Blank California 3523 PDF Form

In the landscape of California's tax incentives, the Form 3523 stands out as an essential document for entities conducting research and development within the state. Crafted for the taxable year 2020, this form facilitates the calculation and claim of the Research Credit, a tax benefit designed to encourage innovation and investment in R&D activities by mitigating the associated costs. The form, which should be attached to the filer's California tax return, is structured to accommodate various types of filers - from individuals to corporations, S corporations, estates, trusts, partnerships, and limited liability companies. Its intricate design guides claimants through two prominent paths of credit computation: the Regular Credit and the Alternative Incremental Credit, thus offering flexibility based on the specifics of the taxpayer's R&D expenditures. Furthermore, the form meticulously details the inputs required for calculating the base amount, qualified research expenses, and ultimately the credit due, while also providing for the reduction of the credit under specific sections of the Internal Revenue Code (IRC). In addition to credit computation, Form 3523 lays out the framework for credit carryover, ensuring that excess credits can be utilized in future tax years, thereby bolstering long-term R&D investment. The completion of this form, backed by rigorous documentation, serves as a gateway to substantial tax savings, reinforcing California's commitment to fostering an environment conducive to research and development.

Document Preview Example

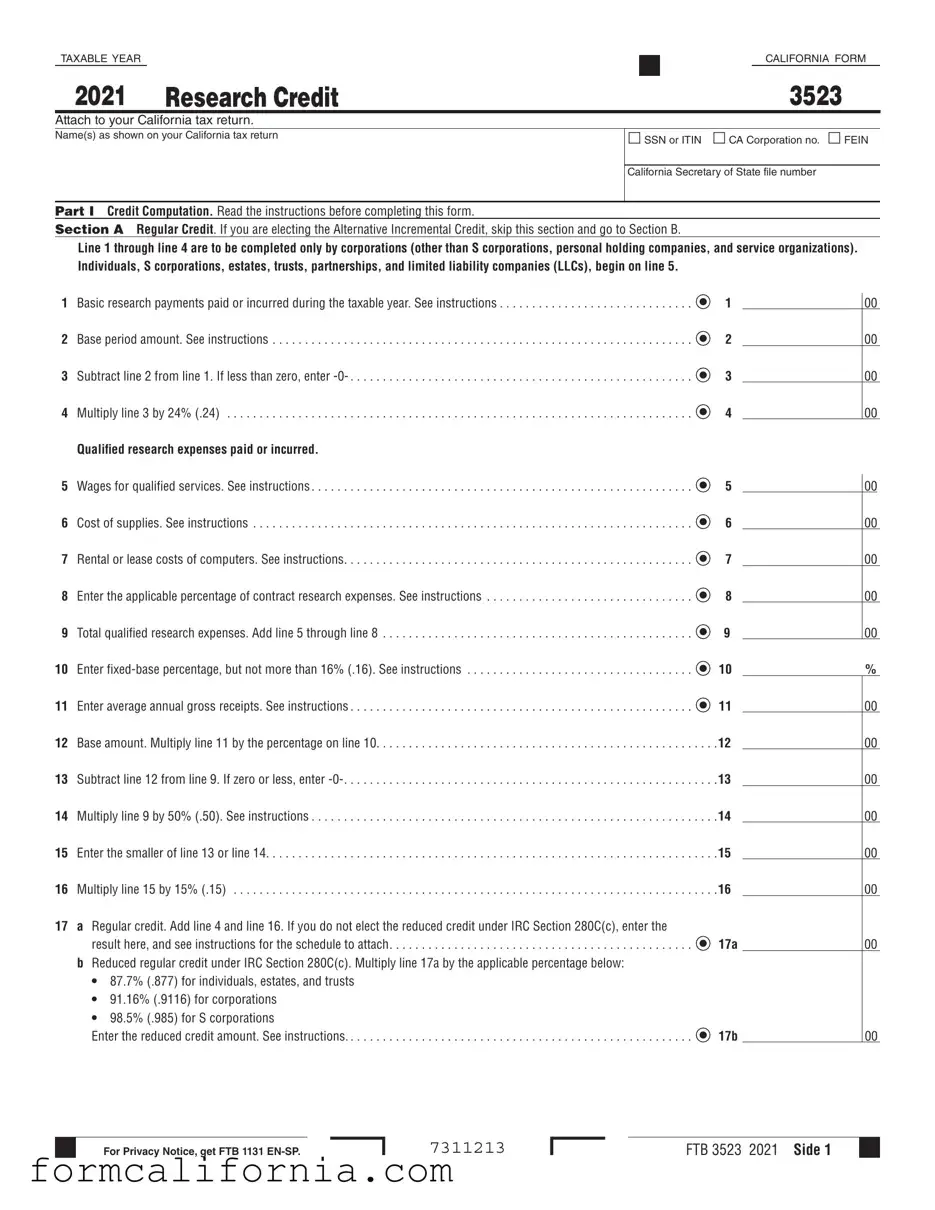

TAXABLE YEAR |

|

|

CALIFORNIA FORM |

|

|

|

|

2021 RESEARCH CREDIT |

3523 |

||

|

|

|

|

Attach to your California tax return.

Name(s) as shown on your California tax return

◻ SSN or ITIN ◻ CA Corporation no. ◻ FEIN

California Secretary of State file number

PART I Credit Computation. Read the instructions before completing this form.

