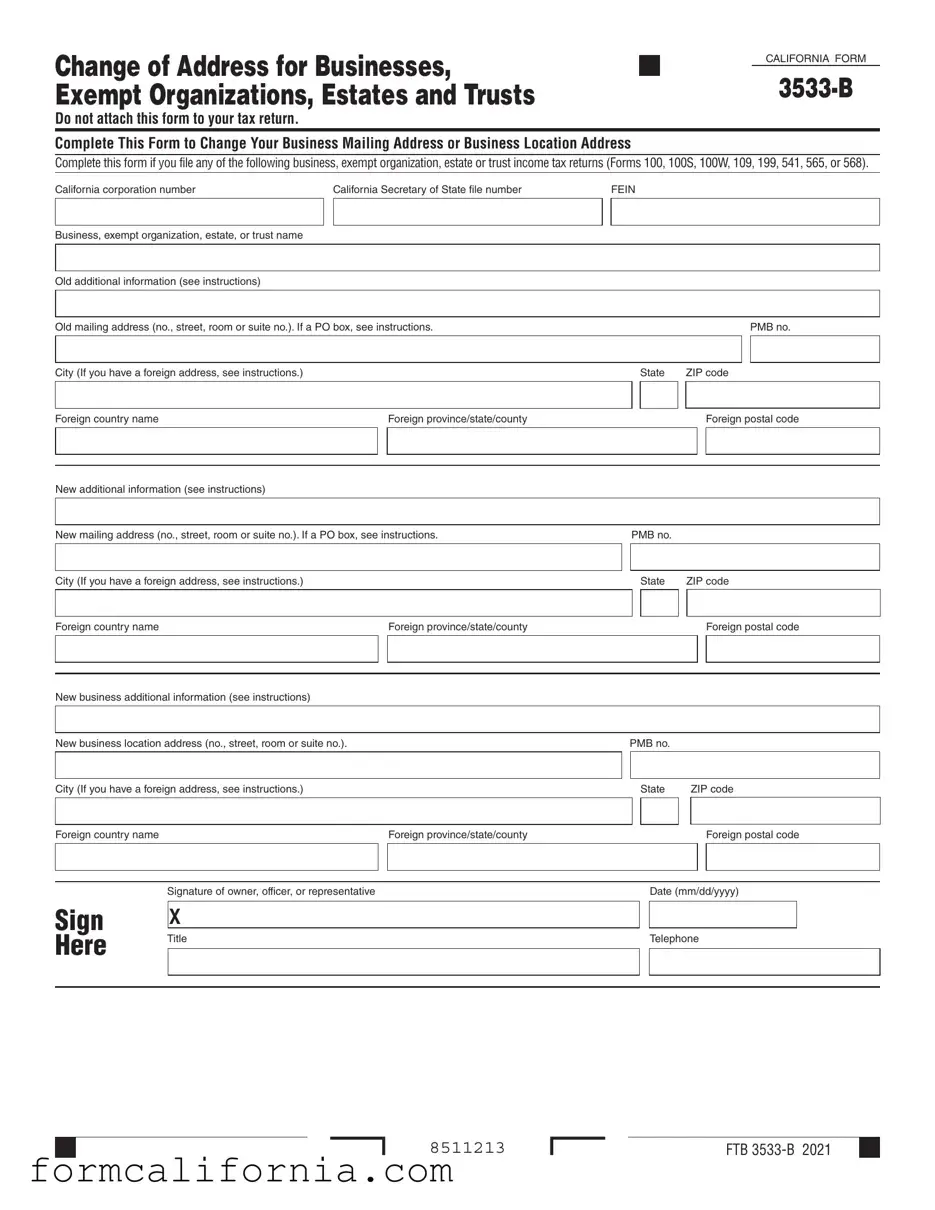

Blank California 3533 B PDF Form

When businesses, exempt organizations, estates, or trusts undergo changes that affect their mailing or location addresses in California, the California 3533 B form comes into play. This vital document ensures that critical updates are recorded to keep the communication lines open and compliance in check with the state's taxation authority. Specifically designed not to be attached with tax returns, the form accommodates updates for entities filing various income tax returns including forms 100, 100S, 100W, 109, 199, 541, 565, or 568. It requires detailed information such as the California corporation number, California Secretary of State file number, and the Federal Employer Identification Number (FEIN), among other specifics. The form guides the filer through updating old mailing and business location addresses to the new ones, taking care to provide separate instructions for those with foreign addresses. A signature from an authorized owner, officer, or representative finalizes the submission, solidifying the change and ensuring that the entity's records with the California taxing authorities are current and accurate. This straightforward process outlined by the 3533-B form plays a crucial role in maintaining the fluid operation and legal compliance of businesses and other entities within the state.

