Blank Ca Rrf 1 PDF Form

In today's rapidly evolving nonprofit sector, the importance of compliance and transparency cannot be overstated. Within the jurisdiction of California, one critical piece of the compliance puzzle is the annual submission of Form RRF-1 to the Attorney General's Registry of Charitable Trusts. This document, officially known as the Annual Registration Renewal Fee Report, serves multiple key functions. Firstly, it plays a pivotal role in the early detection of fiscal mismanagement and the unlawful diversion of charitable assets, thus safeguarding the integrity of charitable contributions. All qualifying charitable entities, including nonprofit corporations and unincorporated associations holding assets for charitable purposes, must file this form not just as a matter of regulatory obligation but as a testament to their commitment to fiscal responsibility and organizational accountability. The form requires detailed disclosures about financial transactions, including any dealings between the organization and its directors, officers, or trustees, as well as information on program expenses, assets, and total revenue. Furthermore, its structured fee schedule ensures that the fee burden is proportionate to the size of the organization, thereby maintaining fairness across the board. The comprehensive nature of the RRF-1, including mandatory disclosures on the use of commercial fundraisers and the receipt of government funding, underscores the depth of scrutiny applied to charitable trusts in California. However, beyond mere regulatory compliance, the RRF-1 and its associated documents offer charities a structured opportunity to reflect on their operations, financial health, and overall mission alignment, thereby playing a crucial role in the ongoing vitality and efficacy of the nonprofit sector.

