Blank California 3539 PDF Form

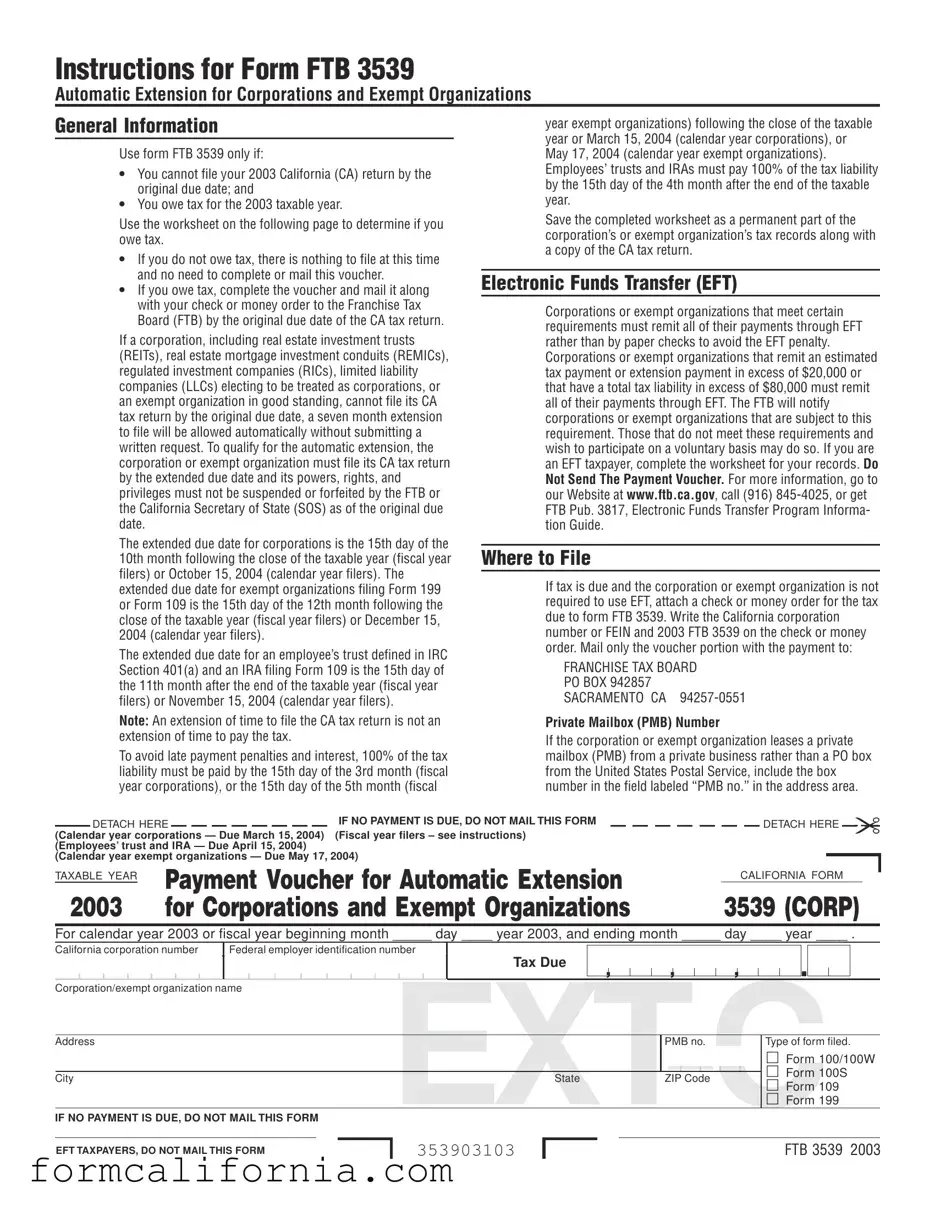

The California Form 3539 provides a pathway for corporations and exempt organizations to obtain an automatic extension to file their state tax returns without having to submit a formal request. This document is crucial for entities that find themselves unable to file their California (CA) tax return by the original deadline. It outlines that if such entities owe tax for the 2003 taxable year, they must complete the form and send the appropriate payment by the original due date to avoid penalties. Interestingly, the form accommodates various types of filers— from corporations, including real estate investment trusts (REITs) and limited liability companies (LLCs) electing to be treated as corporations, to exempt organizations and even employee trusts and IRAs, each with specified extended due dates tailored to their filing status. Noteworthy is the requirement for electronic funds transfer (EFT) for those entities whose payments exceed certain thresholds, reinforcing the state's push towards digitalization of tax payments. Furthermore, the document reiterates that the provision of an extension to file does not extend the deadline for tax payment, cautioning against late payment penalties and interest. It also addresses specific instructions for combined reports, demonstrating the state's nuanced approach towards unitary or combined filing methods, and provides clear guidance for entities utilizing private mailbox numbers. With an inclusive scope, Form 3539 serves as a comprehensive guide for navigating tax extension requests, ensuring entities remain in compliance while managing their fiscal responsibilities.