SECTION A Regular Credit. If you are electing the Alternative Incremental Credit, skip this section and go to Section B.

Line 1 through line 4 are to be completed only by corporations (other than S corporations, personal holding companies, and service organizations). Individuals, S corporations, estates, trusts, partnerships, and limited liability companies (LLCs), begin on line 5.

1 |

Basic research payments paid or incurred during the taxable year. See instructions |

1 |

2 |

Base period amount. See instructions |

2 |

3 |

Subtract line 2 from line 1. If less than zero, enter |

3 |

4 |

Multiply line 3 by 24% (.24) |

4 |

|

Qualified research expenses paid or incurred. |

|

5 |

Wages for qualified services. See instructions |

5 |

6 |

Cost of supplies. See instructions |

6 |

7 |

Rental or lease costs of computers. See instructions |

7 |

8 |

Enter the applicable percentage of contract research expenses. See instructions |

8 |

9 |

Total qualified research expenses. Add line 5 through line 8 |

9 |

10 |

Enter |

10 |

11 |

Enter average annual gross receipts. See instructions |

11 |

12 |

Base amount. Multiply line 11 by the percentage on line 10 |

12 |

13 |

Subtract line 12 from line 9. If zero or less, enter |

13 |

14 |

Multiply line 9 by 50% (.50). See instructions |

14 |

15 |

Enter the smaller of line 13 or line 14 |

15 |

16 |

Multiply line 15 by 15% (.15) |

16 |

17a Regular credit. Add line 4 and line 16. If you do not elect the reduced credit under IRC Section 280C(c), enter the

result here, and see instructions for the schedule to attach. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  17a

17a

bReduced regular credit under IRC Section 280C(c). Multiply line 17a by the applicable percentage below: 87.7% (.877) for individuals, estates, and trusts

91.16% (.9116) for corporations

98.5% (.985) for S corporations

Enter the reduced credit amount. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  17b

