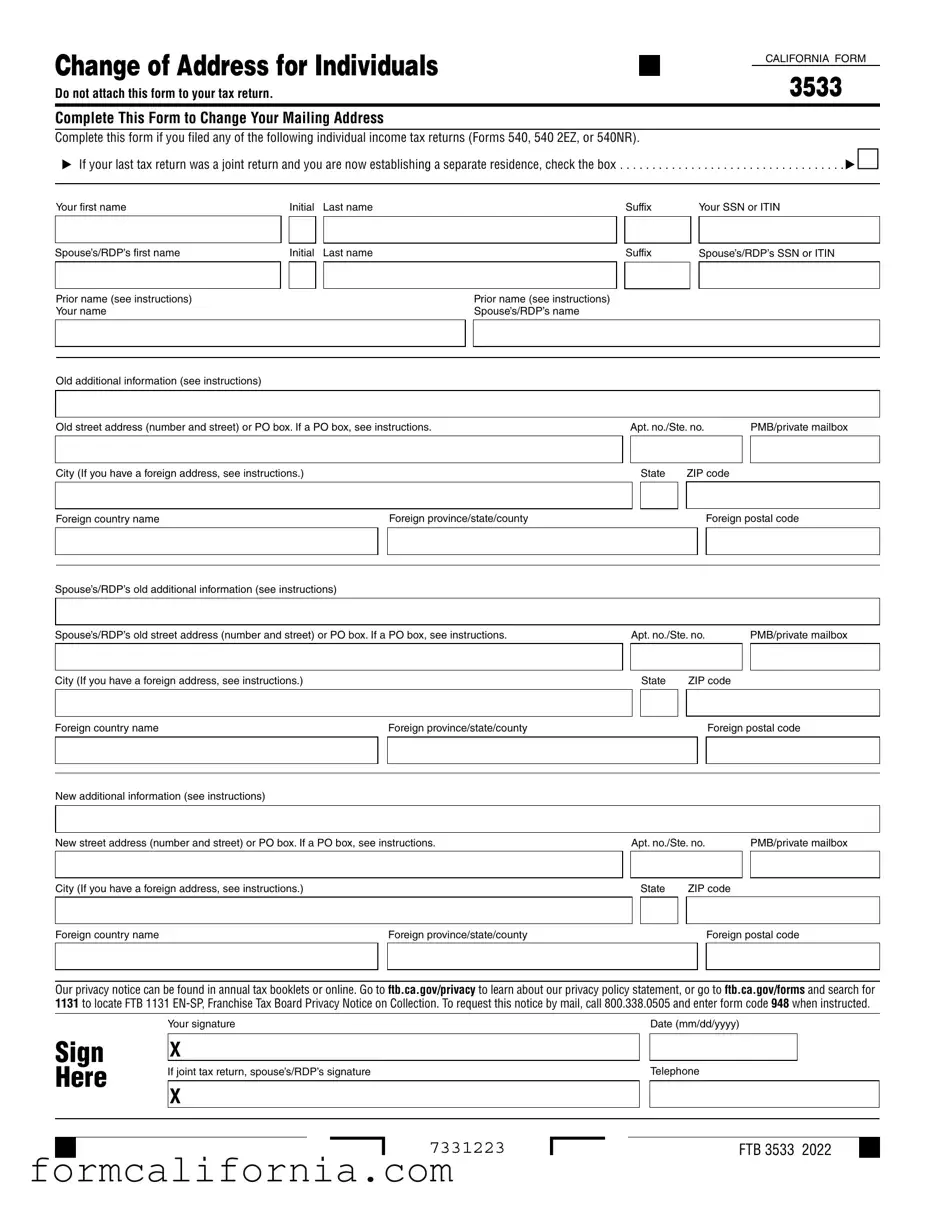

Blank California 3533 PDF Form

California's tax system, like those of many states, requires accurate and current information from its taxpayers to ensure the efficient processing of tax returns and timely communication. The California Form 3533 plays a crucial role in this ecosystem, serving as the official document for individuals who need to notify the California Franchise Tax Board of a change in their mailing address. Originally designed for those who have filed individual income tax returns, including Forms 540, 540 2EZ, or 540NR, its utility extends to any taxpayer in the state seeking to update their address. This form accommodates various scenarios, including changes resulting from the establishment of a separate residence after filing a joint tax return. Detailed instructions guide the taxpayer through providing both their old and new addresses, ensuring the accuracy of this vital information. Additionally, the form respects taxpayer privacy rights while explaining the significance of providing the requested updates. By mandating a signature from the individual (and their spouse or registered domestic partner if applicable), the form emphasizes the seriousness and personal responsibility of maintaining current contact details with the tax authorities. The careful design of the Form 3533 underscores the balance between bureaucratic requirements and the need for a straightforward process to keep tax records up to date.