Document Preview Example

Instructions for Form FTB 3539

Automatic Extension for Corporations and Exempt Organizations

General Information |

|

year exempt organizations) following the close of the taxable |

|

|

year or March 15, 2004 (calendar year corporations), or |

|

||

Use form FTB 3539 only if: |

|

May 17, 2004 (calendar year exempt organizations). |

• You cannot file your 2003 California (CA) return by the |

|

Employees’ trusts and IRAs must pay 100% of the tax liability |

|

by the 15th day of the 4th month after the end of the taxable |

|

original due date; and |

|

|

|

year. |

|

• You owe tax for the 2003 taxable year. |

|

|

|

|

|

Use the worksheet on the following page to determine if you |

|

Save the completed worksheet as a permanent part of the |

|

corporation’s or exempt organization’s tax records along with |

|

owe tax. |

|

|

|

a copy of the CA tax return. |

|

• If you do not owe tax, there is nothing to file at this time |

|

|

|

|

|

and no need to complete or mail this voucher. |

|

|

|

Electronic Funds Transfer (EFT) |

|

• If you owe tax, complete the voucher and mail it along |

|

|

with your check or money order to the Franchise Tax |

|

Corporations or exempt organizations that meet certain |

Board (FTB) by the original due date of the CA tax return. |

|

|

|

requirements must remit all of their payments through EFT |

|

If a corporation, including real estate investment trusts |

|

|

|

rather than by paper checks to avoid the EFT penalty. |

|

(REITs), real estate mortgage investment conduits (REMICs), |

|

Corporations or exempt organizations that remit an estimated |

regulated investment companies (RICs), limited liability |

|

tax payment or extension payment in excess of $20,000 or |

companies (LLCs) electing to be treated as corporations, or |

|

that have a total tax liability in excess of $80,000 must remit |

an exempt organization in good standing, cannot file its CA |

|

all of their payments through EFT. The FTB will notify |

tax return by the original due date, a seven month extension |

|

corporations or exempt organizations that are subject to this |

to file will be allowed automatically without submitting a |

|

requirement. Those that do not meet these requirements and |

written request. To qualify for the automatic extension, the |

|

wish to participate on a voluntary basis may do so. If you are |

corporation or exempt organization must file its CA tax return |

|

an EFT taxpayer, complete the worksheet for your records. Do |

by the extended due date and its powers, rights, and |

|

Not Send The Payment Voucher. For more information, go to |

privileges must not be suspended or forfeited by the FTB or |

|

our Website at www.ftb.ca.gov, call (916) |

the California Secretary of State (SOS) as of the original due |

|

FTB Pub. 3817, Electronic Funds Transfer Program Informa- |

date. |

|

tion Guide. |

The extended due date for corporations is the 15th day of the |

|

|

|

Where to File |

|

10th month following the close of the taxable year (fiscal year |

|

|

filers) or October 15, 2004 (calendar year filers). The |

|

|

|

If tax is due and the corporation or exempt organization is not |

|

extended due date for exempt organizations filing Form 199 |

|

|

or Form 109 is the 15th day of the 12th month following the |

|

required to use EFT, attach a check or money order for the tax |

close of the taxable year (fiscal year filers) or December 15, |

|

due to form FTB 3539. Write the California corporation |

2004 (calendar year filers). |

|

number or FEIN and 2003 FTB 3539 on the check or money |

The extended due date for an employee’s trust defined in IRC |

|

order. Mail only the voucher portion with the payment to: |

|

FRANCHISE TAX BOARD |

|

Section 401(a) and an IRA filing Form 109 is the 15th day of |

|

|

the 11th month after the end of the taxable year (fiscal year |

|

PO BOX 942857 |

filers) or November 15, 2004 (calendar year filers). |

|

SACRAMENTO CA |

Note: An extension of time to file the CA tax return is not an |

|

Private Mailbox (PMB) Number |

extension of time to pay the tax. |

|

If the corporation or exempt organization leases a private |