Document Preview Example

Change of Address for Businesses, |

|

|

CALIFORNIA FORM |

|

|

|

|

Exempt Organizations, Estates and Trusts |

|

|

|

|

|

Do not attach this form to your tax return.

Complete This Form to Change Your Business Mailing Address or Business Location Address

Complete this form if you file any of the following business, exempt organization, estate or trust income tax returns (Forms 100, 100S, 100W, 109, 199, 541, 565, or 568).

California corporation number |

California Secretary of State file number |

|

FEIN |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business, exempt organization, estate, or trust name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Old additional information (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Old mailing address (no., street, room or suite no.). If a PO box, see instructions. |

|

|

|

|

|

|

|

|

|

PMB no. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

|

|

|

|

State |

ZIP code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

|

Foreign province/state/county |

|

|

|

|

|

|

|

Foreign postal code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New additional information (see instructions)

New mailing address (no., street, room or suite no.). If a PO box, see instructions. |

|

PMB no. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

ZIP code |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/state/county |

|

|

|

|

|

|

|

|

Foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New business additional information (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New business location address (no., street, room or suite no.). |

|

PMB no. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

|

|

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/state/county |

|

|

|

|

|

|

|

|

Foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of owner, officer, or representative |

|

|

|

|

Date (mm/dd/yyyy) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HERE |

Title |

|

|

|

|

Telephone |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8511213 |

FTB |

Document Specs

| Fact | Detail |

|---|---|

| Purpose | Form 3533-B is for changing the business mailing address or location address for businesses, exempt organizations, estates, and trusts in California. |

| Applicability | It’s used when filing California income tax returns for certain entities, including Forms 100, 100S, 100W, 109, 199, 541, 565, or 568. |

| Required Information | Information needed includes the California corporation number, Secretary of State file number, FEIN, and both old and new addresses. |

| Submission | This form should not be attached to your tax return but completed and submitted separately to update address information. |

| Governing Law | California's tax laws govern the submission and processing of Form 3533-B, as managed by the California Franchise Tax Board. |

| Identification Details | Businesses must provide identification details such as the name of the business, exempt organization, estate, or trust, along with specific identifiers for official records. |

Detailed Instructions for Writing California 3533 B

Filling out the California Form 3533-B is an essential step for businesses, exempt organizations, estates, and trusts that need to update their mailing or location addresses. It's crucial in ensuring correspondence and important information from the tax authority reach you without delays. The process is straightforward but requires attention to detail to ensure all information is accurate and complete.

- Start by identifying the specific tax returns your entity files from the listed options (Forms 100, 100S, 100W, 109, 199, 541, 565, or 568) to confirm that the Form 3533-B is applicable to your situation.

- Fill in your California corporation number, if applicable. This is a unique number assigned by the California Secretary of State.

- Enter the California Secretary of State file number. This is also a unique identifier but is different from the California corporation number.

- Provide your entity's Federal Employer Identification Number (FEIN).

- Write the full name of your business, exempt organization, estate, or trust as it currently appears on official documents.

- Under the section labeled "Old mailing address," input the address you are changing from, including any pertinent details such as room, suite, or PMB number, as well as city, state, and ZIP code. If you have a foreign address, make sure to follow the specific instructions for listing it.

- In the section marked "New mailing address," enter the new address to which you wish correspondence to be sent. Again, remember to follow special guidelines if this address is outside the United States.

- If there is a change in the physical location of the business, fill in the "New business location address" with the new address details, similar to how you filled out the mailing address sections above.

- Include any new additional information

- Once all the information has been provided, the form must be signed by an owner, officer, or authorized representative of the entity. Ensure the signature is accompanied by the date (mm/dd/yyyy) and the title of the person signing the form.

- Finally, provide a contact telephone number where you or a representative can be reached to clarify or confirm the information if necessary.

After completing the form, review all details for accuracy to prevent any processing delays. The completed Form 3533-B should not be attached to your tax return. Instead, it must be sent to the appropriate mailing address as provided by the California tax authority. Timely updating your address helps maintain seamless communication, ensuring you remain informed about important tax-related information and updates.

Things to Know About This Form

What is the purpose of the California Form 3533-B?

