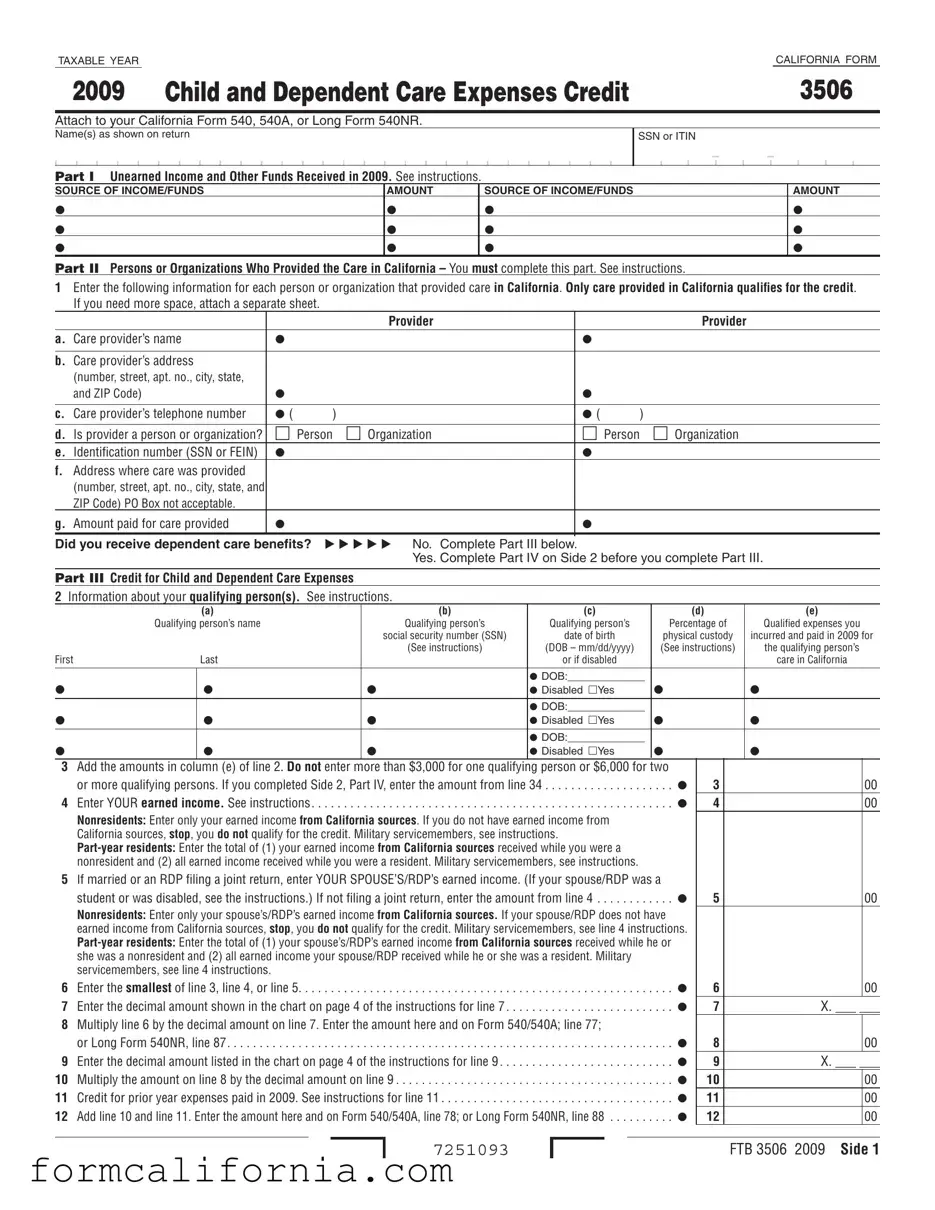

Blank California 3506 PDF Form

The complexity of navigating child and dependent care expenses is significantly eased for California residents with the California Form 3506. This form, designed for the 2009 tax year, serves as an essential tool for individuals seeking to claim the Child and Dependent Care Expenses Credit on their California Form 540, 540A, or Long Form 540NR. By meticulously reporting both unearned income and specific details about care providers in California - including their names, addresses, and the cost of care provided - taxpayers can accurately calculate the credit. This calculation involves understanding the nuances of one's earned income, the qualified expenses incurred and paid for the care of qualifying persons, and navigating the steps to determine the allowable credit amount. Additionally, for those who received dependent care benefits, the form guides taxpayers through the process of determining the amount of these benefits that can be excluded from their income, thereby impacting the credit eligibility and amount. The form also includes provisions for calculating credit for prior year expenses paid in the current tax year, ensuring that taxpayers can maximize their benefits over time. In essence, Form 3506 is a comprehensive document that addresses the intricacies of claiming child and dependent care expenses, offering a pathway to reduce tax liability for eligible California residents.

Document Preview Example

TAXABLE YEAR |

|

CALIFORNIA FORM |

2009 |

Child and Dependent Care Expenses Credit |

3506 |

Attach to your California Form 540, 540A, or Long Form 540NR.

Name(s) as shown on return

SSN or ITIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

Part I Unearned Income and Other Funds Received in 2009. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

SOURCE OF INCOME/FUNDS |

AMOUNT |

|

SOURCE OF INCOME/FUNDS |

|

|

AMOUNT |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Part II Persons or Organizations Who Provided the Care in California – You must complete this part. See instructions.