Document Preview Example

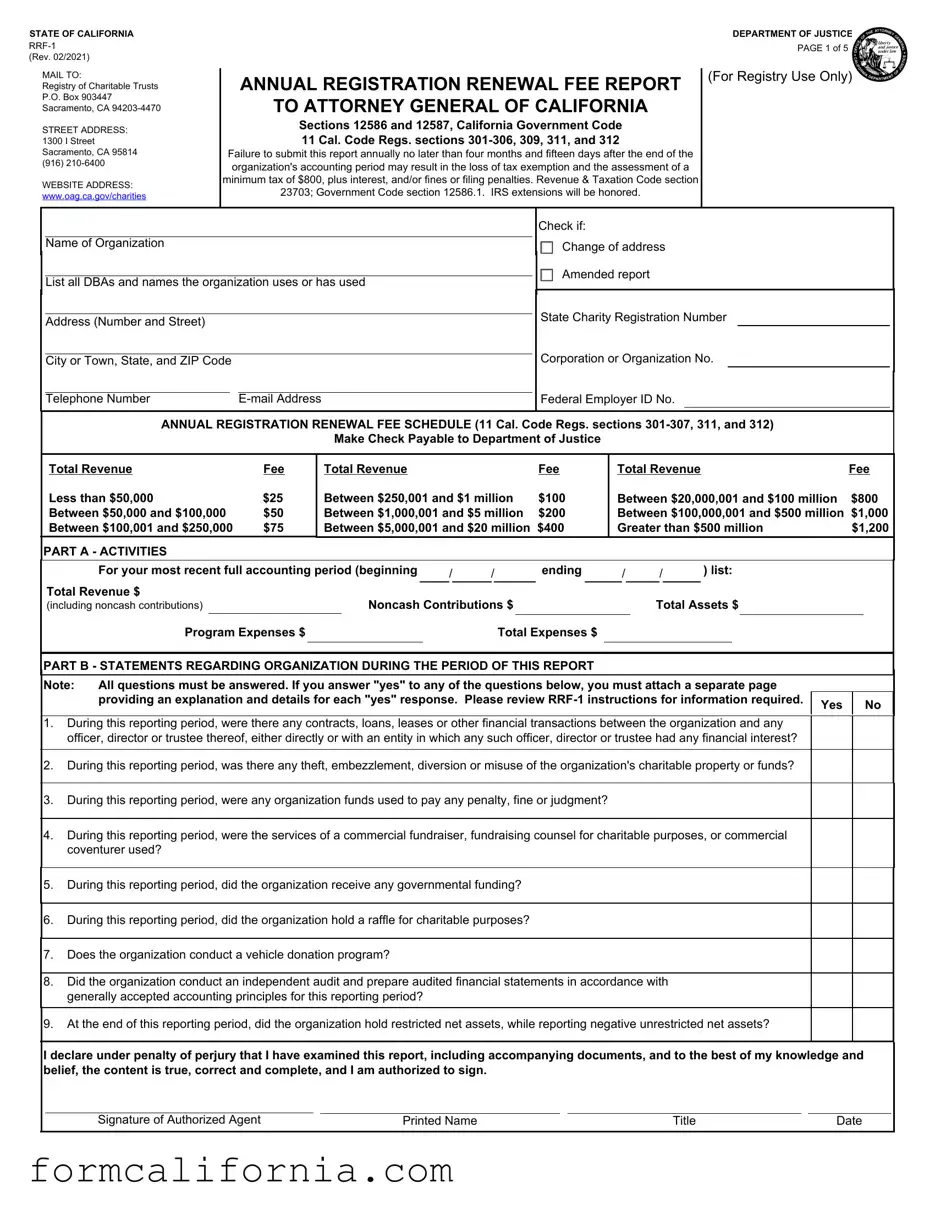

STATE OF CALIFORNIA

(Rev. 02/2021)

MAIL TO:

Registry of Charitable Trusts P.O. Box 903447 Sacramento, CA

STREET ADDRESS: 1300 I Street Sacramento, CA 95814 (916)

WEBSITE ADDRESS: www.oag.ca.gov/charities

ANNUAL REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

Sections 12586 and 12587, California Government Code 11 Cal. Code Regs. sections

Failure to submit this report annually no later than four months and fifteen days after the end of the organization's accounting period may result in the loss of tax exemption and the assessment of a minimum tax of $800, plus interest, and/or fines or filing penalties. Revenue & Taxation Code section 23703; Government Code section 12586.1. IRS extensions will be honored.

DEPARTMENT OF JUSTICE

PAGE 1 of 5

(For Registry Use Only)

Name of Organization

List all DBAs and names the organization uses or has used

Address (Number and Street)

City or Town, State, and ZIP Code

Telephone Number |

Check if:

Change of address

Amended report

State Charity Registration Number

Corporation or Organization No.

Federal Employer ID No.

ANNUAL REGISTRATION RENEWAL FEE SCHEDULE (11 Cal. Code Regs. sections

Make Check Payable to Department of Justice

Total Revenue |

Fee |

Less than $50,000 |

$25 |

Between $50,000 and $100,000 |

$50 |

Between $100,001 and $250,000 |

$75 |

Total Revenue |

Fee |

Between $250,001 and $1 million |

$100 |

Between $1,000,001 and $5 million |

$200 |

Between $5,000,001 and $20 million $400

Total Revenue |

Fee |

Between $20,000,001 and $100 million |

$800 |

Between $100,000,001 and $500 million |

$1,000 |

Greater than $500 million |

$1,200 |

PART A - ACTIVITIES

For your most recent full accounting period (beginning |

/ |

/ |

|

|

ending |

/ |

/ |

) list: |

||||||||||

Total Revenue $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Noncash Contributions $ |

|

|

|

Total Assets $ |

||||||||||||||

(including noncash contributions) |

|

|

|

|||||||||||||||

Program Expenses $ |

|

|

|

|

|

|

Total Expenses $ |

|

|

|

|

|

|

|

||||

PART B - STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note: |

All questions must be answered. If you answer "yes" to any of the questions below, you must attach a separate page |

|

providing an explanation and details for each "yes" response. Please review |

Yes

No

1.During this reporting period, were there any contracts, loans, leases or other financial transactions between the organization and any officer, director or trustee thereof, either directly or with an entity in which any such officer, director or trustee had any financial interest?

2.During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable property or funds?

3.During this reporting period, were any organization funds used to pay any penalty, fine or judgment?

4.During this reporting period, were the services of a commercial fundraiser, fundraising counsel for charitable purposes, or commercial coventurer used?

5.During this reporting period, did the organization receive any governmental funding?

6.During this reporting period, did the organization hold a raffle for charitable purposes?