The California Form 3533-B is designed to communicate changes in mailing addresses or business location addresses for businesses, exempt organizations, estates, and trusts with the California tax authorities. This form is necessary for any entity that files specific business, exempt organization, estate, or trust income tax returns, including Forms 100, 100S, 100W, 109, 199, 541, 565, or 568. It ensures that the California Franchise Tax Board (FTB) has the most current address information to send correspondence and important tax documents.

Who needs to file Form 3533-B?

Form 3533-B must be filed by entities such as businesses, exempt organizations, estates, and trusts that need to update their mailing or business location addresses and that file the following tax returns with the California Franchise Tax Board: Forms 100, 100S, 100W, 109, 199, 541, 565, or 568. This includes any entity registered with the California corporation number, California Secretary of State file number, or having a Federal Employer Identification Number (FEIN).

What information is required to complete Form 3533-B?

To complete Form 3533-B, the following information is necessary:

- The entity's California corporation number or California Secretary of State file number.

- The Federal Employer Identification Number (FEIN).

- The name of the business, exempt organization, estate, or trust.

- The old and new mailing addresses, including street number, room or suite number, city, state, and ZIP code. For foreign addresses, country name, province/state/county, and foreign postal code are needed.

- The old and new business location addresses, if applicable.

- Signature of the owner, officer, or authorized representative, alongside their title and the date of signing.

How do I submit Form 3533-B?

Form 3533-B should not be attached to your tax return. Instead, it must be separately mailed or submitted in accordance with the instructions provided by the California Franchise Tax Board. The specific mailing address or submission guidelines can be found on the FTB's official website or the instructions accompanying the form.

Is there a deadline for submitting Form 3533-B?

While there is no specific deadline for submitting Form 3533-B, it is recommended to file it as soon as possible after your address changes. This ensures that the California Franchise Tax Board has your most current address on file to avoid any delays in receiving communications or essential tax documents. Timely updating your address can prevent missed deadlines, penalties, or lost correspondence.

Common mistakes

When businesses engage with the California Form 3533-B, which is utilized to update mailing or location addresses for various entities, certain oversights can compromise the success of this simple yet crucial process. Recognizing and avoiding these mistakes is essential for ensuring that the state has the correct information on file, which in turn helps in avoiding unnecessary complications or delays in communication.

- Not completing the form in its entirety: Every section of the form is essential. Leaving out information such as the California corporation number or the Secretary of State file number may lead to processing delays.

- Failing to provide the correct organization names: It is crucial to include the accurate business, exempt organization, estate, or trust name as currently on file with the California Franchise Tax Board to ensure that the change of address is applied to the correct entity.

- Using a P.O. Box without reading the instructions: Certain restrictions apply when using a P.O. Box as a new mailing or location address. Misunderstanding these instructions can result in the form being returned or incorrectly processed.

- Omitting old address information: Forgetting to include either the old mailing or location address prevents the form from being processed accurately, as it doesn't give a clear before-and-after picture of the change.

- Incorrectly filling out the date: The date must be in the mm/dd/yyyy format. An incorrect or improperly formatted date can invalidate the form.

- Misunderstanding the new additional info section: Not providing clear, new additional information when required can cause confusion and processing delays.

- Neglecting to sign the form: The absence of a signature from an owner, officer, or authorized representative renders the document incomplete and unprocessable.

- Forgetting to include contact information: A current telephone number ensures that any issues can be quickly resolved; missing this detail slows down the process significantly.

- Assuming all addresses can be updated with this form: Some entities may have specific requirements or separate processes for updating addresses that are not covered by this form.

Avoiding these common errors involves careful reading of the instructions provided with California Form 3533-B, diligent gathering of the required information, and a thorough review of the form before submission. Not only does this guarantee that the state accurately records the new information, but it also prevents any unnecessary delays or complications in communication with the California Franchise Tax Board.

Documents used along the form

When handling the affairs related to the California 3533-B form, which is essential for businesses, exempt organizations, estates, and trusts planning to change their mailing or location address, several other documents might also be needed to ensure a smooth transition and compliance with all state requirements. These documents assist in various ways, from reporting income to updating records officially. Understanding these documents will provide clarity and ease the process.

- Form 100 - This is the California Corporation Franchise or Income Tax Return, a crucial document for corporations operating in California. It reports the income, deductions, and credits of the corporation.

- Form 100S - Known as the California S Corporation Franchise or Income Tax Return, it is used by S corporations to report income, deductions, and credits to the state.

- Form 100W - This is the California Corporation Franchise or Income Tax Return — Water's-Edge Filers form, specifically for corporations that only pay taxes on income derived from within California's borders.

- Form 109 - The California Exempt Organization Business Income Tax Return is designed for exempt organizations that have unrelated business income.

