Blank California 3528 A PDF Form

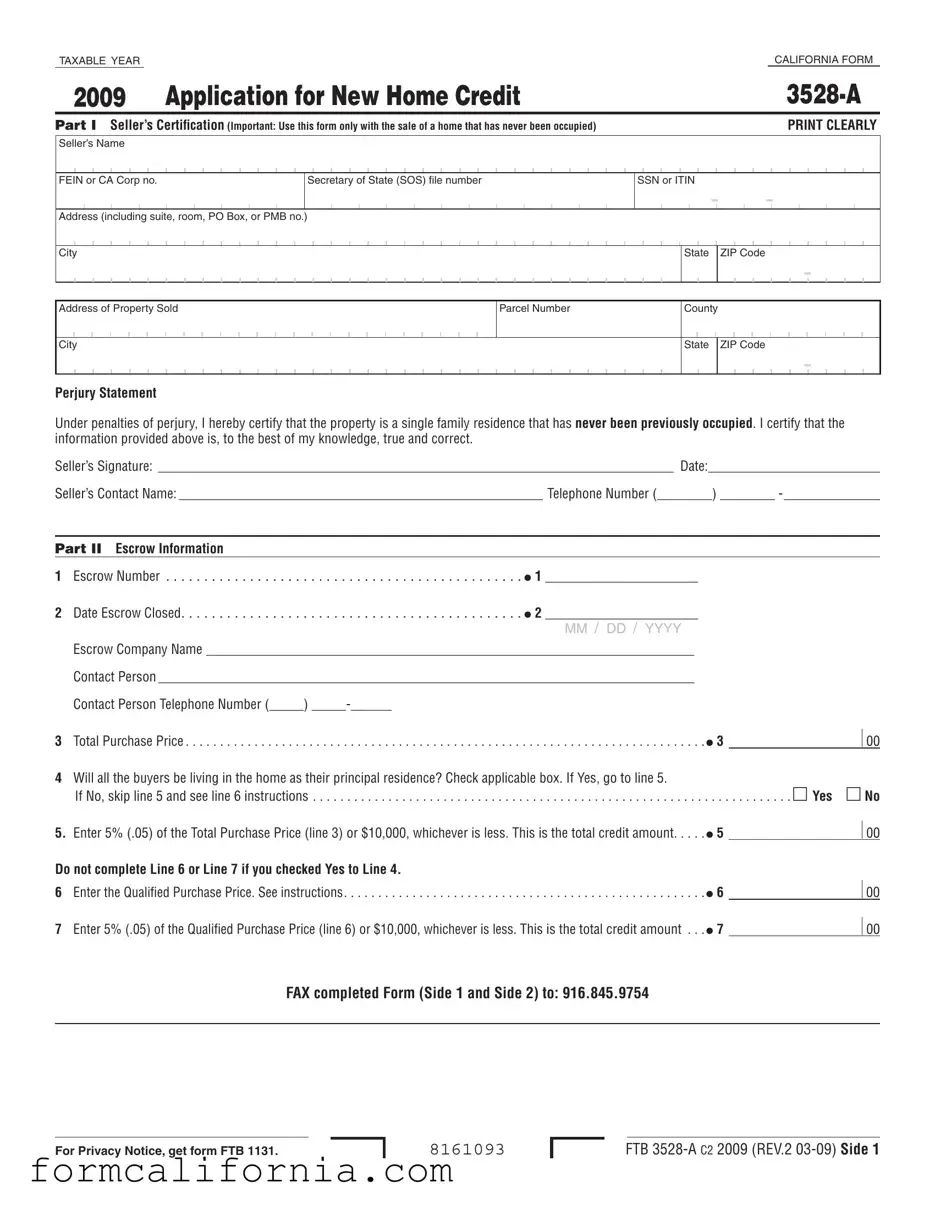

In California, the journey towards homeownership comes with various steps, including understanding the tax implications and benefits. Among these, the California Form 3528-A, also known as the Application for New Home Credit, plays a pivotal role for individuals purchasing new homes that have never been occupied before. This form, specifically designed for transactions occurring between March 1, 2009, and March 1, 2010, allows sellers to certify that the home in question has never been lived in, setting the scene for potential buyers to receive a tax credit. This incentive aims to lessen the financial burden on new homeowners by offering a credit of 5% of the purchase price or $10,000, whichever is less. The process necessitates the seller's detailed information in Part I, including a perjury statement ensuring the truthfulness of the claim that the property is freshly occupying its first residents. Following this, the escrow details and buyer’s qualification information are meticulously filled out, establishing the groundwork for the tax credit application—right from the escrow number and closing date to the specific allocation for qualified buyers. Applicants must act swiftly, submitting the form within one week of escrow closure, via fax, to be considered for the credit. This form underlines California's commitment to encouraging home ownership while setting strict guidelines to ensure fairness and accuracy in the allocation of this financial incentive.

Document Preview Example

TAXABLE YEARCALIFORNIA FORM

2009 |

|

|

|

Application for New Home Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

Part I Seller’s Certiication (Important: Use this form only with the sale of a home that has never been occupied) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINT CLEARLY |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seller’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN or CA Corp no. |

|

|

|

|

|

|

|

|

|

|

Secretary of State (SOS) ile number |

SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Address (including suite, room, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Property Sold

City

Perjury Statement

Parcel Number |

County |

||||||||

|

|

|

|

|

|

|

|

|

|

|

State ZIP Code |

||||||||

-

Under penalties of perjury, I hereby certify that the property is a single family residence that has never been previously occupied. I certify that the information provided above is, to the best of my knowledge, true and correct.