1Enter the following information for each person or organization that provided care in California. Only care provided in California qualifies for the credit. If you need more space, attach a separate sheet.

|

|

|

Provider |

|

|

Provider |

a. Care provider’s name |

|

|

|

|

|

|

b. Care provider’s address |

|

|

|

|

|

|

|

(number, street, apt. no., city, state, |

|

|

|

|

|

|

and ZIP Code) |

|

|

|

||

c. |

Care provider’s telephone number |

( |

) |

( |

) |

|

d. |

Is provider a person or organization? |

Person Organization |

Person |

Organization |

||

e. |

Identification number (SSN or FEIN) |

|

|

|

|

|

f.Address where care was provided (number, street, apt. no., city, state, and ZIP Code) PO Box not acceptable.

g. Amount paid for care provided |

|

|

Did you receive dependent care benefits? |

No. Complete Part III below. |

|

|

|

Yes. Complete Part IV on Side 2 before you complete Part III. |

Part III Credit for Child and Dependent Care Expenses

2Information about your qualifying person(s). See instructions.

|

|

(a) |

(b) |

(c) |

(d) |

(e) |

|

Qualifying person’s name |

Qualifying person’s |

Qualifying person’s |

Percentage of |

Qualified expenses you |

|

|

|

|

social security number (SSN) |

date of birth |

physical custody |

incurred and paid in 2009 for |

|

|

|

(See instructions) |

(DOB – mm/dd/yyyy) |

(See instructions) |

the qualifying person’s |

First |

|

Last |

|

or if disabled |

|

care in California |

|

|

|

|

|

|

|

|

|

|

|

DOB:_____________ |

|

|

|

Disabled Yes |

|||||

|

|

|

|

DOB:_____________ |

|

|

|

Disabled Yes |

|||||

|

|

|

|

DOB:_____________ |

|

|

|

Disabled Yes |

|||||

3Add the amounts in column (e) of line 2. Do not enter more than $3,000 for one qualifying person or $6,000 for two

or more qualifying persons. If you completed Side 2, Part IV, enter the amount from line 34 . . . . . . . . . . . . . . . . . . . .

4 Enter YOUR earned income. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Nonresidents: Enter only your earned income from California sources. If you do not have earned income from California sources, stop, you do not qualify for the credit. Military servicemembers, see instructions.

