Blank California 100X PDF Form

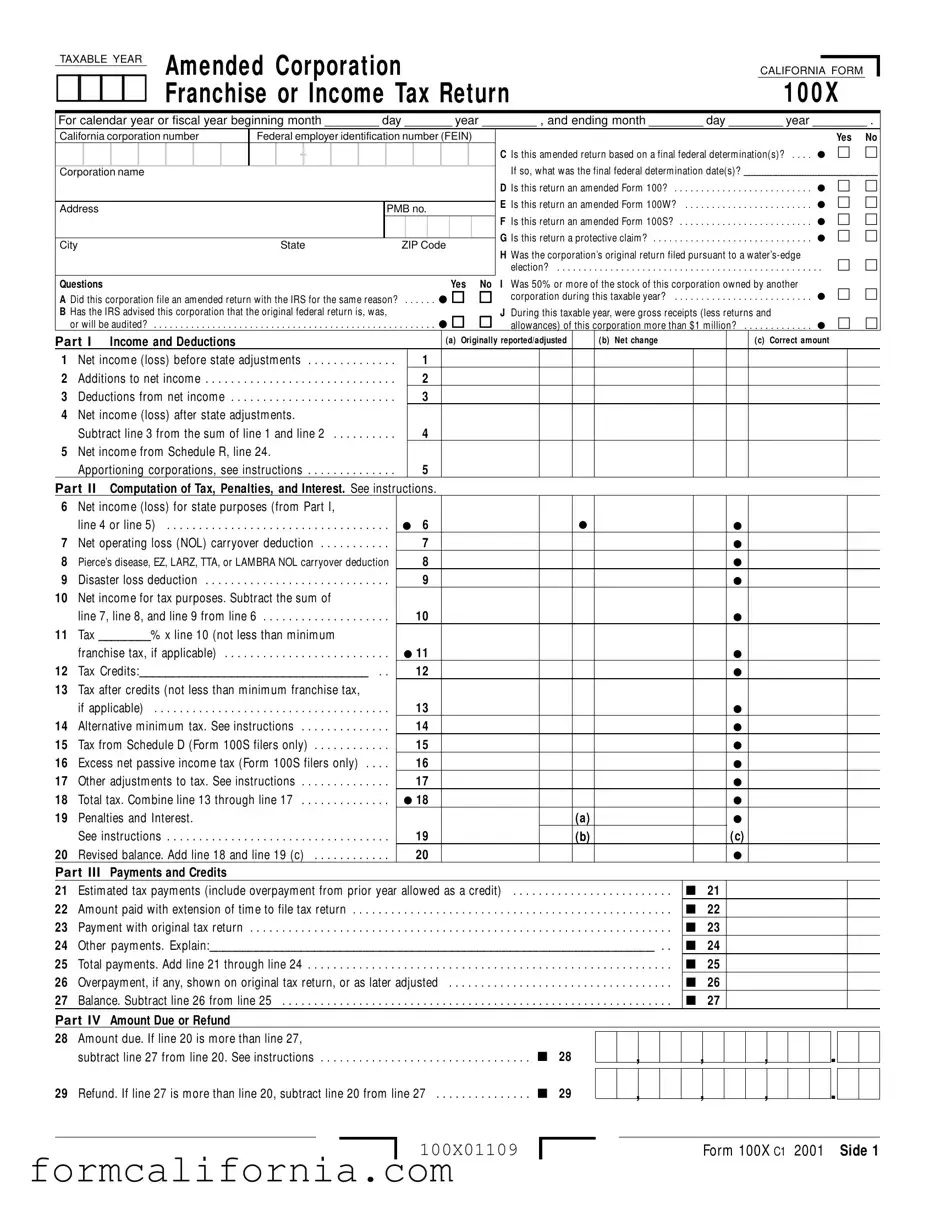

The California 100X form, an Amended Corporation Franchise or Income Tax Return, serves a crucial function for corporations looking to amend previously filed state income or franchise tax returns. Required for adjustments to a corporation’s tax responsibilities, this form navigates through various sections, including income and deductions, computation of tax, penalties and interest, payments and credits, and an in-depth explanation of changes made. The 100X form is utilized by corporations to report both increases and decreases in tax liability due to various reasons such as final federal determinations, auditing adjustments, or to correct errors in the originally filed return. It uniquely caters to amending previous filings for several types of corporation tax returns, including Forms 100, 100W, and 100S, making it a comprehensive tool for corporate tax corrections. Additionally, this form touches on specific directives for filing based on tax due or refunds, incorporating instructions for electronic funds transfer payments, and detailing the statute of limitations for claiming refunds. Filing this amended return may be prompted by IRS adjustments, necessitating California corporations to adapt their tax filings in response within a six-month period to ensure compliance and accuracy in their tax obligations. In essence, the California 100X form is pivotal for corporations to rectify their tax filings, ensuring accuracy and adherence to state tax laws.

