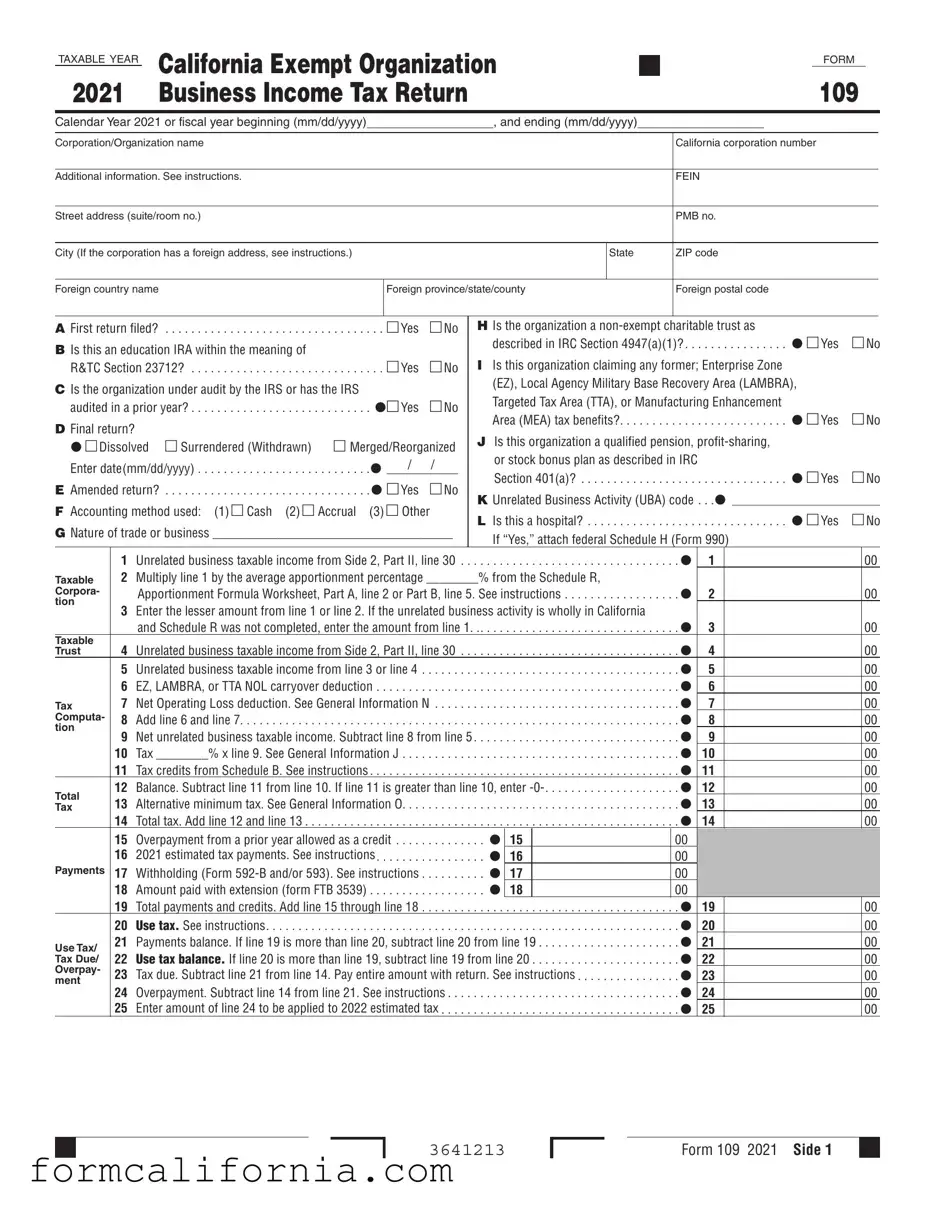

Blank California 109 PDF Form

The California 109 form serves as the Business Income Tax Return for exempt organizations within the state, applicable for the 2020 tax year. It is designed to capture details regarding the tax obligations of organizations that are typically free from income tax due to their nature of operations, including charitable, educational, and certain other types of non-profit entities. By requiring information such as corporation/organization names, addresses, and the fiscal period the return covers, it ensures a comprehensive assessment of any business income that may be subject to taxes. Importantly, the form touches on various aspects such as audits, final returns, amendments, and accounting methods, in addition to specific questions about engagement in profit-generating activities that might affect the organization’s tax-exempt status. It also covers unrelated business taxable income, specific deductions, taxes, payments, and credits, providing a detailed overview of the financial and operational status of the exempt organization. For organizations operating beyond California borders, it accommodates foreign address entries, acknowledging the global reach of many non-profits. Furthermore, it facilitates discussions on net operating loss deductions, tax apportionment, and penalties, offering a clear framework for tax compliance in the non-profit sector.

Document Preview Example

TAXABLE YEAR |

California Exempt Organization |

|

|

|

|

|

|

|

|

|

FORM |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

109 |

|

|

|

||||||||||||||||||||

2021 |

|

Business Income Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Calendar Year 2021 or fiscal year beginning (mm/dd/yyyy) |

|

|

|

|

|

|

|

, and ending (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporation/Organization name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California corporation number |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Additional information. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Street address (suite/room no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PMB no. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

