Blank California 3555 PDF Form

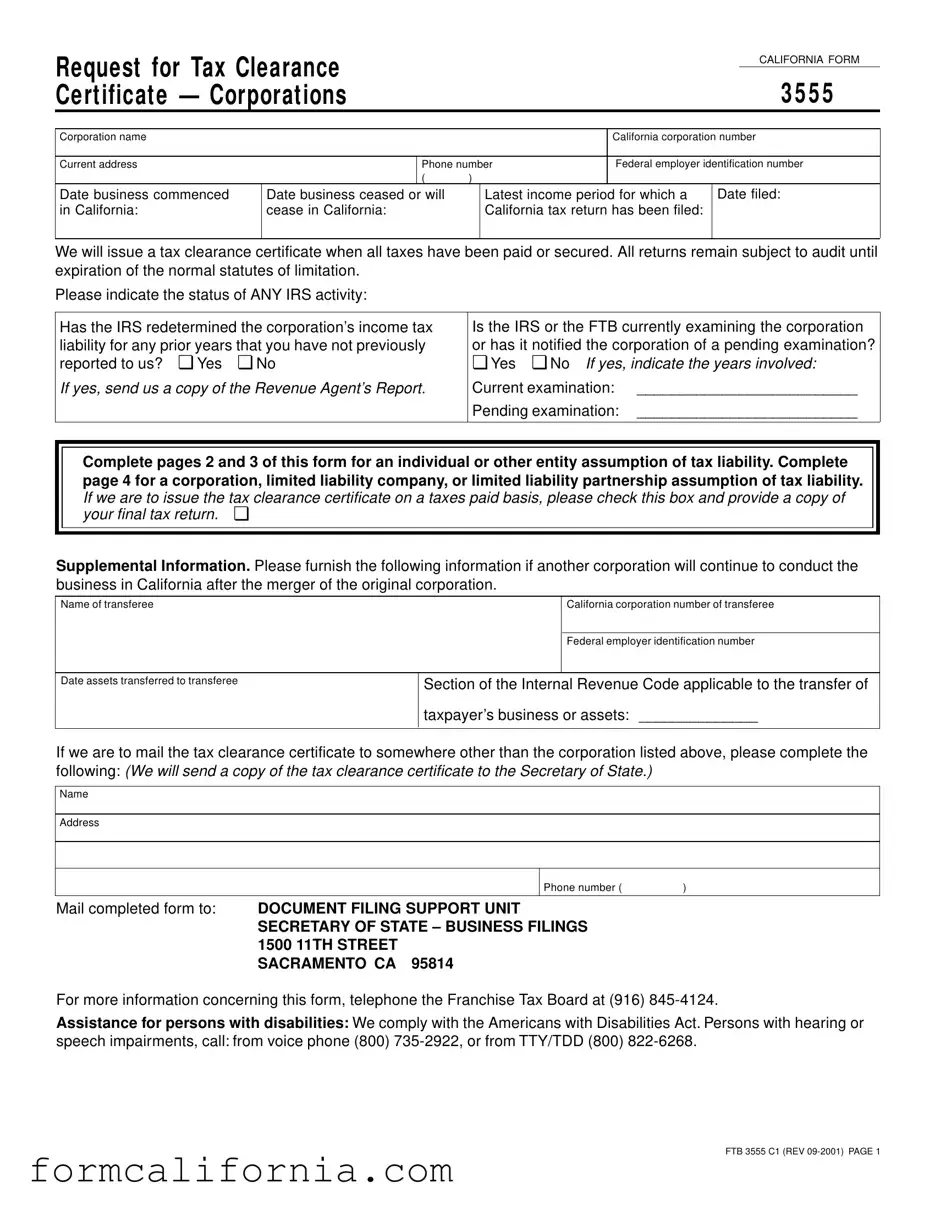

When it comes to wrapping up or transferring the responsibilities of a business in California, the California Form 3555, or the Request for Tax Clearance Certificate for Corporations, plays a crucial role. This form serves as a comprehensive tool for corporate entities looking to ensure they've met all tax-related obligations to the Franchise Tax Board before dissolving, surrendering, or transferring their business. It requires detailed information about the corporation, including its name, California corporation number, current address, and federal employer identification number. Furthermore, the form inquires about the business's operational dates in California, the latest income period for tax returns filed, and any ongoing examinations by the Internal Revenue Service (IRS) or Franchise Tax Board (FTB). Corporations assuming tax liability, whether individually, through a trust, or another corporate entity, must provide an in-depth financial statement outlining their assets, liabilities, and net worth to demonstrate their capacity to fulfill the original corporation's tax obligations. Additionally, the form accommodates situations where a business continues under a new entity post-merger, requiring information about the transferee corporation. The submission of this form, complete with all necessary supplements and financial statements, can significantly streamline the process of obtaining a tax clearance certificate, marking a critical step in the transition or conclusion of corporate affairs in California.

Document Preview Example

Request for Tax Clearance |

|

|

|

|

CALIFORNIA FORM |

||

|

|

3 5 5 5 |

|||||

Certificate — Corporations |

|

|

|||||

|

|

|

|

|

|

|

|

Corporation name |

|

|

|

|

California corporation number |

||

|

|

|

|

|

|||

Current address |

|

Phone number |

Federal employer identification number |

||||

|

|

( |

) |

|

|

|

|

Date business commenced |

Date business ceased or will |

|

Latest income period for which a |

Date filed: |

|||

in California: |

cease in California: |

|

California tax return has been filed: |

|

|||

|

|

|

|

|

|

|

|