Document Preview Example

TAXABLE YEAR |

Amended Corporation |

CALIFORNIA |

FORM |

|

|

|

|

Franchise or Income Tax Return |

|

|

|

1 0 0 X |

|||

For calendar year or fiscal year beginning month ________ day _______ year ________ , and ending month ________ day ________ year ________ . |

|||||||||||||||||||||||||||||||||||||||

California corporation number |

|

Federal employer identification number (FEIN) |

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C Is this am ended return based on a final federal determ ination(s)? |

. . . . |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If so, what was the final federal determ ination date(s)? _________________________ |

|||||||||||||

Corporation name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D Is this return an am ended Form 100? . . |

. . |

. . |

. . . . |

. . . . |

. . . . . . . . |

. . . . |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E Is this return an am ended Form 100W? |

|

|

|

|

|

|

||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

PMB no. |

|

. . |

. . |

. . . . |

. . . . |

. . . . . . . . |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.F Is this return an am ended Form 100S? |

. . |

. . |

. . . . |

. . . . |

. . . . . . . . |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G Is this return a protective claim ? |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. . |

. . |

. . . . |

. . . . |

. . . . . . . . |

||||||||

City |

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

H Was the corporation’s original return filed pursuant to a |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

election? . . . |

. . . . |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. . . . |

. . . . |

. . . . . . . . |

. . . . . . |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Was 50% or m ore of the stock of this corporation owned by another |

|

||||||||||||

Questions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No I |

|

||||||||||||||||

A Did this corporation file an am ended return with the IRS for the sam e reason? |

|

. |

. |

. . |

. |

. |

corporation during this taxable year? . . |

. . |

. . |

. . . . |

. . . . |

. . . . . . . . |

. . . . |

||||||||||||||||||||||||||

B Has the IRS advised this corporation that the original federal return is, was, |

|

|

|

|

|

|

|

|

|

|

|

J During this taxable year, were gross receipts (less returns and |

|

|

|

||||||||||||||||||||||||

or will be audited? |

. . . . . . |

. . . . |

. |

. . |

. |

. |

. |

. . |

. |

. |

allowances) of this corporation m ore than $1 m illion? |

. . . . |

|||||||||||||||||||||||||||

Part I |

Income and Deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Originally reported/adjusted |

|

( b) Net change |

|

|

|

|

(c) Correct amount |

|

||||||||||||||||

1 |

Net incom e (loss) before state adjustm ents |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

2 |

. . . . . . . . . . .Additions to net incom e |

. . . . . |

. . . . |

. . . . |

. . . . |

. . |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3 |

. . . . . . .Deductions from net incom e |

. . . . . |

. . . . |

. . . . |

. . . . |

. . |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

4 |

Net incom e (loss) after state adjustm ents. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Subtract line 3 from the sum of line 1 and line 2 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

5 |

Net incom e from Schedule R, line 24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Apportioning corporations, see instructions |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Part II |

Computation of Tax, Penalties, and Interest. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

6 |

Net incom e (loss) for state purposes (from Part I, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

line 4 or line 5) |

. . . . |

. . . . |

. . . . |

. |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

7 |

. . . . . . . . . . .Net operating loss (NOL) carryover deduction |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

8 |

Pierce’s disease, EZ, LARZ, TTA, or LAM BRA NOL carryover deduction |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

9 |

Disaster loss deduction |

. . . . |

. . . . |

. . . . |

. |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

10 |

Net incom e for tax purposes. Subtract the sum of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

line 7, line 8, and line 9 from line 6 |

. . |

. . . . . |

. . . . |

. . . . |

. . . . |

. |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

11 |

Tax ________% x line 10 (not less than m inim um |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

franchise tax, if applicable) |

. . . |

. . . . . |

. . . . |

. . . . |

. . . . |

. |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

12 |

Tax Credits:___________________________________ . . |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

13 |

Tax after credits (not less than m inim um franchise tax, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

if applicable) |

. . . . |

. . . . |

. . . . |

. |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

14 |

Alternative m inim um tax. See instructions |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

15 |

Tax from Schedule D (Form 100S filers only) |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

16 |

Excess net passive incom e tax (Form 100S filers only) . . . . |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

17 |

Other adjustm ents to tax. See instructions |

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

18 |

Total tax. Com bine line 13 through line 17 |

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

19 |

Penalties and Interest. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

|

|

|

|

|

|

|

||||||||

|

. . . . . . . . . . . . . . . . . . . . . .See instructions |

. . . . |

. . . . |

. . . . |

. |

19 |

|

|

|

|

|

|

|

|

(b) |

|

|

|

|

(c) |

|

|

|

|

|||||||||||||||

20 |

Revised balance. Add line 18 and line 19 (c) |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Part III |

Payments and Credits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

21 |

Estim ated tax paym ents (include overpaym ent from prior year allowed as a credit) |

. . . . . |

. . . . . |

. . . |

. . . . . . . . . . . . |

21 |

|

|

|

|

|

||||||||||||||||||||||||||||

22 |

Am ount paid with extension of tim e to file tax return |

|

. |

. . |

|

. . |

. |

. . . |

. |

. |

. . . |

. . |

. . . . |

. . . . . . |

. . . |

. . . . . . . . . . . . |

22 |

|

|

|

|

|

|||||||||||||||||

23 |

Paym ent with original tax return . . . . |

. . . . . |

. . . . |

. . . . |

. . . . |

. . |

. . |

|

. |

. . |

|

. . |

. |

. . . |

. |

. |

. . . |

. . |

. . . . |

. . . . . . |

. . . |

. . . . . . . . . . . . |

23 |

|

|

|

|

|

|||||||||||

24 |

Other paym ents. Explain:____________________________________________________________________ . . |