City (If the corporation has a foreign address, see instructions.) |

|

|

|

|

|

|

|

|

|

|

State |

|

|

ZIP code |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Foreign country name |

|

|

|

Foreign province/state/county |

|

|

Foreign postal code |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

A First return filed? |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . |

□ Yes |

□ No |

|

H Is the organization a |

|

|

|

|

||||||||||||||||||||

B Is this an education IRA within the meaning of |

|

|

|

|

|

|

|

|

described in IRC Section 4947(a)(1)? . . . . |

. . |

. . . . . . . |

. . . • □ Yes |

□ No |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

R&TC Section 23712? |

. . . . . |

. . . |

□ Yes |

□ No |

|

I Is this organization claiming any former; Enterprise Zone |

|

|

|

|

|||||||||||||||||||||

C Is the organization under audit by the IRS or has the IRS |

|

|

|

|

|

|

(EZ), Local Agency Military Base Recovery Area (LAMBRA), |

|

|

|

|

||||||||||||||||||||

•□ Yes |

|

|

|

Targeted Tax Area (TTA), or Manufacturing Enhancement |

|

|

|

|

|||||||||||||||||||||||

audited in a prior year? |

. . . . . |

|

□ No |

|

|

|

|

|

|||||||||||||||||||||||

D Final return? |

|

|

|

|

|

|

|

|

|

|

Area (MEA) tax benefits? |

. |

. . . |

. . |

. . |

. . . . . . . |

. . . • □ Yes |

□ No |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

• □ Dissolved |

□ Surrendered (Withdrawn) |

□ Merged/Reorganized |

|

J Is this organization a qualified pension, |

|

|

|

|

|||||||||||||||||||||||

Enter date(mm/dd/yyyy) |

|

. |

• |

|

/ |

/ |

|

|

|

or stock bonus plan as described in IRC |

|

|

|

• □ Yes |

|

|

|

|

|||||||||||||

. . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□ No |

|||||||||||||

E Amended return? |

|

. |

• □ Yes |

□ No |

|

|

. . . . . . . . . . . . . .Section 401(a)? |

. |

. . . |

. . |

. . |

. . . . . . . . . . |

|||||||||||||||||||

. . . . . |

|

|

K Unrelated Business Activity (UBA) code . . |

.• |

|

|

|

|

|||||||||||||||||||||||

F Accounting method used: (1) □ Cash (2) □ Accrual |

(3) □ Other |

|

L Is this a hospital? |

|

|

|

|

|

|

. |

. . . • □ Yes |

□ No |

|||||||||||||||||||

G Nature of trade or business _____________________________________ |

|

. |

. . . |

. . |

. . |

. . . . . . |

|||||||||||||||||||||||||

|

If “Yes,” attach federal Schedule H (Form 990) |

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

1 |

Unrelated business taxable income from Side 2, Part II, line 30 |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

1 |

|

|

|

|

|

00 |

|

|||||||||||||

Taxable |

2 |

Multiply line 1 by the average apportionment percentage ________% from the Schedule R, |

|

|

. • |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Corpora- |

|

Apportionment Formula Worksheet, Part A, line 2 or Part B, line 5. See instructions |

|

2 |

|

|

|

|

|

00 |

|

||||||||||||||||||||

tion |

3 |

Enter the lesser amount from line 1 or line 2. If the unrelated business activity is wholly in California |

|

|

. • |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

and Schedule R was not completed, enter the amount from line 1 |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

3 |

|

|

|

|

|

00 |

|

||||||||||||||

Taxable |

4 |

Unrelated business taxable income from Side 2, Part II, line 30 |

|

|

|

|

|

|

|

|

|

. • |

|

4 |

|

|

|

|

|

00 |

|

||||||||||

Trust |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|

|

||||||||||||||||||

|

5 |

Unrelated business taxable income from line 3 or line 4 |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

5 |

|

|

|

|

|

00 |

|

||||||||||

|

6 |

EZ, LAMBRA, or TTA NOL carryover deduction . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

6 |

|

|

|

|

|

00 |

|

||||||||

Tax |

7 |

Net Operating Loss deduction. See General Information N |

. . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

7 |

|

|

|

|

|

00 |

|

|||||||||

Computa- |

8 |

Add line 6 and line 7 |

. . . . . . |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

8 |

|

|

|

|

|

00 |

|

||||||

tion |

9 |

Net unrelated business taxable income. Subtract line 8 from line 5 |

|

|

|

|

|

|

|

|

|

. • |

|

9 |

|

|

|

|

|

00 |

|

||||||||||

|

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

10 |

Tax ________% x line 9. See General Information J |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

10 |

|

|

|

|

|

00 |

|

|||||||||||

|

11 |

Tax credits from Schedule B. See instructions |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

11 |

|

|

|

|

|

00 |

|

||||||||

Total |

12 |

Balance. Subtract line 11 from line 10. If line 11 is greater than line 10, enter |

. • |

12 |

|

|

|

|

|

00 |

|

||||||||||||||||||||

13 |

Alternative minimum tax. See General Information O |

|

|

|

|

|

|

|

|

|

|

|

|

. • |

13 |

|

|

|

|

|

00 |

|

|||||||||

Tax |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|

||||||||||||||||

|

14 |

Total tax. Add line 12 and line 13 . . . . |

. . . . . . |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

14 |

|

|

|

|

|

00 |

|

|||||||

|

15 |

. . . . . . . . . .Overpayment from a prior year allowed as a credit |

. . |

. |

. • |

15 |

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

16 |

. .2021 estimated tax payments. See instructions |

|

. . . . . . . . . . . |

. . |

. |

. • |

16 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|||||||

Payments |

17 |

Withholding (Form |

. . |

. |

. • |

17 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

18 |

Amount paid with extension (form FTB 3539) |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. • |

18 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

||||||

|

19 |

Total payments and credits. Add line 15 through line 18 |

|

|

|

|

|

|

|

|

|

|

|

|

• |

19 |

|

|

|

|

|

00 |

|

||||||||

|

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|||||||||||||||||

|

20 |

USE TAX. See instructions |

. . . . . . |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

20 |

|

|

|

|

|

00 |

|

|||||||

Use Tax/ |

21 |

Payments balance. If line 19 is more than line 20, subtract line 20 from line 19 |