We will issue a tax clearance certificate when all taxes have been paid or secured. All returns remain subject to audit until expiration of the normal statutes of limitation.

Please indicate the status of ANY IRS activity:

Has the IRS redetermined the corporation’s income tax |

Is the IRS or the FTB currently examining the corporation |

|

liability for any prior years that you have not previously |

or has it notified the corporation of a pending examination? |

|

reported to us? ❏ Yes ❏ No |

❏ Yes ❏ No If yes, indicate the years involved: |

|

If yes, send us a copy of the Revenue Agent’s Report. |

Current examination: |

__________________________ |

|

Pending examination: |

__________________________ |

|

|

|

Complete pages 2 and 3 of this form for an individual or other entity assumption of tax liability. Complete page 4 for a corporation, limited liability company, or limited liability partnership assumption of tax liability.

If we are to issue the tax clearance certificate on a taxes paid basis, please check this box and provide a copy of your final tax return. ❏

Supplemental Information. Please furnish the following information if another corporation will continue to conduct the business in California after the merger of the original corporation.

Name of transferee

California corporation number of transferee

Federal employer identification number

Date assets transferred to transferee

Section of the Internal Revenue Code applicable to the transfer of

taxpayer’s business or assets: ______________

If we are to mail the tax clearance certificate to somewhere other than the corporation listed above, please complete the following: (We will send a copy of the tax clearance certificate to the Secretary of State.)

Name

Address

Phone number ( |

) |

Mail completed form to: DOCUMENT FILING SUPPORT UNIT

SECRETARY OF STATE – BUSINESS FILINGS 1500 11TH STREET

SACRAMENTO CA 95814

For more information concerning this form, telephone the Franchise Tax Board at (916)

Assistance for persons with disabilities: We comply with the Americans with Disabilities Act. Persons with hearing or

speech impairments, call: from voice phone (800)

FTB 3555 C1 (REV

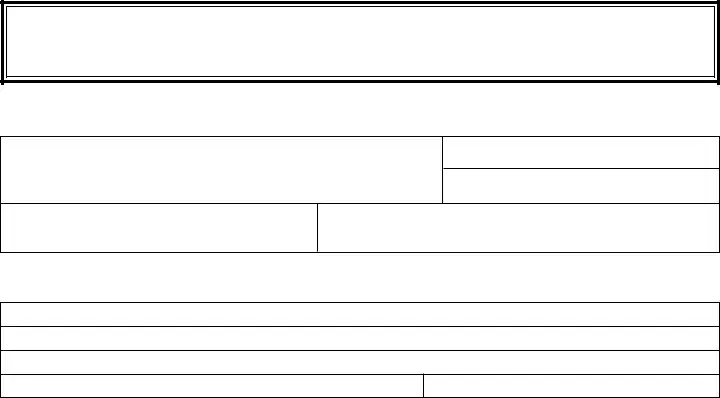

Please complete Section A or B below.