24 |

|

|

|

|

|

||||||||||||||||||||||||||||||||

25 |

Total paym ents. Add line 21 through line 24 |

. |

. . |

|

. . |

. |

. . . |

. |

. |

. . . |

. . |

. . . . |

. . . . . . |

. . . |

. . . . . . . . . . . . |

25 |

|

|

|

|

|

||||||||||||||||||

26 |

Overpaym ent, if any, shown on original tax return, or as later adjusted |

. . . . . |

. . . . . |

. . . |

. . . . . . . . . . . . |

26 |

|

|

|

|

|

||||||||||||||||||||||||||||

27 |

Balance. Subtract line 26 from line 25 |

. |

. . |

|

. . |

. |

. . . |

. |

. |

. . . |

. . |

. . . . |

. . . . . . |

. . . |

. . . . . . . . . . . . |

27 |

|

|

|

|

|

||||||||||||||||||

Part IV |

Amount Due or Refund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

28 |

Am ount due. If line 20 is m ore than line 27, |

|

|

|

subtract line 27 from line 20. See instructions |

28 |

|

29 |

Refund. If line 27 is m ore than line 20, subtract line 20 from line 27 |

29 |

, |

, |

, |

, |

, |

, |

.

.

100X01109

Form 100X C1 2001 Side 1

Part V Explanation of Changes

1 Enter nam e, address, and California corporation num ber used on original tax return (if sam e as shown on this am ended return, write “ Sam e” ).

California corporation number |

Federal employer identification number (FEIN) |

-

Corporation name

Address |

|

PMB no. |

|

|

||

|

|

|

|

|

|

|

City |

State |

ZIP Code |

|

|

||

|

|

|

|

|

|

|

2Explanation of Changes to items in Part I, Part II, Part III, and Part IV.

Enter the line num ber from Side 1 for each item that is changing and give the reason for each change. Attach all supporting form s and schedules for item s changed. Include federal schedules if a change was m ade to the federal return. Be sure to include the corporation nam e and California corporation num ber on each attachm ent. Refer to the instructions and form s in the tax booklet for the year that is being am ended.

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

|

Under penalties of perjury, I declare that I have filed an original return and I have examined this amended return, including accompanying schedules and statements, and to |

||||||||||||||||||||

Please |

the best of my knowledge and belief, this amended return is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which |

||||||||||||||||||||

Sign |

preparer has any knowledge. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of officer |

|

Title |

|

Date |

|

Telephone |

|||||||||||||||

Here |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Preparer’s signature |

|

|

Date |

|

|

Check if self- |

|

|

|

Paid preparer’s SSN/PTIN |

||||||||||

Paid |

|

|

|

|

|

employed |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|||||||||

Preparer’s |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Firm’s name (or yours, if |

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Telephone |

|||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

||||

Where to File Form 100X

If the Form 100X results in a refund or no am ount due, m ail the am ended tax return to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAM ENTO CA 94257- 0500

If the Form 100X results in an am ount due, m ail the am ended tax return to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAM ENTO CA 94257- 0501

Side 2 Form 100X C1 2001

100X01209

For Privacy Act Notice, get form FTB 1131.

Instructions for Form 100X

Amended Corporation Franchise or Income Tax Return

General Information

Income year vs. taxable year

Effective for years beginning on or after Januar y 1, 2000, references to “ incom e year” w ere replaced w ith “ taxable year” in all provisions of the Corporation Law (CTL), the Adm inistration of the Franchise and Incom e Tax Law (AFITL), and the Personal Incom e Tax Law (PITL) . When referring to an incom e

m easurem ent period beginning before Januar y 1, 2000, the term “ taxable year” should be interpreted to m ean “ incom e year” .

Statute of limitation

California Revenue and Taxation Code Section 19306 w as am ended to provide that the statute of lim itation (SOL) for a refund w ill be four years from the later of the original due date or the date the tax return w as filed. This law change is effective for any year w ith an open SOL for issuing a refund as of Januar y 1, 2000. If the tax return is delinquent, the SOL for refund w ill revert back to four years from the original due date, not the extended due date.

Preparer Tax Identification Number (PTIN) Beginning Januar y 1, 2000, tax professionals have the option of providing their individual Social Security Num ber (SSN) or Preparer Tax Identification Num ber (PTIN) on returns they prepare. Preparers w ho w ant a PTIN m ust com plete and subm it federal Form W- 7P, Application for Preparer Tax Identification Num ber, to the IRS.

A Purpose

Use Form 100X to am end a previously filed Form 100, California Corporation Franchise or Incom e Tax Return; Form 100W, California Corporation Franchise or Incom e Tax Return – Water’s- Edge Filers; or Form 100S, California S Corporation Franchise or Incom e Tax Return.

A claim for refund of an overpaym ent of tax should be m ade by filing a Form 100X.

If the corporation is filing an am ended tax return in response to a billing notice the corporation received, the corporation w ill continue to receive billing notices until the am ended tax return is accepted. In addition, the corporation m ust pay the assessed tax before the corporation can claim a refund for any part of the assessed tax.

Note: Do not use this form to change the corporate filing status. If changing corporate status from a C corporation to an S corpora- tion, or vice versa, file form FTB 3560,

S Corporation Election or Term ination/ Revocation.