. • |

21 |

|

|

|

|

|

00 |

|

||||||||||||||||||||

22 |

USE TAX BALANCE. If line 20 is more than line 19, subtract line 19 from line 20 |

|

|

. • |

22 |

|

|

|

|

|

00 |

|

|||||||||||||||||||

Tax Due/ |

|

|

|

|

|

|

|||||||||||||||||||||||||

Overpay- |

23 |

Tax due. Subtract line 21 from line 14. Pay entire amount with return. See instructions |

|

|

. • |

23 |

|

|

|

|

|

00 |

|

||||||||||||||||||

ment |

|

|

|

|

|

|

|||||||||||||||||||||||||

24 |

Overpayment. Subtract line 14 from line 21. See instructions |

|

|

|

|

|

|

|

|

|

. • |

24 |

|

|

|

|

|

00 |

|

||||||||||||

|

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|

|||||||||||||||||||

|

25 |

. . . . . . . . . .Enter amount of line 24 to be applied to 2022 estimated tax |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

25 |

|

|

|

|

|

00 |

|

||||||||||||||

3641213

Form 109 2021 Side 1

|

|

26 |

. . . . . . . . . . . . . . . . . . . . . . .Refund. If line 25 is less than line 24, then subtract line 25 from line 24 |

•. . . |

. . • |

26 |

||||

|

|

|

. . . . . . . . .a Fill in the account information to have the refund directly deposited. Routing number |

26a |

|

|||||

|

|

|

b Type: Checking |

•□ |

Savings |

c Account Number |

• |

|

26c |

|

Refund or |

|

|

|

|

•□ |

|

|

|

||

Amount |

|

27 |

Penalties and interest. See General Information M |

. |

. . • |

27 |

||||

Due |

|

. . |

|

|||||||

|

|

28 |

• □ Check if estimate penalty computed using Exception B or C and attach form FTB 5806 |

. . . |

. . . . |

|

||||

|

|

29 |

Total amount due. Add line 22, line 23, line 25, and line 27, then subtract line 24 |

. . . |

. . • |

29 |

||||

Unrelated Business Taxable Income |

|

|

|

|

|

|||||

Part I |

Unrelated Trade or Business Income |

|

|

|

|

|

||||

00

00

00

1 |

a |

Gross receipts or gross sales______________ b Less returns and allowances______________ c Balance |

• 1c |

00 |

|

2 |

Cost of goods sold and/or operations (Schedule A, line 7) |

• |

2 |

00 |

|

3 |

Gross profit. Subtract line 2 from line 1c |

• |

3 |

00 |

|

4 |

a |

Capital gain net income. See Specific Line Instructions – Trusts attach Schedule D (541) |

• 4a |

00 |

|

|

|

|

|

|

|

|

b |

Net gain (loss) from Part II, Schedule |

• 4b |

00 |

|

|

|

|

|

|

|

|

c |

Capital loss deduction for trusts |

• 4c |

00 |

|

5Income (or loss) from partnerships, limited liability companies, or S corporations. See Specific Line Instructions.

|

Attach Schedule |

• |

5 |

00 |

6 |

Rental income (Schedule C) |

• |

6 |

00 |

7 |

Unrelated |

• |

7 |

00 |

8 |

Investment income of an R&TC Section 23701g, 23701i, or 23701n organization (Schedule E) |

• |

8 |

00 |

9 |

Interest, Annuities, Royalties and Rents from controlled organizations (Schedule F) |

• |

9 |

00 |

10 |

Exploited exempt activity income (Schedule G) |

• 10 |

00 |

|

|

|

|

|

|

11 |

Advertising income (Schedule H, Part III, Column A) |

• 11 |

00 |

|

|

|

|

|

|

12 |

Other income. Attach schedule |

• 12 |

00 |

|

|

|

|

|

|

13 |

Total unrelated trade or business income. Add line 3 through line 12 |

• 13 |

00 |

|

Part II Deductions Not Taken Elsewhere (Except for contributions, deductions must be directly connected with the unrelated business income.)

14 |

Compensation of officers, directors, and trustees from Schedule I |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

14 |

|

00 |

15 |

Salaries and wages |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

15 |

|

00 |

16 |

Repairs |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

16 |

|

00 |

17 |

Bad debts |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

17 |

|

00 |

18 |

Interest. Attach schedule |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

18 |

|

00 |

19 |

Taxes. Attach schedule |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

19 |

|

00 |

20 |

Contributions. See instructions and attach schedule |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

20 |

|

00 |

21 |

a Depreciation (Corporations and Associations – Schedule J) (Trusts – form FTB 3885F) |

• |

21a |

|

00 |

|

|

|

|

b Less: depreciation claimed on Schedule A. See instructions |

|

21b |

|

00 |

21 |

|

00 |

22 |

Depletion. Attach schedule |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

• |

22 |

|

00 |

23 |

a Contributions to deferred compensation plans |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

23a |

|

00 |

|

b Employee benefit programs. See instructions |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . .. |

•. . |

23b |

|

00 |

24 |

Other deductions. Attach schedule |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

24 |

|

00 |

|

25 |

Total deductions. Add line 14 through line 24 |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . .. |

•. . |

25 |

|

00 |

26 |

Unrelated business taxable income before allowable excess advertising costs. Subtract line 25 from line 13 |

26 |

|

00 |

||||

|

|

|

|

. |

• |

|

|

|

27 |

Excess advertising costs (Schedule H, Part III, Column B) |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

27 |

|

00 |

|

|

|

|

. |

• |

|

|

|

|

28 |

Unrelated business taxable income before specific deduction. Subtract line 27 from line 26 |

28 |

|

00 |

||||

|

|

|

|

. |

• |

|

|

|

29 |

Specific deduction. See instructions |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

29 |

|

00 |

|

30 |

Unrelated business taxable income. Subtract line 29 from line 28. If line 28 is a loss, enter line 28 |

. . |

30 |

|

00 |

|||

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

Sign |

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and |

||||||||||

Here |

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

||||||||||

|

|

|

|

Title |

|

Date |

|

|

• Telephone |

||

|

Signature |

▶ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

of officer |

|

|

|

|

|

|

|

|

|

|

|

Preparer’s |

|

|

|

|

Date |

|

Check if self- |

• PTIN |

||

|

|

|

|

|

|

|

|

||||

|

▶ |

|

|

|

|

|

|

▶ □ |

|

||

Paid |

signature |

|

|

|

|

|

employed |

|

|||

|

|

|

|

|

|

|

|

|

|

• Firm’s FEIN |

|

Preparer’s |

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours, |

|

|

|

|

|

|

|

|

|

||

Use Only |

if |

▶ |

|

|

|

|

|

||||

|

and address |

|

|

|

|

|

|

|

|

• Telephone |

|

|

|

|

|

|

|

|

|

|

|||

May the FTB discuss this return with the preparer shown above? See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . • □ Yes □ No

Side 2 Form 109 2021

3642213

Schedule A Cost of Goods Sold and/or Operations.

