Blank California 100 We PDF Form

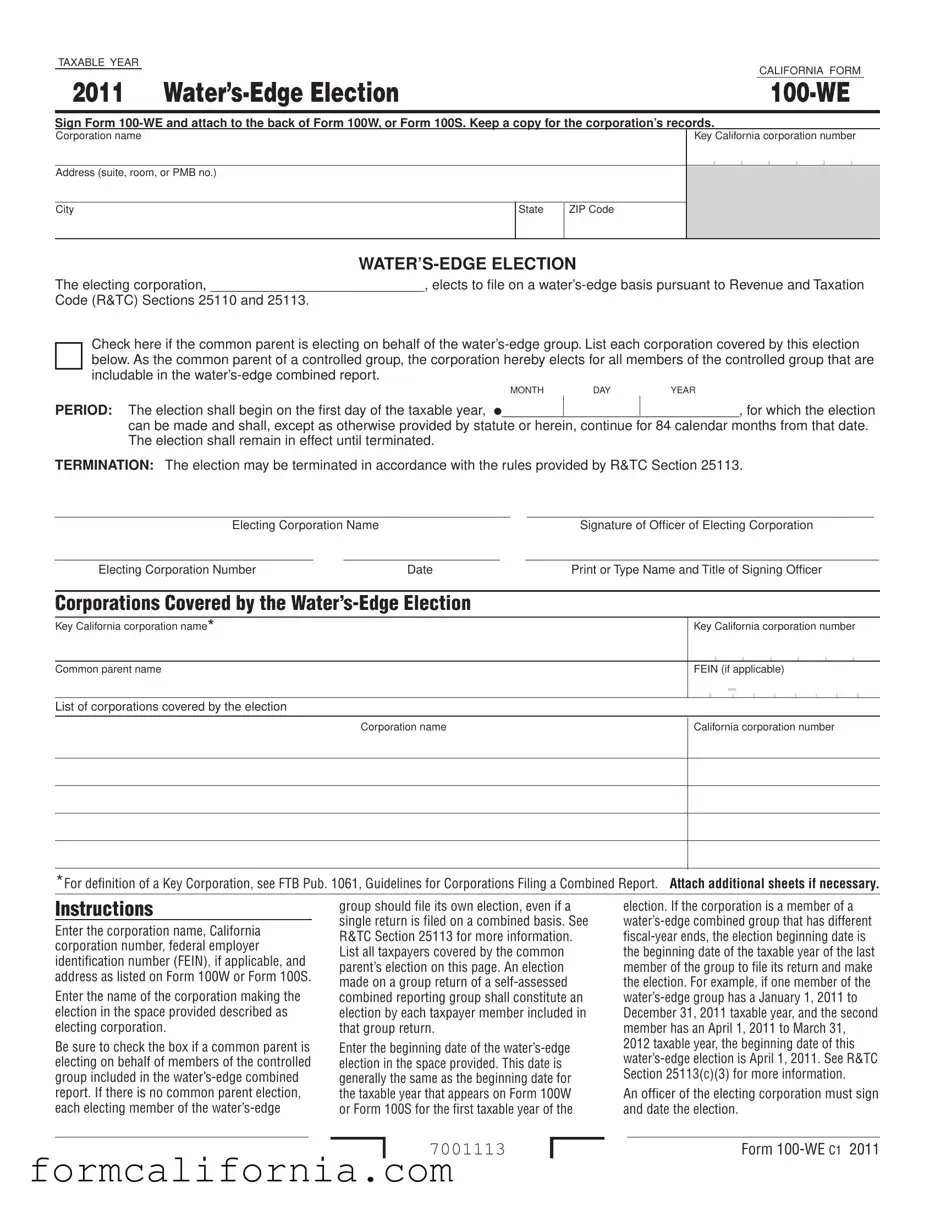

In the intricate landscape of corporate taxation in California, understanding and navigating tax forms is paramount for compliance and strategic financial planning. Among these forms, the California Form 100-WE, known for its role in the Water’s-Edge Election, stands out for its critical use by corporations choosing to adopt a water’s-edge method of income reporting. This election allows a corporation, or a common parent of a controlled group, to limit its taxable income to the income from sources within the United States, thereby potentially reducing its overall tax liability. The electing corporation signifies its decision through Form 100-WE, which must be attached to either Form 100W or Form 100S, with a comprehensive list of each corporation covered by this election. It marks the beginning of a substantial commitment, as the election spans 84 calendar months and sets the tone for how these entities will approach their tax responsibilities. Furthermore, the form details provisions for termination in accordance with the Revenue and Taxation Code (R&TC) Sections, thereby offering guidelines for altering the election. It is vital for corporate entities to meticulously fill out this form, ensuring all information is accurate—from the corporation name and number to the list of all taxpayers under the common parent’s election—since any discrepancies could impact the validity of the election or its perceived benefits.

Document Preview Example

TAXABLE YEAR

|

|

CALIFORNIA FORM |

|

|

|

2011 |

||

|

|

|

Sign Form

Corporation name

Key California corporation number

Address (suite, room, or PMB no.)

City

State

ZIP Code

The electing corporation, ____________________________, elects to file on a

Code (R&TC) Sections 25110 and 25113.

Check here if the common parent is electing on behalf of the

MONTHDAYYEAR

PERIOD: The election shall begin on the first day of the taxable year, I_______________________________, for which the election

can be made and shall, except as otherwise provided by statute or herein, continue for 84 calendar months from that date. The election shall remain in effect until terminated.

TERMINATION: The election may be terminated in accordance with the rules provided by R&TC Section 25113.

___________________________________________________________________ |

___________________________________________________ |

|

Electing Corporation Name |

Signature of Officer of Electing Corporation |

|

______________________________________ |

_______________________ |

____________________________________________________ |

Electing Corporation Number |

Date |

Print or Type Name and Title of Signing Officer |

Corporations Covered by the

Key California corporation name*

Key California corporation number

Common parent name

