Blank California 3521 PDF Form

In the state of California, individuals and entities involved in providing low-income housing are offered an opportunity to lower their tax liabilities through the Low-Income Housing Credit, as outlined in Form 3521 for the tax year 2020. This critical tax form serves as an attachment to the California tax return, specifically designed for those who have invested in the construction, acquisition, or renovation of low-income housing projects. Form 3521 meticulously details the process for calculating the available credit, taking into account various factors such as the eligible basis of the project, the involvement of affiliated corporations or pass-through entities, and the portion of the credit derived from passive activities. Additionally, it addresses potential decreases in the eligible basis of any project and outlines the procedure for carryover computation, ensuring that applicants accurately report and maximize their entitlement within the stipulated guidelines. Moreover, the form facilitates the allocation of the low-income housing credit among affiliated corporations, providing a structured approach to distribute the tax benefit. This introduction to Form 3521 underscores its importance in encouraging the development of low-income housing units while offering tangible financial incentives for stakeholders committed to this vital sector.

Document Preview Example

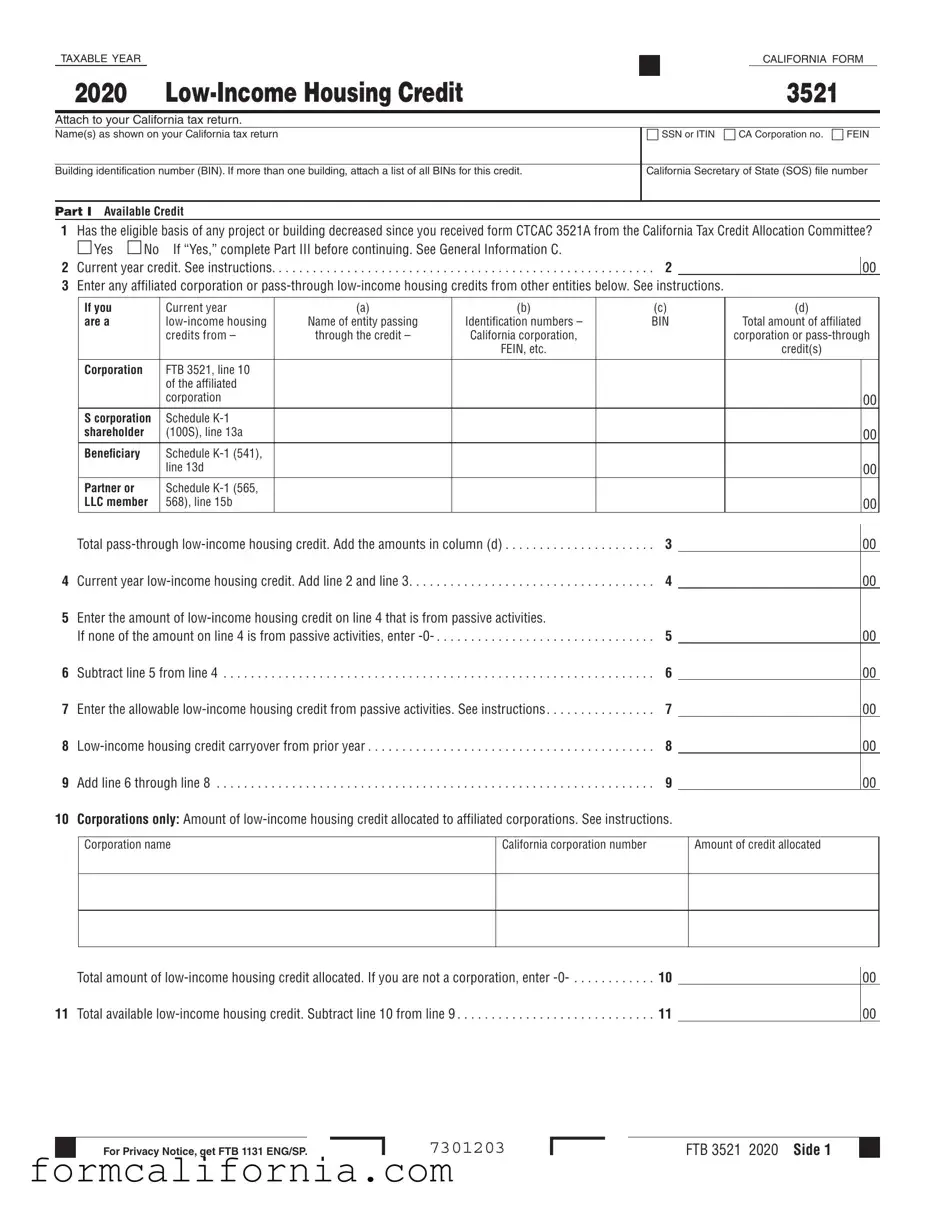

TAXABLE YEARCALIFORNIA FORM

2020 |

3521 |

Attach to your California tax return. |

|

Name(s) as shown on your California tax return |

□ SSN or ITIN □ CA Corporation no. □ FEIN |

Building identification number (BIN). If more than one building, attach a list of all BINs for this credit.

California Secretary of State (SOS) file number

Part I Available Credit

1Has the eligible basis of any project or building decreased since you received form CTCAC 3521A from the California Tax Credit Allocation Committee?

□Yes □No If “Yes,” complete Part III before continuing. See General Information C. |