Method of inventory valuation (specify)_______________________________________________

1 |

. . . . . . . . . . .Inventory at beginning of year |

. . |

1 |

|

00 |

2 |

Purchases |

•. . |

2 |

|

00 |

3 |

Cost of labor |

3 |

|

00 |

|

4 |

a Additional IRC Section 263A costs. Attach schedule |

•. . |

4a |

|

00 |

|

b Other costs. Attach schedule |

4b |

|

00 |

|

5 |

Total. Add line 1 through line 4b |

. . |

5 |

|

00 |

6 |

Inventory at end of year |

. . |

6 |

|

00 |

7 |

Cost of goods sold and/or operations. Subtract line 6 from line 5. Enter here and on Side 2, Part I, line 2 |

. . |

7 |

|

00 |

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to this organization? □ Yes □ No

Schedule B Tax Credits.

1 |

. . . . . . .Enter credit name__________________________code •__________ |

• |

1 |

|

00 |

|

2 |

. . . . . . .Enter credit name__________________________code •__________ |

• |

2 |

|

00 |

|

3 |

. . . . . . .Enter credit name__________________________code •__________ |

• |

3 |

|

00 |

|

4Total. Add line 1 through line 3. If claiming more than 3 credits, enter the total of all claimed credits,

|

on line 4. Enter here and on Side 1, line 11 |

. . . . . . . . . . . . . . . . . |

. . . . . |

4 |

00 |

|

Schedule K |

|

|

|

|

||

1 |

Interest computation under the |

. . . • |

1 |

00 |

||

2 |

Interest on tax attributable to installment: a Sales of certain timeshares or residential lots. |

. . . . . . . . . . . . . . . . . |

. . . • 2a |

00 |

||

|

|

|

|

|

|

|

|

|

b Method for |

. . . . . . . . . . . . . . . . . |

. . . • 2b |

00 |

|

|

|

. |

. . . • |

|

|

|

3 |

IRC Section 197(f)(9)(B)(ii) election to recognize gain on the disposition of intangibles |

. . . . . . . . . . . . . . . . |

3 |

00 |

||

|

|

. |

. . . • |

|

|

|

4 |

Credit recapture. Credit name___________________________________________ |

. . . . . . . . . . . . . . . . |

4 |

00 |

||

5 |

Total. Combine the amounts on line 1 through line 4. See instructions |

. . . . . . . . . . . . . . . . . |

. . . . . |

5 |

00 |

|

Schedule R Apportionment Formula Worksheet. Use only for unrelated trade or business amounts. |

|

|

|

|||

Part A. |

Standard Method – |

|

||||

|

|

|

(a) |

|

(b) |

(c) |

|

|

|

Total within and |

Total within |

Percent within |

|

|

|

|

outside California |

California |

California [(b) ÷ (a)] x 100 |

|

1 |

Total sales |

• |

• |

|

|

|

2 |

Apportionment percentage. Divide total sales column (b) by total sales column (a) and |

|

|

|

• |

|

|

|

|

||||

|

multiply the result by 100. Enter the result here and on Form 109, Side 1, line 2 |

|

|

|

||

Part B. |

Three Factor Formula. Complete this part only if the corporation uses the |

|

|

|

||

|

|

|

(a) |

|

(b) |

(c) |

|

|

|

Total within and |

Total within |

Percent within |

|

|

|

|

outside California |

California |

California [(b) ÷ (a)] x 100 |

|

1 |

Property factor: See instructions |

• |

• |

|

• |

|

2 |

Payroll factor: Wages and other compensation of employees |

• |

• |

|

• |

|

3 |

Sales factor: Gross sales and/or receipts less returns and allowances |

• |

• |

|

• |

|

|

||||||

4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total percentage: Add the percentages in column (c) |

|

|

|

|

|

5 |

Average apportionment percentage: Divide the factor on line 4 by 3 and enter the |

|

|

|

|

|

|

result here and on Form 109, Side 1, line 2. See instructions for exceptions. |

|

|

|

|

|

Schedule C Rental Income from Real Property and Personal Property Leased with Real Property

For rental income from

1Description of property

2 Rent received |

3 Percentage of rent attributable |

or accrued |

to personal property |

%

%

%

4 Complete if any item in column 3 is more than 50%, or for any item |

5 Complete if any item in column 3 is more than 10%, but not more than 50% |

|

||

if the rent is determined on the basis of profit or income |

|

|

|

|

(a) Deductions directly connected |

(b) Income includible, column 2 |

(a) Gross income reportable, |

(b) Deductions directly connected with |

(c) Net income includible, column 5(a) |

(attach schedule) |

less column 4(a) |

column 2 x column 3 |

personal property (attach schedule) |

less column 5(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add columns 4(b) and column 5(c). Enter here and on Side 2, Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3643213