|

|

|

To avoid late payment penalties and interest, 100% of the tax |

|

mailbox (PMB) from a private business rather than a PO box |

liability must be paid by the 15th day of the 3rd month (fiscal |

|

from the United States Postal Service, include the box |

year corporations), or the 15th day of the 5th month (fiscal |

|

number in the field labeled “PMB no.” in the address area. |

DETACH HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Calendar year corporations — Due March 15, 2004) (Fiscal year filers – see instructions) (Employees’ trust and IRA — Due April 15, 2004)

(Calendar year exempt organizations — Due May 17, 2004)

TAXABLE YEAR |

Payment Voucher for Automatic Extension |

|

|

2003 |

for Corporations and Exempt Organizations |

DETACH HERE

CALIFORNIA FORM

3539 (CORP)

For calendar year 2003 or fiscal year beginning month _____ day ____ year 2003, and ending month _____ day ____ year ____ .

California corporation number |

Federal employer identification number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

||||||||

Corporation/exempt organization name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PMB no. |

|

|

|

Type of form filed. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 100/100W |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 100S |

|||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

ZIP Code |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 109 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

EFT TAXPAYERS, DO NOT MAIL THIS FORM

353903103

FTB 3539 2003

Penalties and Interest

•If the corporation or exempt organization fails to pay its total tax by the original due date, a late payment penalty plus interest will be added to the tax due.

•If the corporation or exempt organization does not file its CA tax return by the extended due date, or the corporation’s powers, rights, and privileges have been suspended or forfeited by the FTB or the California SOS, as of the original due date, the automatic extension will not apply and a delinquency penalty plus interest will be assessed from the original due date of the CA tax return.

•If the corporation or exempt organization is required to remit all of its payments through EFT and pays by another method, a 10%

Combined Reports

•If members of a combined unitary group have made or intend to make an election to file a combined unitary group single return, only the key corporation designated to file the return should submit form FTB 3539. The key corporation must include payment of at least the minimum franchise tax for each corporation of the combined unitary group that is subject to the franchise tax in California.

•If members of a combined unitary group intend to file separate returns with the FTB, each member must submit its own form FTB 3539 if there is an amount entered on line 3 of the Tax Payment Worksheet.

•If any member of a combined unitary group meets the requirements for mandatory EFT, all members must remit their payments through EFT, regardless of their filing election.

Exempt Organizations

•Form 100 filers:

The due dates for corporations also apply to the filing of Form 100, California Corporation Franchise or Income Tax Return, by political action committees and exempt homeowners’ associations.

Political action committees and exempt homeowners’ associations that file Form 100 should not enter the minimum franchise tax on line 1 of the Tax Payment Worksheet.

•Form 199 Filers:

Generally, Form 199, California Exempt Organization Annual Information Return, requires a $10 filing fee to be paid with the return on the original or extended due date.

Use form FTB 3539 only if paying the fee early. Enter the amount of the fee on line 3 of the Tax Payment Worksheet.

•Form 109 Filers:

The due dates for filing Form 109, California Exempt Organization Business Income Return, depend on the type of organization filing the return. Employees’ pension trusts and IRAs (including education IRAs) must file on or before the 15th day of the 4th month after the close of their taxable year. All other exempt organizations (except homeowners’ associations and political organizations) must file on or before the 15th day of the 5th month after the close of their taxable year.