7.Does the organization conduct a vehicle donation program?

8.Did the organization conduct an independent audit and prepare audited financial statements in accordance with generally accepted accounting principles for this reporting period?

9.At the end of this reporting period, did the organization hold restricted net assets, while reporting negative unrestricted net assets?

I declare under penalty of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge and belief, the content is true, correct and complete, and I am authorized to sign.

Signature of Authorized Agent |

Printed Name |

Title |

Date |

STATE OF CALIFORNIA |

DEPARTMENT OF JUSTICE |

PAGE 2 of 5 |

|

(Rev. 02/2021) |

|

Office of the Attorney General

Registry of Charitable Trusts

Privacy Notice

As Required by Civil Code § 1798.17

Collection and Use of Personal Information. The Attorney General's Registry of Charitable Trusts (Registry), a part of the Public Rights Division, collects the information requested on this form as authorized by the Supervision of Trustees and Fundraisers for Charitable Purposes Act (Gov. Code § 12580 et seq.) and regulations adopted pursuant to the Act (Cal. Code Regs., tit. 11, §§

Providing Personal Information. All the personal information requested in the form must be provided. An incomplete submission may result in the Registry not accepting the form, and cause your organization to be out of compliance with legal requirements to operate in California.

Access to Your Information. The completed form is a public filing that will be made available on the Attorney General's website at www.oag.ca.gov/charities pursuant to the public access requirements of the Act. You may review the records maintained by the Registry that contain your personal information, as permitted by the Information Practices Act. See below for contact information.

Possible Disclosure of Personal Information. In order to process the applicable registration, renewal, registration update, application, or report, we may need to share the information on this form with other government agencies. We may also share the information to further an investigation, including an investigation by other government or law enforcement agencies. In addition, the information is available and searchable on the Attorney General's website.

The information provided may also be disclosed in the following circumstances:

·With other persons or agencies where necessary to perform their legal duties, and their use of your information is compatible and complies with state law, such as for investigations or for licensing, certification, or regulatory purposes;

·To another government agency consistent with state or federal law.

Contact Information. For questions about this notice or access to your records, contact the Registrar of Charitable Trusts, 1300 I Street, Sacramento, CA 95814 at rct@doj.ca.gov or (916)

STATE OF CALIFORNIA

MAIL TO:

Registry of Charitable Trusts P.O. Box 903447 Sacramento, CA

WEBSITE ADDRESS: www.oag.ca.gov/charities

DEPARTMENT OF JUSTICE

Page 3 of 5

INSTRUCTION FOR FILING

ANNUAL REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

Section 12586 and 12587, California Government Code 11 Cal. Code Regs. section

(FORM

The purpose of the Annual Registration Renewal Fee Report (Form

WHO MUST FILE A FORM

Every charitable nonprofit corporation, unincorporated association or trustee holding assets for charitable purposes that is required to register with the Attorney General's Office is also required to annually file Form

(1)a government agency,

(2)a religious corporation sole,

(3)a cemetery corporation regulated under Chapter

12 of Division 3 of the Business and Professions Code,

(4)a political committee defined in Section 82013 of the California Government Code which is required to and which does file with the Secretary of State any statement pursuant to the provisions of Article 2 (commencing with Section 84200) of Chapter 4 of Title 9,

(5)a charitable corporation organized and operated primarily as a religious organization, educational institution or hospital,

(6)a health care service plan that is licensed pursuant to Section 1349 of the Health and Safety Code and reports annually to the Department of Managed Health Care,

(7)corporate trustees which are subject to the jurisdiction of the Commissioner of Financial Institutions of the State of California or to the Comptroller of Currency of the United States. However, for testamentary trusts, such trustees should file a copy of a complete annual financial summary which is prepared in the ordinary course of business. See Probate Code sections