FEIN (if applicable)

List of corporations covered by the election

Corporation name

California corporation number

*For definition of a Key Corporation, see FTB Pub. 1061, Guidelines for Corporations Filing a Combined Report. Attach additional sheets if necessary.

Instructions

Enter the corporation name, California corporation number, federal employer identification number (FEIN), if applicable, and address as listed on Form 100W or Form 100S.

Enter the name of the corporation making the election in the space provided described as electing corporation.

Be sure to check the box if a common parent is electing on behalf of members of the controlled group included in the

group should file its own election, even if a single return is filed on a combined basis. See R&TC Section 25113 for more information. List all taxpayers covered by the common parent’s election on this page. An election made on a group return of a

Enter the beginning date of the

election. If the corporation is a member of a

2012 taxable year, the beginning date of this

An officer of the electing corporation must sign and date the election.

7001113

Form

Document Specs

| 1 | The California Form 100-WE is used for the Water's-Edge Election. |

| 2 | This form must be signed and attached to the back of Form 100W or Form 100S. |

| 3 | The election allows a corporation to file on a water’s-edge basis, as per Revenue and Taxation Code Sections 25110 and 25113. |

| 4 | The election begins on the first day of the taxable year for which it can be made and continues for 84 calendar months. |

| 5 | Termination of the election must comply with the rules provided by R&TC Section 25113. |

| 6 | If a common parent is electing on behalf of the water's-edge group, a checkbox on the form should be marked accordingly. |

| 7 | Corporations covered by this election are to list key California corporation name and number, common parent name, and FEIN if applicable. |

| 8 | The form requires the signature of an officer of the electing corporation, along with the corporation name, number, and the signing officer’s title. |

Detailed Instructions for Writing California 100 We

Once you've decided to make a water's-edge election for your corporation in California, filling out Form 100-WE is a crucial step. This form accompanies either Form 100W or Form 100S and signals your election to the state. It's a straightforward process but requires attention to detail to ensure accuracy and compliance. Here’s how you can complete this form.

- Begin by entering the full and official Corporation name at the top of Form 100-WE where indicated.

- Right after the corporation name, fill in the Key California corporation number. This number is crucial for identification and tracking purposes.

- Provide the complete Address of the corporation, including suite, room, or PMB number.