5If married or an RDP filing a joint return, enter YOUR SPOUSE’S/RDP’s earned income. (If your spouse/RDP was a

student or was disabled, see the instructions.) If not filing a joint return, enter the amount from line 4 . . . . . . . . . . . .

Nonresidents: Enter only your spouse’s/RDP’s earned income from California sources. If your spouse/RDP does not have earned income from California sources, stop, you do not qualify for the credit. Military servicemembers, see line 4 instructions.

6 Enter the smallest of line 3, line 4, or line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Enter the decimal amount shown in the chart on page 4 of the instructions for line 7 . . . . . . . . . . . . . . . . . . . . . . . . . .

8Multiply line 6 by the decimal amount on line 7. Enter the amount here and on Form 540/540A; line 77;

|

or Long Form 540NR, line 87 |

|

9 |

Enter the decimal amount listed in the chart on page 4 of the instructions for line 9 |

|

10 |

Multiply the amount on line 8 by the decimal amount on line 9 |

|

11 |

Credit for prior year expenses paid in 2009. See instructions for line 11 |

|

12 |

Add line 10 and line 11. Enter the amount here and on Form 540/540A, line 78; or Long Form 540NR, line 88 |

|

3 |

00 |

|

4 |

00 |

|

5 |

00 |

|

6 |

00 |

|

7 |

X. ___ ___ |

|

8 |

|

00 |

9 |

X. ___ ___ |

|

10 |

|

00 |

11 |

|

00 |

12 |

|

00 |

7251093

FTB 3506 2009 Side 1

Part IV Dependent Care Benefits

13Enter the total amount of dependent care benefits you received for 2009. This amount should be shown in box 10 of your Form(s)

|

sole proprietorship or partnership |

13 |

|

00 |

|

14 |

Enter the amount, if any, you carried over from 2008 and used in 2009 during the grace period |

|

14 |

|

00 |

15 |

Enter the amount, if any, you forfeited or carried forward to 2010 |

|

15 |

( |

) 00 |

16 |

Combine line 13 through line 15 |

16 |

|

00 |

|

17Enter the total amount of qualified expenses incurred in 2009 for the

|

care of the qualifying person(s). See instructions |

17 |

00 |

18 |

Enter the smaller of line 16 or line 17 |

18 |

00 |

19 |

Enter YOUR earned income |

19 |

00 |

20If married or an RDP filing a joint return, enter YOUR SPOUSE’S/RDP’s earned income (if your spouse/RDP was a student or was disabled, see the instructions for line 5); if married or an RDP filing a separate return, see the instructions for the

amount to enter; all others, enter the amount from line 19 |

20 |

00 |

21 Enter the smallest of line 18, line 19, or line 20 |

21 |

00 |

22Enter $5,000 ($2,500 if married or an RDP filing separately and you were required

to enter your spouse’s/RDP’s earned income on line 20) |

22 |

00 |

23Enter the amount from line 13 that you received from your sole proprietorship or partnership. If you did not receive

|

|

any amounts, enter |

. . . . . . . . . . . . . . . . . . . . . |

23. |

00 |

||||

24 |

|

Subtract line 23 from line 16 |

24 |

|

00 |

|

|

|

|

25 |

|

Enter the smaller of line 21 or line 22 |

25 |

|

00 |

|

|

|

|

26 |

Deductible benefits. Enter the smallest of line 21, line 22, or line 23 |

. . . . . . . . . . . . . . . . . . . . . |

. |

26 |

|

00 |

|||

27 |

Excluded benefits. Subtract line 26 from line 25. If zero or less, enter |

. . . . . . . . . . . . . . . . . . . . . |

. |

27 |

|

00 |

|||

28 |

Taxable benefits. Subtract line 27 from line 24. If zero or less, enter |

. . . . . . . . . . . . . . . . . . . . . |

. |

28 |

|

00 |

|||

29 |

Enter $3,000 ($6,000 if two or more qualifying persons) |

. . . . . . . . . . . . . . . . . . . . . |

. |

29 |

|

00 |

|||

30 |

Add line 26 and line 27 |

. . . . . . . . . . . . . . . . . . . . . |

30. |

|

00 |

||||

31 |

Subtract the amount on line 30 from the amount on line 29. If zero or less, stop. You do not qualify for the credit. |

|

|

|

|

|

|||

|

|

Exception – If you paid 2008 expenses in 2009, see instructions for line 11 |

. . . . . . . . . . . . . . . . . . . . . |

. |

31 |

|

00 |

||

32 |

Complete Side 1, Part III, line 2. Add the amounts in column (e) and enter the total here |