A. INDIVIDUAL ASSUMPTION OF TAX LIABILITY

Corporation name

Current address

|

California corporation number |

Phone number |

Federal employer identification number |

( )

I unconditionally agree to file or cause to be filed with the Franchise Tax Board, under the provisions of the Bank and Corporation Tax Law, all tax returns and data required and to pay in full all accrued or accruing tax liabilities, penalties, interest, and fees due from the above named corporation at the effective date of dissolution or surrender.

My net worth (assets minus liabilities) is not less than: $ _____________________ .

(We require a detailed financial statement [PAGE 3].)

Name of individual assumer (print) |

|

Social security number |

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone number ( |

) |

|

|

|

|

|

|

|

|

Date |

Signature |

|

|

|

|

|

|

B. TRUST ASSUMPTION OF TAX LIABILITY

Corporation name

Current address

|

California corporation number |

Phone number |

Federal employer identification number |

( )

This trust unconditionally agrees to file or cause to be filed with the Franchise Tax Board, under the provisions of the Bank and Corporation Tax Law, all tax returns and data required and to pay in full all accrued or accruing tax liabilities, penalties, interest, and fees due from the above named corporation at the effective date of dissolution or surrender:

(We require a detailed financial statement [PAGE 3].)

Name of trust

Trust federal identification number

Address

Phone number ( |

) |

Date

Trustee’s name (print)

Trustee’s signature

FOR PRIVACY ACT NOTICE, SEE FORM FTB 1131.

FTB 3555 C1 (REV

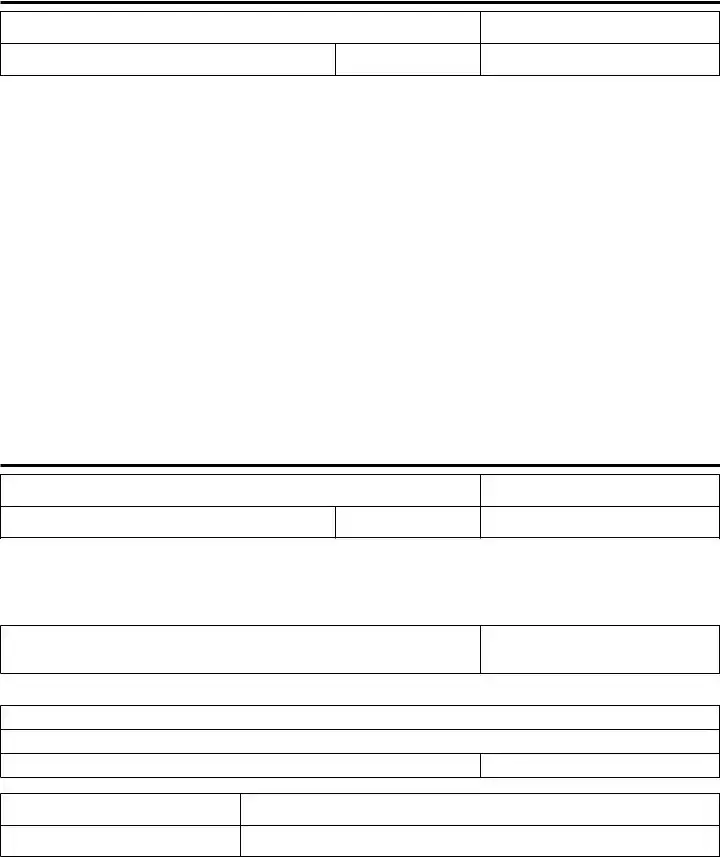

FINANCIAL STATEMENT FOR INDIVIDUAL OR OTHER ENTITY

Corporation name |

Corporation number |

|

|

|

|

Statement of Assets and Liabilities

Item |

|

Present |

Liabilities |

Equity in |

|

value (A) |

balance due (B) |

asset |

|

|

|

|||

Cash |

|

|

|

|

Bank accounts |

|

|

|

|

Stocks and bonds |

|

|

|

|

Cash or loan value of insurance |

|

|

|

|

Household furniture |

|

|

|

|

Real property |

|

|

|

|

Vehicles |

|

|

|

|

|

|

|

|

|

Other assets (describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal taxes outstanding |

|

|

|

|

Loans |

|

|

|

|

|

|

|

|

|

Other (include judgements) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets |

|

|

|

|

(Total column A less total column B) |

|

|

|

$ |

General Information (Please attach additional schedules if necessary.) |

||||

|

|

|

|

|

Net annual income |

Source (name of business or employer) |

|

|

|

|

|

|

|

|

Banks and savings and loan accounts (names and addresses)

Description and license number of each vehicle

Stocks and bonds (name of company, number of shares, etc.)