- Enter the City, State, and ZIP Code related to the corporation's address to ensure accurate and timely communication.

- In the section titled "WATER’S-EDGE ELECTION," fill in the name of the electing corporation again in the space provided.

- If a common parent is making the election on behalf of the water's-edge group, make sure to check the specified box to indicate this.

- Under the list to List each corporation covered by this election, provide the names and key California corporation numbers for all entities included under this election. If necessary, attach additional sheets following the same format provided.

- For the PERIOD section, enter the starting date of the election. This date should correspond to the first day of the taxable year for which the election becomes effective and will continue for 84 months unless terminated according to provisions.

- Under TERMINATION, understand that this election may be terminated based on specific rules laid out in R&TC Section 25113, though no immediate action is required in this section upon initial filing.

- An officer of the electing corporation must sign at the bottom of the form, providing their signature, date, and printed name and title. This verifies that the information provided is accurate and that the corporation elects to file on a water's-edge basis.

After completing Form 100-WE, attach it to the back of Form 100W or Form 100S when you file those forms. Keeping a copy for your corporation’s records is also advised. This completes the process of electing for the water's-edge filing basis. Make sure to review all entries for accuracy before submission to avoid any processing delays or issues.

Things to Know About This Form

What is the California Form 100-WE?

The California Form 100-WE, also known as the Water's-Edge Election, is a document used by corporations to elect to be taxed on a water's-edge basis. This means they choose to have their California income tax calculated based on the income of their domestic and certain foreign subsidiaries rather than their worldwide income. This election is pursuant to Revenue and Taxation Code (R&TC) Sections 25110 and 25113. Companies attach Form 100-WE to the back of Form 100W, or Form 100S, as applicable.

Who needs to file Form 100-WE?

Corporations that wish to make a water's-edge election in California must file Form 100-WE. This includes any member of a controlled group that is includable in the water's-edge combined report. If there is a common parent of the group, it can make the election on behalf of all the eligible group members. Otherwise, each eligible corporation must file its own election.

How do you make a water’s-edge election?

To make a water's-edge election, the electing corporation must fill out Form 100-WE, including the corporation name, California corporation number, and address, as well as the election commencement date. It is important to indicate whether the election is being made by a common parent on behalf of the controlled group. All corporations covered by this election need to be listed on the form. An officer of the electing corporation must sign and date the form, confirming the election.

When does the water’s-edge election start and how long does it last?

The election starts on the first day of the taxable year for which the election is made. It continues for 84 calendar months from that date, equating to seven years. The commencement date is generally the same as the beginning date for the taxable year listed on Form 100W or Form 100S for the first taxable year of the election. If members of the water’s-edge combined group have different fiscal-year ends, the commencement date is the beginning date of the taxable year of the last member to file its return and make the election.

Can the water's-edge election be terminated early?

Yes, the water's-edge election may be terminated before the end of the seven-year period in accordance with the rules provided by R&TC Section 25113. Termination rules allow for some flexibility but must be carefully adhered to in order to avoid unintended tax consequences or penalties.

What are the key considerations for making a water’s-edge election?

Before making a water's-edge election, corporations should consider several key factors:

- The potential tax benefits and implications of electing to be taxed on a water's-edge basis versus a worldwide basis.

- The administrative responsibilities, including record-keeping and compliance associated with making and maintaining the election.

- The duration of the election and the conditions under which it may be terminated or renewed.

Common mistakes

Filling out the California Form 100-WE, known as the Water’s-Edge Election form, requires careful attention to detail to avoid common mistakes. Here are five frequent errors made by filers:

- Incorrect Corporation Details: One of the most common mistakes is entering incorrect information for the corporation's name, California corporation number, or the Federal Employer Identification Number (FEIN). This data must match exactly what is registered with the state and the IRS.

- Failing to Check the Common Parent Box: For corporations that are part of a controlled group, overlooking the checkbox for the common parent election is a frequent error. If a common parent is making the election for the group, this box must be checked to indicate the election is made on behalf of all eligible members within the water’s-edge group.