. |

32 |

|

00 |

||||

33 |

Enter the amount from your federal Form 2441, Part III, line 34 |

. . . . . . . . . . . . . . . . . . . . . |

33. |

|

00 |

||||

34 |

Enter the smaller of line 31, line 32, or line 33. Also, enter this amount on Side 1, Part III, line 3 and |

|

|

|

|

|

|||

|

|

complete line 4 through line 12 |

. . . . . . . . . . . . . . . . . . . . . |

34. |

|

00 |

|||

Worksheet – Credit for 2008 Expenses Paid in 2009 |

|

|

|

|

|

|

|

||

1. |

Enter your 2008 qualified expenses paid in 2008. If you did not claim the credit for these expenses on your 2008 |

|

|

|

|

|

|||

|

|

return, get and complete a 2008 form FTB 3506 for these expenses. You may need to amend your 2008 return |

. . . |

|

. . . . |

. 1.____________________ |

|||

2. |

Enter your 2008 qualified expenses paid in 2009 |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 2.____________________ |

|||

3. |

Add the amounts on line 1 and line 2 |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 3.____________________ |

|||

4. |

Enter $3,000 if care was for one qualifying person ($6,000 for two or more) |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 4.____________________ |

|||

5. |

Enter any dependent care benefits received for 2008 and excluded from your income |

|

|

|

|

|

|

|

|

|

|

(from your 2008 form FTB 3506, Part IV, line 28) |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 5.____________________ |

||

6. |

Subtract amount on line 5 from amount on line 4 and enter the result |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 6.____________________ |

|||

7. |

Compare your and your spouse’s/RDP’s earned income for 2008 and enter the smaller amount |

. . . |

|

. . . . |

. 7.____________________ |

||||

8. |

Compare the amounts on line 3, line 6, and line 7 and enter the smallest amount |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 8.____________________ |

|||

9. |

Enter the amount from your 2008 form FTB 3506, Side 1, Part III, line 6 |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 9.____________________ |

|||

10. |

Subtract amount on line 9 from amount on line 8 and enter the result. If zero or less, stop here. You cannot increase |

|

|

|

|

|

|||

|

|

your credit by any previous year’s expenses |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 10.____________________ |

||

11. |

Enter your 2008 federal adjusted gross income (AGI) (from your 2008 Form 540/540A, line13; |

|

|

|

|

|

|||

|

|

or Long Form 540NR, line 13) |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 11.____________________ |

||

12. |

2008 federal AGI decimal amount (from 2008 form FTB 3506, instructions for line 7) |

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 12.______ . ______ ______ |

||

13. |

Multiply line 10 by line 12 |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 13.____________________ |

|||

14. |

2008 California AGI decimal amount (from 2008 form FTB 3506, instructions for line 9) |

. . . |

|

. . . . |

. 14.______ . ______ ______ |

||||

15. |

Multiply line 13 by line 14. Enter the result here and on your 2009 form FTB 3506, Side 1, Part III, line 11 |