Form 109 2021 Side 3

Schedule D Unrelated

1 Description of |

2 Gross income from or |

3 |

Deductions directly connected with or allocable to |

|

|

allocable to |

(a) |

(b) Other deductions |

|

|

property |

|||

|

|

(attach schedule) |

(attach schedule) |

|

|

|

|

||

4 Amount of average acquisition |

5 Average adjusted basis of or |

6 Debt basis |

7 Gross income reportable, |

8 Allocable deductions, |

9 Net income (or loss) includible, |

indebtedness on or allocable |

allocable to |

percentage, |

column 2 x column 6 |

total of columns 3(a) and |

column 7 less column 8 |

to |

property (attach schedule) |

column 4 ÷ |

|

3(b) x column 6 |

|

(attach schedule) |

|

column 5 |

|

|

|

%

%

%

Total. Enter here and on Side 2, Part I, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule E Investment Income of an R&TC Section 23701g, Section 23701i, or Section 23701n Organization

1 Description |

2 Amount |

3 Deductions directly connected |

4 Net investment income, |

5 |

6 Balance of investment income, |

|

|

(attach schedule) |

column 2 less column 3 |

(attach schedule) |

column 4 less column 5 |

|

|

|

|

|

|

|

|

|

|

|

|

Total. Enter here and on Side 2, Part I, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter gross income from members (dues, fees, charges, or similar amounts). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule F Interest, Annuities, Royalties and Rents from Controlled Organizations

|

|

|

Exempt Controlled Organizations |

|

|

||

1 |

Name of controlled organizations |

2 Employer |

3 |

Net unrelated income |

4 Total of specified |

5 Part of column (4) that is |

6 Deductions directly |

|

|

identification |

|

(loss) |

payments made |

included in the controlling |

connected with income in |

|

|

number |

|

|

|

organization’s gross |

column (5) |

|

|

|

|

|

|

income |

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

Nonexempt Controlled Organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Taxable income |

|

8 |

Net unrelated income |

9 Total of specified payments |

10 Part of column (9) that is |

11 Deductions directly |

|

|

|

|

(loss) |

made |

included in the controlling |

connected with income in |

|

|

|

|

|

|

organization’s gross |

column (10) |

|

|

|

|

|

|

income |

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

4 |

Add columns 5 and 10 |

. . . . . . . . . . . . . . . . . |

. . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

|

|

5 |

Add columns 6 and 11 |

. . . . . . . . . . . . . . . . . |

. . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

6 Subtract line 5 from line 4. Enter here and on Side 2, Part I, line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule G Exploited Exempt Activity Income, other than Advertising Income

1Description of exploited activity (attach schedule if more than one unrelated activity is exploiting the same exempt activity)

2 Gross unrelated |

3 Expenses directly |

business income |

connected with |

from trade or |

production |

business |

of unrelated |

|

business income |

|

|

4Net income from unrelated trade or business, column 2 less column 3

5Gross income from activity that is not unrelated business income

6Expenses attributable to column 5

7Excess exempt expense, column 6 less column 5 but not more than column 4

8Net income includible, column 4 less column 7 but not less than zero

Total. Enter here and on Side 2, line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Side 4 Form 109 2021

3644213

Schedule H Advertising Income and Excess Advertising Costs

Part I Income from Periodicals Reported on a Consolidated Basis

1 Name of periodical |

2 Gross |

3 Direct |

4 Advertising income |

5 Circulation |

6 Readership |

7 If column 5 is greater than |

|

advertising |

advertising |

or excess advertising |

income |

costs |

column 6, enter the income |

|

income |

costs |

costs. If column 2 is |

|

|

shown in column 4, in |

|

|

|

greater than column 3, |

|

|

Part III, column A(b). If |

|

|

|

complete columns 5, |

|

|

column 6 is greater than |

|

|

|

6, and 7. If column 3 |

|

|

column 5, subtract the sum |

|

|

|

is greater than |

|

|

of column 6 and column 3 |

|

|

|

column 2, enter the |

|

|

from the sum of column 5 |

|

|

|

excess in Part III, |

|

|

and column 2. Enter amount |

|

|

|

column B(b). Do not |

|

|

in Part III, column A(b). If the |

|

|

|

complete columns 5, |

|

|

amount is less than zero, |

|

|

|

6, and 7. |

|

|

enter |

|

|

|

|

|

|

|

Totals . . . . . . . . . . . . . . . . . . .

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 If column 5 is greater than |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

column 6, enter the income |

||

Part II |

Income from Periodicals Reported on a Separate Basis |

|

|

|

|

|

|

|

|

|

|

shown in column 4, in |

|||||||||||

|

|

|

|

|

|

|

|

|

|

amount is less than zero, |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part III, column A(b). If |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

column 6 is greater than |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

column 5, subtract the sum |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of column 6 and column 3 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from the sum of column 5 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and column 2. Enter amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in Part III, column A(b). If the |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter |

0 . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part III |

Column A – Net Advertising Income |

|

|

|

Part III Column B – Excess Advertising Costs |

|

|

|

|||||||||||||||

(a) Enter “consolidated periodical” and/or |

|

|

(b) Enter total amount from Part I, columns 4 or 7, |

(a) Enter “consolidated periodical” and/or |

(b) |

Enter total amount from Part I, column 4, |

|||||||||||||||||

names of |

|

|

and amount listed in Part II, columns 4 or 7 |

|

names of |

|

and amounts listed in Part II, column 4 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Enter total here and on Side 2, Part I, line 11 |

|

|

|

|

|

|

|

Enter total here and on Side 2, Part II, line 27 |

|

|

|

|

|

|

|||||||||

Schedule I |

Compensation of Officers, Directors, and |

Trustees |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

1 Name of officer |

|

|

2 SSN or ITIN |

|

3 Title |

|

4 Percent of time devoted |

|

|

5 Compensation attributable |

|

6 Expense account allowances |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

to business |

|

|

|

to unrelated business |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

Total. Enter here and on Side 2, Part II, line 14 |

|

|

|

|

|

|

|

|

|

||||||||||||||

Schedule J |

Depreciation (Corporations and Associations only. Trusts use form FTB 3885F.) |

|

|

|

|

|

|

|

|

|

|

||||||||||||

1 Group and guideline class or description |

|

2 Date acquired (dd/mm/yyyy) |

|

3 Cost or other basis |

|

4 Depreciation allowed |

5 |

Method of computing |

6 Life or rate |

7 Depreciation for |

|||||||||||||

of property |

|

|

|

|

|

|

|

|

|

|

|

or allowable in prior |

|

depreciation |

|

|

|

|

|

this year |

|||

|

|

|

|

|

|

|

|

|

|

|

|

years |

|

|

|

|

|

|

|

|

|

|

|

1 Total additional |

|

||||||||||||||||||||||

2Other depreciation:

Buildings . . . . . . . . . . . . . . . . . . . .