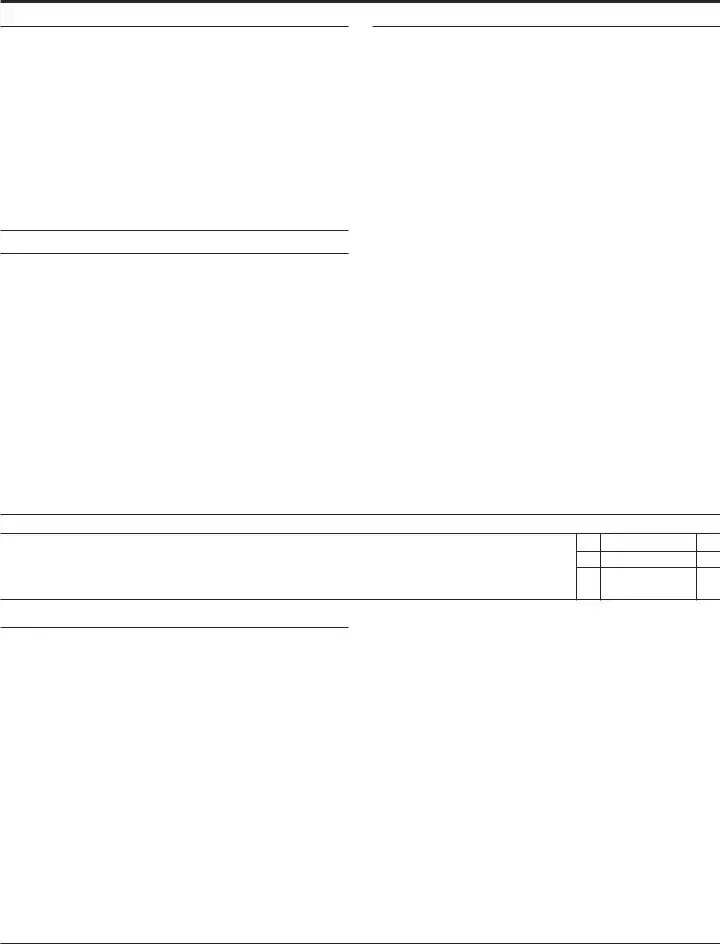

TAX PAYMENT WORKSHEET FOR YOUR RECORDS

1 Total tentative tax. Include alternative minimum tax if applicable. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Estimated tax payments including prior year overpayment applied as a credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Tax Due. If line 2 is more than line 1, see instructions. If line 1 is more than line 2, subtract line 2 from line 1. Enter the result here and on form FTB 3539 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

3

How to Complete the Tax Payment Worksheet

Line 1 – Enter the total tentative tax, including the alterna- tive minimum tax, if applicable, for the taxable year.

•If filing Form 100, Form 100W, or Form 100S, and subject to franchise tax, the tentative tax may not be less than the minimum franchise tax and Qualified Subchapter S Subsidiary (QSub) annual tax (S corporations only).

•If filing Form 100, Form 100W, or Form 100S, and subject to income tax, enter the amount of tax. Corpora- tions subject to the income tax do not pay the minimum franchise tax.

•If a corporation incorporates or qualifies to do business in California on or after January 1, 2000, the corporation will compute its tax liability for the first taxable year by multiplying its state net income by the appropriate tax rate and will not be subject to the minimum franchise tax. The corporation will become subject to minimum franchise tax beginning in its second taxable year.

•If filing Form 109, enter the amount of tax. Form 109 filers are not subject to the minimum franchise tax.

Line 2 – Enter the estimated tax payments, including prior year overpayment applied as a credit. S corporations include any QSub annual tax payments.

Line 3

Tax due. If the amount on line 1 is more than the amount on line 2, then the corporation’s or exempt organization’s tentative tax is more than its payments and credits. The corporation or exempt organization has tax due.

Subtract line 2 from line 1. Enter this amount on line 3 and on form FTB 3539.

If the amount on line 2 is more than the amount on line 1, the payments and credits are more than the tentative tax. The corporation or exempt organization has no tax due. DO NOT SEND THE PAYMENT VOUCHER. The corporation or exempt organization will automatically qualify for an extension if the California tax return is filed by the extended due date and the corporation and or exempt organization is in good standing with the FTB and SOS.