Seller’s Signature: ___________________________________________________________________________ Date:_________________________

Seller’s Contact Name: _____________________________________________________ Telephone Number (________) ________

Part II Escrow Information

1 |

Escrow Number |

I1 ____________________ |

2 |

Date Escrow Closed |

I2 ____________________ |

|

|

MM / DD / YYYY |

|

Escrow Company Name _______________________________________________________________________ |

|

|

Contact Person ______________________________________________________________________________ |

|

|

Contact Person Telephone Number (_____) |

|

3 |

Total Purchase Price |

. . . . . . . . . . . . . . . . . . . . . . . . . . . I3 |

00

4Will all the buyers be living in the home as their principal residence? Check applicable box. If Yes, go to line 5.

|

If No, skip line 5 and see line 6 instructions |

. . . . . . . . . . . . . |

mYes m No |

5. |

Enter 5% (.05) of the Total Purchase Price (line 3) or $10,000, whichever is less. This is the total credit amount |

I5 |

00 |

Do not complete Line 6 or Line 7 if you checked Yes to Line 4. |

|

|

|

6 |

Enter the Qualified Purchase Price. See instructions |

I6 |

00 |

7 |

Enter 5% (.05) of the Qualified Purchase Price (line 6) or $10,000, whichever is less. This is the total credit amount . . . |

I7 |

00 |

FAX completed Form (Side 1 and Side 2) to: 916.845.9754

For Privacy Notice, get form FTB 1131.

8161093

FTB

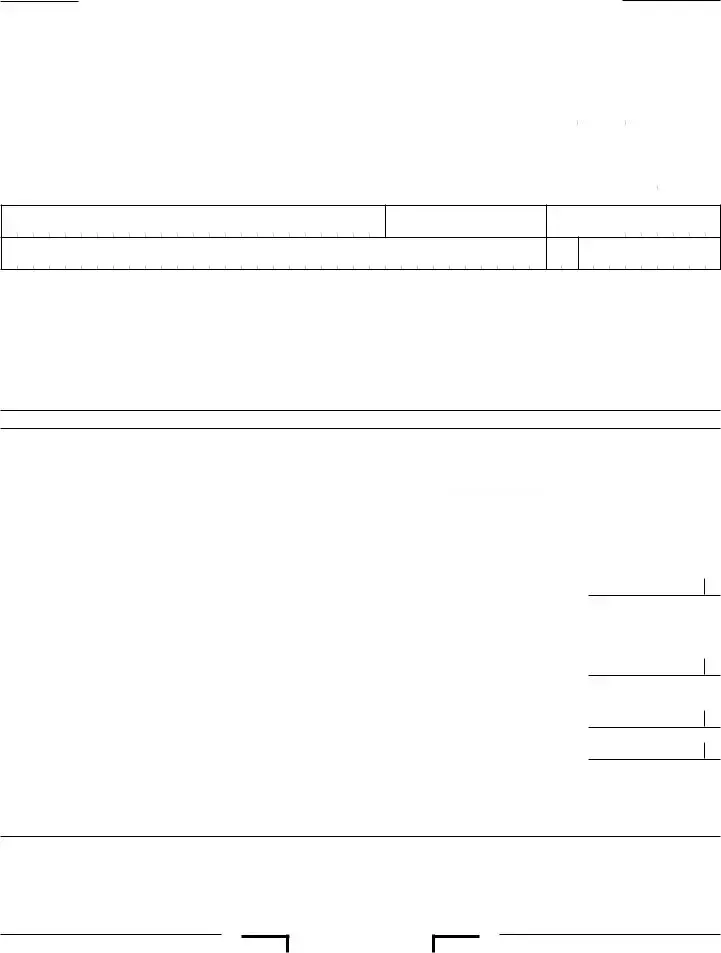

Part III Qualiied Buyer’s Information |

Escrow Number: __________________________ |

|

|

Perjury Statement |

|

By completing and signing, the Buyer is acknowledging that he/she is purchasing a single family residence in which he/she intends to live for a minimum of two years as his/her principal residence and which is eligible for the homeowner’s exemption under R&TC Section 218.

Buyer 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINT CLEARLY |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Buyer’s First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Buyer’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Buyer’s Ownership Percent |

|

Buyer’s Individual Credit |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

______ _____ _____ • _____ _____% |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||||||||||||||||||||

Spouse’s/RDP’s First Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Spouse’s/RDP’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse’s/RDP’s SSN or ITIN |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( __________ ) __________ – _______________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

Zip Code |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Spouse/s/RDP’s Signature (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Buyer 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Buyer’s First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Buyer’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Buyer’s Ownership Percent |

|

Buyer’s Individual Credit |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

______ _____ _____ • _____ _____% |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||||||||||||||||||||||||||||||||||

Spouse’s/RDP’s First Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Spouse’s/RDP’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( __________ ) __________ – _______________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address

City

Buyer’s Signature

Spouse/s/RDP’s Signature (if applicable)

State Zip Code

-

Date

Date

Buyer 3.

Buyer’s First Name |

|

Initial |

Buyer’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s SSN or ITIN |

|

* Buyer’s Ownership Percent |

Buyer’s Individual Credit |

|

|

|||||||||

- |

- |

______ _____ _____ • _____ _____% |

$ |

|

|

|

|

|

|

|

|

|

.00 |

|

Spouse’s/RDP’s First Name (if applicable) |

|

Initial |

Spouse’s/RDP’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

- |

Buyer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

- |

( __________ ) __________ – _______________________ |

|||||||||||||

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address

City

Buyer’s Signature

Spouse/s/RDP’s Signature (if applicable)

State Zip Code

Date

Date

-

* Married/RDP couples are considered to be one buyer. If married/RDP, enter the combined percentage in the Buyer’s Ownership Percent field.