Furniture and fixtures . . . . . . . . . . .

Transportation equipment . . . . . . .

Machinery and other equipment. . .

Other (specify)________________

___________________________

3 Other depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Amount of depreciation claimed elsewhere on return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Balance. Subtract line 5 from line 4. Enter here and on Side 2, Part II, line 21a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3645213

Form 109 2021 Side 5

Document Specs

| Fact | Detail |

|---|---|

| Form Type | California Exempt Organization Business Income Tax Return (Form 109) |

| Applicable Year | 2020 |

| Usage | Used by exempt organizations for business income tax reporting |

| Eligibility | Exempt organizations operating in California |

| Key Sections | Unrelated Business Taxable Income, Tax and Payments, Deductions |

| Special Conditions | Includes questions about audits, specific tax benefits, and organizational status |

| Accounting Methods | Allows for Cash, Accrual, or Other accounting methods |

| Governing Law | Revenue and Taxation Code (R&TC), Internal Revenue Code (IRC) |

| Privacy Notice | Includes information on privacy rights and how information is used |

| Preparation Declaration | Requires declaration that the information is true, correct, and complete |

Detailed Instructions for Writing California 109

Filing the California 109 form, the Business Income Tax Return for exempt organizations, is an essential annual requirement that ensures your organization remains compliant with state tax laws. This step-by-step guide aims to simplify the process, ensuring accuracy and completeness in your submission.

- Identify the applicable tax year for the return and provide the exact dates for your fiscal year if it does not align with the calendar year.

- Enter the organization’s full name, California corporation number, and Federal Employer Identification Number (FEIN).

- Provide the complete address of the organization. If this includes a foreign address, refer to the specific instructions for the correct format.

- Indicate by checking the appropriate box whether this is the first return the organization is filing.

- Answer "Yes" or "No" to questions regarding the nature of your organization, including if it's an education IRA, under IRS audit, a charitable trust, has dissolved, or is claiming tax benefits from specific zones.

- Determine your accounting method (cash, accrual, or other) and specify the nature of your trade or business.

- Calculate and enter your unrelated business taxable income, ensuring to follow the instructions for apportioning income if necessary.

- Work through each revenue and deduction section, accurately entering all requested information.

- Compute the total tax, credits, and payments. Ensure all carryover deductions and estimated tax payments are correctly applied.

- Complete all relevant schedules that apply to your organization’s activities and financial situations, such as Schedules A through R, ensuring detailed accuracy.

- Review the form to ensure all applicable sections are filled out and that the math on deductions, income, and tax liabilities is correct.

- Provide the officer's or authorized individual's signature and date the form to declare under penalty of perjury that the information is true, complete, and correct. If another individual prepared the form, include their information in the designated preparer section.

- Finally, if you are expecting a refund and prefer direct deposit, ensure you provide accurate banking information.

Once complete, review the entire form for accuracy and completeness. Refer to the instructions for submission guidelines and address any final questions before sending it to the California Franchise Tax Board. Timeliness and accuracy in filing this form are crucial to maintaining your exempt status and avoiding potential penalties.

Things to Know About This Form

What is the California Form 109?

California Form 109, also known as the California Exempt Organization Business Income Tax Return, is a form used by tax-exempt organizations in California to report and pay taxes on income that is unrelated to their exempt purposes. This income could include business income, investment income, or any other income that is not directly related to the organization's primary exempt function.

Who needs to file Form 109?

Form 109 must be filed by exempt organizations that have gross income of $1,000 or more from a trade or business that is unrelated to their exempt purpose, as defined under Internal Revenue Code Section 501. This includes nonprofit organizations, charities, and educational institutions that operate within California.

What is the due date for filing Form 109?

The due date for filing Form 109 is the 15th day of the 5th month after the organization's accounting period ends. For organizations following a calendar year, the due date is May 15th of the following year. If the due date falls on a weekend or legal holiday, the deadline is extended to the next business day.

Are there any penalties for late filing?

Yes, organizations that fail to file Form 109 by the due date may face penalties. The penalty is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. Additionally, there may be interest charges on the unpaid tax.

How is unrelated business income calculated?

Unrelated business income is calculated by taking the gross income from the unrelated business activity, subtracting the cost of goods sold, and deducting expenses directly connected with conducting the trade or business. Specific modifications may be necessary, such as adjustments for net operating loss carryforwards or deductions for contributions made.

Can tax credits be claimed on Form 109?

Yes, organizations filing Form 109 can claim certain California-specific tax credits that may reduce the amount of unrelated business income tax owed. These credits are listed on Schedule B of the form, and detailed instructions for each credit can be found in the form’s instructions.

Is it possible to file an amended Form 109?

Yes, if an organization needs to correct or update information after the original Form 109 has been filed, they can file an amended return. To indicate that it is an amended return, the organization must check the "Amended return" box located on the form and include any required schedules or explanations for the changes.

What should be done if the organization's address has changed?

If an organization changes its address after filing Form 109, it should notify the California Franchise Tax Board by either updating their information online through the MyFTB account service or filing a Change of Address form (FTB 3533).

How can an organization get help with filing Form 109?

Organizations seeking help with filing Form 109 can consult the instructions provided by the California Franchise Tax Board, seek assistance from a professional tax advisor, or contact the Franchise Tax Board directly for specific questions or guidance.