Unless other w ise stated, the term “ corpora- tion” as used in Form 100X and in these instructions includes banks, financial corporations, S corporations, exem pt

hom eow ners’ associations, political organiza- tions, lim ited liability com panies; and lim ited liability partnerships classified as corporations.

B When to File

File Form 100X only after the original tax return has been filed. Corporations m ust file a claim for refund w ithin four years from the original due date of the tax return, the date the tax return w as filed, or w ithin one year from the date the tax w as paid, w hichever is later. Tax returns filed before the due date are considered as filed on the original due date.

If the federal corporate tax return is exam ined and changed by the Internal Revenue Ser vice (IRS), report these changes to the Franchise Tax Board (FTB) w ithin six m onths of the final federal determ ination by either:

•Filing Form 100X, Am ended Corporation Incom e Tax Return; or

•Sending a letter w ith copies of the federal changes to:

CORPORATION RAR FRANCHISE TAX BOARD PO BOX 942857

SACRAM ENTO CA 94257- 0501

With either m ethod, you m ust include a copy of the final federal determ ination, all underly- ing data and schedules that explain or support the federal adjustm ents. Please note that m ost penalties assessed by the IRS also apply under California law. If penalties are included in a paym ent w ith the am ended return, see the instructions for line 19, Penalties and Interest.

C Where to File

Tax Due

If tax is due, and the corporation is not required to use electronic funds transfer (EFT), m ake check or m oney order payable to the Franchise Tax Board. Write the California corporation num ber and ‘’2001 Taxable Year Form 100X’’ on the check or m oney order.

M ail Form 100X w ith the check or m oney order to:

FRANCHISE TAX BOARD PO BOX 942857

SACRAM ENTO CA 94257- 0501

Note: If the corporation m ust pay its tax liability using EFT, all paym ents m ust be rem itted by EFT to avoid penalties. See the instructions for line 28, Am ount Due.

Refund

M ail Form 100X to:

FRANCHISE TAX BOARD PO BOX 942857

SACRAM ENTO CA 94257- 0500

Private Delivery Services

California law conform s to federal law regarding the use of certain designated private deliver y services to m eet the “ tim ely m ailing as tim ely filing/paying” rule for tax returns and paym ents. See federal Form 1120, U.S. Corporation Incom e Tax Return, for a list of designated deliver y ser vices. Private delivery ser vices cannot deliver item s to PO boxes. If using one of these ser vices to m ail any item to the FTB, DO NOT use an FTB PO box. Address the am ended tax return to:

FRANCHISE TAX BOARD

SACRAM ENTO CA 95827

Private M ailbox (PM B) Number

If the corporation leases a PM B from a private business rather than a PO box from the United States Postal Service, include the box num ber in the field labeled “ PM B no.” in the address area.

Specific Line Instructions

Questions

B and C – The corporation m ust report any changes m ade by the IRS that result in additional tax to the FTB w ithin six m onths of the date of the final federal determ ination in the follow ing instances:

•Based on a federal audit;

•Reporting a final federal determ ination; or

•The IRS asked for inform ation to establish the accuracy of specific item s on the federal return and a change w as m ade.

If the IRS changes result in a refund for California, generally the corporation m ust file a claim w ithin tw o years of the IRS final determ ination date.

Be sure to include a com plete copy of the final federal determ ination and all supporting

com putations and schedules, along w ith a schedule of the adjustm ents as applicable to the corporation’s California tax liability. For m ore inform ation, get FTB Pub. 1008, Federal Tax Adjustm ents and Your Notification Responsibilities to California.

D, E, and F – Check the appropriate box to indicate w hether this Form 100X is being filed to am end a Form 100, Form 100W, or

Form 100S.

G – Check the “ Yes” box if this Form 100X is being filed as a protective claim for refund. A protective claim is a claim for refund filed before the expiration of the statute of

lim itations for w hich a determ ination of the claim depends on the resolution of som e other disputed issues, such as pending state or federal litigation or audit.

H – Corporations are not allow ed to elect or term inate a w ater’s- edge election on an am ended return. For inform ation on how to elect or term inate a w ater’s- edge election, get the Form 100- W, Water’s- Edge Booklet.

I and J – If this am ended return is being filed to report an increase or decrease to the prepaid m inim um franchise tax, answ er question I and question J.

Columns (a), (b), and (c)

Column (a) – Enter the am ounts as show n on the original or last previously am ended tax return or, if the tax return w as adjusted or exam ined, enter the am ounts that w ere determ ined by the FTB as a result of the exam ination, w hichever occurred later.

Form 100X 2001 Page 1

Column (b) – Enter the net increase or the net decrease for each line changed. List each change on Side 2, Part V, question 2 and provide an explanation and supporting schedules for each change.

Column (c) – Add any increase in colum n (b) to the am ount in colum n (a) or subtract any decrease in colum n (b) from the am ount in colum n (a) and enter the result in colum n (c) . If there is no change, enter the am ount from colum n (a) in colum n (c) .

Part I Income and Deductions

Line 5 – Net income from Schedule R

If the corporate taxpayer apportions its business incom e to California and there is a net change in the am ount of net business incom e (loss) after state adjustm ents apportioned to the corporate taxpayer, then the corporate taxpayer m ust recom pute and attach Schedule R, Apportionm ent and Allocation of Incom e.