Side 2 FTB

8162093

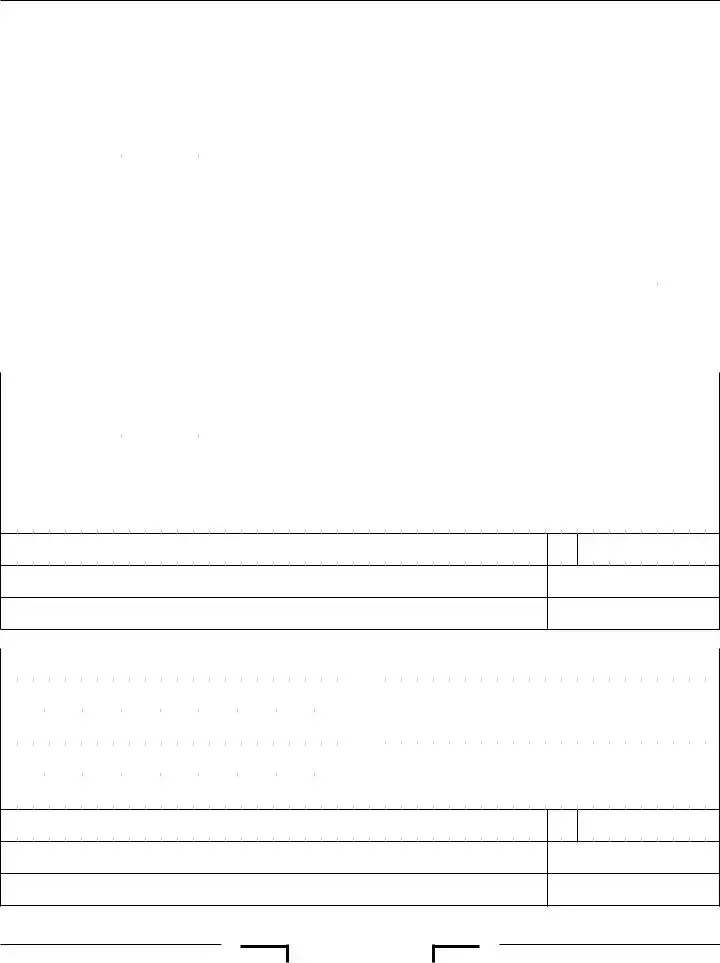

Instructions for

Application for New Home Credit

General Information |

The FTB may request documentation to |

residence is made, on a timely filed original |

|||

A |

Purpose |

ensure the parties have complied with the |

return. If the available credit exceeds the |

||

requirements of the credit under Revenue and |

current year net tax, the unused credit may not |

||||

Use form FTB |

Taxation Code (R&TC) Section 17059. |

be carried over to the following year. |

|||

Home Credit, if you are a seller of a new home |

The credit must be apportioned equally for |

F Filing Form FTB |

|||

which has never been occupied and are selling |

|||||

two married taxpayers filing separate tax |

The escrow person will FAX a copy of the form |

||||

to any individual who purchases the residence |

returns, even if their ownership percentage |

||||

on or after March 1, 2009, and before March 1, |

is not equal. For two or more taxpayers who |

FTB |

|||

2010. The seller must first complete Part I of |

are not married, the credit shall be allocated |

the buyer within one week after the close of |

|||

form FTB |

among the taxpayers who will occupy the |

escrow. If a seller has several buyers, send |

|||

has never been occupied, and provide a copy |

home as their principal residence using their |

only one application per FAX. |

|||

to the buyer or escrow person. The buyer will |

percentage of ownership in the property. The |

Do not mail the form. |

|||

complete the rest of form FTB |

total amount of the credits allocated to all of |

FTB’s FAX Number is 916.845.9754 |

|||

escrow person will FAX the completed form |

these taxpayers shall not exceed ten thousand |

The FAX number will be disconnected once the |

|||

FTB |

dollars ($10,000). |

||||

$100,000,000 total allocation amount has been |

|||||

within one week of the close of escrow, at |

C |

Definitions |

|||

reached. Do not use any other FAX number. |

|||||

916.845.9754, and provide a copy to the buyer. |

|||||

The copy received from the seller or escrow |

A “qualified principal residence” means a |

Applications sent to any other FTB FAX number |

|||

will not be be processed. |

|||||

person does not constitute an allocation of |

|||||

We will post a notice on our website at |

|||||

the credit to the Buyer; instead the Buyer will |

attached, that has never been occupied and |

||||

receive confirmation from the FTB certifying |

is purchased to be the principal residence of |

ftb.ca.gov when the credit has been fully |

|||

the allocation of tax credit. The Buyer cannot |

the taxpayer for a minimum of two years and |

allocated. |

|||

claim this credit unless they receive an |

is eligible for the property tax homeowner’s |

For more information, contact Withholding |

|||

allocation of the credit from the FTB. |

exemption. |

Services and Compliance at: |

|||

Upon receipt of form FTB |

• Types of residence: Any of the following can |

888.792.4900 |

|||

allocate the credit on a |

|

qualify if it is your principal residence and |

916.845.4900 (not |

||

basis. The total amount of credit that may |

|

is subject to property tax, whether real or |

|

||

be allocated by the FTB must not exceed one |

|

personal property: a single family residence, |

Specific Instructions |

||

hundred million dollars ($100,000,000). |

|

a condominium, a unit in a cooperative |

|

||

|

Part I – Seller’s Certification |

||||

Registered Domestic Partner – For purposes |

|

project, a houseboat, a manufactured home, |

|||

|

or a mobile home. |

Enter the name, address, and identification |

|||

of California income tax, references to a |

|

||||

• |

|||||

spouse, a husband, or a wife also refer to a |

number of the seller. If the seller is an |

||||

California Registered Domestic Partner (RDP), |

|

by an |

individual, enter the SSN or ITIN. If the seller |

||

unless otherwise specified. |

|

New Home Credit because the home has not |

is a corporation or partnership, enter the FEIN |

||

Round Cents to Dollars – Round cents to the |

|

been “purchased.” |

or CA Corporation number. If the seller is a |

||

“One week” means a 7 calendar day period. We |

Limited Liability Company (LLC), enter the |

||||

nearest whole dollar. For example, round $50.50 |

|||||

Secretary of State (SOS) file number. Include |

|||||

up to $51 or round $25.49 down to $25. |

will count the day after escrow closes as the |

||||

the Private Mail Box (PMB) in the address |

|||||

|

|

first full day. |

|||

B |

Qualifications |

field. Write “PMB” first, then the box number. |

|||

Example: Escrow closes March 1, 2009. We |

|||||

California allows a credit against net tax equal |