|

2 Current year credit. See instructions. . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . 2 |

00 |

3Enter any affiliated corporation or

If you |

Current year |

(a) |

(b) |

(c) |

(d) |

|

are a |

Name of entity passing |

Identification numbers – |

BIN |

Total amount of affiliated |

||

|

credits from – |

through the credit – |

California corporation, |

|

corporation or |

|

|

|

|

FEIN, etc. |

|

credit(s) |

|

Corporation |

FTB 3521, line 10 |

|

|

|

|

|

|

of the affiliated |

|

|

|

|

|

|

corporation |

|

|

|

|

00 |

S corporation |

Schedule |

|

|

|

|

|

shareholder |

(100S), line 13a |

|

|

|

|

00 |

Beneficiary |

Schedule |

|

|

|

|

|

|

line 13d |

|

|

|

|

00 |

Partner or |

Schedule |

|

|

|

|

|

LLC member |

568), line 15b |

|

|

|

|

00 |

Total

4 Current year

5Enter the amount of

If none of the amount on line 4 is from passive activities, enter

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . . . . . 6

7Enter the allowable

8

9 Add line 6 through line 8 . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . . . . . . 9

10Corporations only: Amount of

Corporation name |

California corporation number |

Amount of credit allocated |

00

00

00

00

00

00

00

Total amount of

11 Total available

00

00

|

|

|

7301203 |

|

|

|

For Privacy Notice, get FTB 1131 ENG/SP. |

FTB 3521 2020 Side 1 |

|

||

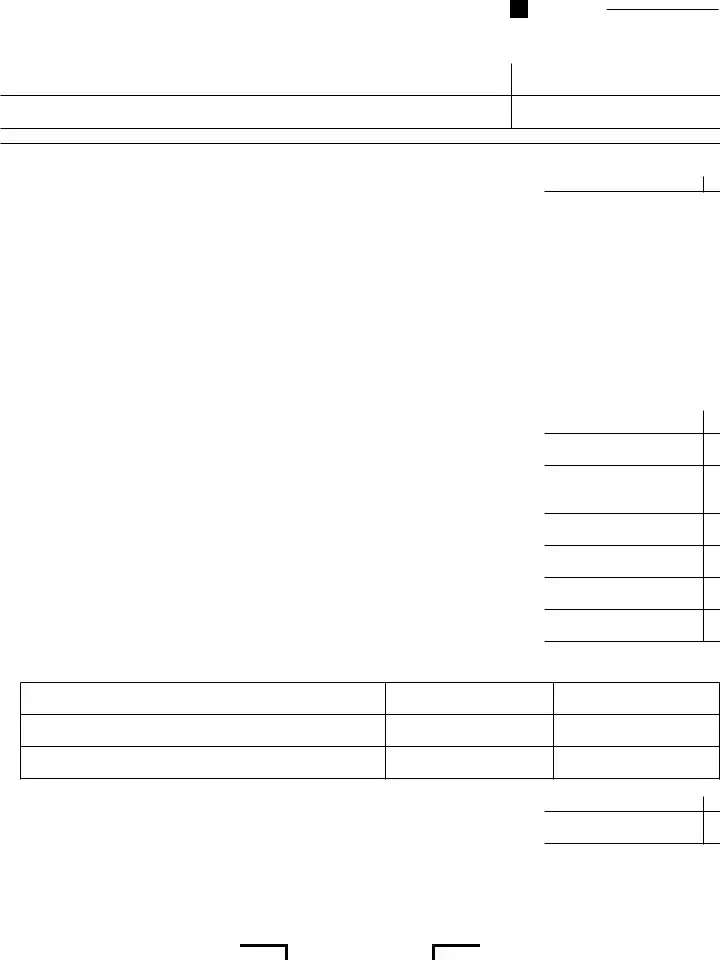

Part II Carryover Computation

12a Credit claimed. Enter the amount of the credit claimed on the current year tax return.

See instructions. . . . . . . . . . . . . . . . . . 對 . |

. . . . . . . . . . . . . . . .12a |

(Do not include any assigned credit claimed on form FTB 3544, |

Part B.) |

12b Total credit assigned. Enter the total amount from form FTB 3544, Part A, column (g).

If you are not a corporation, enter

13 Credit carryover available for future years. Add line 12a and line 12b, subtract the result from line 11 . . 13

00

00

00

Part III Basis Recomputations. Complete this part only if the basis in a project or building has decreased. Use additional sheets if necessary.

14Date building was placed in service (month/year) . . . . .

15 BIN . . . . . . . . . . . . . . . . . 對 . . . . .

16Eligible basis of building. See General Information C . . . .

17

18Qualified basis of

by line 17 . . . . . . . . . . . . . . . . . 對 . . .

19Applicable percentage. See General Information B . . . . .