- Omitting Member List: Another mistake is not listing all corporations covered by the common parent’s election. It is essential to include the names and California corporation numbers of all members covered by this election to ensure the election is properly applied to each member of the water's-edge group.

- Incorrect Election Period: Filers often enter the wrong beginning date for the water’s-edge election period. This date should be the first day of the taxable year for which the election is effective. If members of the water’s-edge group have different fiscal year ends, the election should begin on the first day of the taxable year for the last member to file.

- Signature Errors: Failing to have the form signed and dated by an officer of the electing corporation is a critical yet common oversight. The election is not valid without the proper authorization, signature, and date from an officer vested with the requisite authority.

To ensure the successful filing of Form 100-WE, attention to these details is crucial. Each of these mistakes can lead to delays or even the rejection of the election, impacting the corporation's tax filing status and liabilities.

Documents used along the form

When corporations operate across borders, understanding and properly handling required documentation becomes crucial to comply with local regulations. In California, the Form 100-WE represents a vital piece of this puzzle for corporations choosing to elect the water's-edge basis of taxation. This tax option allows multinational corporations to limit their California taxable income to the income from their U.S. operations and those from any "water's-edge." Beyond Form 100-WE, managing a corporation’s tax obligations often involves a suite of additional forms and documents, each playing its unique role in the complex tapestry of corporate taxation.

- Form 100W - Also known as the California Corporation Franchise or Income Tax Return — Water’s-Edge Filers, this form is the primary tax return for corporations that have elected the water's-edge option. It helps calculate the income tax based on the corporation's income derived from its operations within and closely connected to the United States. Corporations attach Form 100-WE to the back of this form as a declaration of their election.

- Form 100S - This form is dedicated to S Corporations filing in California. Similar to Form 100W, it's used by entities that have made the S election under federal tax law, allowing income to pass through to shareholders. For those S Corporations electing the water’s-edge taxation method, Form 100-WE accompanies Form 100S to indicate this choice.

- Form FTB 3539 - Payment Voucher for Automatic Extension for Corporations and Exempt Organizations, is often filed alongside Form 100-WE as it allows corporations more time to file their income tax returns. The voucher is used to make a payment of estimated tax due, ensuring compliance and avoiding penalties as the more detailed paperwork is finalized.

- FTB Pub. 1061 - Guidelines for Corporations Filing a Combined Report provides an extensive overview of the rules, regulations, and processes for corporations that are part of a combined reporting group opting for the water’s-edge election. This publication helps to clarify which entities should be included in the combined report, how to apportion income, and other nuances, especially beneficial for corporations covered by the water’s-edge election indicated in Form 100-WE.

To navigate the intricate requirements of the California tax system for corporations, it is essential to comprehend the purpose and use of these forms and documents. Each serves a specific function, from detailing tax obligations on a water’s-edge basis to ensuring adherence to payment deadlines. Accurate completion and timely submission of these documents ensure corporations maintain good standing, leverage beneficial tax options, and avoid penalties. As such, understanding the synergy between Form 100-WE and its accompanying forms and guidelines is paramount for any corporation engaged in multinational operations and subject to California's tax jurisdiction.

Similar forms

The California Form 100-S, which is used for S Corporations to file their state income tax returns, shares similarities with the California Form 100-WE in terms of its administrative aspects. Both forms necessitate detailed corporate information and are integral parts of a corporation’s tax-reporting obligations within the state. While the Form 100-WE focuses on electing a water’s-edge basis for taxation, the Form 100-S deals with the regular income taxation for S Corporations. Both require careful attention to the tax year and corporate details, ensuring compliance with California’s Revenue and Taxation Code.

Form 100W, the California Corporation Franchise or Income Tax Return — Water’s-Edge Filers, is directly associated with Form 100-WE, as it is the primary tax return for corporations opting for the water’s-edge method of taxation. The necessity to attach Form 100-WE to the back of Form 100W underscores their connectivity. Both forms work in tandem to complete the water’s-edge election process and fulfill the corporation's tax obligations under this specific filing status, aiming to accurately report and tax income attributed to California sources.