Example: 111 Main Street PMB 123. |

||||

will accept an application filed March 1, 2009 |

|||||

Enter the address of the property sold, |

|||||

to the lesser of 5% (.05) of the purchase |

through March 8, 2009. |

||||

price of the qualified principal residence or ten |

A “qualified buyer” is an individual who |

including parcel number and county. |

|||

thousand dollars ($10,000). |

Complete the Seller’s Certification, sign and date. |

||||

purchases a |

|||||

The credit shall be: |

|

||||

detached or attached, and intends to live in the |

Part II – Escrow Information |

||||

|

|

||||

• |

Allocated for the purchase of only one |

qualified principal residence for a minimum of |

Line 1 – Escrow Number |

||

|

qualified principal residence with respect to |

two years. |

|||

|

Enter the escrow number for the property |

||||

|

any taxpayer. |

“Total purchase price” is the price before |

|||

|

purchased, if any. |

||||

• Claimed only on a timely filed return, |

reduction of ownership percentage. |

||||

Line 2 – Date Escrow Closed |

|||||

|

including returns filed on extension. |

“Qualified purchase price” is the price after |

|||

• |

Applied in equal amounts over the three |

Enter the date escrow closed. Complete the |

|||

reduction of the |

|||||

|

successive taxable years beginning with |

escrow information including the escrow |

|||

|

percentage. |

||||

|

the taxable year in which the purchase of |

company name, contact person, and telephone |

|||

|

“Purchase date” is the date escrow closes. |

||||

|

the qualified principal residence is made |

number. |

|||

|

(maximum of $3,333 per year.) |

D |

Limitations |

Line 3 – Total Purchase Price |

|

The credit will not be allocated: |

The credit cannot reduce regular tax below |

Enter the total purchase price of the property. |

|||

|

|

If there is more than one buyer, this amount is |

|||

• |

If the residence has been previously |

the tentative minimum tax (TMT). This credit |

|||

the total paid by all buyers. |

|||||

|

occupied. |

cannot be carried over. |

|||

|

Line 4 |

||||

• If the taxpayer does not intend to take |

This credit is nonrefundable. |

||||

|

occupancy of the principal residence for at |

Check whether all of the buyers will be living |

|||

|

|

|

|||

|

least two years immediately following the |

E |

Claiming the Credit |

in the home as their principal residence. |

|

|

purchase. |

The credit is applied against the net tax in equal |

Disregard any buyers on title for incidental |

||

• If the application is not received within one |

purposes who do not have an ownership |

||||

amounts (1/3 each year) over three successive |

|||||

|

week after the close of escrow. |

interest. Check the applicable box. If Yes, go to |

|||

|

taxable years, beginning with the taxable year |

||||

in which the purchase of the qualified principal |

line 5. If No, go to line 6 of the instructions. |

|

FTB

Line 5

Do not complete line 5 if you checked No on line 4.

Enter 5% (.05) of the Total Purchase Price, from line 3, or $10,000, whichever is less. This is the total credit amount. Do not complete line 6 or line 7. Go to the instructions for Part III, Qualified Buyer’s Information, on Page 2.

Example:

Total Purchase Price . . . . . . . . . . . $250,000 X 5%

$12,500

Since $12,500 is greater than the maximum credit amount of $10,000, the total credit amount is $10,000.

Line 6

To compute line 6, first complete Part III, Qualified Buyer’s Information, on Side 2 of the form, for each qualified buyer. However, do not complete the Buyer’s Individual Credit amount. This will be computed and entered after completing line 6 and line 7 of form FTB

After completing the Qualified Buyer’s Information (except for the Buyer’s Individual Credit), compute the Qualified Purchase Price.

Qualiied Purchase Price

Compute the Total Qualified Ownership Percentage by adding the Ownership Percentage for each Qualified Buyer from Part III of the form.

Multiply the Total Qualified Ownership Percentage by the Total Purchase Price amount from line 3 on Side 1 of the form. This is the Qualified Purchase Price. Enter this amount on Line 6. See the following example.

Example:

The Total Purchase Price on line 3 is $180,000. There is one

Example: Buyer 1

included. There are three Qualified Buyers with the following listed Ownership Percentages:

Qualiied Buyer |

Ownership |

|

Percentage |

Buyer 1 |

50.00% |

|

|

Buyer 2 |

20.00% |

|

|

Buyer 3 |

20.00% |

|

|

Total Qualiied |

|

Ownership |

90.00% |

Percentage |

|

|

|

Multiply the Total Purchase Price from line 3 by the Total Qualified Ownership Percentage, to compute the Qualified Purchase Price.