Part II Computation of Tax, Penalties, and Interest

For additional inform ation (such as applicable tax rates or instructions on how to determ ine net operating loss carr yover, alternative

m inim um tax (AM T), excess net passive incom e tax, etc.) refer to Form 100, Form 100W, or Form 100S instructions for the taxable year being am ended.

Line 14 – Alternative minimum tax (AM T)

Note: This applies to Form 100 or Form 100W filers only.

Enter in colum n (b) the net increase or net decrease in AM T betw een the original Schedule P (100), Alternative M inim um Tax and Credit Lim itations – Corporations, or Schedule P (100W), Alternative M inim um Tax and Credit Lim itations – Water’s- Edge Filers, and the am ended Schedule P (100) or Schedule P (100W) . Be sure to attach the am ended Schedule P (100) or

Schedule P (100W) to Form 100X.

Line 17 – Other adjustments to tax

For interest adjustm ents under the “ look- back” m ethod of com pleted long- term contracts, enter the net increase or net decrease in colum n (b) . Be sure to sign the am ended form FTB 3834, Interest Com puta- tion Under the Look- Back M ethod for

Com pleted Long- Term Contracts, and attach it to Form 100X.

Also, enter in colum n (b) the net increase or net decrease of any credit recapture, LIFO recapture, or tax on installm ent sales. For

m ore inform ation, get Form 100, Form 100W, or Form 100S, Schedule J, Add- on Taxes and Recapture of Tax Credits, for taxable years 1991 through 2001 or get Form 100 or

Form 100S instructions for taxable years 1988 through 1990.

Enter the increase or decrease to the $600 prepaym ent m inim um franchise tax for qualified new corporations per California Revenue and Taxation Code Section 23221,

effective for taxable years beginning on or after January 1, 1997, and before Januar y 1, 1999. Enter the increase or decrease to the $300 prepaym ent for taxable years beginning on or after Januar y 1, 1999, and before Januar y 1, 2000. (For corporations incorpo- rating on or after Januar y 1, 2000, there is no prepaym ent.)

Line 19 – Penalties and Interest

Line 19 (a) – In colum n (b) enter the net increase or net decrease of any penalties being reported on the am ended return.

Line 19 (b) – In colum n (b) enter the net increase or net decrease of interest being reported on the am ended return.

Line 19 (c) – In colum n (c) enter the total of line 19 colum n (a) and colum n (b) .

If the corporation does not com pute the interest due, FTB w ill figure any interest due and bill the corporation. Interest accrues on the unpaid tax from the original due date of the return to the date paid. For the applicable interest rates, get FTB Pub. 1138A, Bank and Corporation Billing Inform ation.

Part III Payments and Credits

Enter any paym ents or credits on the appropriate line.

Part IV Amount Due or Refund

Line 28 – Amount due

M ake the check or m oney order payable to the

“Franchise Tax Board” for the am ount show n on line 28. Write the California corporation num ber and taxable year on the check. Attach the check to the front of Form 100X.

Note: A corporation required to pay its taxes through EFT m ust m ake all paym ents by EFT, even if the tax due on the original tax return w as paid by check or m oney order. Indicate w hich taxable year the paym ent should be applied to w hen paying by EFT.

Line 29 – Refund

If the corporation is entitled to a refund larger than the am ount claim ed on the original tax return, line 29 w ill show the am ount of refund. The FTB w ill figure any interest due and w ill include it in the refund. If you are claim ing a refund for interest previously paid, include the interest am ount on line 19.

Part V Explanation of

Changes

Line 1

If the original tax return w as filed using a different Corporation nam e, address, and/or California corporation num ber, enter the nam e, address, and California corporation num ber used on the original tax return on this line.

Line 2

Explain in detail any changes m ade to the

am ounts listed in Side 1, colum n (a) . Include in your explanation the line num ber refer- ences for both the original and am ended tax

returns and any detailed com putations. Include a copy of the federal Form 1120X and schedules if a change w as m ade to the federal return. Include the corporation’s nam e and California corporation num ber on all attachm ents.

Where to Get Tax Forms and Publications

By Internet – You can dow nload, view, and print California bank and corporation tax form s and publications. Go to our Website at:

www. ftb. ca. gov

By phone – To order 2001 business entity tax form s call (800) 338- 0505 and follow the recorded instructions. This ser vice is available to callers w ith touchtone phones from 6 a.m . to 8 p.m ., M onday through Friday except state holidays. Please allow tw o w eeks to receive your order. If you live outside of California, please allow three w eeks to receive your order.

By mail – Write to:

TAX FORM S REQUEST UNIT FRANCHISE TAX BOARD PO BOX 307

RANCHO CORDOVA CA 95741- 0307

General Toll- Free Phone Service

Our general toll- free phone ser vice is available M onday through Friday, from 7 a.m . until

8p.m and from 8 a.m . until 5 p.m . on Saturdays.

Note: We m ay m odify these hours w ithout notice to m eet operational needs.