17b

00

00

00

00

00

00

00

00

00

%

00

00

00

00

00

00

00

00

|

For Privacy Notice, get FTB 1131 |

7311213 |

FTB 3523 2021 Side 1 |

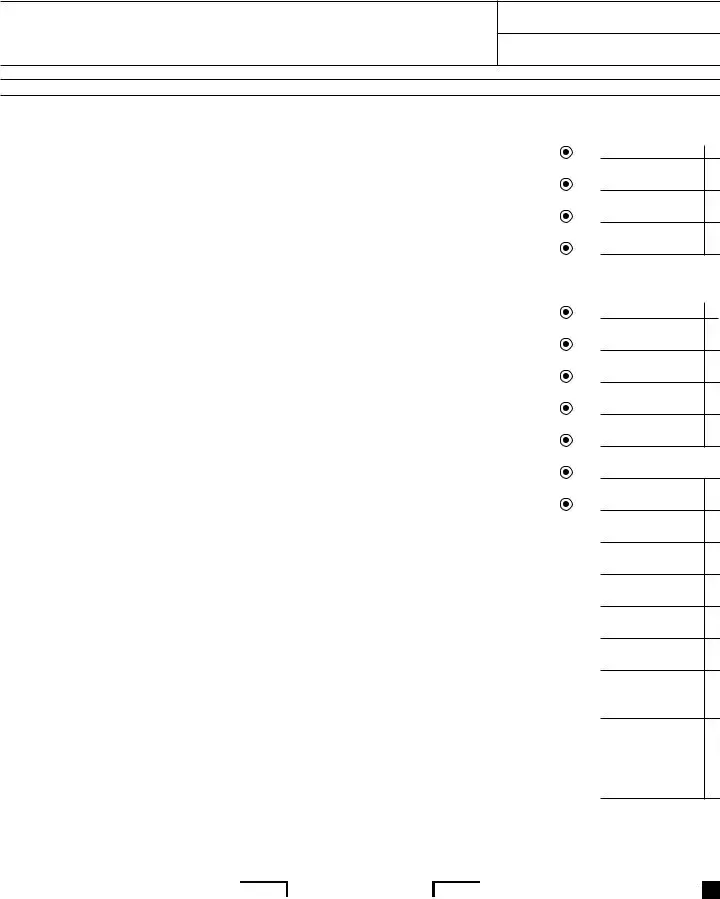

SECTION B Alternative Incremental Credit. Skip this section if you completed Section A, Regular Credit.

Line 18 through line 21 are to be completed only by corporations (other than S corporations, personal holding companies, and service organizations). Individuals, S corporations, estates, trusts, partnerships, and LLCs, begin on line 22.

18 |

Basic research payments paid or incurred during the taxable year. See instructions |

18 |

19 |

Base period amount. See instructions |

19 |

20 |

Subtract line 19 from line 18. If less than zero, enter |

20 |

21 |

Multiply line 20 by 24% (.24) |

21 |

|

Qualified research expenses paid or incurred. |

|

22 Wages for qualified services. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  22

22

23 Cost of supplies. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  23

23

24 Rental or lease costs of computers. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  24

24

25 Enter the applicable percentage of contract research expenses. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  25

25

26 Total qualified research expenses. Add line 22 through line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  26

26

27 Enter average annual gross receipts. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  27 28 Multiply line 27 by 1% (.01). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .28 29 Subtract line 28 from line 26. If zero or less, enter

27 28 Multiply line 27 by 1% (.01). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .28 29 Subtract line 28 from line 26. If zero or less, enter

39a Alternative incremental credit. Add line 21, line 36, line 37, and line 38. If you do not elect the reduced credit

under IRC Section 280C(c), enter the result here, and see instructions for the schedule that must be attached . . . . . . .  39a

39a

bReduced alternative incremental credit under IRC Section 280C(c). Multiply line 39a by the applicable percentage below: 87.7% (.877) for individuals, estates, and trusts

91.16% (.9116) for corporations

98.5% (.985) for S corporations

Enter the reduced credit amount. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  39b

39b

SECTION C Available Research Credit

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

40  40

40

41Current year research credit. If you did not elect the reduced credit under IRC Section 280C(c), add line 17a or

line 39a to line 40 and enter the result here. If you elected the reduced credit under IRC Section 280C(c),

add line 17b or line 39b to line 40 and enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  41

41

42Enter the amount of credit on line 41 that is from passive activities. If none of the amount on line 41 is from

passive activities, enter

43 Subtract line 42 from line 41 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43 44 Enter the allowable credit from passive activities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .44

45

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  45

45

46 Total. Add line 43 through line 45. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  46

46

PART II Carryover Computation. Combined Report Filers see instructions for Part III before completing this part.

47Credit claimed. Enter the amount of the credit claimed on the current year tax return. See instructions.

(Do not include any assigned credit claimed on form FTB 3544, Part B.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  47

47

48Total credit assigned. Enter the total amount from form FTB 3544, Part A, column (g). If you are not a corporation,

enter  48

48

49 Credit carryover available for use or assignment for future years. Subtract lines 47 and 48 from line 46 . . . . . . . . . . . . . .  49