WHAT TO FILE

ALL REGISTRANTS, regardless of the amount of total revenue, must file Form

A copy of IRS Form 990,

EXTENSIONS FOR FILING

Extensions of time for filing Form

ANNUAL REGISTRATION RENEWAL FEE

All registrants must include with Form

Total Revenue |

Fee |

Less than $50,000 |

$25 |

Between $50,000 and $100,000 |

$50 |

Between $100,001 and $250,000 |

$75 |

Between $250,001 and $1 million |

$100 |

Between $1,000,001 and $5 million |

$200 |

Between $5,000,001 and $20 million |

$400 |

Between $20,000,001 and $100 million |

$800 |

Between $100,000,001 and $500 million |

$1,000 |

Greater than $500 million |

$1,200 |

NOTE: A REGISTRATION FEE IS NOT DUE WITH AN AMENDED REPORT FOR ANY REPORT PERIOD IN WHICH A FEE HAS ALREADY BEEN PAID UNLESS AN AMENDED REPORT CHANGES THE AMOUNT OF THE FEE DUE.

STATE OF CALIFORNIA

STATE CHARITY REGISTRATION NUMBER

The State Charity Registration Number is the Charitable Trust (CT) number assigned to an organization by the Registry of Charitable Trusts at the time of registration. If you do not know the organization's State Charity Registration Number, you may look it up using the Registry Search feature on the Attorney General's website at www.oag.ca.gov/charities. If you are unable to locate the State Charity Registration Number, leave that line blank and Registry staff will insert the number when it is received in the Registry of Charitable Trusts.

OTHER IDENTIFICATION NUMBERS

The corporation number is a

The organization number is a

The Federal Employer Identification Number is a

The following will assist you in responding to the questions on Form

PART A

Provide the beginning and ending dates of the most recent full accounting period (Month/Day/Year). An accounting period may be by calendar year (ex:

For each amount, report only whole dollars without rounding (e.g., $100.99 should be reported as $100).

Total Revenue - is the amount earned and received during the current year and it includes all contributions (including noncash contributions), gifts, grants, investment income, membership dues, program service revenues, special event revenue, and other revenue. For charities reporting to the IRS it is the amount reported as total revenue on IRS Form 990, Part 1, line 12; IRS Form

Noncash Contributions - Are noncash donations made to a charity. Common examples are donations of food, clothing, equipment, pharmaceutical and medical supplies. Noncash contributions exclude contributions made by cash, check, electronic funds transfer, debit card, credit card, or payroll deduction. For charities reporting to the IRS it is the amount reported to the IRS Form 990, Part VIII, line 1g.

DEPARTMENT OF JUSTICE

Page 4 of 5

Total Assets - Are resources owned by the charity which have current or future economic value that can be measured. For charities reporting to the IRS it is the amount reported in IRS Form 990, Part X, line 16, column (B); IRS Form

Program Expenses - Are expenses incurred by the organization to further its exempt purposes. For charities reporting to the IRS it is the amount reported in IRS Form 990, Part IX, line 25, column (B); IRS Form

Total Expenses - Are all expenses paid or incurred by the organization including program expenses, fundraising expenses, employee salary & wages, accounting, depreciation, management and administrative expenses. For charities reporting to the IRS it is the amount reported in IRS Form 990, Part IX, line 25, column (A); IRS Form

PART B

PART B, QUESTION #1

If “yes,” provide the following information on the attachment:

1)Full name of the director, trustee, or officer involved and position with the organization.

2)Nature of the transaction, e.g., loan to director, contract with officer's business, etc.

3)Attach a copy of the board of directors' meeting minutes authorizing the transaction.

4)Include, if applicable, the date of transaction; purpose of transaction; amount of the loan or contract; interest rates; repayment terms; balance due; type of collateral provided; copy of contract, loan or other agreement; amount paid to director, trustee, or officer for the period; evidence of other bids received related to the transaction.

PART B, QUESTION #2

If “yes,” provide the following information on the attachment:

1)Nature, date, amount of loss, and parties involved.

2)Description of the steps the organization took to recover the loss. Attach a copy of any police and/or insurance report.

3)Description of the procedures the organization implemented to prevent a recurrence of the situation.