Document Preview Example

Change of Address for Individuals |

|

|

CALIFORNIA FORM |

|

|

|

|

|

|

|

|

Do not attach this form to your tax return. |

3533 |

||

|

|

|

|

Complete This Form to Change Your Mailing Address

Complete this form if you filed any of the following individual income tax returns (Forms 540, 540 2EZ, or 540NR).

▶If your last tax return was a joint return and you are now establishing a separate residence, check the box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .▶ □

Your first name |

|

Initial |

Last name |

|

|

|

Suffix |

|

Your SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s first name |

|

Initial |

Last name |

|

|

|

Suffix |

|

Spouse’s/RDP’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Prior name (see instructions) |

|

|

|

|

|

Prior name (see instructions) |

|

|

||

Your name |

|

|

|

|

|

Spouse’s/RDP’s name |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Old additional information (see instructions)

Old street address (number and street) or PO box. If a PO box, see instructions. |

Apt. no./Ste. no. |

|

|

PMB/private mailbox |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

|

|

|

|

|

Foreign postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s old additional information (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s old street address (number and street) or PO box. If a PO box, see instructions. |

Apt. no./Ste. no. |

|

PMB/private mailbox |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

|

|

|

|

|

Foreign postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New additional information (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New street address (number and street) or PO box. If a PO box, see instructions. |

Apt. no./Ste. no. |

|

|

PMB/private mailbox |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

|

|

|

|

|

Foreign postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

|

|

Your signature |

|

|

Date (mm/dd/yyyy) |

|

||

SIGN |

|

|

|

|

|

|

||

X |

|

|

|

|

|

|||

|

|

|

|

|

|

|||

HERE |

If joint tax return, spouse’s/RDP’s signature |

|

|

Telephone |

|

|||

|

|

|

|

|

|

|

||

X |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7331223 |

|

|

FTB 3533 2022 |

|

||

Document Specs

| Fact | Detail |

|---|---|

| Form Name and Number | California Form 3533, Change of Address for Individuals |

| Purpose | To update the mailing address of individuals who have filed California individual income tax returns (Forms 540, 540 2EZ, or 540NR). |

| When to Use | If you need to change your address after filing your tax return, or if you filed a joint tax return and are now establishing a separate residence. |

| Key Information Required | Personal information (including SSN or ITIN), spouse’s/RDP’s information if applicable, old address, and new address details. |

| Governing Law | California Revenue and Taxation Code |

Detailed Instructions for Writing California 3533

When the need arises to update your mailing address with the California Franchise Tax Board, the CALIFORNIA FORM 3533 is the required documentation to complete this process. This adjustment could be necessitated by a variety of circumstances, such as moving to a new home or separating residences following a joint tax return. The importance of submitting this form cannot be overstated, as it ensures that all correspondence and sensitive documents from the tax authority reach you at your new address. Careful completion of this form will help in avoiding any disruption in receiving notices, refunds, or any tax-related communications.

- Locally at the top of the form, start by ticking the box if your last return was joint and you're now establishing a residency separate from your spouse or Registered Domestic Partner (RDP).

- Enter your first name, middle initial, last confirmation, and any suffix (Jr, Sr, III, etc.) along with your Social Security Number (SSN) or Individual Tax Identification Number (ITIN).

- If applicable, provide your spouse’s/RDP’s first name, initial, last name, suffix, and their SSN or ITIN.

- List any prior names for both yourself and your spouse/RDP if that information has changed since your last filing.

- Under 'Old street address', input your previous address details including the apartment or suite number, city, state, and ZIP code. If it was a foreign address, include the foreign country name, province/state/county, and the postal code.