. . . |

|

. . . . |

. 15.____________________ |

||||

Side 2 FTB 3506 2009

7252093

Document Specs

| Fact | Detail |

|---|---|

| Form Number | 3506 |

| Title | Child and Dependent Care Expenses Credit |

| Taxable Year | 2009 |

| Primary Use | To claim the credit for child and dependent care expenses in California. |

| Attachment Requirement | Must be attached to California Form 540, 540A, or Long Form 540NR. |

| Qualification | Only care provided in California qualifies for the credit. |

| Income Reporting | Includes unearned income and other funds received, and requires details on the persons or organizations that provided the care. |

| Governing Law(s) | California Revenue and Taxation Code |

| Maximum Benefit Amounts | Do not enter more than $3,000 for one qualifying person or $6,000 for two or more qualifying persons. |

Detailed Instructions for Writing California 3506

After completing your California income tax forms, the next step involves addressing any applicable credits, such as the Child and Dependent Care Expenses Credit via Form 3506. This specific form is an avenue to claim credits for child and dependent care expenses incurred within the state of California. Properly completing and attaching Form 3506 to your California Form 540, 540A, or Long Form 540NR is crucial for accurately processing your tax return and ensuring you receive any credits for which you are eligible. Follow the detailed steps below to effectively fill out Form 3506.

- Begin with Part I, entering any unearned income and other funds received in 2009. List each source of income/funds and the corresponding amount received.

- In Part II, provide detailed information for each person or organization that provided care in California. This includes the care provider's name, address, telephone number, identifying if the provider is a person or organization, their identification number (SSN or FEIN), and the address where care was provided. Additionally, state the amount paid for the care provided. If more space is needed, attach a separate sheet with the required information.

- For those who did not receive dependent care benefits, skip to Part III. Here, enter information about your qualifying person(s), such as name, social security number, date of birth, percentage of physical custody, and qualified expenses incurred and paid in 2009 for the qualifying person’s care in California.

- Add the amounts in column (e) of line 2, ensuring not to exceed $3,000 for one qualifying person or $6,000 for two or more qualifying persons.

- Enter YOUR earned income. Nonresidents and part-year residents must follow specific instructions based on their source of income.

- If married or in a Registered Domestic Partnership (RDP) and filing a joint return, enter your spouse’s/RDP’s earned income. If not filing a joint return, simply enter the amount from the previous step.

- Determine the smallest of line 3, line 4, or line 5 and enter this amount.

- Lookup the decimal amount listed in the instructions for line 7 and multiply line 6 by this decimal amount. Enter the result and include this on your main tax return form as instructed.

- Proceed to calculate the credit by multiplying the amount on line 8 by the decimal amount listed in the instructions for line 9.

- Add any credit for prior year expenses paid in 2009 to the amount from the previous step and enter the total.

If you received dependent care benefits in 2009, you must complete Part IV before finishing Part III. This section involves detailing the total amount of dependent care benefits received, any amounts carried over or forfeited, and calculating the eligible credit based on your particular situation. Always refer to the instructions specific to each part if clarification is needed, ensuring the information entered is accurate and complete. Remember, diligent completion of Form 3506 is essential for obtaining any eligible credits for child and dependent care expenses within California.

Things to Know About This Form

What is Form 3506 and who needs to file it?

Form 3506, also known as the Child and Dependent Care Expenses Credit Form, is a document for California taxpayers to claim a credit for child and dependent care expenses. If you paid someone to care for your child, spouse, or dependent while you worked or looked for work, and the care was provided in California, you might need to file this form. Attach it to your California Form 540, 540A, or Long Form 540NR.

How do I qualify for the child and dependent care expenses credit?

To qualify for this credit:

- The care must have been provided in California.

- The expenses must have been paid for the care of one or more qualifying persons.

- You (and your spouse/RDP if filing jointly) must have earned income during the year.

- The care provider's information, including name, address, and identification number, must be provided.

What are the limits on the amount of care expenses I can claim?

The maximum amount of care expenses you're allowed to claim is $3,000 for one qualifying person or $6,000 for two or more qualifying persons. However, the actual credit amount might be less, depending on your income and the amount of care expenses you incurred.

Can I claim the credit if I received dependent care benefits?