20Multiply line 18 by line 19. See Specific Line Instructions for Part I, line 2 . . . . . . . . . . . . . . . . . 對 . .

14

15

16

17

18

19

20

(a)

Building 1

(b)

Building 2

(c)

Total

|

Side 2 FTB 3521 2020 |

7302203 |

Document Specs

| Fact | Detail |

|---|---|

| Form Number and Title | California Form 3521: Low-Income Housing Credit |

| Tax Year | 2020 |

| Main Purpose | Used by taxpayers to claim the low-income housing credit on their California tax return. |

| Governing Law | Operates under the regulations set forth by the California Tax Credit Allocation Committee, according to California's Revenue and Taxation Code. |

| Attachments Required | If claiming for more than one building, a list of all Building Identification Numbers (BINs) for which the credit is claimed must be attached. |

Detailed Instructions for Writing California 3521

Filling out the California Form 3521, the Low-Income Housing Credit form, is an essential step for individuals and corporations seeking to claim this credit on their California tax return. This guide will walk you through the process step by step, ensuring that you provide all the necessary information accurately. Remember, this form is attached to your California tax return, so it's important to complete it carefully to take advantage of the low-income housing credit.

- At the top of the form, enter the taxable year for which you are filing.

- Provide the Name(s) as shown on your California tax return, followed by your SSN or ITIN, CA Corporation number, or FEIN as applicable.

- Enter the Building identification number (BIN) for the property. If you have more than one building, attach a separate list of all BINs.

- If applicable, include your California Secretary of State (SOS) file number.

- In Part I, Question 1, check yes or no to indicate if the eligible basis of any project or building has decreased since receiving form CTCAC 3521A from the California Tax Credit Allocation Committee. If “Yes,” you will need to complete Part III before continuing.

- Enter the current year credit amount in line 2. See the form instructions for how to calculate this amount.

- For line 3, enter any affiliated corporation or pass-through low-income housing credits from other entities. This requires the name of the entity passing through the credit, identification numbers, and the total amount of affiliated credits.

- Add the amounts in column (d) of line 3 and enter the sum in line 4 as your Current year low-income housing credit.