Total Purchase Price . . . . . . . . . . $180,000 Total Qualified Ownership

Percentage . . . . . . . . . . . . . . . X 90%

Qualified Purchase Price . . . . . . . . $162,000

The Qualiied Purchase Price entered on line 6 would be $162,000.

Line 7

Enter 5% (.05) of the Qualified Purchase Price amount from line 6, or $10,000, whichever is less.

This is the total credit amount.

Example:

Qualified Purchase Price . . . . . . . $162,000

Total Qualified Ownership

Percentage . . . . . . . . . . . . . . . . X 5%

Total Credit Amount . . . . . . . . . . . . . $8,100

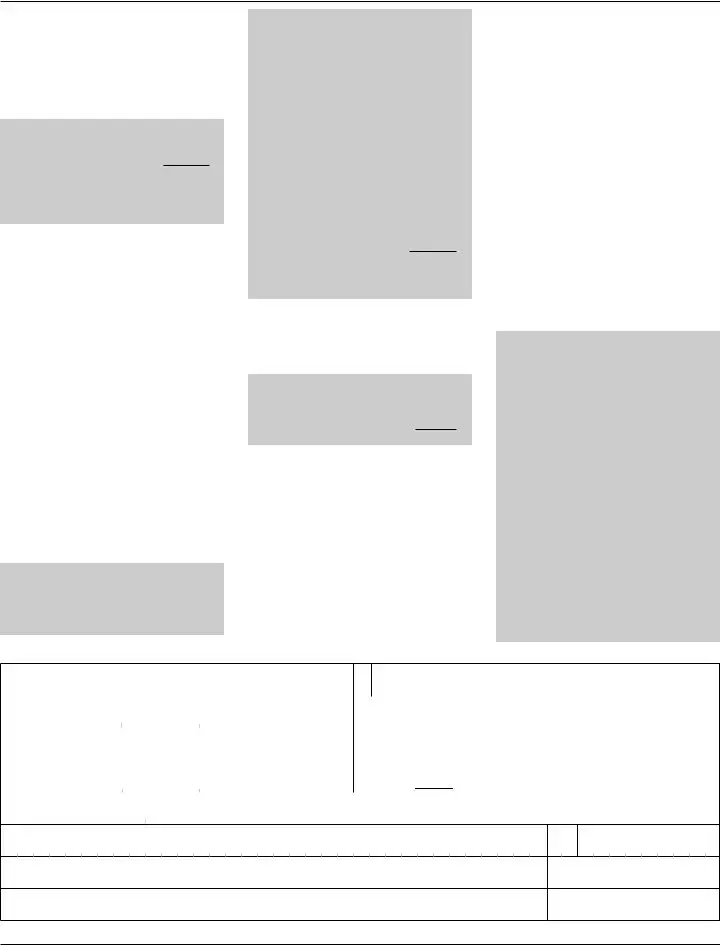

Part III – Qualified Buyer’s Information

Complete Part III, Qualified Buyer’s Information, on Side 2 of the Form, for each qualified buyer. If there are more than three qualified buyers, attach additional copies of Side 2 of form

FTB

bottom of the page shows how a married/RDP couple would complete the Qualified Buyer’s Information.

Computing the Individual Credit Amount

If Yes is checked on line 4:

For each qualified buyer, multiply the Buyer’s Ownership Percentage by the Total Credit Amount, on line 5. Enter the Individual Credit amount in Part III, in the repsective Buyer’s Individual Credit box for each qualified buyer.

If No is checked on line 4:

Compute the Individual Credit for each Qualified Buyer using the following formula:

Individual |

|

|

Ownership Percentage |

X Total credit amount |

|

Total Qualified |

||

|

||

Ownership Percentage |

|

Enter the Individual Credit amount in Part III, in the respective Buyer’s Individual Credit box for each Qualified Buyer. Round your credit to the nearest whole dollar.

Example:

There are three Qualified Buyers with the following Ownership Percentages:

Buyer 1 (a married couple): 50%

Buyer 2 (a single person): 20%

Buyer 3 (a single person): 20%

The Total Qualified Ownership Percentage is 90% (50%+20%+20%). The total credit from line 7 is $8,100. The individual credit amount for each buyer will be:

Buyer 1: (50% / 90%) x $8,100 = $4,500

Buyer 2: (20% / 90%) x $8,100 = $1,800

Buyer 3: (20% / 90%) x $8,100 = $1,800 Total credit amount = $8,100

The total credit can never be more than $10,000. If allocated, Buyer 1 will take a $1,500 credit for each of the next three years. Buyer 2 and Buyer 3 will take a $600 credit each for each of the next three years. The example below shows how Buyer 1 would complete the Qualified Buyer’s Information.

Buyer’s First Name |

Initial Buyer’s Last Name |

H |

|

|

U |

|

S |

|

|

B |

|

|

A |

|

|

|

N |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X B |

|

|

U |

|

|

Y |

|

E |

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Buyer’s SSN or ITIN |

- 4 |

|

|

|

- 6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Buyer’s Ownership Percent |

Buyer’s Individual Credit |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1 |

|

|

|

|

2 |

|

|

3 |

|

5 |

|

|

|

7 |

|

|

8 |

|

|

|

9 |

______ 5_____ |

0_____ |

• 0 0 %_____ _____ |

$ |

|

|

4 |

|

5 |

0 |

|

0 |

|

.00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Spouse’s/RDP’s First Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Spouse’s/RDP’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

W |

|

I |

|

F |

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

B |

|

U |

|

Y |

|

E |

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

Spouse’s/RDP’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

1 |

|

|

|

2 |

|

|

|

3 |

- 4 |

|

5 |

- 6 |

|

|

7 |

|

|

8 |

|

|

9 |

( 5 5 5 ) 5 5 5 |

|

- 5 5 5 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

1 |

|

2 |

|

3 |

|

4 |

|

|

|

|

|

|

|

|

B |

U |

Y |

E |

R |

|

W |

A |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

City

B U Y E R V I L L E

Buyer’s Signature

State Zip Code

C A 1 2 3 4 5- 1 2 3 4

Date

Spouse/s/RDP’s Signature (if applicable)

Date

* Married/RDP couples are considered to be one buyer. If married/RDP, enter the combined percentage in the Buyer’s Ownership Percent field.

