part of an entity. Here are six significant takeaways to keep in mind:

- Various Purposes: The form is versatile, allowing for the refund of tax deposits, the transfer of these deposits to another tax year, or converting a pending deficiency protest or appeal into a claim for a refund.

- Timely Requests: You can request a refund or transfer of your tax deposit at any point before the Franchise Tax Board (FTB) uses it to offset a final tax liability.

- Writing Requirement for Converting Protests or Appeals: To change a pending deficiency action into a refund claim, a written statement is necessary. Filing a separate FTB 3581 form for the relevant tax year and checking the appropriate box meets this requirement.

- Completing the Form: For the FTB to process your request efficiently, complete all pertinent fields. This includes your social security number or ITIN, California corporation or Secretary of State file number, and the specifics of the tax deposit payment.

- Inclusion of Registered Domestic Partners: In California, tax references to a spouse extend to Registered Domestic Partners (RDPs), ensuring equal treatment under state tax laws.

- Separate Submissions for Each Tax Year: If you have requests for multiple tax years, you'll need to file an FTB 3581 form for each one. Be sure to mail these to the correct address, depending on whether you're filing as an individual or an entity.

Understanding these key aspects of the FTB 3581 form can significantly aid in navigating the process, ensuring that your tax deposit requests are handled accurately and efficiently.

Discover More PDFs

California Gypsy Moth Checklist - Master the simple art of inspecting for gypsy moth to keep your new community safe from infestation.

California Participating Practitioner Application - Provides space for specifying the frequency, duration, and quantity of the requested treatment, ensuring clarity of the treatment plan.

Smllc Meaning - Only e-filed returns with a balance due need to utilize the FTB 3588 form for payment purposes.