Real property (brief descriptions and locations)

I certify that the information above is correct to the best of my knowledge.

Assumer’s name (print) _____________________________________________________________________________________________________

Assumer’s address |

____________________________________________________________ Phone number ( |

) |

_______________________ |

Assumer’s signature |

__________________________________________________________________________ |

Date |

_______________________ |

FTB 3555 C1 (REV

CORPORATION, LIMITED LIABILITY COMPANY, OR LIMITED LIABILITY PARTNERSHIP ASSUMPTION OF TAX LIABILITY

The Assumption of Tax Liability

of (1) __________________________________________________________ )

|

) |

|

A corporation |

) ________________________ |

|

|

) |

California Corporation number, Secretary of |

|

State file number, or federal employer |

|

by (2) _________________________________________________________ ) |

identification number |

|

|

||

|

) |

|

A corporation, limited liability company, or limited liability partnership |

) ________________________ |

|

|

|

California Corporation number, Secretary of |

|

|

State file number, or federal employer |

|

|

identification number |

(Name of assumer) __________________________________________________ unconditionally

agrees to file with the Franchise Tax Board all tax returns and data required and pay in full all tax liabilities, penalties, interest and fees of (1) _________________________________________

_________________________________________________________________________________; at the

effective date of dissolution or surrender of the corporation.

|

(2) _________________________________________ |

|

Exact corporation, limited liability company, or limited liability partnership name |

_______________________________________ |

_________________________________________ |

Printed name and title of officer/manager/partner/member |

Signature and title of officer/manager/partner/member |

State of _______________________________

County of _____________________________

On ________________________________________ before me, the undersigned, a notary public in and for

said state, personally appeared _______________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

personally known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature ________________________________________________________

Name __________________________________________________________

(typed or printed)

Note: LLC, LLP, and corporation assumers must provide a financial statement.

FTB 3555 C1 (REV

Document Specs

| # | Fact |

|---|---|

| 1 | The California Form 3555 is designed to request tax clearance certificates for corporations. |

| 2 | It is specifically used by corporations looking to dissolve, surrender, or confirm their tax status in California. |

| 3 | Corporations must provide comprehensive information including corporation name, California corporation number, and federal employer identification number. |

| 4 | The form requires details about when the business commenced and ceased operations in California, along with the latest income period filed. |

| 5 | Before issuing a tax clearance certificate, all taxes must be paid or secured, and returns remain subject to audit. |

| 6 | It also requires disclosure of any Internal Revenue Service (IRS) or Franchise Tax Board (FTB) examinations or redeterminations of income tax liability. |

| 7 | Sections are included for both individual and trust assumptions of tax liability, needing detailed financial statements. |

| 8 | The form allows for the assumption of tax liability by another corporation, limited liability company, or limited liability partnership with detailed information on the assuming entity. |

| 9 | Submission should be directed to the Document Filing Support Unit within the Secretary of State – Business Filings in Sacramento, California. |

| 10 | The governing law for this form is the Bank and Corporation Tax Law in California. |

Detailed Instructions for Writing California 3555

After deciding to obtain a California Tax Clearance Certificate, completing the Form 3555 is the next step. This document is crucial for corporations that are winding down operations in California or have undergone changes needing state tax clearance. It ensures that all taxes have been paid or arrangements have been made to settle any outstanding amounts. Follow these outlined steps carefully to fill out the form accurately.

- Enter the corporation name and California corporation number in the designated fields.

- Provide the current address and phone number of the corporation.

- Fill in the federal employer identification number (FEIN).

- Specify the date the business commenced operations in California.