Page 2 FTB

Document Specs

| Fact | Detail |

|---|---|

| Form Name | California Form 3528-A, Application for New Home Credit |

| Year | 2009 |

| Purpose | Used by sellers of new homes that have never been occupied to apply for a new home credit for the buyer. |

| Eligibility | New home sold to an individual who intends to use the residence as their principal residence for at least two years. |

| Credit Amount | Lesser of 5% (.05) of the purchase price or $10,000. |

| Credit Allocation | First-come, first-served basis, with a total allocation not exceeding $100,000,000. |

| Governing Law | Revenue and Taxation Code (R&TC) Section 17059. |

Detailed Instructions for Writing California 3528 A

The California Form 3528 A, Application for New Home Credit, is a document sellers and buyers need to complete and submit under specific conditions. This brief explanation is followed by a detailed series of steps to efficiently fill out the form. Prioritizing accuracy and clarity will help ensure the process is completed successfully and in compliance with all necessary regulations.

- Part I – Seller’s Certification

- Enter the seller's full name.

- Provide the Federal Employer Identification Number (FEIN) or CA Corporation number. If an individual, input the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- List the Secretary of State (SOS) file number, if applicable.

- Fill out the full address of the seller including suite, room, PO Box, or PMB number along with the city, state, and ZIP code.

- Enter the physical address of the property sold, city, and the parcel number, followed by the county, state, and ZIP code.

- Sign and date the form under the perjury statement, providing confirmation that the property has never been occupied.

- Include the seller's contact name and telephone number.

- Part II – Escrow Information

- Input the Escrow Number.

- Enter the Date Escrow Closed with the format MM/DD/YYYY.

- Write down the Escrow Company Name, Contact Person, and their Telephone Number.

- Specify the Total Purchase Price of the property.

- Indicate whether all buyers will be living in the home as their principal residence by checking the appropriate box. If "Yes", move to the next line; if "No", skip to the instructions for lines 6 and 7.

- If applicable, calculate 5% of the Total Purchase Price or $10,000, whichever is less, as the total credit amount and enter it. If "No" was checked, follow the adjustments as per instructions for lines 6 and 7.

- Part III – Qualified Buyer’s Information

- For each buyer (up to three on the form), input the Buyer’s First Name, Initial, Last Name, SSN or ITIN, Ownership Percent, and Individual Credit. If more space is needed, attach additional copies of Side 2 of the form.

- For spouses or Registered Domestic Partners (if applicable), provide their First Name, Initial, Last Name, and SSN or ITIN.

- Include the Buyer’s Telephone Number and Mailing Address, including city, state, and ZIP code.

- Both the buyer and the spouse/RDP (if applicable) must sign and date the form.

Once completed, the escrow officer is responsible for faxing the filled-out form to 916.845.9754 within one week after the close of escrow. Importantly, this document's successful submission is crucial for the processing of a New Home Credit. Sellers and buyers should ensure the accuracy and completeness of their information to facilitate this process.

Things to Know About This Form

What is Form 3528-A in California?

Form 3528-A, also known as the Application for New Home Credit, is a document used in California for sellers and buyers involved in the sale of a new home that has never been occupied. It is specifically designed to apply for a tax credit for individuals purchasing their principal residence from March 1, 2009, to March 1, 2010. Sellers must complete Part I of the form, certifying the home’s status, and provide it to the buyer or escrow agent, who will then complete and submit the form to the Franchise Tax Board (FTB) for a tax credit allocation.

Who needs to file Form 3528-A?

This form must be filed by the seller of a new home that has never been previously occupied, to certify the home's condition. After the seller's certification, the buyer or the escrow agent completes the form to apply for the New Home Credit on behalf of individuals intending to use the home as their principal residence.

How is the New Home Credit calculated?

The New Home Credit is calculated as the lesser of 5% (.05) of the purchase price of the qualified principal residence or $10,000. The total amount of the credit is then divided equally across three successive tax years, starting with the year in which the property purchase was made.

What are the eligibility criteria for the New Home Credit?

- The home must be a single-family residence that has never been occupied before.

- Buyers intending to claim the credit must live in the home as their principal residence for at least two years following the purchase date.

- The application (Form 3528-A) must be received by the FTB within one week after the close of escrow.

What happens if the total purchase price is shared among multiple buyers?

If there is more than one buyer, the Qualified Purchase Price will be proportionally allocated based on each qualified buyer's ownership percentage. The credit amount will then be calculated as 5% of this Qualified Purchase Price or $10,000, whichever is lesser. Each qualified buyer's share of the credit is determined by their ownership percentage in relation to the total Qualified Purchase Price.

Can Form 3528-A be filed if the home was previously occupied?

No, Form 3528-A cannot be filed for homes that have been previously occupied. The New Home Credit specifically targets homes that are sold as new constructions and have never been lived in before the sale.

What is the deadline for submitting Form 3528-A?