Page 2 FTB 3539 2003

Document Specs

| Fact | Description |

|---|---|

| Form Title | California Form 3539 (FTB 3539) |

| Purpose | Automatic Extension for Corporations and Exempt Organizations |

| Applicable Year | 2003 Taxable Year |

| Original Due Dates | March 15, 2004 for calendar year corporations; May 17, 2004 for calendar year exempt organizations |

| Extension Length | Seven months without written request |

| Payment Requirement | 100% of the tax liability by the 15th day of the 4th month after the end of the taxable year for employees’ trusts and IRAs |

| EFT Requirements | Corporations/exempt organizations meeting certain criteria must remit all payments through Electronic Funds Transfer (EFT) |

| Penalties and Interest | Applies if total tax is not paid by the original due date, for non-compliance with EFT payment, and if CA tax return is not filed by the extended due date |

| Governing Law | California Revenue and Taxation Code |

| Where to File | Franchise Tax Board, Sacramento, CA |

Detailed Instructions for Writing California 3539

Form FTB 3539 is designed to provide an automatic extension for corporations and exempt organizations that are unable to file their California income tax returns by the original deadline. It's important to note that this form should only be utilized if tax is owed for the tax year and the entity cannot meet the original filing deadline. The process of completing and submitting this form ensures that these entities can avoid late filing penalties, provided the tax owed is paid by the original due date, and the return is filed by the extended due date. Following the appropriate steps carefully ensures compliance with California tax obligations.

- Determine if tax is owed by using the worksheet provided with the instructions. If no tax is owed and you are not an electronic funds transfer (EFT) taxpayer, no action is required at this time concerning Form FTB 3539.

- If tax is owed, begin by filling in the voucher portion of the form with the taxable year and the beginning and ending dates of the fiscal year if applicable.

- Enter the California corporation number and the Federal Employer Identification Number (FEIN) in the designated fields.

- Provide the name of the corporation or exempt organization, along with the complete address, including the PMB number if a private mailbox is used.

- Select the type of form being filed by checking the appropriate box: Form 100/100W, Form 100S, Form 109, or Form 199.

- Calculate the total tentative tax, including any applicable alternative minimum tax. This figure should be entered in the Tax Payment Worksheet for your records and should reflect payments and credits to ensure the correct tax due is recorded.

- If estimated tax payments and any prior year overpayment applied as a credit already made exceed your calculated tentative tax, you may not need to submit a payment with Form FTB 3539. Verify this by reviewing the instructions provided with the worksheet.

- In case of tax due, write a check or money order for the amount of tax owed. Make sure to write the California corporation number or FEIN and "2003 FTB 3539" on the check or money order to ensure proper processing.

- Detach the voucher portion of Form FTB 3539 and mail it with the payment to the address provided in the instructions: Franchise Tax Board, PO BOX 942857, Sacramento CA 94257-0551.

- If you are subject to making payments via EFT, do not mail the voucher. Complete the worksheet for your records and follow the guidelines for EFT payments as stated in the instructions.

It is essential that the completed worksheet is saved as a permanent part of the corporation’s or exempt organization’s records along with a copy of the filed California tax return. Timely compliance with these steps ensures that the entity remains in good standing and avoids potential penalties and interest for late payment or filing.

Things to Know About This Form

What is Form FTB 3539 and who needs to use it?

Form FTB 3539, or the Payment Voucher for Automatic Extension for Corporations and Exempt Organizations, is designed for use by corporations, including S corporations, LLCs electing to be treated as corporations, and exempt organizations that cannot file their California tax return by the original due date. This form helps these entities pay their anticipated tax liability to avoid penalties and interest for late payment. It's important for entities that owe tax for the taxable year 2003 but cannot file on time to complete and submit this voucher alongside their payment.

How does a corporation or exempt organization qualify for the automatic extension?

To qualify for the automatic seven-month extension, a corporation or exempt organization must ensure it files its California tax return by the extended due date. Additionally, its powers, rights, and privileges must not be suspended or forfeited by the Franchise Tax Board (FTB) or the California Secretary of State (SOS) as of the original due date. Entities do not need to submit a written request for this extension, but they must adhere to these conditions to avoid penalties.

Are there any specific payment requirements for those filing Form FTB 3539?