49

00

00

00

00

00

00

00

00

00

00

|

Side 2 FTB 3523 2021 |

7312213 |

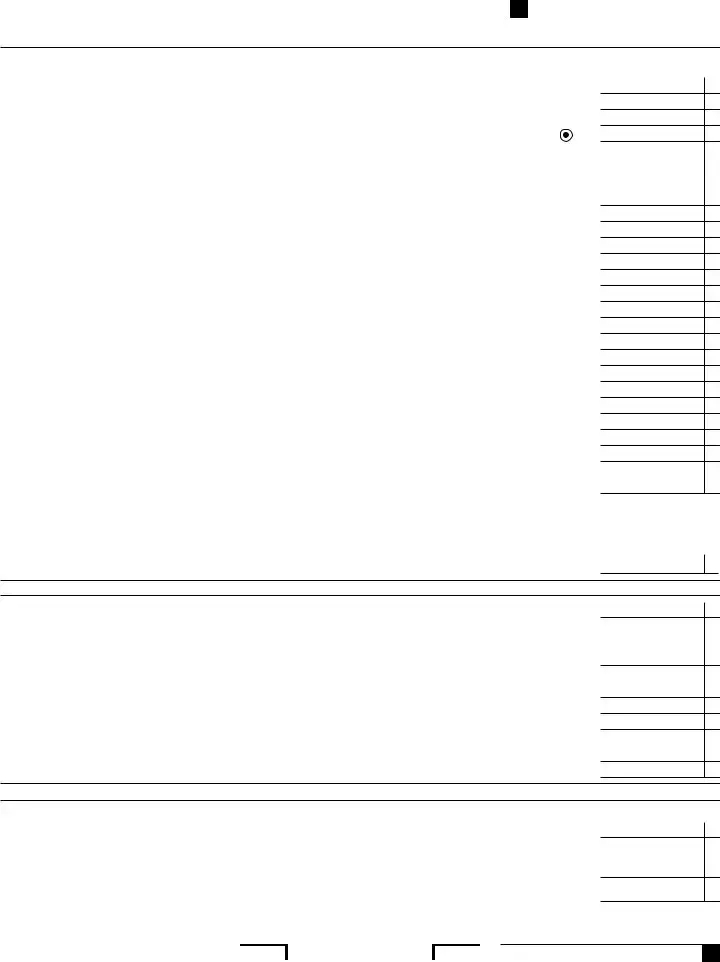

PART III Credit Allocation and Carryover Per Entity – Only Combined Report Filers

To make an election for assigning credits, you must also complete form FTB 3544, Part A. Otherwise, the assignment indicated here will be invalid.

Credit Generated and Assigned Per Entity

|

(a) |

(b) |

(c) |

(d) |

(e) |

|

Corporation |

Corporation no., FEIN, or |

Amount of credit generated |

Amount of generated credit |

Total of generated credit |

|

|

SOS no. |

in current year |

carryover from prior years |

and credit carryover from |

|

|

|

|

|

prior years |

|

|

|

|

|

col. (c) + col. (d) |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

(f)* |

(g) |

(h) |

|

Amount of credit from col. (e) claimed |

Amount of research credit |

Generated credit carryover |

|

in current year return. (Do not include |

assigned and to be reported |

for future years |

|

any assigned credit claimed on |

on form FTB 3544, Part A |

col. (e) – [col. (f) + col. (g)] |

|

form FTB 3544, Part B.) |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

*There is a $5,000,000 business credit limitation on the application of tax credits. See instructions.

|

|

7313213 |

FTB 3523 2021 Side 3 |

Document Specs

| Fact | Detail |

|---|---|

| Form Title | California Form 3523 - Research Credit |

| Taxable Year | 2020 |

| Attachment Requirement | Must be attached to the California tax return |

| Eligibility | Corporations, S corporations, individuals, estates, trusts, partnerships, and limited liability companies (LLCs) |

| Sections | Includes Regular Credit (Section A), Alternative Incremental Credit (Section B), and Available Research Credit (Section C) |

| Credit Computation | Detailed steps are provided for calculating both Regular and Alternative Incremental Credits based on qualified research expenses and other criteria |

| Governing Law | The form refers to IRC Section 280C(c) for the election of reduced credit amounts |

| Privacy Notice | Reference to FTB 1131 ENG/SP for privacy information |

| Special Instructions | Included for different types of filers, like Combined Report Filers in Part II and credit allocation for entities in Part III |

Detailed Instructions for Writing California 3523

Filing the California Form 3523, the Research Credit form, is an essential step for those who are eligible and looking to claim research credits on their California tax return. Whether you're a corporation, individual, or part of a pass-through entity like an S corporation, partnership, or LLC, it's important to follow the instructions carefully to ensure you accurately compute and claim your research credit. Here is a straightforward guide to assist you in filling out the form:

- Start by entering the taxable year at the top of the form.