- In line 5, enter the amount of low-income housing credit from passive activities. If none, enter “-0-”.

- Subtract line 5 from line 4 and enter the result in line 6.

- Line 7 asks for the allowable low-income housing credit from passive activities, per the instructions.

- Enter any low-income housing credit carryover from the prior year on line 8.

- Add the amounts from lines 6 through 8 and enter the sum in line 9. This is your total available credit before any corporate allocations.

- Corporations only: Complete line 10, detailing the amount of low-income housing credit allocated to affiliated corporations.

- Subtract line 10 from line 9 to get your total available low-income housing credit, and enter this in line 11.

- In Part II, for Carryover Computation, enter the credit claimed this year in line 12a and the total credit assigned in line 12b. Then calculate your credit carryover available for future years in line 13.

- If the eligible basis of any building or project has decreased, complete Part III, Basis Recomputations, with all necessary details. Use additional sheets if necessary.

Items like the applicable percentage, eligible and qualified basis, as well as specifics for pass-through entities, require careful attention to the instructions provided with the form or consult with a tax professional if needed. Once completed, attach Form 3521 to your California tax return before submitting it to the appropriate authorities. Remember, accurate completion of the form helps ensure you receive the correct credit amount without unnecessary delays.

Things to Know About This Form

What is California Form 3521?

Form 3521, also known as the Low-Income Housing Credit form, is used by individuals and entities in California who are involved in providing low-income housing. It allows them to claim a tax credit on their California tax return. This credit is designed to encourage the development and availability of affordable low-income housing.

Who needs to file Form 3521?

Any taxpayer who has received a California Tax Credit Allocation Committee (CTCAC) Form 3521A confirming their eligibility for the low-income housing credit should file Form 3521. This includes individual landlords, corporations, and partnerships involved in the provision of low-income housing.

What information do I need to complete Form 3521?

To properly fill out the Form 3521, you will need:

- The Building Identification Number(s) (BIN) for each qualifying building.

- Details of the eligible basis of any project or building, including any decreases.

- Current year credit amounts.

- Information about pass-through low-income housing credits from other entities, if applicable.

- Any low-income housing credit carryover from the previous year.

How is the current year credit calculated on Form 3521?

The current year credit on Form 3521 is calculated based on the qualified basis of each low-income building and the applicable percentage as determined by the California Tax Credit Allocation Committee. This calculation considers the cost and usage of the building for low-income housing.

Can I claim credits from passive activities on Form 3521?

Yes, amounts of low-income housing credit that come from passive activities can be entered on Form 3521. If none of the credit comes from passive activities, you should enter "-0-" in the relevant section on the form.

What happens if the eligible basis of my project decreases?

If the eligible basis of your project or building decreases, you must complete Part III of Form 3521 before proceeding. This part requires detailed calculations to adjust the credit based on the new eligible basis.

Is it possible to have carryovers or carrybacks of the low-income housing credit?

Yes, Form 3521 allows for the carryover of unused low-income housing credit from prior years. Corporations can also allocate credits to affiliated corporations. However, carrybacks of the credit are not permitted.

How do I report pass-through credits from other entities?

On Form 3521, pass-through low-income housing credits from other entities are reported in Part I, line 3. You must list the names of the entities, identification numbers, and the total amount of affiliated credits for each.

Where can I find more information or assistance with Form 3521?

More information and assistance with Form 3521 are available from the California Franchise Tax Board (FTB). They provide detailed instructions for filling out the form as well as resources for taxpayers looking for help with their low-income housing projects.

Common mistakes

Filling out the California Form 3521, known as the Low-Income Housing Credit form, is essential for entities seeking to claim this credit on their California tax returns. However, certain mistakes can often occur during the process. These errors can lead to delays, audits, or even denial of the credit claimed. Understanding and avoiding these common pitfalls is vital for a successful filing.

Not attaching the required building identification number (BIN): A common mistake is failing to include the BIN for each building for which the credit is claimed. If there is more than one building, an attached list of all BINs is necessary.