Yes, entities required to remit payments via Electronic Funds Transfer (EFT) because of either an estimated tax payment or extension payment exceeding $20,000, or a total tax liability over $80,000 in the previous year, must continue to use EFT instead of mailing the payment voucher. Entities not meeting these thresholds but wishing to participate in EFT voluntarily may do so. The voucher should not be mailed by EFT taxpayers, but it's crucial for them to complete the Tax Payment Worksheet for their records and ensure the correct tax amount is paid through EFT.

What happens if the tax is not fully paid by the original due date?

Entities that fail to pay the full tax amount by the original due date face late payment penalties and interest on the due amount. Furthermore, if a corporation or exempt organization does not file its California tax return by the extended due date, or if its powers, rights, and privileges have been suspended or forfeited by the FTB or SOS as of the original due date, the automatic extension does not apply. This failure results in a delinquency penalty plus interest assessed from the original due date of the tax return. Additionally, a 10% non-compliance penalty is assessed if an entity required to use EFT makes a payment through other methods.

Common mistakes

Filling out the California 3539 form correctly is crucial for corporations and exempt organizations to avoid penalties and delays. Common mistakes can have significant implications. Here are four frequently made errors:

- Not paying the total tax liability by the due date. Remember, an extension to file is not an extension to pay. You must pay 100% of the tax liability by the 15th day of the 4th or 5th month after the close of the taxable year to avoid late payment penalties and interest.

- Failing to include the California corporation number or FEIN and the year 2003 on the check or money order. This mistake can lead to payment processing delays and misapplication of funds, which might result in unintended penalties and interest.

- Incorrectly calculating the tax due. The tax payment worksheet is there to help avoid errors, but it's crucial to include alternative minimum tax if applicable and correctly subtract any payments or credits. Overlooking these details can lead to underpayment or overpayment of taxes.

- Submitting the payment voucher when not necessary. If you do not owe tax or are an EFT taxpayer, do not mail the form. This is a common error that leads to unnecessary processing and can confuse the records.

Moreover, be aware of the specific requirements for electronic funds transfer (EFT) taxpayers. Those required to remit payments through EFT but who pay by another method will face a 10% non-compliance penalty. Understanding and adhering to these guidelines will ensure that your organization remains in good standing and avoids additional fines.

- Always double-check that you've calculated the tax due correctly and included all the necessary information with your payment.

- Remember to save the completed worksheet as a permanent part of your tax records along with a copy of the California tax return.

- Ensure that your corporation or exempt organization’s powers, rights, and privileges are not suspended or forfeited as of the original due date to qualify for the automatic extension.

- Avoid common pitfalls by reviewing all instructions and requirements carefully before submitting the form and payment.

Documents used along the form

When preparing to file the California Form 3539, which facilitates an automatic extension for corporations and exempt organizations, it's important to be aware of other documents and forms that may be relevant to the process. These additional documents ensure compliance with state requirements and help streamline tax preparation and submission.

- Form 100 or 100S: These are California Corporation Franchise or Income Tax Returns. Form 100 is for C corporations, while 100S is for S corporations. They report income, deductions, and credits to the state.

- Form 199: This is the California Exempt Organization Annual Information Return. It's used by certain nonprofits, charities, and other tax-exempt organizations to report their annual financial information.

- Form 109: Known as California Exempt Organization Business Income Tax Return, it is specifically for exempt organizations that have business income separate from their exempt function.

- EFT Authorization Agreement: For entities required or choosing to make payments via Electronic Funds Transfer, this agreement form must be completed to authorize the Franchise Tax Board to electronically withdraw funds from their account.

- Form 568: Limited Liability Company Return of Income. While primarily for LLCs, it's relevant for those who elect to be taxed as a corporation and may need to file this form in addition to or instead of Form 100/100S.

- Form 8822-B: Change of Address or Responsible Party — Business. If there have been changes to the business address or responsible parties, this IRS form should be filed to update records for both federal and state tax purposes, ensuring all notices and refunds are properly directed.

These documents and forms complement the completion and filing of Form 3539, ensuring organizations meet all their reporting and payment obligations. Accurate and timely submission of these forms prevents penalties and ensures entities remain in good standing, which is essential for ongoing operations and compliance.