- Provide the Name(s) as shown on your California tax return.

- Check the appropriate box and enter your SSN or ITIN, CA Corporation no., or FEIN.

- If applicable, fill in the California Secretary of State file number.

- Move on to Part I - Credit Computation. If you are a corporation (excluding S corporations, personal holding companies, and service organizations), begin with Line 1. Otherwise, start at Line 5.

- Complete Lines 1 through 4 if applicable, or Lines 5 through 17b for calculating the Regular Credit. Make sure to refer to the instructions for each line to ensure the correct amounts are entered.

- If the Alternative Incremental Credit applies to you, skip Part I Section A and fill out Lines 18 through 39b in Section B. Again, corporate filers start with Line 18, while all others start with Line 22.

- For Part II - Carryover Computation, enter the amount of credit claimed this year on Line 47, the total credit assigned on Line 48, and calculate the credit carryover for future years on Line 49.

- Complete Part III only if you are a Combined Report Filer. This section requires information on credit generated, assigned per entity, and any carryover.

- For each part of the form, carefully read and follow the specific instructions provided to ensure accurate calculation and reporting.

- After filling out the form, attach it to your California tax return before submission.

Remember to review your entries for accuracy, and refer to the official instructions for any sections that require detailed computation or additional documentation. Filing this form accurately plays a critical role in claiming your eligible research credits, thus potentially reducing your tax liability.

Things to Know About This Form

What is California Form 3523?

California Form 3523, known as the Research Credit form, is a document used to calculate and claim tax credits for certain research expenses. Businesses and individuals involved in qualified research activities in California may use this form to reduce their state income tax. It must be attached to the California tax return.

Who can file Form 3523?

This form can be filed by corporations (excluding S corporations, personal holding companies, and service organizations), individuals, S corporations, estates, trusts, partnerships, and limited liability companies (LLCs). The form includes different sections for calculating the credit based on the entity type and the expenses incurred.

What are qualified research expenses?

Qualified research expenses include wages for qualified services, cost of supplies, and rental or lease costs of computers that are used for research. These expenses must be paid or incurred during the taxable year for research activities in California. Additionally, a percentage of contract research expenses may qualify.

How is the credit calculated?

The Research Credit is calculated differently depending on whether you're electing the Regular Credit or the Alternative Incremental Credit. Both require computing expenses like wages, supplies, and contract research expenses. The calculation involves specific percentages, base amounts, and finally, subtracting and multiplying those figures according to instructions provided for each line.

Can the credit reduce my tax to below zero?

No, the research credit cannot reduce your tax liability to below zero. However, if your credit amount exceeds your tax liability, you may carry over the unused portion to future years, subject to certain limitations.

How do pass-through entities report this credit?

Pass-through entities such as S corporations, estates, trusts, partnerships, and LLCs report their share of the research credit to their owners or beneficiaries. These owners can then claim the credit on their individual California tax returns. The form includes a section for reporting pass-through research credits.

What happens if I don't use all of my credit this year?

If the full amount of your credit is not used in the current year, you are allowed to carry over the unused portion to future years. However, carrying over requires careful calculation, documented in Part II of the form, and there may be limitations based on the tax liability and other credits claimed.

Common mistakes

Filling out the California Form 3523, also known as the Research Credit form, can be quite the hurdle if you're not paying close attention. Missteps are common, but being aware of them can help ensure your form is accurate and you receive the credit you deserve. Here are seven mistakes to steer clear of:

- Starting in the wrong section: Corporations often begin in Section A without realizing that their specific type such as S corporations, personal holding companies, and service organizations should start in Section B. This easy-to-make mistake can lead to improperly calculated credits.

- Incorrectly calculated expenses: Lines 5 through 8 require entering various qualified research expenses. It's easy to miscalculate these values or misunderstand what qualifies, leading to either inflated or undershot amounts.

- Overlooking base period amounts: Line 2 and Line 19 ask for base period amounts, a common stumbling block if historical data isn't well organized or understood. This error can drastically affect the credit calculation.

- Improper fixed-base percentage: Line 10's fixed-base percentage is often entered incorrectly due to misconceptions about its calculation, capping it at 16%. Misinterpreting how to calculate this figure can heavily skew your credit amount.