Yes, you can still claim the credit even if you received dependent care benefits, but there are special rules. You must complete Part IV of Form 3506 before Part III. This section helps adjust your qualifying expenses based on the dependent care benefits you received. Be sure to report the total amount of dependent care benefits in Part IV.

Where do I report my care expenses if they were for a previous year?

If you paid for care expenses in a previous year but did not claim them, you may be able to claim a credit for those expenses. Use the Worksheet – Credit for 2008 Expenses Paid in 2009 provided in the instructions. You'll need to enter your qualified expenses from the previous year and any related dependent care benefits. The calculated amount from this worksheet will be entered in Part III, Line 11 of Form 3506.

Common mistakes

When filling out the California Form 3506 for Child and Dependent Care Expenses Credit, it's important to approach the task with care and attention to detail. Several common mistakes can easily be avoided to ensure that the form is completed accurately, allowing for the full benefit of the child and dependent care credit. Here are five common pitfalls:

Incorrectly reporting income - Many individuals either incorrectly report their income or overlook it entirely. Part I of the form requires the listing of unearned income and other funds received. It's crucial to accurately report all sources of income, as this can affect the credit amount.

Missing information about care providers - Part II of the form demands detailed information about the care providers. A common mistake is not providing complete information, such as the care provider’s address, telephone number, and identification number (SSN or FEIN). This section must be filled out meticulously to qualify for the credit.

Forgetting to detail all qualifying persons - Part III requires information about each qualifying person. Sometimes, filers forget to list all qualifying children or dependents, or they provide incomplete information about them. Remember to include the full name, social security number, date of birth, and the total qualified expenses incurred for each person.

Miscalculating the credit - Line 3 in Part III and subsequent calculations are often sources of errors. Filers sometimes enter incorrect amounts or misunderstand the limits for one qualifying person ($3,000) or two or more qualifying persons ($6,000). It's essential to add the amounts accurately and not to exceed the allowed maximum.

Overlooking the dependent care benefits section - If you received dependent care benefits, Part IV must be completed before finalizing Part III. This section is sometimes skipped or incorrectly filled out. Reporting the total amount of dependent care benefits received in 2009 and accurately calculating the deductible and taxable benefits are crucial steps that can impact the final credit amount.

Avoiding these mistakes can not only expedite the processing of your form but also ensure that you receive the maximum credit for which you're eligible. Careful attention to each part of the form, along with double-checking all entries and calculations, will contribute to a smoother filing process and help avoid delays or adjustments down the line.

Documents used along the form

When filing the California Form 3506 for Child and Dependent Care Expenses Credit, individuals may need to complement it with additional forms and documents to ensure the accuracy of their tax returns and compliance with the tax laws. Here is an overview of these additional documents.

- Form 540/540A, also known as California Resident Income Tax Return: This is the primary state tax return form for California residents, to which the Form 3506 must be attached.

- Form 540NR, Long or Short Form, known as California Nonresident or Part-Year Resident Income Tax Return: For individuals who are not full-year residents of California but need to report income earned in the state. Form 3506 should be attached if they paid child and dependent care expenses in California.

- Form 2441, Child and Dependent Care Expenses: A federal form used to calculate the child and dependent care expenses credit on the federal tax return. Information from Form 2441 can help complete certain parts of Form 3506.

- W-2 Forms, Wage and Tax Statements from Employers: These forms report income and taxes withheld, and box 10 shows any dependent care benefits provided by the employer, which is necessary for completing Form 3506.

- Schedule CA (540), California Adjustments - Residents: This schedule is used to calculate adjustments to the federal adjusted gross income (AGI) and is necessary for filers who have differences between their federal and state taxable income.

- Receipts for Child and Dependent Care Expenses: While not a formal tax form, retaining receipts and records of child and dependent care expenses is crucial. These documents serve as proof of the expenses claimed on Form 3506.

This list adds up to a comprehensive set of documents and forms that support the filing of the California Form 3506. Keeping accurate records and documents organized will facilitate a smoother filing process and ensure taxpayers can substantiate their claims for credits or deductions.