The completed Form 3528-A must be faxed to the Franchise Tax Board at 916.845.9754 by the escrow agent within one week following the close of escrow. It's crucial to submit the form within this timeframe to ensure eligibility for the New Home Credit.

Where can I find more information or assistance with Form 3528-A?

For more information, you can contact the Withholding Services and Compliance section of the Franchise Tax Board by phone at 888.792.4900 or 916.845.4900. Additionally, detailed instructions are available on the FTB's website, which can guide you through the process of completing and submitting Form 5228-A.

Common mistakes

Filling out the California 3528 A form, which is essential for applying for the New Home Credit, often involves complex details that can easily be overlooked. To ensure accuracy and completeness, being aware of common mistakes can help avoid delays or disqualification from credit allocation. Here are seven frequent errors applicants make:

Incorrectly stating the property has never been occupied. The New Home Credit is reserved strictly for homes that have never been lived in. Misinterpreting this requirement or providing inaccurate information on the seller’s certification part (Part I) undermines the application.

Failing to round cents to dollars on financial amounts. While it might seem minor, not adhering to the rounding instructions can lead to errors in calculation and in the overall credit claimed.

Omitting the FEIN, CA Corp number, or SSN/ITIN in the seller's information section. This vital information verifies the seller's identity and legal status, thereby shaping the eligibility for the credit.

Incorrect calculation of the Total Credit Amount. Applicants often mistake the process for calculating the 5% (.05) of the Total Purchase Price or $10,000, whichever is less, leading to incorrect credit amounts being claimed.

Missing the deadline for faxing the completed form. The form must be sent to the FTB within one week of the close of escrow - a term explicitly defined as a 7 calendar day period post-escrow closure.

Inaccurate allocation of the credit among multiple buyers. The credit must be divided based on ownership percentages, which gets particularly complicated when not all buyers qualify under the principle of principal residence occupancy.

Misunderstanding the qualified purchase price for non-principal resident buyers. When buyers do not intend to reside in the home, it necessitates adjustments to the Qualified Purchase Price, a detail often overlooked.

Addressing these errors upfront can streamline the application process for the California 3528 A form, ensuring that applicants are positioned best to receive the New Home Credit. By avoiding these common pitfalls, sellers and buyers alike can navigate the complexities of this tax incentive with confidence.

Documents used along the form

When dealing with the application process for the California Form 3528-A, it's crucial to have a clear understanding of the supporting documents and forms that are frequently needed. These documents play a vital role in ensuring a smooth and compliant transaction for both the seller and the buyer of a new home. Here is a list of some of the other forms and documents often used in conjunction with the California Form 3528-A.

- Form 540 or 540NR (California Resident or Nonresident Income Tax Return): This form is essential for calculating and reporting the buyer's California state income tax, which is relevant when applying for the new home credit.

- Escrow Settlement Statement: This document outlines the final closing costs and the distribution of funds in the real estate transaction. It's crucial for verifying the purchase price and date, which are needed to determine eligibility and the credit amount on Form 3528-A.

- FTB 3519 (Payment for Automatic Extension for Individuals): For buyers who are also applying for an extension to file their California tax return, this form helps in making a payment towards their estimated tax liability, including any amount owed for the new home credit.

- Property Tax Statement: This document verifies the property's assessed value and confirms it is subject to property tax, a requirement for the home to be considered as qualified for the new home credit.

Together, these documents support the application for the California Form 3528-A by providing necessary details about the home purchase, the parties involved, and their financial commitment to the property. Whether you are the seller certifying the eligibility of the property or the buyer applying for the credit, understanding and properly managing these forms and documents is a key step towards benefiting from the New Home Credit.

Similar forms

The California 3528 A Form, the Application for New Home Credit, is similar in purpose and structure to the IRS Form 5695, Residential Energy Credits. Both forms are designed for individuals who make specific qualifying improvements or purchases that are encouraged by the state or federal government. The IRS Form 5695 offers credit for energy-efficient upgrades to a home, while the California 3528 A provides credit for the purchase of a new home that has never been occupied. Each form requires the taxpayer to detail the qualifying expenses to calculate the credit amount they're eligible to claim on their tax return.

Another document akin to the Form 3528 A is Form 5405, First-Time Homebuyer Credit and Repayment of the Credit, a former IRS form used for federal tax returns. This form was designed for individuals purchasing their first home and similarly to the 3528 A, it provided a tax credit to new homeowners. Although the purposes align in incentivizing home ownership, the 5405 form was specifically targeted at first-time buyers and included provisions for repaying the credit if certain conditions were not met, differing slightly in its requirements and the administration of the credit compared to California's new home credit.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), shares a similarity in its purpose with the 3528 A, as both provide a tax benefit for individuals making significant life investments - in education for Form 8863, and in purchasing a new home with the 3528 A. While one focuses on education expenses and the other on home purchases, both forms require the taxpayer to calculate the allowable credit based on qualifying expenses and include it in their tax returns to reduce their tax liability.

The California Solar Initiative (CSI) Rebate Application Form parallels the 3528 A in encouraging investments in specific areas through financial incentives – the CSI for solar energy systems and the 3528 A for new home purchases. Both forms serve to offset some of the costs associated with these investments by providing rebates or tax credits. Applicants must provide detailed information about the property and the investment (solar installation or home purchase) to qualify for the benefits.

Form 8396, Mortgage Interest Credit, also serves a similar purpose to the California 3528 A Form by offering a federal tax credit. Form 8396 is for homeowners who hold a Mortgage Credit Certificate (MCC) from their state or local government, allowing them to claim a credit for a portion of their mortgage interest. Like the 3528 A, this form aims to promote homeownership, albeit focusing more broadly on reducing the cost burden of mortgage interest rather than incentivizing the purchase of never-before-occupied homes.