- Indicate the date business ceased or will cease in California.

- Enter the latest income period for which a California tax return has been filed.

- If the IRS has redetermined the corporation’s income tax liability for any years not previously reported, check "Yes" and list the years involved. Attach a copy of the Revenue Agent’s Report if applicable.

- For a current or pending IRS or FTB examination, check "Yes" under the appropriate question and provide the year(s) of the current examination or the details of the pending examination.

- If another entity will assume the tax liability, choose either Section A for an individual assumption or Section B for a trust assumption. Complete the relevant section:

- For Section A (Individual Assumption): Fill in the assumer’s name, social security number, address, phone number, and net worth. Sign and date the form.

- For Section B (Trust Assumption): Enter the trust’s name, federal identification number, address, phone number, trustee’s name, then sign and date the form.

- Complete the financial statement provided on page 3, detailing the corporation’s assets and liabilities.

- For corporations, limited liability companies, or partnerships assuming tax liability, complete the section on page 4. Include the names and identification numbers of the parties involved, and have the form signed by an authorized officer.

- Check the box on the first page if the tax clearance certificate is to be issued on a taxes paid basis and attach a copy of the final tax return.

- If the tax clearance certificate should be mailed to an address different from the one listed above, provide the name, address, and phone number of the alternate recipient.

- Review the entire form to ensure all provided information is accurate.

- Mail the completed form to the Document Filing Support Unit at the Secretary of State – Business Filings, 1500 11th Street, Sacramento, CA 95814.

The process of obtaining a tax clearance certificate can seem complex, but attentiveness to detail and accuracy in filling out the Form 3555 will simplify the process. Ensure all requested documents are attached and the form is signed where required to avoid delays. Contact the Franchise Tax Board directly for any questions or clarification on filling out the form.

Things to Know About This Form

What is California Form 3555?

California Form 3555, known as the Request for Tax Clearance Certificate, is a document used by corporations seeking to clear any outstanding tax liabilities with the state's Franchise Tax Board (FTB). This form is necessary for corporations that are dissolving, merging, or ceasing operations in California, ensuring that all taxes owed to the state are paid or secured before the business officially concludes its activities.

Who needs to file Form 3555?

Corporations operating within California that plan to dissolve, merge, or cease their business activities in the state are required to file Form 3555. This includes both domestic corporations originally established in California and foreign corporations that have registered to do business in the state. Filing this form is a critical step in the process of concluding a corporation's legal and financial obligations in California.

What information is required on Form 3555?

Form 3555 requests detailed information regarding the corporation's tax status and history, including:

- The corporation's name and California corporation number.

- Current address and phone number.

- Federal Employer Identification Number (FEIN).

- Dates the business commenced and ceased operations in California.

- Latest income period for which a California tax return has been filed.

- Details on any ongoing or pending IRS or FTB examinations.

- Supplemental information if another corporation will continue the business after a merger.

This information helps the FTB ascertain the tax obligations of the corporation and issue a tax clearance certificate if appropriate.

How do I submit Form 3555?

Form 3555 must be completed in its entirety and mailed to the Document Filing Support Unit of the Secretary of State - Business Filings at 1500 11th Street, Sacramento, CA 95814. It is critical to include all required supplemental documents, such as the final tax return or financial statements, as specified on the form.

What happens after Form 3555 is filed?

Upon receipt, the California Franchise Tax Board will review Form 3555 and all accompanying documentation to ensure that all outstanding taxes, penalties, interest, and fees due from the corporation have been paid or secured. If the FTB determines that no further liabilities exist, it will issue a tax clearance certificate. This certificate is then sent to the Secretary of State and, if requested, to another specified recipient. Note that the issuance of this certificate may be delayed if there are pending or ongoing tax audits or examinations.

Can Form 3555 be filed electronically?

As of the latest available information, Form 3555 cannot be filed electronically. Corporations are required to mail the completed form along with any necessary attachments to the specified address.

What should I do if I need help with Form 3555?

If you have questions or need assistance with Form 3555, you can contact the Franchise Tax Board directly at (916) 845-4124. For individuals with hearing or speech impairments, toll-free numbers are available: voice phone users can call (800) 735-2922, and TTY/TDD users can call (800) 822-6268. These resources can provide guidance on filling out the form correctly and ensuring that all tax obligations are properly addressed.