- Repeat the address entry process for your spouse’s/RDP’s previous address, if it's different from yours.

- For the 'New street address' section, fill in your new mailing address details similarly, including apartment or suite number, city, state, and ZIP code, along with any pertinent foreign address details if applicable.

- Read through the privacy rights section at the bottom of the form to understand how your information may be used and the implications of not providing the requested information.

- Lastly, sign and date the form in the designated area. If you filed a joint return, ensure that your spouse/RDP also signs the form. Provide a current telephone number where you can be reached.

Once the form is fully completed, it should not be attached to your tax return. Instead, it must be sent separately to the address provided by the Franchise Tax Board for processing. Timely updating your address facilitates smooth communication, preventing delays in receiving refunds, notices, or any important information related to your state income tax filings.

Things to Know About This Form

What is the California 3533 Form?

The California 3533 Form is officially known as the Change of Address for Individuals form. It is used by residents of California to inform the California Franchise Tax Board (FTB) about a change in their mailing address. This form is necessary to ensure that any correspondence or tax refund checks from the FTB are sent to the correct address. Individuals should complete this form if they have filed individual income tax returns using Forms 540, 540 2EZ, or 540NR.

When should the California 3533 Form be filed?

This form should be filed as soon as possible after you move to a new address. Timeliness is key to ensure that all communications from the California Franchise Tax Board reach you without delay. It is important to note that this form should not be attached to your tax return.

Can I file the California 3533 Form if I filed a joint return but now have a separate address?

Yes, individuals who filed a joint tax return but are now establishing a separate residence should use the California 3533 Form to update their address. There is a specific checkbox on the form for individuals in this situation. Checking this box indicates that the individual filing the form has a new separate address, different from the one previously filed under a joint return.

How do I complete the California 3533 Form?

To complete the California 3533 Form, you will need to provide:

- Your first name, middle initial, last name, and suffix if applicable.

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- If applicable, similar information for your spouse/Registered Domestic Partner (RDP).

- Any prior names, if you've had a name change.

- Both the old and new addresses, including specific details like apartment or suite numbers, city, state, and ZIP code. For foreign addresses, additional details such as foreign country name, province/state/county, and postal code are required.

Where do I send the completed California 3533 Form?

After completing the form, you should not attach it to your tax return. Instead, you need to send it directly to the California Franchise Tax Board. The exact mailing address can be found on the FTB's official website (ftb.ca.gov). It is recommended to check the website for the most current address and any additional submission guidelines.

What are the consequences of not informing the FTB about a change of address?

Failure to update your address with the California Franchise Tax Board can lead to several issues. It can delay the delivery of important tax documents, refunds, and notifications regarding your taxes. This may result in missed deadlines, potential penalties, or even audit actions. Therefore, submitting the California 3533 Form promptly after moving is crucial for maintaining accurate and timely correspondence with the FTB.

Common mistakes

Filling out the California Form 3533 to change one's mailing address seems straightforward, but it's common for people to make mistakes. These errors can delay processing times and cause unnecessary stress. Here are some of the most frequent missteps:

- Not checking the box to indicate a change from a joint to a separate residence. This small detail can significantly impact the processing of the form.

- Forgetting to sign the form. This may seem obvious, but an unsigned form is one of the most common reasons for delays.

- Entering incorrect social security numbers (SSN) or individual taxpayer identification numbers (ITIN) for themselves or their spouse/Registered Domestic Partner (RDP). Accuracy here is crucial for identity verification.

- Omitting prior names. This is particularly important for individuals who have changed their names due to marriage, divorce, or other reasons.

- Leaving out details about the old address, such as the apartment or suite number. The more specific you are, the better.

- Not providing a complete new address, including apartment or suite numbers and private mailbox numbers if applicable. Every detail helps to ensure timely mail delivery.

- Ignoring instructions for filling out addresses correctly, especially for those with foreign addresses. The format can differ significantly from domestic addresses.

- Using a P.O. Box without reading the specific instructions. There are certain conditions under which a P.O. Box can be used, and knowing them is essential.

- Not including dates in the proper format (mm/dd/yyyy). Consistency with date formats helps in processing the form accurately.