- Misreported wages for qualified services: On Lines 5 and 22, accurately reporting wages for qualified services can be tricky. There's a tendency to either overestimate or underestimate, especially when it comes to understanding which services qualify.

- Skipping rental or lease costs of computers: Line 7 and Line 24 ask for rental or lease costs for computers used in research. It's commonly missed either because it's overlooked or there's a misconception it's not applicable to one's situation.

- Electing the reduced credit incorrectly: Lines 17b and 39b involve deciding on electing a reduced credit under IRC Section 280C(c). The decision here affects the calculation process, and misunderstanding how it impacts your credit can lead to less favorable outcomes.

Ensuring accuracy on these points can be the difference between maximizing your credit and potentially leaving money on the table or facing complications with the state tax authority. A careful review of each part of the form, alongside the guidelines provided, is indispensable for any filer aiming to make the most of their Research Credit.

Documents used along the form

When dealing with the complexities of tax filings, particularly with respect to the California Form 3523, which serves as a declaration for research credit, individuals and entities may need to complement this form with additional documents. These documents are essential for providing a comprehensive view of your financial transactions to the authorities, ensuring compliance with tax laws, and optimizing your tax credits and benefits.

- Form 100 or Form 100S: California Corporation Franchise or Income Tax Return. This form is necessary for corporations, documenting their income, deductions, and tax liability.

- Form 540: California Resident Income Tax Return. Individuals use this form to report their income, deductions, and any credits applicable to them.

- Form 568: Limited Liability Company Return of Income. It details the income and deductions specific to LLCs operating in California.

- Form 3800: Tax Computation for Certain Children with Unearned Income. It is relevant for taxpayers who need to calculate the "kiddie tax."

- FTB 3544: Election to Assign Credit Within Combined Reporting Group or Credit Allocation and Carryover. This document complements Form 3523 by allowing the allocation of credits among entities.

- FTB 3544A: List of Assigned Credit Received and/or Claimed by Assignee. Accompanies FTB 3544, detailing the specifics of credit assignments.

- FTB 3885: Corporation Depreciation and Amortization. Companies use this form to itemize their depreciation and amortization expenses, which can impact the calculation of taxable income.

- Schedule R: Apportionment and Allocation of Income. This schedule is vital for businesses operating in and out of California, dictating how income is divided for tax purposes.

- Form 700: Conflict of Interest Code. Though not directly related to tax filing, it's relevant for public officials and employees to declare any potential conflicts of interest.

- Form 1099-MISC: Miscellaneous Income. For individuals and entities that need to report payments made to others, such as rents or royalty, which might affect gross income and consequently the research credit.

Each of these forms plays a crucial role in the broader context of tax filing and compliance within the state of California. By diligently preparing and submitting these documents where applicable, taxpayers can ensure that they meet all legal requirements, accurately report their financial activities, and maximize potential benefits under the law. It's always recommended to seek guidance from tax professionals to navigate the complexities of tax filings effectively.

Similar forms

The California Form 3523, similar to the Federal Form 6765 (Credit for Increasing Research Activities), allows businesses and individuals to calculate and claim tax credits for research and development (R&D) expenses. Just like its federal counterpart, California Form 3523 is designed to incentivize innovation and investment in R&D within the state. Both forms require the taxpayer to detail their qualified research expenses, including wages, supplies, and contract research costs, and then calculate the applicable credits based on these expenditures. The main difference lies in their jurisdiction and specific percentages used in the calculation, tailored to state vs. federal tax policies.

Parallel to the New York State Form CT-606 (Claim for Qualified Research Activities Credit), California Form 3523 emphasizes the state-level commitment to foster research and development. Both forms serve the purpose of reducing the tax liability for qualified research activities conducted within their respective states. They require similar types of information, such as expenses on wages, supplies, and contract research. However, the specific requirements and the formula for calculating the credit might differ, reflecting the unique tax benefits and policies of California and New York.

Another document akin to California Form 3523 is the Texas Form 1330 (Texas Research & Development Activities Credit Schedule). This form, like California's, is designed for entities that engage in qualified research activities within the state, offering them a tax incentive to encourage growth and innovation within Texas. Both forms share a similar structure, asking for detailed information about research expenses. However, they cater to their state’s tax codes and offer different rates and limitations on the credit amounts that can be claimed.