Common mistakes

Filling out the California 3555 form requires attention to detail and accuracy. Despite best efforts, some people make mistakes that can delay the process of obtaining a tax clearance certificate. Below are ten common pitfalls to avoid:

- Not fully completing the form: Every section of the form should be filled out. Leaving sections blank can result in processing delays.

- Incorrect Corporation Information: Entering the wrong corporation name, California corporation number, or federal employer identification number can lead to confusion and incorrect processing of the form.

- Outdated Contact Information: Providing outdated or incorrect current address and phone number details can hinder communication.

- Failure to indicate IRS activity: Not properly indicating whether the IRS has redetermined the corporation’s income tax liability or if there’s a current or pending examination can affect the clearance process.

- Omission of Supplemental Information: If another corporation will continue the business, failing to provide the transferee's details can cause incomplete submissions.

- Inaccurate Financial Statements: For sections requiring detailed financial statements, inaccuracies or unclear information can lead to requests for clarification or additional documentation.

- Forgetting to Sign and Date: The form becomes invalid without the authorized signature of the corporation or the individual assuming tax liability and the date.

- Misunderstanding the Assumption of Tax Liability: Not correctly specifying the entity assuming tax liability, whether it’s an individual, trust, corporation, limited liability company, or limited liability partnership, can lead to incorrect processing.

- Incorrectly Addressing the Tax Clearance Certificate mailing address: If you wish the certificate to be mailed to an address that is different from the corporation's, failing to correctly complete the mailing section can result in delivery errors.

- Failure to attach required documents: Not attaching required documents such as the final tax return or detailed financial statements can halt the clearance process.

To avoid these mistakes, applicants should:

- Review the entire form before submission.

- Ensure all corporation and contact information is current and accurate.

- Attach all required documents and indicate IRS activities accurately.

- Fill out financial statements with attention to detail.

- Double-check the mailing address for the tax clearance certificate.

- Sign and date the form where necessary.

By avoiding these common errors, you can expedite the process of obtaining a tax clearance certificate in California.

Documents used along the form

When dealing with business changes or dissolution in California, particularly concerning a tax clearance certificate, the California Form 3555 is essential. However, this form is often part of a larger set of documents required to navigate the process effectively. Understanding these related documents can help ensure that the transition, whether it’s dissolving a corporation or changing its structure, proceeds smoothly and in compliance with state regulations.

- Articles of Incorporation: A document filed with the state to legally establish a corporation. It outlines the corporation's name, purpose, incorporator information, stock details, and other essential corporate structuring details.

- Statement of Information (Form SI-550): A form that corporations and limited liability companies (LLCs) must file with the California Secretary of State providing current information about the business’s addresses, directors, officers, and agent for service of process.

- Final Corporate Tax Return (Form 100 or Form 100S): A tax form that corporations must file as their final tax return indicating that it is the final return and that the corporation will cease doing business or dissolve.

- Certificate of Dissolution: A form filed with the California Secretary of State by a closing corporation. It signifies the corporation's intent to dissolve and details the steps taken by the corporation to finalize its business affairs.

- Certificate of Cancellation (LLCs): Similar to the Certificate of Dissolution for corporations, this form is for limited liability companies indicating the dissolution and cessation of business activities in California.

- Minutes of the Final Board Meeting: Not a formal state document but necessary; it includes records from the corporation’s final board meeting outlining the decision to dissolve, settle debts, distribute assets, and other dissolution procedures.

In navigating these processes, the correct documents serve as a roadmap for legal compliance and proper execution of business decisions. Whether dissolving a business, transitioning, or restructuring, these forms play critical roles in aligning business practices with state requirements, thereby protecting the interests of the business owners, shareholders, and other stakeholders.

Similar forms

The California 3555 form, concerning requests for tax clearance for corporations, shares similarities with various other documents across different legal and administrative processes. One such document is the IRS Form 8822-B, which businesses use to notify the Internal Revenue Service of a change in address or the identity of their responsible party. Both forms ensure that critical tax-related information is up-to-date, facilitating effective communication between corporations and regulatory bodies, and helping to maintain compliance with tax obligations.