Incorrectly answering eligibility questions: Specifically, the question regarding the decrease in the eligible basis of any project or building since receiving form CTCAC 3521A needs accurate responses. An incorrect answer can lead to the improper calculation of available credits.

Omitting affiliate corporation or pass-through entity information: When relevant, information regarding affiliated corporations or pass-through entities must be accurately filled in, including names, identification numbers, and credit amounts.

Failure to calculate the current year credit correctly: Line 2 requires careful calculation according to specific instructions, and inaccuracies here can significantly affect the total credit amount.

Neglecting to identify credits from passive activities: Line 5 asks for the amount of low-income housing credit from passive activities. Ignoring this step can affect the carryover computation.

Incorrect carryover computation on Part II: The carryover computation is crucial for understanding how much of the credit can be applied in future tax years. Mistakes in this section, especially failing to accurately calculate the credit available for future years, can impact financial planning.

Misallocating credits to affiliated corporations: For corporations, accurately allocating credits among affiliates is critical. Incorrect amounts or failing to record allocations can lead to discrepancies and potential audits.

Forgetting to include the Date the building was placed in service in Part III: If the eligible basis of a project or building has decreased, the date the building was placed in service is critical for basis recomputation.

Incorrect Basis Recomputations: In Part III, accurate recomputation of the building's eligible and qualified basis, as well as the applicable percentage, are necessary steps if there's been a change. Errors in this section can drastically affect the credit amount.

It is important for taxpayers to carefully review their forms for these common mistakes and consult the instructions or a professional if uncertainties arise. Ensuring accuracy in the form can aid in the smooth processing of the low-income housing credit claim.

Documents used along the form

When dealing with the California 3521 form, which relates to the Low-Income Housing Credit, individuals and entities often have to manage several additional documents throughout the filing process. Each of these documents plays a critical role in ensuring compliance and maximization of the benefits related to low-income housing credits. They range from supporting eligibility documentation to detailed financial schedules.

- CTCAC 3521A - This document is provided by the California Tax Credit Allocation Committee and is pivotal for the initial qualification of a project for low-income housing credits. It outlines the project's eligible basis and the amount of credit allocated.

- California Schedule K-1 (565, 568) - Used by partnerships and LLCs to report members' or partners' shares of income, deductions, and tax credit amounts, including low-income housing credits passed through to them.

- Schedule K-1 (541) - Employed by trusts and estates to report beneficiaries' shares of income, deductions, and credits, it similarly includes details on low-income housing credit amounts passed to beneficiaries.

- FTB 3544 - This is the Part A and Part B form used by entities to either assign credits to other corporations within a combined reporting group or to claim assigned credits from other entities, ensuring proper allocation within affiliated groups.

- FTB 1131 ENG/SP (Privacy Notice) - While technically not a filing form, this document provides essential information regarding privacy rights and how personal information is used, and it is recommended to be reviewed by anyone filing California tax-related documents.

- Additional BIN List - If a project comprises multiple buildings, a supplementary list of all Building Identification Numbers (BINs) associated with the credit must be attached, providing a detailed breakdown of the project's scope.

- Part III Additional Sheets - If the eligible basis of any building or project decreases, detailed basis recomputation is required, often necessitating additional sheets to be attached, especially for larger projects with complex financial structures.

- Owned Entity Declarations and Schedules - Specially for low-income housing credits, ownership structures can be complex. Declarations and schedules outlining the structure of ownership entities, affiliations, and the flow of credits through these entities can be crucial, especially when dealing with passive activity limits and carryovers.

The California Form 3521 and its associated documents form a comprehensive framework for administering the Low-Income Housing Credit in California. Proper preparation and understanding of these forms ensure that eligible entities can efficiently claim and manage their credits, supporting the development and maintenance of affordable housing. Whether you are directly involved in low-income housing projects or advising clients in this sector, familiarization with these forms will be invaluable in navigating the tax and regulatory landscape.

Similar forms

The IRS Form 8586, "Low-Income Housing Credit," presents a notable similarity to the California Form 3521, as both are utilized for reporting tax credits related to low-income housing projects. They serve to ensure that entities involved in providing affordable housing are recognized with tax incentives, encouraging more development in this sector. While the IRS form is for federal tax purposes, California's form specifically addresses the state's tax considerations, tailoring its focus to the California Tax Credit Allocation Committee's (CTCAC) regulations and requirements.