Similar forms

The IRS Form 2441, "Child and Dependent Care Expenses," is closely related to the California 3506 form. Both forms are designed to provide tax relief to taxpayers who incur expenses for the care of a qualifying person, enabling the taxpayer to work or actively look for work. While the 3506 form is specific to California, providing a credit against state taxes, the IRS Form 8481 applies to federal taxes. The structure of both documents requires the taxpayer to detail care provider information, expenses, and income to calculate the allowable credit.

Form W-10, "Dependent Care Provider’s Identification and Certification," shares a purpose with part of the California 3506 form. Both require detailed information about the care providers, including names, addresses, and taxpayer identification numbers (SSN or EIN). This similarity exists because accurately identifying care providers ensures the legitimacy of the claimed expenses for child and dependent care credit, a necessary step for both federal and state tax compliance.

The Schedule 2 (Form 1040), "Tax," is another form that bears resemblance to the California 3506 form in its function, though it serves different tax purposes. The connection lies in the inclusion of tax credits, including those related to dependent care, which directly affect the calculation of the taxpayer's final tax liability or refund. Like the 3509 form, Schedule 2 acts as an attachment that influences the main tax return by adjusting the taxpayer's financial responsibilities based on specific expenses and credits.

The California Form 540, "California Resident Income Tax Return," is directly linked to the California 3506 form. The 3506 form is an attachment to Form 540, where the calculated child and dependent care expenses credit from form 3506 is reported. This process mirrors the integration between forms on both state and federal levels, where supplemental forms adjust gross income or directly apply tax credits to the main income tax return, influencing the tax calculation.

Finally, the Earned Income Credit (EIC) worksheets, both federal and state versions, share conceptual similarities with the California 3506 form. Though focused on different tax relief areas, they require taxpayers to report income and calculate eligibility for a tax credit based on specific criteria, such as income levels and dependent information. The methodology of calculating a benefit based on qualifying criteria and income parameters, aiming to reduce tax liability for eligible filers, links these documents.

Dos and Don'ts

When dealing with the California 3506 form, it's vital to adhere to guidelines to ensure accuracy and compliance. Here are steps to follow and avoid:

Do:

- Ensure all personal information is accurate, including names, Social Security Numbers (SSNs), or Individual Taxpayer Identification Numbers (ITINs). This information must match what's on your tax return.

- Detail every source of income and funds received as specified in Part I. This includes unearned income that can affect the credit amount.

- Complete Part II carefully, providing detailed information about each care provider, including their name, address, and identification number. It's crucial that the care was provided in California as only such expenses qualify for this credit.

- Accurately calculate the credit in Part III, adhering to the limits on expenses that can be claimed per qualifying person. Don’t enter more than $3,000 for one qualifying person or $6,000 for two or more qualifying persons.

Don’t:

- Forget to attach the form to your California Form 540, 540A, or Long Form 540NR. This form is an attachment and must be submitted with your state tax return.

- Provide incomplete provider information in Part II. A P.O. Box for the care provider's address is not acceptable. Also, ensure the care provider’s identification number is provided; this could be a Social Security Number (SSN) or a Federal Employer Identification Number (FEIN).

- Miscalculate your credit amount. The calculation involves several steps, including determining your earned income and the smallest of various amounts. Errors here can result in inaccuracies that may affect your return.

- Overlook dependent care benefits received. If you received dependent care benefits, make sure to complete Part IV before Part III. This includes amounts shown in box 10 of your Form(s) W-2 and potentially affects your credit.

Misconceptions

Understanding the California Form 3506, which pertains to Child and Dependent Care Expenses Credit, is crucial for taxpayers seeking to claim this credit. However, several misconceptions often cloud the understanding and proper utilization of this form. Let's address some common misunderstandings:

Misconception #1: The credit can be claimed regardless of income level.