Common mistakes

Failing to accurately determine and enter the organization's status regarding exemptions, audits, and fiscal specifics early in the form can create groundwork errors that compromise the entire filing process. For instance, not correctly indicating whether the organization is an education IRA under R&TC Section 23712 or whether it is currently under audit by the IRS can lead to incorrect processing of the form. Additionally, those filing for the first time sometimes overlook marking the "First return filed?" box accurately, potentially confusing the IRS about the organization's filing history.

Incorrectly reporting Unrelated Business Taxable Income (UBTI) is a common mistake. Organizations often miscalculate their UBTI by improperly accounting for gross receipts, returns, allowances, and costs of goods sold. This inaccuracy affects lines 1 through 30 on Side 2, Part I, leading to an overstated or understated tax liability. Proper understanding and reporting of gross income from unrelated trade or business activities alongside applicable deductions are crucial for accurate tax computation.

Misunderstanding or neglecting to apply the correct apportionment percentage from the Schedule R to line 2 on Side 1 can significantly distort the tax owed. The apportionment formula, whether it's the three-factor formula or the single-sales factor formula, is designed to fairly divide income based on the organization's activity within California. Overlooking or inaccurately applying these percentages can lead to misstated taxable amounts.

Overlooking Net Operating Losses (NOLs) and their carryover provisions often results in overstated taxable income. Line 6 and Line 7 on Side 1 are specifically provided for these deductions, and not utilizing them when applicable denies the organization valuable tax relief, which could have been carried forward from prior years or other zones like EZ, LAMBRA, or TTA.

Incorrectly calculating or failing to claim allowable tax credits on Schedule B is another frequent oversight. These credits can significantly reduce the amount of tax owed, yet organizations sometimes either misinterpret their eligibility or incorrectly apply the credits, leading to missed opportunities for tax savings.

Failing to properly account for and deduct contributions, salaries, and other expenses that are directly connected with the conduct of unrelated business activities. Particularly, lines 14 through 24 on Side 2, Part II, offer organizations the opportunity to deduct various operational expenses, including compensation of officers and employees, applicable taxes, and interest. Neglecting these deductions or inaccuracies in reporting them could artificially inflate the organization's reported income and tax liability.

Incorrect or incomplete reporting of direct-deposit information for refunds on line 26 can delay or misdirect funds. Ensuring that the routing and account numbers are correct is crucial for the timely and secure receipt of any overpayment refunds the organization is entitled to. This administrative detail, though small, is a common source of post-filing complications.

Documents used along the form

When navigating the complexities of California's tax obligations for exempt organizations, the Form 109, or the California Exempt Organization Business Income Tax Return, stands as a pivotal document. Yet, it's just one item in a comprehensive toolkit necessary for these organizations to maintain compliance and optimize their financial health. Alongside Form 109, several other forms and documents play critical roles in ensuring exempt organizations meet their tax responsibilities while harnessing opportunities for tax benefits. Understanding these additional forms enhances the organization's ability to navigate the tax landscape effectively.

- Form 199: California Exempt Organization Annual Information Return. This form is essential for most exempt organizations operating within California. It provides a detailed account of the organization’s annual financial activity, excluding specific income sources taxed under unrelated business income.

- Schedule R: Apportionment and Allocation of Income. For organizations that operate both within and outside California, Schedule R is vital. It helps calculate the portion of income attributable to California, necessary for accurately computing the state tax liability.

- Form 592-B: Resident and Nonresident Withholding Tax Statement. This document is crucial for organizations that withhold taxes on payments made to nonresidents of California, indicating income and the amount of tax withheld.

- Form 590: Withholding Exemption Certificate. Form 590 enables organizations to claim exemptions from withholding on payments for services performed in California, based on their exempt status or other qualifying criteria.

- Form FTB 3539: Payment for Automatic Extension for Corporations and Exempt Organizations. This form allows for an automatic 7-month extension to file Form 109, providing organizations extra time to gather necessary information and prepare their return.

Seamlessly integrating these documents with the submission of California Form 109 can significantly impact an exempt organization's tax handling. Each form plays a specific role in detailing the financial intricacies, tax liabilities, and exemptions applicable to the organization. Mastery of this documentation ensures not only compliance with the state's tax regulations but also empowers organizations to leverage fiscal opportunities to their advantage. Hence, these forms are not merely bureaucratic necessities; they are instruments that, when utilized effectively, can enhance the financial standing and operational efficiency of exempt organizations in California.

Similar forms

The California 109 Form, which deals with exempt organization business income tax returns, offers similarities to several other types of tax documents, each serving distinct functions but intersecting in their requirement for detailed financial disclosures and adherence to tax law regulations. One of these similar documents is the IRS Form 990. Form 990 is required for tax-exempt organizations to provide the Internal Revenue Service with annual financial information. Both forms ensure organizations maintain their tax-exempt status by disclosing income, expenditures, and adherence to the operational standards required for their tax-exempt designation.

Another related document is the IRS Form 1120, which is the U.S. Corporation Income Tax Return. It's required for corporations to report their income, gains, losses, deductions, credits, and to figure out their income tax liability. The California 109 form and Form 1120 overlap in their purpose of reporting business income and calculating taxes owed, although one is for exempt organizations in California and the other is for corporations with federal tax obligations.

IRS Form 1065, U.S. Return of Partnership Income, also shares commonalities with the California 109 Form. Form 1065 is used by partnerships to report their financial information to the IRS. Like the California 109, it requires detailed reporting of income and losses but is designed for partnerships rather than exempt organizations. Both forms enable their respective entities to comply with tax requirements through detailed financial disclosures.

IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, is akin to the California 109 Form in that it serves a specific entity type, in this case, estates and trusts, requiring detailed financial reporting for tax purposes. Both documents require entities to report income and deductions, ensuring compliance with tax laws and proper calculation of tax liabilities based on their operational finances.