- Form 199 - This is the California Exempt Organization Annual Information Return, which provides the state with information about an exempt organization's activities and financial status.

- Form 541 - Also known as the California Fiduciary Income Tax Return, this form is for estates and trusts to report income, deductions, gains, losses, etc.

- Form 565 - The Partnership Return of Income form is utilized by partnerships to report their income, deductions, gains, losses, and other financial activities.

- Form 568 - This form, Limited Liability Company Return of Income, is for limited liability companies (LLCs) to report income, deductions, and other tax-related items.

Understanding and preparing these documents correctly is critical for businesses, exempt organizations, estates, and trusts. They play a vital role in maintaining compliance with California's tax and legal requirements, thereby avoiding possible penalties and fines. For those who may find this process daunting, professional advice and assistance can prove beneficial in navigating through these requirements with greater ease and confidence.

Similar forms

The IRS Form 8822-B is quite similar to the California 3533-B form in its core function: it is used to notify the Internal Revenue Service of a change in address for businesses, estates, trusts, or certain other organizations. Like the 3533-B form, the 8822-B requires basic information about the entity, including its previous and new addresses, tax identification numbers, and the type of tax form(s) it files. Both forms are essential for ensuring that tax-related communications are sent to the correct address.

The Statement of Information (SOI) form, required by many states including California for registered corporations and LLCs, also shares similarities with the 3535-B form. Though primarily used to update the state about changes in company management, addresses, and other key details annually or biennially, it similarly ensures that the entity's current contact information is on file, mirroring the purpose of updating address information for tax compliance as seen with the 3533-B.

Analogous to the 3533-B is the Change of Registered Agent/Office form, commonly used across many states. While its primary function is to notify state authorities of a change in a business's registered agent or office location, it is similar in its administrative nature, requiring entities to update their official contact details to maintain compliance and ensure the proper delivery of legal and state correspondence.

Employer Identification Number (EIN) Update Letter is another document that parallels the 3533-B form. Though not a standardized form, businesses often need to inform the IRS when their address changes to ensure their EIN record is accurate. This letter typically includes information similar to what's found on the 3533-B, such as the business name, EIN, and old and new addresses, albeit in a less formal format.

The USPS Change of Address Form, officially known as PS Form 3575, while used by individuals and businesses for postal mail forwarding, shares a fundamental similarity with the 3533-B: both are formal notifications of an address change. The key difference lies in their recipients and the nature of their use — one for tax purposes and the other for general postal services, yet both are vital for uninterrupted communication.

Business License Application Forms or updates to existing licenses often require similar information to the 3533-B form. When a business relocates, it must update its address with the licensing authority to ensure compliance with local or state business regulations. This parallel underscores the universal need for current address information across various governmental and regulatory domains.

The Secretary of State (SOS) File Number Update Form, found in some states, while specifically aimed at updating an entity's file number or related administrative details, often encompasses the need to report address changes as well. The process and information required can mirror that of the 3533-B, emphasizing the maintenance of accurate records within state agencies.

Lastly, the Nonprofit Change of Address Form, which several states require from non-profit organizations to update their records, closely resembles the 3533-B form. Like the forms for businesses and other entities, it ensures that nonprofits' contact information is current, facilitating proper regulatory oversight and communication. This form underscores the universal need across sectors to keep address information up to date with the relevant authorities.

Dos and Don'ts

When it’s time to update your business, exempt organization, estate, or trust address in California, using Form 3533-B is essential. The process can be straightforward if you follow some key do’s and don’ts. Here are five of each to guide you effectively through filling out this form.

Do:

- Ensure all information is current and accurate before submission, including the California corporation number, California Secretary of State file number, and FEIN.

- Use the appropriate address fields to denote changes in either the mailing or location addresses, keeping in mind that if a P.O. box is your mailing address, specific instructions must be followed.

- Include additional information as required, such as any changes in the trust name or if an exempt organization has undergone restructuring, following the form’s instructions for new additional information.

- Sign and date the form. This validates the form, making it a legitimate document for processing. The signature of the owner, officer, or representative is mandatory.

- Contact the appropriate agency or seek professional advice if there are any uncertainties about how to accurately complete the form.

Don’t:

- Attach this form to your tax return. Form 3533-B is processed separately and should be submitted according to the specific instructions provided.

- Leave any fields blank that are applicable to your situation. Incomplete information can delay processing or lead to the form being returned for corrections.

- Overlook the specific instructions for businesses with a foreign address. Special requirements apply to these entries, including the need to include a foreign country name, province/state/county, and postal code.