- Failing to provide contact information. A telephone number can be crucial if there are questions or additional information is needed.

By avoiding these common mistakes, the process of changing your mailing address with the California tax board can be smooth and efficient.

Remember, taking the extra time to review and double-check the information on your Form 3533 can save you time and inconvenience in the long run.

Documents used along the form

When dealing with changes in address or personal circumstances, especially in a state like California, it's essential for individuals to be aware of the suite of forms and documents that may need to accompany a primary form like the California 3533 form. Used specifically for notifying the relevant state tax authority about a change of address, California Form 3533 is just the starting point for a range of paperwork necessary under different circumstances.

- California Form 540: This is the standard state income tax return form for California residents. It is relevant for individuals who have filed this form in the past and are now submitting a Form 3533 due to a change of address.

- California Form 540 2EZ: A simpler version of the standard tax return, designed for residents with less complicated tax situations. It's mentioned directly in the Form 3533 instructions as a previously filed form that necessitates a change of address notification through Form 3533.

- California Form 540NR: This form is for nonresidents or part-year residents of California. It details income that is subject to California state taxes. Like the 540 and 540 2EZ forms, if a taxpayer has filed a 540NR in the past, a change of address needs to be recorded on Form 3533.

- California Form 592-B: A form that reports withholding from California source income. Individuals who have received this form in the past and who are changing their address may need to notify the payers of the change using the information from their Form 3533.

- IRS Form 8822: A federal form used to report a change of address to the Internal Revenue Service. While this is a federal form, individuals filing a Form 3533 for state purposes should also consider updating their address with the IRS if they have not done so.

- Proof of Address Documents: Although not a formal form, individuals might also need to prepare documents proving their new address. These can include utility bills, lease agreements, or bank statements that have the new address listed. This documentation is often required for verification purposes in various situations unrelated to tax forms.

Gathering and completing these forms and documents can ensure a smooth transition for individuals undergoing a change in residence or other circumstances requiring an update to personal information. Handling these matters promptly helps in staying compliant with both state and federal requirements, prevents delays in receiving important mail, and ensures the accuracy of tax-related filings.

Similar forms

The California 3533 form, designated for the change of mailing address for individuals, mirrors the concepts and intentions found in the federal Form 8822, Change of Address. Both forms serve as official notifications to their respective tax agencies about a change in address. They request similar information, such as the filer's name, social security number (or taxpayer identification number), old address, and new address, ensuring the tax authorities can update their records and correspond with the taxpayer accurately. This alignment ensures both state and federal tax agencies are notified appropriately when a person moves, maintaining seamless communication.

Similar to a Voter Registration Update form used in many states, the California 3533 form allows individuals to update governmental records following a change of residence. While the Voter Registration Update primarily focuses on ensuring electoral roll accuracy and the individual's ability to vote in the correct precinct, both forms are critical for keeping governmental entities informed about where an individual resides. The underlying purpose is to ensure correspondence and legal documents are sent to the right address, minimizing the risk of missed important notices or the disenfranchisement of voters.

The form also has similarities to the U.S. Postal Service's Official Change of Address Form, which notifies the postal service of a change in address to redirect mail. While the Postal Service's form is broader in scope, aiming to reroute all mail to a new address, the California 3533 form specifically targets tax-related communications. Both forms, however, are pivotal in ensuring that mail, whether it's personal, commercial, or governmental, reaches the individual at their new location, thus avoiding potential complications arising from missed communications.

Last, the DMV Change of Address Form, which residents of California must submit to the Department of Motor Vehicles following a move, is another document with a similar aim as the California 3533 form. This DMTNV form is essential for updating driver’s license information, vehicle registration, and voting address records. While one form focuses on the tax implications of a move and the other on vehicular and licensing aspects, together they encapsulate the full spectrum of address changes across state departments, ensuring an individual's records are consistent and up-to-date across various governmental databases.

Dos and Don'ts

When filling out the California Form 3533 for a change of address, attention to detail and accuracy are paramount. This form is vital for ensuring that any correspondence or documents from the state tax agency are sent to the correct location. Below is a guide designed to assist individuals in completing the Form 3533 correctly and avoiding common pitfalls.