Finally, the Illinois Schedule 1299-D (Income Tax Credits) also mirrors the purpose of California Form 3523 in providing tax incentives for R&D activities but within Illinois. This form encompasses a broader range of tax credits, including those for research and development, but like the California form, it delineates a series of calculations to quantify eligible credits based on specified research expenses. The diversity in focus and application between these states’ forms illustrates the tailored approach regions can take to stimulate economic development through tax policy.

Dos and Don'ts

When filling out the California Form 3523, also known as the Research Credit form, it's essential to proceed with care and precision. This form allows entities and individuals in California to calculate and claim tax credits for certain research expenses incurred within the taxable year. This list is meant to guide you through the process, outlining key do's and don'ts to help ensure the form is completed accurately and effectively.

Do:- Read through the instructions provided by the California Franchise Tax Board (FTB) before starting. This ensures you understand the requirements and how to calculate your credit properly.

- Verify your eligibility for the credit. Confirm that your research activities and expenditures qualify under the definitions provided by the FTB.

- Keep detailed records of all qualifying research expenses. Documentation should include receipts, payroll records, and contracts related to research activities.

- Calculate your expenses carefully. Use the detailed instruction guide provided for each line item to ensure accuracy in your calculations.

- Determine the correct section to complete based on your entity type. For example, corporations other than S corporations, personal holding companies, and service organizations complete Part I, Section A, while individuals, S corporations, estates, trusts, partnerships, and LLCs start on line 5.

- Elect the reduced credit under IRC Section 280C(c) if applicable. This option may reduce the credit amount but can result in a lower overall tax liability.

- Attach the form to your California tax return as instructed. Ensure all related schedules, documentation, and supporting worksheets are included.

- Check for mathematical errors. Review your calculations for accuracy to avoid delays or potential issues with the FTB.

- Use up-to-date forms and instructions. Tax laws and forms change, so always use the latest versions available from the FTB website.

- Consider consulting with a tax professional if you're unsure about any part of the form or if your situation is complex.

- Overlook the Privacy Notice provided by the FTB. It contains important information about how your personal data is handled.

- Guess on figures or provide estimates for expenses. Only use actual, documented expenses in your calculations.

- Forget to declare all sources of research expenses. This includes wages for qualified services, cost of supplies, and contract research expenses among others.

- Ignore the instructions for the carryover computation if you're unable to use the entire credit amount in the current year.

- Mistakenly complete Section B if you've already filled out Section A. Section B is for claiming the Alternative Incremental Credit and is a different calculation method.

- Delay the filing of your form beyond your tax return deadline. This could result in the forfeiture of your claim for the credit for the year.

- Underestimate the importance of electing the reduced credit, as this can impact the computation of your net regular tax and tentative minimum tax.

- Omit any required signatures or additional forms that may be necessary for your specific claim.

- Disregard the need to fill out form FTB 3544, Part A if you're making an election for assigning credits within a combined report.

- Use the form to report expenses that do not meet the strict definitions of qualified research under California tax law.

Adhering to these guidelines will help streamline the process of claiming your research credit and ensure compliance with California tax laws.

Misconceptions

Understanding legal and tax documents is crucial for accurate compliance and optimization of benefits. The California Form 3523, associated with the research credit, is no exception. However, several misconceptions may lead to confusion or misuse of the form. Here, we aim to clear up a few common misunderstandings.

- Misconception 1: Only large corporations can benefit from the research credit on Form 3523.

This is incorrect. While the form and credit computation appear designed with corporations in mind, individuals, S corporations, estates, trusts, partnerships, and limited liability companies (LLCs) are also eligible to claim the research credit, provided they engage in qualifying research activities.

- Misconception 2: The research credit is only for high-tech or pharmaceutical companies.

Many believe that the credit exclusively benefits those in high-tech fields or pharmaceuticals. However, the eligibility for the credit spans a broader range of industries. Any company that spends resources on research and development (R&D) aimed at creating new or improved products or processes may qualify.

- Misconception 3: All R&D activities qualify for the credit.

Not all R&D activities will qualify for the research credit. The activities must meet specific requirements defined by the IRS, including technological in nature and aimed at creating new or improved functionality, performance, reliability, or quality.

- Misconception 4: You can claim the credit for research done outside California.