IRS Form 990-T, Exempt Organization Business Income Tax Return, is specifically designed for exempt organizations that have unrelated business taxable income. This form closely resembles the California 109 Form since both require tax-exempt organizations to report income that is not related to their exempt purposes. They ensure that organizations pay taxes on income generated from activities that fall outside their tax-exempt operations.

Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, while serving a different primary purpose, shares similarities with the California 109 Form in its complex reporting requirements and focus on transparency. Form 5471 requires detailed financial disclosures by U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, echoing the California 109's emphasis on detailed financial transparency for tax purposes.

The Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., is another document related to the California 109 Form. It is used within the context of partnerships to report each partner's share of the partnership's income, deductions, and credits. Like the California 109, the Schedule K-1 plays a crucial role in tax reporting by providing detailed information necessary for partners to file their individual tax returns, ensuring that income from various sources is accurately reported for tax purposes.

Each of these documents, while serving unique functions within the tax code, shares the underlying principle of the California 109 Form: to provide detailed accountings of an entity's financial activities to ensure proper tax reporting and compliance. Through these varied forms, the tax system accommodates the diverse structures and operational modes of entities, from corporations and partnerships to exempt organizations and trusts.

Dos and Don'ts

When completing the California Form 109 for the 2020 tax year, there are several important practices to consider to ensure the accuracy and compliance of your exempt organization business income tax return. Here are seven things you should do, as well as seven things you should avoid.

Do:

- Review the instructions carefully provided by the California Franchise Tax Board for filling out Form 109 to ensure all applicable sections are completed correctly.

- Ensure accuracy in reporting your organization's name, California corporation number, and FEIN to avoid processing delays or issues.

- Check the correct boxes for specific questions such as if it's your first return filed, whether the organization is under IRS audit, and if this is a final return.

- Select the right accounting method used by your organization, whether it's cash, accrual, or another method, as this affects how income and expenses are reported.

- Accurately calculate unrelated business taxable income and deductions, making sure to attach any required schedules or documentation.

- Claim any applicable tax credits accurately, ensuring to attach Schedule B for tax credits with the precise names and codes.

- Sign and date the return , providing the title of the officer completing the form. If prepared by someone other than the taxpayer, ensure their information is included.

Don't:

- Forget to attach required schedules such as Schedules A, D, E, H, and others that are relevant to your organization's income and deductions.

- Overlook checking the appropriate boxes for specific conditions or statuses of the organization that can affect tax liabilities or benefits.

- Miscalculate income or deductions , as errors can result in inaccuracies in unrelated business taxable income and potentially lead to penalties.

- Fail to claim available tax credits your organization may be eligible for, as this can result in a higher tax liability than necessary.

- Omit any part of the payment information if you're expecting a refund and wish to have it directly deposited.

- Leave blank any fields that are applicable to your return, as incomplete information can delay processing and impact your tax assessment.

- Submit the form without reviewing for completeness and accuracy to ensure all necessary information has been provided and is correct.

Misconceptions

Understanding the California Form 109 can be challenging due to misconceptions about its purpose and requirements. Here are six common misunderstandings:

- Form 109 is only for non-profit organizations. While Form 109 is designed for exempt organizations, it specifically caters to those with business income. This includes trusts deemed as non-exempt charitable trusts under IRC Section 4947(a)(1), indicating a broader scope than just non-profit organizations.

- All exempt organizations must file Form 109. This statement is inaccurate as only organizations with unrelated business income (UBI) are required to file Form 109. The form serves to report and tax business income that is not directly related to the organization's exempt purpose.

- Filing Form 109 means losing non-profit status. Filing this form does not impact an organization's non-profit status. Form 109 is a way to comply with tax laws by reporting unrelated business income, which is subject to taxation to ensure fairness among businesses.

- Organizations under audit by the IRS should not file Form 109. Even if an organization is currently under IRS audit, it must still file Form 109 if it has unrelated business income. The form contains a section to disclose if the organization is under audit, ensuring transparency and compliance.

- There's no need to report income if it's all spent on charitable activities. Regardless of how the income is used, if an organization generates unrelated business income, it must report this income on Form 109. The utilization of income for charitable activities does not exempt an organization from filing requirements.

- Form 109 cannot be amended once submitted. If an organization finds errors or omissions in their initially filed Form 109, an amended return can be filed. The form includes an option to indicate that it's an amended return, allowing organizations to correct previously submitted information.

By understanding and addressing these misconceptions, organizations can better navigate their tax filing obligations under California law concerning unrelated business income.

Key takeaways

Understanding the California 109 form, especially designed for exempt organizations, can be vital for accurately reporting and managing business income tax within the state. Here are some key takeaways:

- The California 109 Form is specifically used by exempt organizations to file their business income tax return, applicable for either the calendar year or a defined fiscal year.

- Organizations must accurately fill in their identification details such as corporation/organization name, California corporation number, FEIN, and the complete address. For entities with a foreign address, special instructions provided in the form must be followed.

- The form allows entities to declare various types of statuses like whether it's their first return filed, if the organization is under audit by the IRS or has been in a prior year, and if this filing represents a final return due to dissolution, surrender, or merger.

- Special attention needs to be given to the sections addressing unrelated business taxable income (UBTI), as properly determining this income is crucial for tax compliance and accurately calculating any owed taxes.

- Exempt organizations with unrelated business activities must be diligent in documenting and calculating net operating loss deductions and any applicable tax credits from Schedule B, as these can significantly impact the tax liabilities reported on the form.

- Accurate reporting of payment information, including estimated tax payments, withholding amounts, and payments made with extensions, is necessary for reconciling the total payment credits against the tax due.

Overall, detailed and accurate completion of the California 109 Form is essential for exempt organizations to comply with state tax obligations, report their unrelated business income correctly, and appropriately calculate their tax liabilities or refunds.

Discover More PDFs

Earthquake Authority - Ensures clarity in billing procedures, specifying whether the insurance bill should be sent directly to the insured party or a designated mortgagee.

California Notice of Completion - It's a document landlords hand out when they need someone to move out within 20 days, specifically in California.