Similarly, the standard California Form 100, for C Corporations filing their income tax returns, parallels Form 100-WE in providing a structured approach to tax reporting and compliance. While Form 100 addresses the broad scope of corporate income taxation, the 100-WE delves into the specialized election for a water’s-edge tax basis. Both forms are essential to navigating the complexities of California's tax environment, ensuring corporations meet regulatory requirements specific to their operational structures and chosen tax strategies.

Form 568, Limited Liability Company Return of Income, shares a conceptual framework with Form 100-WE by offering a specialized tax filing avenue for a different entity type, in this case, LLCs. Like the 100-WE allows corporations to opt into a specific tax regime, Form 568 accommodates the unique tax considerations for California LLCs. Although serving different entities, both highlight California’s tailored approach to tax filing, offering entity-specific forms to address varied taxation methodologies.

The California Form 565, Partnership Return of Income, also aligns with the Form 100-WE by facilitating a specialized tax filing process, catering to partnerships. Despite the difference in entity type and specific tax treatment, both forms represent the need for detailed financial and organizational information to comply with state tax laws. Each form underscores the importance of transparency and accuracy in reporting income derived within California, albeit for distinct entity types.

Moreover, the Delegation of Authority Form (FTB 3520) parallels the elective essence of Form 100-WE, as it allows for the delegation of certain tax responsibilities and powers. Though FTB 3520 is more procedural, allowing entities to authorize individuals or third parties to conduct tax-related matters on their behalf, it shares with Form 100-WE the concept of electing to streamline tax affairs in a manner that best suits the filing entities’ operational preferences.

Form 109, California Exempt Organization Business Income Tax Return, though catering to tax-exempt organizations, reflects the specificity and focused approach seen in Form 100-WE. Both documents cater to specific segments of tax filers, requiring detailed income and organizational information to ensure compliance with state tax laws and regulations tailored to the filer’s tax status or election.

The California Estimated Tax for Corporations Form (Form 100-ES) offers a preparatory step towards tax compliance, akin to how Form 100-WE prepares a corporation for its water’s-edge election. While Form 100-ES deals with estimating and paying taxes throughout the year, its purpose in facilitating tax compliance and planning parallels the elective and preparatory nature of Form 100-WE in electing a specific tax treatment regime.

Another comparable document is the California Articles of Incorporation, which, while not a tax form, is integral to establishing a corporation’s legal and operational foundation within the state. The elective nature of Form 100-WE, in choosing a specific tax regime, mirrors the foundational decisions made during incorporation, such as the choice of corporate name, purpose, and structure, which have long-term legal and tax implications.

Finally, the Statement of Information (Form SI-550), required annually for most corporations, shares with Form 100-WE the need for updated corporate information, ensuring ongoing compliance with California’s regulatory environment. Though Form SI-550 is more focused on current operational data, and Form 100-WE on a specific tax election, both emphasize the importance of maintaining current and accurate records within the state’s regulatory framework.

Dos and Don'ts

When completing the California Form 100-WE for the Water’s-Edge Election, understanding the correct steps to follow and pitfalls to avoid is essential. In order to ensure the process is handled efficiently and accurately, here are several do’s and don’ts:

- Do ensure that the corporation name, California corporation number, and address entered on Form 100-WE match those on Form 100W or Form 100S.

- Do check the box if a common parent is making the election on behalf of the water’s-edge group. Providing clear indication of this is crucial for the election to be processed correctly.

- Do list all taxpayers covered by the common parent’s election accurately. Including all relevant corporations in this section is essential for a comprehensive election.

- Do accurately enter the beginning date of the Water’s-Edge Election, ensuring it matches the beginning date of the taxable year shown on Form 100W or Form 100S.

- Do sign and date the election form. An officer of the electing corporation must do this to validate the election.

- Don’t forget to attach the form to the back of Form 100W or Form 100S when submitting. Keeping a copy for the corporation’s records is also recommended.

- Don’t overlook the requirement to attach additional sheets if the space provided is insufficient to list all corporations covered by the election. Ensuring every entity is accounted for is critical.

Attention to these guidelines is important for the successful filing of the California Form 100-WE. Verification of all information and adherence to the specific requirements of the Water’s-Edge Election procedure will help prevent processing delays or issues with the election status.