Form 8609, "Low-Income Housing Credit Allocation and Certification," is another document closely aligned with California Form 3521. This form is a foundational document for property owners, as it serves as a formal allocation and certification of the low-income housing tax credit from the state agency to the taxpayer. Essentially, it is the precursor that qualifies owners to claim annual credits on forms like the 8586 or 3521, delineating the project's eligibility and the specific allocation of credits over a 10-year period.

The "Carryover Allocation" document is critical in the process of securing low-income housing tax credits, especially when aspects of these projects span multiple tax years. Similar to sections within California Form 3521 that address carryover credits, this document ensures that any unused credits due to tax liability limits can be applied to future tax years, preserving the economic viability of affordable housing initiatives over time.

Form 8823, "Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition," while serving a different primary purpose from Form 3521, shares the theme of compliance and oversight of low-income housing properties. It is used by agencies to report to the IRS any issues of noncompliance or when a property is no longer part of the program. Both documents are integral to the regulatory framework ensuring that the benefits of the low-income housing program are realized as intended.

Form 8866, "Interest Computation Under the Look-Back Method for Completed Long-Term Contracts," although more broadly applicable beyond low-income housing, shares similarities in tax calculations with certain sections of California Form 3521. Specifically, it involves intricate calculations related to deferred taxes, an issue that can also arise in the context of allocating and carrying over low-income housing credits across different tax periods.

The Schedule K-1 forms, particularly those used by partnerships and S corporations (Form 1065, Schedule K-1 for Partnerships, and Form 1120S, Schedule K-1 for S Corporations), share similarities with the pass-through section of Form 3521. They are pivotal in allocating income, deductions, and credits, including low-income housing credits, to partners or shareholders. This ensures that the tax benefits of low-income housing projects flow through to the individual level, where they can be claimed on personal tax returns.

Finally, the California Secretary of State (SOS) file number and related documentation, while not tax forms per se, are essential for entities engaging in low-income housing projects and claiming credits through Form 3521. The SOS file number is a unique identifier for registered business entities, ensuring that the entity is duly recognized and eligible to undertake such projects and receive related tax benefits under California law.

Dos and Don'ts

When filling out the California 3521 form, which is essential for claiming the Low-Income Housing Credit, individuals and entities must navigate a series of detailed requirements. Ensuring accuracy and compliance with the instructions is crucial for a successful submission. Below are four key practices to follow, alongside four mistakes to avoid, to facilitate a smooth process.

Do:

- Double-check the eligibility criteria and the building identification number (BIN) accuracy before proceeding. Each building has a unique BIN that must align with the California Tax Credit Allocation Committee records.

- Complete Part III if the eligible basis of any project or building has decreased since receiving form CTCAC 3521A. It’s important to provide updated information to reflect current values accurately.

- Accurately add the total amount of affiliated and pass-through credits, if applicable. These figures impact the current year's credit computation and must be meticulously calculated.

- Ensure to enter the correct amount of the low-income housing credit from passive activities in line 5. Distinctively differentiating between passive and non-passive activities is vital for the correct computation of allowable credits.

Don't:

- Overlook the need to attach a list of all BINs if claiming credits for more than one building. Failure to provide a comprehensive listing may result in processing delays or rejection of the claim.

- Miscalculate the carryover computation in Part II. This section is critical for understanding how much credit is available for future years, directly affecting financial planning and compliance.

- Submit the form without verifying all entered information against the instructions and the General Information sections. Accuracy is paramount, and all numbers and responses must align with the provided guidelines.

- Ignore the requirement to allocate low-income housing credit to affiliated corporations, where applicable. Corporations must accurately report any allocated amounts to ensure compliance and accurate credit distribution.