The Property Tax Postponement (PTP) Application shares objectives with the Form 3528 A by offering financial relief to eligible homeowners. The PTP program allows senior citizens, blind, or disabled individuals to defer property tax payments. While the PTP Application focuses on aiding homeowners in maintaining their residences by postponing property taxes, the 3528 A encourages the initial purchase of new homes. Despite their differences, both aim to support California residents in achieving or maintaining homeownership.

Lastly, the New Residential Construction Exemption form, part of property tax documents in many jurisdictions, seeks to incentivize the development of new homes by offering temporary relief from certain property taxes. Although it serves a different phase of the homeownership process compared to the purchase incentives of the 3528 A Form, both facilitate economic activity and growth within the housing sector by reducing initial costs associated with construction and purchasing of new homes.

Dos and Don'ts

When filling out the California 3528 A form, it's important to make sure the information you provide is accurate and complete. Here are lists of things you should do and things you shouldn't do to help guide you through the process.

Things You Should Do

- Ensure all information is printed clearly to avoid misunderstandings or processing delays.

- Verify the property sold has never been previously occupied before certifying in Part I.

- Include accurate escrow information, including the escrow number and the actual date escrow closed, in Part II.

- Calculate the total credit amount correctly by following the specific instructions, ensuring you do not exceed the $10,000 limit.

Things You Shouldn't Do

- Do not leave any required fields blank. Incomplete forms may result in processing delays or denial of the application.

- Do not guess on numbers or fill in information you are unsure about; verify all details for accuracy.

- Avoid submitting the form without the seller’s certification in Part I completed, signed, and dated.

- Do not delay sending the form; it must be faxed to the FTB within one week of the close of escrow to be considered.

Following these guidelines will help ensure the California 3528 A form is completed accurately and increases the likelihood of a successful New Home Credit application.

Misconceptions

When it comes to the California Form 3528-A, Application for New Home Credit, there are several misunderstandings that seem to persist. It's crucial to clear up these misconceptions for anyone thinking of taking advantage of this tax credit.

- You can claim the credit after moving into the home: A big point of confusion is the belief that one can simply move into a new home and then claim the credit. In reality, the credit must be allocated to the buyer by the California Franchise Tax Board (FTB) based on a completed and accepted application. The application process includes certification by the seller that the home has never been occupied, among other steps.

- Any home purchase qualifies for the credit: Another misconception is that purchasing any home qualifies you for this credit. However, the form is very specific in stating that the credit is only available for the purchase of a new home that has never been previously occupied. This detail is vital for both buyers and sellers to note.

- It's applicable for purchases outside the specified timeframe: The credit has a set timeframe in which the home purchase must occur. According to the form instructions for the 2009 tax year, the eligible purchase period is between March 1, 2009, and March 1, 2010. Some mistakenly believe they can claim the credit for a home purchased outside of these dates.

- The full credit amount is always $10,000: Lastly, there's the incorrect assumption that the credit always amounts to $10,000. The actual credit is the lesser of 5% of the purchase price or $10,000, and it's further impacted by the buyers' principal residence intentions and the allocation of ownership percentages among qualified buyers. This nuanced calculation can result in a credit amount that is less than the maximum $10,000.

Understanding these aspects of the California Form 3528-A is essential for anyone involved in the buying or selling of a new home in California, especially if they aim to benefit from the New Home Credit. This knowledge ensures both compliance and the correct application of the tax benefits available.

Key takeaways

Filling out and using the California 3528-A form, which is related to the Application for New Home Credit, is an important process for sellers and purchasers of new homes that have never been previously occupied. Here are six key takeaways to understand about this process:

- Eligibility: Only homes that have never been occupied are eligible for this credit. Sellers must certify that the property is a new single-family residence, whether detached or attached, to qualify the buyer for the credit.

- Application Process: The seller starts by completing Part I of the form to certify the home's eligibility. Afterward, the buyer completes the remaining sections. The escrow officer is responsible for faxing the completed form to the Franchise Tax Board (FTB) within one week after closing escrow.

- Credit Amount: The credit is the lesser of 5% of the purchase price or $10,000. It must be claimed on a timely filed tax return, including extensions, and is applied over three consecutive years.

- Allocation: Credit allocation by the FTB is done on a first-come, first-served basis. Importantly, receiving a copy of the form from the seller or escrow doesn’t guarantee the credit; confirmation from the FTB is necessary.

- Qualifying Buyers: Buyers must intend to occupy the residence as their principal residence for at least two years to qualify. For married couples or Registered Domestic Partners (RDPs), they are treated as one buyer for credit purposes. The application also requires buyers to disclose their percentage of ownership and calculate their individual credit based on ownership percentage.

- Limitations and Expiration: The application must be received within one week after escrow closes. Additionally, there is a cap on the total credit amount available statewide, and the program expires once this cap is reached. The FTB will post a notice on their website once the allocation amount is fully utilized, signaling the end of the program's availability for new applicants.

It's crucial for both sellers and buyers to closely follow the instructions provided on the form and ensure timely submission to take advantage of this credit. Both parties should also be aware of the limitations and qualifications to ensure compliance and secure the credit successfully.

Discover More PDFs

What Is Probate in California - Targets a specific segment of estates, making it a specialized form within California’s legal landscape for estate management.

Why Don't I Qualify for Dependent Care Credit - Calculation of credit involves considering both current and previous year's eligible expenses.

California De 4 - Use the DE 4 form to communicate your financial situation to your employer for tax withholding purposes.