Similar forms

The IRS Form 7004 is similar to the California Form 3539 as both forms are used for filing an extension for business-related tax returns. Form 7004 is applied at the federal level to request automatic extensions for various business entity returns, including corporations, partnerships, and certain trusts. Like Form 3539, which gives California corporations and exempt organizations more time to file without a written request, Form 7004 grants an automatic extension for filing federal business tax returns, allowing entities additional time to gather necessary information and complete their returns accurately.

Form 4868, the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, parallels California Form 3539 in its fundamental purpose of providing taxpayers with additional time to file their taxes. While Form 4868 is used by individuals to obtain a six-month extension for their federal income tax returns, Form 3539 offers corporations and exempt organizations in California a similar grace period. Both forms do not extend the time for tax payments; they only delay the filing deadline, necessitating taxpayers to estimate and pay any owed taxes by the original due date to avoid penalties.

The California Form 3588 is the Payment Voucher for Individual e-filed Returns, closely resembling the use case of Form 3539 for entities paying tax due with their extension request. Like the 3539 form that is used alongside an extension request when taxes are owed, Form 3588 is utilized by individual taxpayers who have electronically filed their California income tax returns and need to submit a payment. Both forms facilitate the payment process associated with filing extensions or tax returns, ensuring that dues are properly credited even when filings are delayed or made electronically.

Similar to California Form 3539, the IRS Form 8809, Application for Extension of Time to File Information Returns, serves a comparable role at the federal level. This form allows businesses extra time to file information returns, such as Forms W-2 or 1099, which are crucial for reporting various types of income other than wages. Although serving different types of filings—Form 3539 for tax returns of corporations and exempt organizations and Form 8809 for information returns—both forms acknowledge the need for additional time to ensure the accuracy and completeness of submissions.

The California Form 8582, the California Passive Activity Loss Limitations form, while not an extension form, shares similarities with Form 3539 in its application to specific taxpayer groups and its requirement for intricate tax calculations. Form 3539 caters to corporations and exempt organizations needing to calculate their due taxes accurately for an extension. In contrast, Form 8582 addresses individual taxpayers who must intricately compute passive activity loss limitations, demonstrating the diverse needs across taxpayer categories for specific forms to support their unique filing requirements.

Lastly, the Schedule K-1 (568) for California resembles the purpose behind Form 3539 in its specific applicability to certain entities and the complex financial information it handles. While Form 3539 is used by corporations and exempt organizations to extend their filing deadline and submit payment if necessary, the Schedule K-1 (568) is tailored for members of Limited Liability Companies (LLCs) taxed as partnerships in California. Both documents serve pivotal roles in ensuring entities and their constituents meet tax obligations while contending with intricate tax situations.

Dos and Don'ts

When dealing with the intricacies of California Form 3539, it is important to follow specified guidelines to avoid unnecessary penalties or delays. Carefully filling out this form ensures corporations and exempt organizations manage their tax obligations responsibly. Here are recommendations for correctly handling the form:

Do:- Ensure timely payment: If your organization owes tax for the taxable year, complete and submit Form 3359 along with the necessary payment by the original due date to avoid penalties and interest.

- Save the worksheet: After determining your tax obligation using the worksheet provided with Form 3539 instructions, retain it as part of your permanent tax records alongside a copy of the California tax return.

- Include identifying information on payment: If paying by check or money order, make sure to write the California corporation number or Federal Employer Identification Number (FEIN), and "2003 FTB 3539" on it to ensure your payment is properly credited.

- Verify eligibility for EFT payments: Corporations and exempt organizations that either are mandated or wish to voluntarily remit payments via Electronic Funds Transfer (EFT) should not send the payment voucher but complete the worksheet for their records.

- Submit the form if no payment is due: If the organization does not owe any tax for the taxable year, there is no need to file this form, streamlining the process and saving resources.

- Ignore EFT requirements: Corporations or exempt organizations with a tax payment exceeding $20,000 or a total tax liability over $80,000 must use EFT. Failing to comply results in a 10% non-compliance penalty.

- Forget about the extended due date: While Form 3539 grants an automatic extension for filing the tax return, it does not extend the deadline for the tax payment. Ensure payments are made by the original due date to avoid penalties.

- Overlook the PMB number: For organizations utilizing a Private Mailbox (PMB), including the PMB number in the address ensures the payment and form are correctly received and processed by the Franchise Tax Board.