Another document that shares features with the California 3555 form is the Certificate of Good Standing request form used in many states. This certificate, much like the tax clearance certificate, serves as proof that a corporation is compliant with the required state regulations and filings, and it is in good standing within the state of its incorporation. The underlying purpose of both documents is to attest to the legality and compliance of the business with state and federal obligations.

Similarly, the Application for Employer Identification Number (EIN), or IRS Form SS-4, parallels the California 3555 form in its role of registering an entity’s tax reporting obligations with an authority, albeit at the inception of the business's lifecycle. Where the Form SS-4 enables businesses to obtain an EIN necessary for tax purposes, the California 3555 form helps dissolve or reorganize entities in a manner that assures compliance with tax liabilities.

The Dissolution of Corporation form filed with a state Secretary of State is also akin to the California 3555 form, as both are integral to the process of legally ending or altering a corporation’s existence. The Dissolution form officially removes the corporation's obligations to file future reports and tax returns, while the 3555 form confirms that all current tax responsibilities have been settled or accounted for, marking an essential step in clearing the corporation’s final compliance hurdles.

An Offer in Compromise agreement with the IRS or a state tax authority, which allows businesses to settle their tax debts for less than the full amount owed, also shares common ground with the California 3555 form. Both documents are involved in resolving outstanding tax liabilities, although through different mechanisms, with the end goal of ensuring that businesses can move forward unencumbered by past tax debts.

The Statement of Information (SOI) filed with a Secretary of State, required annually or biennially, updates the state on a corporation’s current directors, officers, and address. While it focuses on current operational details rather than tax specifics, the SOI, like the 3555 form, ensures that a corporation’s most current information is on record, facilitating accurate communication and compliance monitoring.

Finally, the Unemployment Insurance Registration form submitted to a state's workforce agency shares a purpose with the California 3555 form by engaging with state regulatory requirements for operational businesses. Both forms help to establish or clarify the status of a business’s liabilities: the Unemployment Insurance form for payroll taxes and employee benefits, and the 3555 form for broader tax obligations during dissolution or reorganization phases.

Dos and Don'ts

When navigating the complexities of filling out the California Form 3555, it's crucial to approach this document with care and attention to ensure your corporation's compliance with state requirements. Here are essential dos and don'ts to keep in mind:

Do:- Verify all provided information: Double-check your corporation's name, California corporation number, current address, and contact details for accuracy before submitting the form.

- Include all required documents: Attach any necessary supplemental information, financial statements, and if applicable, a copy of the corporation’s final tax return.

- Report IRS activities: If the IRS has re-determined your income tax liability for any prior years or if there's an ongoing or pending examination, disclose this information accurately, including the specific years involved and provide copies of the IRS Revenue Agent's Report.

- Indicate the effective date of dissolution or surrender accurately: It's vital to correctly specify the date business activities ceased or will cease in California.

- Seek professional assistance: If any sections of the form are unclear, consulting with a tax professional or an attorney can provide clarification and prevent errors.

- Omit contact information: Failing to include a valid phone number or address can lead to delays in the clearance process.

- Ignore IRS or FTB inquiries: Not responding to inquiries from the IRS or the Franchise Tax Board regarding your form can result in complications or delays in receiving your tax clearance certificate.

- Submit incomplete forms: Ensure all sections of Form 3555 that apply to your corporation are filled out in their entirety to avoid processing delays.

- Forget to sign the form: An unsigned form is considered incomplete and will not be processed until properly signed by the authorized individual or representative.

- Delay submission: Procrastination can lead to unnecessary stress or late fees. It's best to submit the form well in advance of any deadlines associated with your corporation's dissolution or withdrawal from the state.

Adhering to these guidelines will help streamline the process of obtaining your tax clearance certificate and ensure compliance with the state's requirements.

Misconceptions

Understanding the California Form 3555 can sometimes be challenging, and a few misconceptions have become common. It's important to clarify these misconceptions to ensure that individuals and businesses handle their tax clearance processes correctly.

- Misconception #1: The California Form 3555 is only for corporations ceasing all business operations. While it's often used by corporations winding down operations, it's also necessary for those undergoing significant changes, such as mergers or changes in tax liability assumption.