- Do ensure that you have the correct form for your needs. The California Form 3533 is specifically for individuals needing to report a change of address.

- Do not attach this form to your tax return. It is processed separately and has a different submission procedure.

- Do complete all sections of the form accurately, including your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as that of your spouse or Registered Domestic Partner (RDP) if applicable.

- Do not use abbreviations or unclear writing. It's important that the information on the form is legible and understandable to ensure proper processing.

- Do check the appropriate box if your last tax return was a joint return and you are now establishing a separate residence. This ensures the record update will be accurate for both parties.

- Do not forget to provide both your old and new addresses, including any apartment or suite numbers, to avoid any confusion or overlap with another taxpayer's information.

- Do review the instructions for specific guidelines regarding PO boxes and foreign addresses. These have unique reporting requirements which, if not followed, could result in processing delays.

- Do not overlook signing and dating the form. An unsigned form is considered incomplete and will not be processed until this crucial step is fulfilled.

By following these guidelines closely, individuals can ensure their address change is processed smoothly and efficiently, reducing the likelihood of missed tax correspondence or important notifications from the state tax agency.

Misconceptions

The California 3533 form is a document used to notify the state's tax agency of a change in address for individuals who have filed income tax returns. There are several misconceptions about this form and its requirements that need clarification:

- Misconception 1: The form 3533 needs to be attached to your tax return. This is incorrect. As explicitly stated on the form, it should not be attached to your tax return. Its sole purpose is to update your mailing address with the tax agency.

- Misconception 2: You can only use the form if your last tax return was filed jointly. This is a misunderstanding. Regardless of whether you filed singly or jointly, you can use Form 3533 if you need to update your mailing address.

- Misconception 3: The form is only for those who have moved within California. This assumption is not accurate. If you're moving out of California or even out of the country, you can and should use Form 3533 to update your address to receive important tax correspondence.

- Misconception 4: Filling out the form for a change of address automatically updates your address for other state correspondence. Unfortunately, this is not the case. Form 3533 specifically updates your address for tax purposes. For other state departments or agencies, you might need to notify them separately of your address change.

- Misconception 5: Electronic submission is an option for everyone. While electronic options are becoming more prevalent for various tax-related forms and filings, you should verify the current submission requirements for Form 3533. As of the last guidance, you may need to mail the form, but always check for the most current procedures on the California Franchise Tax Board's website.

It is vital for individuals to understand the correct use and requirements of California Form 3533 to ensure their tax records are accurately updated. Misunderstandings can lead to missed correspondence, including tax notices or refunds, which could have financial implications.

Key takeaways

Filing a Change of Address (Form 3533) with the California Franchise Tax Board is an important step for residents who have moved to ensure that their tax documents are sent to the right place. Here are six key takeaways to keep in mind:

- Do not attach the Form 3533 to your tax return. This form is processed separately and should be submitted independently of your tax return submissions.

- To change your mailing address, complete this form if you have filed a California individual income tax return in the past, specifically Forms 540, 540 2EZ, or 540NR.

- If you previously filed a joint return and are now establishing a separate residence, you must indicate this by checking the appropriate box on the form. This detail is crucial for maintaining accurate records for both parties involved.

- Complete all sections related to both old and new addresses, including any apartment, suite, or private mailbox numbers, to ensure that the California Franchise Tax Board has the most current information.

- For those with foreign addresses, special attention is required to correctly fill in the fields designated for foreign country name, province/state/county, and postal codes. Accurate completion of these sections is vital for ensuring that correspondence from the California Franchise Tax Board reaches you.

- Remember to sign and date the form. If you filed a joint tax return, it’s essential that both parties sign the Form 3533. A missing signature can delay the processing of your change of address.

By keeping these key points in mind and carefully completing the Form 3533, individuals can smoothly update their address with the California Franchise Tax Board, helping to avoid any delays or issues with receiving important tax documents and information.

Discover More PDFs

Ca 540 Instructions - Necessary step for accurately computing California state income tax.

Ca Dmv Address Change - Accuracy in your public professional profile starts with an up-to-date address—make the necessary changes using this specialized form.

California Sales Tax Certificate - To remain in compliance, sellers are cautioned to verify that the goods or services sold qualify under the exemption claimed.