From w ithin the |

|

|

United States |

(800) |

852- 5711 |

From outside the |

|

|

United States |

(916) |

845- 6500 |

|

(not toll- free) |

|

Assistance for persons with disabilities The FTB com plies w ith the Am ericans w ith Disabilities Act. Persons w ith hearing or speech im pairm ents call:

From voice phone

(California Relay Ser vice) . . . . (800) 735- 2922

From TTY/TDD (Direct line to FTB

custom er service) . . . . . . . . (800) 822- 6268

For all other assistance or

special accom m odations . . (800) 852- 5711

Page 2 Form 100X 2001

Document Specs

| Fact | Description |

|---|---|

| Form Identification | The form is named California Form 100X. |

| Purpose | It is used by corporations to amend a previously filed Form 100, Form 100W, or Form 100S for franchise or income tax returns. |

| Applicable Taxable Years | It applies to amending returns for taxable years beginning on or after January 1, 2000, replacing "income year" references with "taxable year". |

| Statute of Limitations for Claims for Refund | Claims for refund must be filed within four years from the original due date of the tax return, the date the return was filed, or within one year from the date the tax was paid, whichever is later, as per California Revenue and Taxation Code Section 19306. |

| Reporting Federal Adjustments | If the IRS audits and changes a corporation's federal return, these changes must be reported to the California Franchise Tax Board within six months of the final federal determination. |

| Special Instructions for Various Changes | The form details specific line instructions for reporting various changes, including net income, state adjustments, tax computations, penalties, and interest. |

| Mailing Address for Returns | Returns resulting in a refund or no amount due are mailed to FRANCHISE TAX BOARD PO BOX 942857 SACRAMENTO CA 94257-0500. Returns resulting in an amount due are mailed to a different PO Box within the same facility. |

Detailed Instructions for Writing California 100X

Filing an amended California Corporation Franchise or Income Tax Return, also known as Form 100X, is a procedure that corporations must follow to correct or update information on a previously filed Form 100, Form 100W, or Form 100S. This could be necessary for various reasons, including reporting additional income, changing deductions, or correcting information. Preparing and submitting this form correctly is crucial to ensure compliance with tax laws and to accurately report the corporation's tax obligations. Below is a straightforward guide to assist you in completing the Form 100X.

- Start by entering the tax year and dates for the fiscal year being amended at the top of the form.

- Provide the California corporation number and the federal employer identification number (FEIN).

- Answer whether this amended return is based on a final federal determination by ticking "Yes" or "No". If "Yes," provide the final federal determination date(s).

- Fill out the corporation name, address, and if applicable, PMB number.

- Indicate by checking the appropriate box if this return is an amended Form 100, Form 100W, or Form 100S.

- State whether the return includes a protective claim by checking "Yes" or "No."

- Answer whether the corporation’s original return was filed pursuant to a water’s-edge election.

- For the questions section, respond to each item regarding IRS amendments, stock ownership, gross receipts, etc., with a "Yes" or "No."

- In Part I - Income and Deductions, report the originally reported or adjusted amounts, the net changes, and the corrected amounts for net income (loss), additions, deductions, and net income after state adjustments.

- Complete Part II - Computation of Tax, Penalties, and Interest based on the adjustments made in Part I.

- In Part III - Payments and Credits, list all payments and credits made towards the tax year being amended.

- Determine the amount due or refund in Part IV.

- Provide detailed explanations for changes made in Part V - Explanation of Changes. Include the corporation name and number used on the original return if different and explain the adjustments to income, deductions, tax computations, and payments/credits.

- Sign and date the form. If a paid preparer completed the form, their information must also be included.

- Review the form instructions for the appropriate mailing address. If you owe additional tax, send the form and payment to one address; if you are due a refund or there is no amount due, use a different address.

After submitting your Form 100X, it’s important to monitor your corporation’s account for updates regarding the processing of the amended return. Adjustments made on the amended return can result in changes to your tax liability, potential refunds, or additional assessments.

Things to Know About This Form

What is Form 100X?

Form 100X is an amended tax return used by corporations operating in California to correct or update their previously filed Form 100, 100W, or 100S tax returns. This form enables corporations to adjust figures, claim refunds for overpaid taxes, or report additional income or tax liabilities based on new information or after federal adjustments.

When should a corporation file Form 100X?

A corporation should file Form 100X after their original tax return has been submitted and when they need to make amendments to their tax report. This includes situations such as changes in income, deduction errors, or following an IRS adjustment that affects their state tax liability. The form must be filed within specific time limits to ensure eligibility for any applicable refunds or to meet reporting requirements for additional taxes owed.

How does a corporation file Form 100X and what are the deadlines for filing?

Filing Form 100X involves completing the form with accurate changes from the original tax return, attaching all required documentation, and mailing it to the appropriate address depending on whether there's a balance due or a refund. The deadlines for filing are contingent upon various conditions:

- If seeking a refund, file within four years from the original tax return's due date or one year from the tax payment date, whichever is later.

- If reporting additional taxes owed due to IRS adjustments, file within six months of the final federal determination.

- All filings should consider the original due date of the tax return as their starting point for deadline calculations.

What are the specific parts of Form 100X and what information is needed?

Form 100X is divided into sections that guide the corporation through amending their prior tax return:

- Part I - Income and Deductions: Here, you report the original amounts, the changes, and the corrected totals.

- Part II - Computation of Tax, Penalties, and Interest: This section adjusts the tax calculation based on the income and deductions reported in Part I. If applicable, it includes adjustments to penalties and interest.

- Part III - Payments and Credits: Any tax payments or credits originally reported and any amendments to them are detailed here.

- Part IV - Amount Due or Refund: This calculates whether the corporation owes additional tax or is due for a refund based on the corrections made.