- Use outdated information or guess about data such as your California corporation number or FEIN. Accuracy is crucial to avoid processing errors.

- Forget to review the entire form once completed to catch any mistakes or omissions. A quick double-check can save you time and hassle in the long run.

Misconceptions

There are several misconceptions about the California 3533 B form, which is designed for businesses, exempt organizations, estates, and trusts to change their mailing or location address. Understanding these misconceptions is crucial to avoid confusion and ensure the form is used correctly.

- Misconception 1: The form is only for corporations.

Despite the common belief, Form 3533-B isn't limited to corporations. It's also applicable to exempt organizations, estates, and trusts that file specific tax returns, like Forms 100, 100S, 100W, 109, 199, 541, 565, or 568.

- Misconception 2: It should be attached to the tax return.

The instructions explicitly state not to attach this form to your tax return. Its sole purpose is to inform of an address change, not to be included with tax documents.

- Misconception 3: A P.O. Box is not allowed as an address.

While specific instructions must be followed, P.O. Boxes can indeed be used as either the old or new mailing address, contrary to what some believe.

- Misconception 4: It’s unnecessary to fill out for minor address changes.

Any change, no matter how minor it seems (like a suite number change), requires this form to be updated. Address accuracy is crucial for receiving important tax documents and information.

- Misconception 5: Foreign addresses aren't accommodated.

The form has sections specifically designed for foreign addresses, including fields for foreign country names, provinces/states/counties, and postal codes, dispelling the myth that it's only for U.S. addresses.

- Misconception 6: Only the owner can sign the form.

It's not just owners who are authorized to sign; officers or authorized representatives of the organization can also sign the form, which provides flexibility in who can complete this important task.

- Misconception 7: No proof is needed for the address change.

While the form itself does not require you to attach proof, it’s always a good practice to keep documentation of your new address on hand should any questions arise from the state tax agency.

- Misconception 8: The form must be filed annually.

There’s no annual requirement for this form. It only needs to be submitted when there’s an actual change in the mailing or location address of the entity in question.

- Misconception 9: Electronic signatures are acceptable.

As of the last update, the form requires a physical signature. Electronic signatures, while increasingly common for many documents, are not specified as acceptable for this particular form.

Understanding these misconceptions helps ensure that businesses, exempt organizations, estates, and trusts correctly use the California 3533 B form to communicate address changes, aiding in smoother operations and compliance with state requirements.

Key takeaways

The California Form 3533-B, also known as the Change of Address for Businesses, serves a vital function for businesses, exempt organizations, estates, and trusts in maintaining accurate records with the state tax authorities. By adhering to the guidelines and key aspects of this form, entities can ensure compliance and streamline their communication with the California Franchise Tax Board. Here are some crucial takeaways about filling out and using this form:

- Do not attach Form 3533-B to your tax return. It is essential to submit this form separately from any tax return documents to ensure that the address change is processed promptly and accurately.

- Applicability of the form: The form is designed for a specific set of entities including businesses, exempt organizations, estates, and trusts that file California tax returns such as Forms 100, 100S, 100W, 109, 199, 541, 565, or 568. It is critical to use this form if any of these entities need to update their mailing or location address with the California Franchise Tax Board.

- Requirement for accurate and complete information: When filling out the form, it’s imperative to provide both the old and new address information, ensuring every detail is accurate and complete. This includes street numbers, room or suite numbers, and for those with a foreign address, appropriate instructions must be followed to include foreign country names, provinces, states, counties, and postal codes.

- Significance of the signature: The form requires the signature of an owner, officer, or authorized representative, underscoring the importance of the document being endorsed by someone with the authority to request such changes. The date of the signature and the title of the person signing are also required to verify the request.

- Additional information fields: The form includes sections for new additional information and new business location address details. It is important to review these sections carefully and provide any relevant updates that accompany the address change, such as a new business location address separate from the mailing address.

Compliance with the form's requirements ensures that entities can effectively communicate with the California Franchise Tax Board and receive important tax information or correspondence at the correct address. Promptly updating addresses using the California Form 3533-B is a critical task for any business, exempt organization, estate, or trust operating within the state.

Discover More PDFs

Smllc Meaning - Penalties and interest may apply for late payments, highlighting the importance of meeting the due date.

Form 541 Instructions 2022 - The form covers both calendar year filers and those with fiscal years beginning in 2002.

What Is Form 100 - If you're filing a tax return in California and have unused credits from past years, Form 3540 helps summarize these carryovers.