Misconceptions

There are several common misconceptions about the California Form 3539, which is the Payment Voucher for Automatic Extension for Corporations and Exempt Organizations. Understanding these can help ensure that corporations and exempt organizations comply with tax requirements effectively.

Misconception 1: Form 3539 grants an extension for the payment of taxes.

This is incorrect. The form provides an extension for filing the tax return, not for the payment of taxes. Taxes owed are still due by the original deadline, and failing to pay on time may result in penalties and interest.

Misconception 2: All corporations and organizations must submit Form 3539 to qualify for an extension.

In fact, if an entity doesn’t owe any tax for the 2003 taxable year, there is no need to submit this form to receive the filing extension.

Misconception 3: Electronic Funds Transfer (EFT) taxpayers must mail the payment voucher.

This is not necessary. EFT taxpayers should not mail the payment voucher if they make their payment electronically, as indicated in the instructions for the form.

Misconception 4: The extension is available only upon the IRS or Franchise Tax Board’s (FTB’s) approval.

The extension to file is granted automatically, provided the entity is in good standing and the return is filed by the extended due date.

Misconception 5: Form 3539 extends the filing deadline for all types of entities the same amount of time.

The extension period varies depending on the type of entity and its fiscal year. For example, calendar year corporations get an extension up to October 15, while exempt organizations filing Form 199 have until December 15.

Misconception 6: Form 3539 can be used for personal tax extension requests.

This form is specifically for corporations and exempt organizations, not for individual taxpayers.

Misconception 7: The voucher must be mailed, regardless of whether tax is due.

If no payment is due, there is no need to mail the form. This is designed to reduce unnecessary paperwork and processing.

Misconception 8: Entities not required to use EFT can’t elect to use it for payment.

Even if not required, entities can choose to pay via EFT voluntarily for ease and efficiency.

Understanding these misconceptions can help corporations and exempt organizations navigate their obligations more clearly and avoid unnecessary errors. Always refer to the latest guidelines from the FTB and seek assistance if you have specific concerns about your situation.

Key takeaways

Filling out and understanding the California Form 3539, which facilitates an automatic extension for corporations and exempt organizations that are unable to file their tax returns by the original due date, involves several key considerations. Here are five crucial takeaways to ensure compliance and make the most of this provision:

- Understanding Eligibility: Form 3539 is designed for entities that cannot file their California tax return by the due date and anticipate owing taxes for the 2003 taxable year. It's crucial to determine if you owe tax using the provided worksheet, as this form serves no purpose if no tax is due.

- Automatic Extension Period: By correctly utilizing Form 3539, eligible corporations and exempt organizations automatically receive a seven-month extension to file their California tax return without needing to submit a written request. However, this is not an extension of time to pay taxes owed. To avoid penalties, estimated taxes owed must be paid by the original tax return due date.

- Payment Method and Electronic Funds Transfer (EFT): If taxes are owed, the voucher and payment should be mailed to the Franchise Tax Board by the original tax return due date. Importantly, entities with taxes or estimated payments surpassing certain thresholds must use EFT, failing which may result in penalties. Voluntary EFT participation is also an option.

- Combined Reports for Unitary Groups: For unitary groups opting to file a combined return, only the key corporation should submit Form 3539, including payment for each taxable entity within the group. Separate filings require individual submissions of Form 3539 if taxes are due. Groups subject to EFT should comply accordingly, regardless of their filing choice.

- Extension Does Not Apply to Payment Deadline: It is essential to remember that acquiring an extension to file using Form 3539 does not extend the deadline for tax payment. To avoid late payment penalties and interest, the tax liability must be settled by the 15th day of the third month following the close of the fiscal year for corporations, with varying dates applicable to exempt organizations and other special cases.

Correctly filling out and submitting Form 3539 is crucial for organizations seeking more time to file their California tax returns. However, maintaining good standing with the Franchise Tax Board and the California Secretary of State by the original due date is a pre-requisite to benefit from the automatic extension.

Discover More PDFs

3532 - The inclusion of old and new additional information sections ensures that the tax board has a complete understanding of your situation.

Judicial Council Form - Acts as a universal addendum for court documents, ensuring compatibility and standardization across filings.