- Part V - Explanation of Changes: A detailed explanation of each change being reported, including corresponding documentation or schedules, is required here to support the amendment.

Thorough documentation and explanations are crucial for quick processing and acceptance of the amended return.

Common mistakes

Not accurately reporting the change in net income (loss) before state adjustments, both originally reported/adjusted and after amendments. This error can significantly impact the overall tax calculation on the form.

Failing to correctly calculate and report the net change in income, additions, or deductions. Often, errors here are due to incorrect arithmetic or misunderstanding what qualifies for these changes.

Omitting necessary explanations for changes to Part I, Part II, Part III, and Part IV in the Explanation of Changes section. Comprehensive details are crucial for the clarity and justification of the amendments made.

Incorrectly reporting or failing to update estimated tax payments, including overpayments from prior years allowed as a credit. This mistake can lead to an inaccurate calculation of the amount due or refund.

Not including all relevant and supporting forms, schedules, and federal adjustments when changes are based on final federal determinations. Without this documentation, the state cannot verify the amendments, leading to processing delays.

Overlooking the need to recalculate net income for state purposes, especially when there are changes in apportionment factors or in the net operating loss carryover deductions. This oversight can significantly alter the tax obligation.

Misunderstanding the amended return's impact on tax credits, including not accurately recalculating the tax after credits or not correctly adjusting net passive income tax for S corporations. This confusion often results in miscalculated tax liabilities.

Not providing a detailed explanation of changes or the specific reasons behind those changes as required in Part V. An insufficient explanation can hinder the processing of the amended return and potentially lead to an audit.

Documents used along the form

When navigating the complexities of tax adjustments, businesses often find themselves managing various forms and documents beyond the California Form 100X, especially when amending a corporation franchise or income tax return. Understanding these additional forms and their purposes can significantly streamline the amendment process, ensuring businesses stay compliant while efficiently managing their tax obligations.

- Form 100 or Form 100W: These are the original tax return forms for California corporations. Form 100 is for all corporations except those electing to be S corporations, while Form 100W is for water's-edge filers. These forms provide the initial information that may be corrected with the 100X amendment.

- Form 100S: This form is filed by S corporations operating in California. It reports income, deductions, and credits of the S corporation. If a Form 100X amends a previously filed Form 100S, reviewing the original 100S submission is crucial to ensure accuracy in the amendment.

- Schedule R: This schedule is attached to the Form 100 or 100W to apportion income to California. If an amended return results from changes to apportioned income, it is essential to include a revised Schedule R with the Form 100X submission.

- FTB 3560: The Election or Termination/Revocation of S Corporation Status form is vital if the amendment on Form 100X relates to changing the entity's tax status. Although not directly amended by Form 100X, changes in status could necessitate adjustments on the Form 100X.

- Form W-7P: While indirectly related, if a tax preparer is involved in filing the amendment and they have elected to use a Preparer Tax Identification Number (PTIN) instead of their Social Security Number, the W-7P form application for PTIN may be relevant.

Properly identifying and utilizing these documents in conjunction with the California Form 100X can effectively ensure that a corporation's amended tax return is accurate and comprehensive. Through a careful review of the original filings and potential corrections or updates, corporations can navigate the amendment process more confidently, ensuring that all adjustments are accurately reflected and reported to the California Franchise Tax Board.

Similar forms

The California 100X Form, an amended corporation franchise or income tax return, bears similarities to other forms used across various states for correcting or updating previously filed tax returns. Comparable in functionality, these documents serve for amendments in their respective jurisdictions or contexts, echoing the purpose of the 100X Form.

Similar to the California 100X Form, the IRS Form 1040X is used by individuals to amend previously filed income tax returns. While the 100X targets corporate entities within California, addressing corrections to franchise or income taxes, the 1040X caters to individual taxpayers nationwide who seek to update their federal income tax submissions. Both forms require detailed explanations of the amendments and supporting documentation, reflecting changes in income, deductions, credits, or tax liability.

Another counterpart is the New York State Form CT-1X, an amended corporation tax return. Like California's 100X, the CT-1X is designed for corporations to amend a previously filed tax return. Though specific to New York State, it similarly allows corporations to adjust figures related to income, deductions, and tax credits, ensuring accurate tax obligations are met. This similarity underlines the universal need for entities to correct or update tax filings in response to errors or changed circumstances.

Similarly, the Texas Franchise Tax Report Amendments form functions akin to the 100X, albeit within Texas. It's used by businesses to make changes to a previously filed franchise tax report. Both the California 100X and the Texas amendment form recognize the importance of accurate financial reporting and tax compliance, providing a mechanism for businesses to rectify previous submissions, adjust tax liabilities, and, if applicable, claim refunds.

On a federal level, the IRS Form 1120X serves a similar purpose for corporations seeking to amend their U.S. Corporation Income Tax Return. Like the California 100X, the 1120X accommodates changes to a corporation's income, deductions, and credits, highlighting the continuity of tax amendment processes across different tax jurisdictions. The IRS form underscores the necessity for corporate entities to maintain accurate and current tax records, mirroring the objectives of state-specific forms like California's 100X.

Lastly, the Michigan Corporate Income Tax Amended Return, Form 4898, parallels the California 100X form in its purpose and utility. Dedicated to amending corporate income taxes within Michigan, it shares the fundamental goal of rectifying or updating prior tax filings. This form, along with others mentioned, underscores a common theme across tax administration: providing entities with a structured approach to ensure tax compliance through the submission of corrected or updated information.