- Misconception #2: Completing the Form 3555 will automatically result in tax clearance. Filling out and submitting Form 3555 is a critical step, but tax clearance is issued only after the California Franchise Tax Board (FTB) verifies that all tax obligations have been met.

- Misconception #3: Only California corporations need to file Form 3555. While primarily designed for California-based corporations, the form may also be relevant for out-of-state entities with tax obligations in California due to their business activities within the state.

- Misconception #4: The form is only for corporations with outstanding taxes. Even if a corporation believes it has no outstanding tax liabilities, it must file Form 3555 to officially clear any potential claims and receive formal tax clearance from the FTB.

- Misconception #5: Form 3555 is a simple, basic form that requires minimal information. The form requires detailed information about the corporation's tax status, any IRS or FTB examinations, and, if applicable, details on the assumption of tax liability by another entity.

- Misconception #6: After filing Form 3555, there is no further obligation for the corporation. Even after filing, corporations may need to respond to inquiries or audits from the FTB to clarify or verify the information provided.

- Misconception #7: Digital submission of Form 3555 is always an option. Depending on the specific circumstances and timing, the FTB may require a hard copy submission to ensure proper documentation and verification.

- Misconception #8: Tax clearance certificates are issued immediately after Form 3555 submission. The review process can take time as the FTB assesses the corporation's compliance with all tax obligations. Patience is often required.

- Misconception #9: Once a tax clearance certificate is issued, it cannot be revoked. If subsequent audits reveal previously undisclosed tax liabilities or inaccuracies in the tax clearance process, the FTB may revoke a previously issued certificate.

It's crucial for corporations and their representatives to carefully review the requirements and instructions for California Form 3555 to ensure complete and accurate submission. Misunderstandings can lead to delays or complications in obtaining tax clearance. For further clarification or assistance, it's advisable to consult with a tax professional or the FTB directly.

Key takeaways

Understanding the California 3555 Form: Key Takeaways for Corporations

Filling out and using the California Form 3555, also known as the Request for Tax Clearance Certificate, is a critical process for corporations operating within the state. This form is essential for ensuring that all taxes have been paid or secured before a corporation dissolves, merges, or ceases operations in California. Here are six key takeaways to help navigate the process:

- The primary purpose of the Form 3555 is to request a tax clearance certificate, confirming that all corporate tax liabilities have been settled with the state. This certificate is necessary for officially closing or altering the structure of a business.

- Corporations must provide detailed information including the corporation name, California corporation number, current address, federal employer identification number (FEIN), and specific dates concerning the commencement and cessation of business operations in California.

- The form requires disclosure of any IRS or FTB (Franchise Tax Board) examinations, including pending or completed, which could affect the corporation's tax liability. Copies of relevant Revenue Agent’s Reports should be attached if applicable.

- For corporations planning to transfer their business operations or assets to another entity in California, supplemental information regarding the transferee must be included. This includes the transferee’s name, corporation number, FEIN, and the date of asset transfer.

- Assumption of tax liability can be made by an individual, another corporation, limited liability company (LLC), limited liability partnership (LLP), or a trust. This section requires the assumer to unconditionally agree to file all required tax returns and assume full responsibility for paying all existing and future liabilities, penalties, interest, and fees.

- Completion and submission of the form must be directed to the Document Filing Support Unit of the Secretary of State - Business Filings, in Sacramento. Proper filing ensures that the corporation’s record is updated, and all tax obligations are cleared, facilitating a smooth transition or dissolution process.

It is imperative to approach the completion of the California Form 3555 with accuracy and thoroughness. Ensuring all required information and documentation are provided will facilitate the timely issuance of the tax clearance certificate. Corporations are advised to consult with a tax professional or legal advisor to navigate this process effectively and comply with all state tax requirements.

Discover More PDFs

California 513 026 - The form requires detailed business information, including doing business as (DBA) name, contact numbers, and full name of the owner(s).

Earthquake Authority - Stresses the need for precise documentation of the number of stories in the building, including basements, affecting policy classification and pricing.

Application to Rent California - An application that serves as a cornerstone in California's rental transactions, ensuring landlords receive comprehensive information from potential tenants.