Misconceptions

When it comes to understanding the nuances of the California Form 100-WE, commonly known as the Water's-Edge Election, several misconceptions can lead businesses astray. Clearing up these misunderstandings is key to ensuring that corporations navigate their tax obligations correctly. Here, we debunk some of the most common misconceptions surrounding this form.

All corporations must file Form 100-WE. In reality, only those electing to file on a water's-edge basis are required to complete this form. This election is optional and tailored for certain corporations that meet specific criteria under the Revenue and Taxation Code (R&TC) Sections 25110 and 25113.

Form 100-WE is a standalone document. However, it must be attached to the back of Form 100W or Form 100S and is not processed independently. Keeping a copy for the corporation’s records is also crucial for compliance and future reference.

Any corporation can elect on a water's-edge basis at any time. The election must begin on the first day of the taxable year for which the election is made and, except in specific circumstances, continues for 84 calendar months from that date.

The election automatically renews. This is incorrect. The water's-edge election remains in effect until actively terminated in accordance with the rules provided by R&TC Section 25113.

Termination of the election can happen at any time without stipulation. Contrary to this belief, terminating the water's-edge election must be done following specific rules and procedures outlined by the R&TC Section 25113.

A common parent is required to elect on behalf of the water's-edge group. While a common parent can elect for all eligible members of a controlled group, it's not mandatory. If there is no common parent election, each electing member of the water's-edge group should file its own election.

The list of corporations covered by the election is optional. It is mandatory to list each corporation covered by this election on Form 100-WE. This includes providing the key California corporation name, California corporation number, and other relevant details.

Filing the election affects only state tax obligations. While primarily affecting California state taxes, the election to file on a water's-edge basis can have broader implications for how a corporation handles its overall tax strategy and compliance with federal and other state tax laws.

Once elected, the terms of the election cannot change. The start date of the election usually aligns with the beginning of the taxable year shown on Form 100W or Form 100S for the first taxable year of the election. However, if members of the water's-edge group have different fiscal-year ends, the election start date may vary, indicating that terms can indeed adjust based on specific group circumstances.

Clearing up these misconceptions around the California Form 100-WE can help corporations make informed decisions about their taxes. With this accurate understanding, businesses can better navigate their financial and regulatory responsibilities within the state of California.

Key takeaways

Filling out and using the California Form 100-WE is crucial for corporations electing to file on a water’s-edge basis. The process involves specific steps and understanding the form's requirements is essential for compliance and to ensure the benefits of this election are fully realized. Here are six key takeaways:

- The electing corporation or the common parent on behalf of the controlled group must sign and attach Form 100-WE to the back of Form 100W or Form 100S, keeping a copy for the corporation’s records.

- Identification: It is mandatory to provide the corporation name, California corporation number, and address as they appear on Form 100W or Form 100S. If applicable, include the federal employer identification number (FEIN).

- Election Details: Clearly identify the corporation making the election by entering its name in the designated space on the form. If a common parent is making the election for a water’s-edge group, ensure to check the corresponding box.

- Listing Corporations: All taxpayers covered by the common parent’s election must be listed on the form. Include each corporation’s name and California corporation number.

- The beginning date of the water’s-edge election is the same as the start date of the taxable year indicated on Form 100W or Form 100S for the first taxable year of the election. If members of the water’s-edge group have different fiscal-year ends, the election starts on the first day of the taxable year of the last member to file its return and make the election.

- An officer of the electing corporation must sign and date the election, certifying the decision to file on a water’s-edge basis under the Revenue and Taxation Code (R&TC) Sections 25110 and 25113.

This overview should serve as a guideline to ensure that the Form 100-WE is filled out accurately and in accordance with the specific requirements of the California Revenue and Taxation Code. It's crucial for corporations to adhere to these guidelines to ensure the legality and validity of their water’s-edge election.

Discover More PDFs

3521 - It includes a section for entering credits from passive activities and calculating the total available credit.

California 3528 A - A required step for homebuyers aiming to capitalize on tax credits for purchasing new, never-before-lived-in properties in California.

California Forms - A legal tool for adjusting the amount of child, spousal, or family support directly taken from wages.