In reality, there are income limits and phase-outs that may affect eligibility and the credit amount. The credit is designed to assist lower to moderate-income taxpayers.Misconception #2: Any type of childcare or dependent care qualifies for the credit.

The care must be necessary for the taxpayer (and spouse, if filing jointly) to work or actively look for work. Additionally, the care provider cannot be a spouse or someone else listed as a dependent on the tax return.Misconception #3: The credit is refundable.

This credit is non-refundable, meaning it can reduce your tax liability to zero, but you won't get a refund on any remaining amount of the credit.Misconception #4: Expenses for overnight camps qualify for the credit.

Only expenses for daytime care are eligible. Overnight camp costs are not considered work-related expenses for the purpose of this credit.Misconception #5: The amount paid to the care provider can be estimated.

Taxpayers must provide accurate information about the amount paid for care, as well as the care provider's name, address, and taxpayer identification number.Misconception #6: You can claim the credit without reporting the care provider’s information.

Failure to include the care provider's information can result in the denial of the credit. It's important to report all necessary details accurately.Misconception #7: The credit applies to the cost of school tuition.

Expenses related to kindergarten or higher levels of school are not eligible. However, before and after-school care for a child in kindergarten or above can qualify.Misconception #8: Only parents can claim the credit.

Guardians or others who have a qualifying person can claim the credit if they meet all the IRS requirements. This includes ensuring the individual is a dependent or could have been had the taxpayer not passed away during the year.Misconception #9: The credit can only be claimed for biological children.

The credit is not limited to biological children but includes other dependents as well, such as stepchildren, foster children, and even adult dependents, under certain circumstances.

Understanding these points correctly can help taxpayers accurately claim the Child and Dependent Care Expenses Credit using California Form 3506, ensuring they take full advantage of available tax benefits while complying with tax laws.

Key takeaways

When preparing to utilize California Form 3506, also known as the Child and Dependent Care Expenses Credit form, individuals should familiarize themselves with several key aspects that will aid in accurately completing the documentation and maximizing potential benefits:

- The necessity of attaching Form 3506 to your California Form 540, 540A, or Long Form 540NR cannot be overstated, as this ensures proper processing of your child and dependent care expenses credit.

- Accurate reporting of all unearned income and other funds received is required in Part I of the form for the correct calculation of the childcare credit.

- For the expenses to qualify for the credit, the care must have been provided in California, emphasizing the need to complete Part II thoroughly, which includes detailed information about the care provider.

- It's important to note that there is a maximum amount that can be claimed: $3,000 for one qualifying person or $6,000 for two or more qualifying persons. This threshold underscores the importance of meticulous record-keeping and calculation to ensure all eligible expenses are accounted for.

- The inclusion of provider identification numbers, whether a Social Security Number (SSN) or a Federal Employer Identification Number (FEIN), is crucial for the validity of the claim.

- The form distinguishes between amounts paid for care and dependent care benefits received, requiring careful distinction and accurate reporting in Parts III and IV to determine the credit properly.

- Eligibility for the credit not only depends on care expenses but also on the claimant's and their spouse's/RDP’s (Registered Domestic Partner) earned income, making precise income reporting essential.

- In cases of adjustments for prior year expenses paid in the current year or dependent care benefit adjustments, the provided worksheets facilitate accurate credit calculations, signifying the importance of attending to these adjustments when applicable.

By understanding these critical components and adhering to the form's instructions, taxpayers can effectively navigate the complexities of claiming the Child and Dependent Care Expenses Credit, potentially yielding significant tax benefits while ensuring compliance with California tax law.

Discover More PDFs

Landlord Eviction Notice Letter - Directed at California tenants, this document signals the urgency and severity of addressing lease violations to avoid eviction.

California De 4 - Employers rely on the completed DE 4 form to withhold the appropriate level of state taxes from wages.

California Forms - Used in situations where there’s an argument to be made for the reduction, increase, or cessation of garnished support payments.