Dos and Don'ts

When filling out the California 100X form, it's important to keep in mind a mix of dos and don'ts to ensure the process is smooth and your amended return is accurately processed. Here's a comprehensive list to guide you through:

- Do ensure the original return has been filed before you attempt to file a Form 100X.

- Don't delay filing Form 100X if you discover errors on your originally filed return. Timely filing can help avoid potential penalties and interest.

- Do double-check that all entries on Form 100X match the amendments you intend to make, specifically comparing the numbers in columns (a) and (c) for accuracy.

- Don't forget to explain each change made on the amended return. Use Part V of the form to provide a detailed explanation for each amendment, including any pertinent calculations.

- Do attach all necessary documentation to support your amendments, such as revised schedules or federal adjustments if your federal tax return was amended.

- Don't overlook the opportunity to correct addresses, names, or other basic information if there were changes or errors in the original filing.

- Do use the correct mailing address based on whether your Form 100X results in a tax due, refund, or no amount due to ensure smooth processing.

- Don't include sensitive personal information unnecessarily in your explanations or attachments to safeguard against identity theft.

- Do sign and date the amended return. An unsigned return can cause delays and may be considered invalid.

By following these guidelines, you can help ensure that your amended California corporate tax return is complete, accurate, and processed efficiently.

Misconceptions

There are several common misconceptions regarding the California Form 100X, which is the Amended Corporation Franchise or Income Tax Return form. These misunderstandings can lead to confusion or incorrect filing. Here, five of these misconceptions are clarified:

- Misconception 1: Form 100X is only for correcting mistakes.

While one primary purpose of Form 100X is indeed to correct errors or omissions on a previously filed Form 100, 100W, or 100S, it is also used to report adjustments following an audit by the IRS or changes in federal tax liability that affect state tax liability. Additionally, it serves as a means to claim a refund or report a protective claim. - Misconception 2: Filing Form 100X automatically triggers an audit.

Filing an amended return does not necessarily increase the chances of an audit. Form 100X is a standard procedure for making corrections or adjustments. While it is true that the information provided will be scrutinized to ensure accuracy, the act of filing an amended return is not, in itself, a red flag for audit selection. - Misconception 3: You can file Form 100X to change the corporation's filing status.

Form 100X is not used to change a corporation’s filing status from, for example, a C corporation to an S corporation. To change corporate status, a separate process involving Form FTB 3560 (S Corporation Election or Termination/Revocation) is required. - Misconception 4: There is no deadline for filing Form 100X.

Corporations must adhere to specific time frames when filing an amended return to claim a refund. Generally, a claim must be filed within four years from the original due date of the return, the date the return was filed, or within one year from the date the tax was paid, whichever is later. - Misconception 5: Form 100X can be used to elect or terminate a water’s-edge election.

A water’s-edge election cannot be made or terminated using Form 100X. The form explicitly states that it should not be used for this purpose. Electing or terminating a water’s-edge election requires following the procedure outlined in the Form 100W booklet.

Understanding these aspects of Form 100X can help ensure that the form is used correctly and efficiently, facilitating accurate reporting and compliance with California tax laws.

Key takeaways

Filling out and submitting the California 100X form is a critical process for corporations looking to amend a previously filed tax return. This document serves to correct or update any aspect of the original filing and can impact the corporation's tax liabilities or refund status. Understanding the nuances of this form can ensure accuracy and compliance. Here are five key takeaways to keep in mind:

- The California 100X form is specifically designed for amending previously filed tax returns for corporations, which includes a variety of entities like S corporations, limited liability companies (LLCs) classified as corporations, and more. It's important to use this form to correct any information or adjust tax liabilities based on new information or changes after the original return was submitted.

- Corporations must file the 100X form only after their original tax return has been filed. There's a statute of limitations for filing a claim for a refund, which is typically four years from the original due date of the tax return, or one year from the date the tax was paid, whichever is later. This deadline is crucial to uphold to ensure eligibility for any potential refunds.

- It's imperative to report any adjustments or changes made by the Internal Revenue Service (IRS) to the Franchise Tax Board (FTB) within six months of the final federal determination. This includes providing a complete copy of the final federal determination along with any supporting computations and schedules. Following these requirements helps maintain state tax compliance and ensures accurate tax liabilities.

- Amendments on the 100X form encompass a wide array of changes, from income and deductions to tax credits and payments. Each section of the form provides space to list originally reported amounts, net changes, and the corrected amounts. Documenting these changes accurately ensures the amendment process reflects the latest and most accurate financial picture of the corporation.

- The correct mailing address for the 100X form depends on whether the amendment results in a tax due or a refund. If tax is owed, the form and payment should be directed to one address, while forms that result in a refund or no amount due have a different submission address. Utilizing the correct address expedites processing and ensures proper handling of the corporation's amended return.

By paying careful attention to these details, corporations can successfully navigate the amendment process with the California 100X form, ensuring their tax responsibilities are met correctly and efficiently.

Discover More PDFs

Ca Cosmetology License Lookup - The form includes a section for applicants to indicate a change of address, enhancing the Board's ability to maintain accurate records.

Grand Parents Rights - Incorporates legal provisions for grandparents whose grandchildren have been adopted by a stepparent.