Form 3523 is a California-specific form. It pertains to research activities conducted within the state. Research conducted outside California may not qualify for credit on this form, though there could be exceptions based on how the research benefits the California operations.

- Misconception 5: The form is only required if you owe taxes in California.

Even if you do not owe taxes, filing Form 3523 can be beneficial. Credits not used in the current year can often be carried forward to offset future tax liabilities, highlighting the importance of filing the form regardless of your immediate tax situation.

- Misconception 6: The research credit is calculated based on total R&D expenditures.

The credit calculation involves more than just totaling R&D expenditures. It is based on increases in R&D spending over a base amount, emphasizing research spending increases rather than absolute spending amounts.

- Misconception 7: If you claim the federal R&D credit, you automatically qualify for the California credit.

While claiming the federal R&D credit suggests you are engaging in qualifying activities, each credit has its set of rules and eligibility requirements. Certain expenditures may qualify for one and not the other.

- Misconception 8: You cannot amend past tax returns to claim the research credit retrospectively.

Taxpayers sometimes overlook the opportunity to claim the research credit in past tax years. Under certain conditions, it is possible to amend past returns to include the credit, potentially leading to refunds for taxes paid in previous years.

- Misconception 9: The calculation method for the credit is one-size-fits-all.

Form 3523 provides options for calculating the credit, including the regular credit method and the alternative incremental credit method. These options allow businesses to choose the method that offers the most significant benefit based on their R&D expenses.

- Misconception 10: Only expenses directly related to product development qualify for the credit.

R&D credits may also apply to research for software development or improvement of business components, not just physical products. The scope of qualifying research is broader than commonly understood.

Correcting these misconceptions helps ensure that eligible entities take full advantage of the research credit, supporting innovation and development. Should you have questions or uncertainties regarding your eligibility or how to properly claim the credit, consulting with a tax professional is advisable.

Key takeaways

Filling out the California Form 3523, also known as the Research Credit form, is crucial for businesses and individuals looking to claim tax credits for research expenses. Here are key takeaways to consider when completing this form:

- Identify Your Eligibility: Before starting, ensure you're eligible for the research credit. This applies to various entities including individuals, corporations, S corporations, estates, trusts, partnerships, and LLCs involved in qualified research activities.

- Choose Your Credit Computation Method: Decide whether to compute your credit using the Regular Credit method (Section A) or the Alternative Incremental Credit (Section B). Each has different calculation methods and requirements.

- Understand Qualified Research Expenses: Qualified research expenses include wages for qualified services, cost of supplies, and rental or lease costs of computers among others. These are crucial in computing your credit.

- Calculate Base Amounts Correctly: For both credit methods, understanding and accurately computing the base period amount is vital. It affects your credit calculation significantly.

- Opt for the Reduced Credit if Beneficial: The form allows for a reduced credit under IRC Section 280C(c), which might be beneficial in some tax situations. Evaluate this option carefully.

- Include Pass-through Credits: If applicable, include any research credits passed through from S corporations, estates, trusts, partnerships, and LLCs.

- Document and Attach Required Schedules: Depending on your credit computation choice and if you opt for the reduced credit, additional schedules may be required. Ensure all necessary documentation is attached.

- Review Carryover Rules: If your research credits exceed your tax liability, understand the rules for carrying over the excess to future years. This could potentially reduce future tax liabilities.

- Navigate Credit Assignments Carefully: For businesses filing combined reports, correctly assigning credits amongst entities is crucial. This requires completion of additional forms and adherence to specific instructions.

- Stay Informed on Applicable Percentages: The form outlines specific percentages applied to various lines in the computation process. These are based on the type of entity and selected computation method. Accuracy here is key to the correct calculation of your credit.

- Privacy Notice Acknowledgment: Be aware that a Privacy Notice, providing details about the use of your information, is available and should be reviewed.

Completing the California Form 3523 accurately can significantly benefit eligible entities by reducing their tax liabilities through credits for qualified research expenses. However, due to the complexity, it may be beneficial to consult with a tax professional or advisor to ensure compliance and optimize your credit.

Discover More PDFs

Suspended Ftb - Corporations must navigate the complexities of fulfilling their tax obligations as delineated in Form 3555, underscoring the importance of accurate and detailed reporting.

Confidential Plates California - Highlighting the non-refundable nature of application fees serves as a reminder of the financial commitment involved in obtaining a license.