Misconceptions

When dealing with the California Form 3521, also known as the Low-Income Housing Credit form, there are several common misconceptions that need to be clarified to ensure accurate understanding and submission. Here's an in-depth look at these misconceptions:

Only for Individual Taxpayers: A prevalent misconception is that Form 3521 is exclusively for individual taxpayers. However, this form is also applicable to corporations, partnerships, estates, and trusts that own qualified low-income housing projects, demonstrating its wide applicability beyond individuals.

One-Time Submission: Some believe that Form 3521 needs to be submitted only once. In reality, anyone claiming the credit must file it annually with their California tax return for each year in which the credit is available or carried over, making it a potentially recurring submission.

Applicable Only to Newly Constructed Buildings: Another misunderstanding is that the credit only applies to newly constructed buildings. Although new constructions qualify, the credit is also available for existing buildings that have been substantially rehabilitated for use as low-income housing, thereby broadening the scope of eligibility.

Immediate Use of the Entire Credit: It's commonly mistaken that the entire amount of the low-income housing credit can be used in the year it is awarded. In fact, due to various limitations, including the taxable income limitation, passive activity loss rules, and the project’s eligible basis, the full credit may not be usable immediately and can be carried forward for future use.

No Need for Detailed Record-Keeping: There's a myth that detailed record-keeping isn't necessary once the credit is claimed. Contrary to this belief, maintaining detailed and accurate records is crucial, as the California Franchise Tax Board (FTB) may request evidence of eligibility, calculation of the credit, and allocation among owners at any point.

Automatic Allocation of Credits among Partners or Members: Finally, some assume that if a property is owned by a partnership or LLC, the tax credits will be automatically allocated among the partners or members. The allocation, however, must be outlined in the partnership agreement or LLC operating agreement, and it's the responsibility of the entity to ensure the credit is distributed according to these terms.

Clarifying these misconceptions is essential for all parties involved in claiming the Low-Income Housing Credit on California Form 3521, ensuring that the credits are utilized correctly and efficiently, in compliance with state regulations.

Key takeaways

When completing the California Form 3521 for the Low-Income Housing Credit, it is crucial that the instructions provided by the California Tax Credit Allocation Committee are closely followed to ensure accuracy and compliance with state regulations.

Eligibility and basis reduction: If the eligible basis of any project or building has decreased since receiving form CTCAC 3521A, Part III must be completed first to adjust the basis before calculating the current year credit. This step is critical for the accurate calculation of the available credit.

Credit calculation: To determine the current year credit, attention to detail is required in filling out Sections 2 and 3. This process involves identifying pass-through credits from affiliated corporations or entities and ensuring all calculations are precise.

Passive activities: The form distinguishes between credits from passive and non-passive activities. It is important to accurately report the amount of credit from passive activities as this affects the allowable low-income housing credit calculation.

Corporate allocations: For corporations, the form includes a section to allocate the amount of low-income housing credit amongst affiliated corporations. Completing this section requires knowing the corporation names and their corresponding California corporation numbers.

Carryover computation: The carryover computation section, Part II, is essential for tracking the credit amount that can be carried over to future years. This involves understanding how to calculate the credit claimable in the current year and any total credit assigned.

Specific instructions: Following the Specific Line Instructions for elements such as the qualified basis of low-income building and the applicable percentage is necessary for accurately computing the current year's credit.

Documentation: It is mandatory to attach a list of all Building Identification Numbers (BINs) if more than one building is applicable for the credit. This ensures that all eligible buildings are accounted for in the credit calculation.

Privacy notice: Form 3521 includes a reference to the FTB 1131 ENG/SP for the Privacy Notice, highlighting the importance of understanding how personal information is handled in connection with this form.

Proper filling out and submission of the California Form 3521 are vital for claiming the Low-Income Housing Credit, necessitating a careful review of all applicable rules and requirements outlined in the form and its accompanying instructions.

Discover More PDFs

Ca Llc 12R - Filing fees for Form LLC-12R are structured to accommodate both initial and periodic filings, allowing businesses to budget for this recurring state requirement efficiently.

California Form 3832 - A critical document ensuring that nonresident members of LLCs consent to California tax laws.

California Sales Tax Certificate - It is not a universal exemption certificate but rather for specific exemption claims like resale or ingredients for manufacturing.