STATE OF CALIFORNIA |

DEPARTMENT OF JUSTICE |

Page 5 of 5 |

|

(Rev. 02/2021) |

|

PART B, QUESTION #3

If “yes,” provide the following information on the attachment:

1)Description of the fine, penalty, or judgment and the circumstances that resulted in the payment, together with the name and title of the person(s) responsible and why the payment was made with the organization's funds.

2)Name of the organization or government agency that issued the fine, penalty or judgment, the amount and date of payment.

3)Copies of all communications with any governmental agency regarding the fine, penalty, or judgment.

4)Description of procedures the organization implemented to prevent a reoccurrence of the fine, penalty, or judgment.

PART B, QUESTION #4

If “yes,” provide an attachment listing the name, mailing address, telephone number, and

PART B. QUESTION #5

If “yes,” provide an attachment listing the name of each funding source, the name of the agency, mailing address, contact person, and telephone number. Do not submit IRS Schedule B as a response to this question. The required attachment must be made available for public viewing.

PART B, QUESTION #6

If “yes,” provide an attachment listing the date of each raffle.

PART B, QUESTION #7

If “yes,” provide an attachment describing whether the vehicle donation program is operated by the charity or a commercial fundraiser, together with the name, mailing address, telephone number and

PART B, QUESTION #8

If you received over $2 million in total revenue, as reported on IRS Form 990,

PART B, QUESTION #9

"Restricted assets" are assets the charity holds that may be used only for a specific purpose. The restriction may come from the governing documents, a condition imposed by the donor, or the solicitation that led to the donation. Examples of restrictions are endowment funds, building funds, gifts for specific purposes, and

If “yes,” provide the following information on the attachment:

1)A written statement confirming that all restricted funds were used consistent with their restricted purpose, and explaining why unrestricted net assets were negative at the end of the reporting period, and

2)Proof of directors' and officers' liability insurance coverage. Please include a cover note stating "confidential" when submitting the proof of insurance.

SIGNATURE

A signature of an authorized agent is required. An authorized agent may be the president or chief executive officer, treasurer or chief financial officer of a public benefit corporation; or a trustee if the organization is a trust; or other authorized agent of the organization. Signatures do not need to be original inked signature. Copies or electronic signatures are acceptable.

Document Specs

| Fact | Details |

|---|---|

| Governing Law | Sections 12586 and 12587, California Government Code and 11 Cal. Code Regs. sections 301-306, 309, 311, and 312. |

| Annual Reporting Deadline | Must be submitted annually no later than four months and fifteen days after the end of the organization's accounting period. |

| Penalties for Late Submission | May result in the loss of tax exemption, minimum tax of $800, plus interest and/or fines or filing penalties. |

| IRS Extension | IRS extensions for financial reporting will be honored. |

| Filing Fees | Based on total revenue; ranging from $25 for revenue less than $50,000 to $1,200 for revenue greater than $500 million. |

| Required Attachments for Certain Questions | If "yes" is answered to specific questions, a separate page providing an explanation and details must be attached. |

| Address for Submission | Registry of Charitable Trusts P.O. Box 903447 Sacramento, CA 94203-4470 |

| Public Access to Form | The completed form will be made available on the Attorney General's website pursuant to public access requirements. |

| Requirement for Audited Financial Statements | Required if the organization received over $2 million in total revenue, as reported on IRS Forms 990, 990-PF, or 990-EZ. |

Detailed Instructions for Writing Ca Rrf 1

Filling out the CA RRF-1 form is an annual requirement for charitable organizations operating in California. This process ensures that your organization remains in compliance with state regulations and continues to enjoy its tax-exempt status, avoiding unnecessary fines or penalties. Here are the detailed steps you need to follow to accurately complete and submit your CA RRF-1 form:

- Start by entering the official name of your organization in the "Name of Organization" field.

- If applicable, list all Doing Business As (DBAs) and previous names the organization has used in the designated space.

- Fill in the organization's current mailing address, including city or town, state, and ZIP code.

- Provide the telephone number and email address of the organization where indicated.

- If there's been a change of address since your last filing, ensure you check the "Change of address" box.

- If this report is an amendment to a previously filed report, check the "Amended report" box.

- Enter your State Charity Registration Number, Corporation or Organization No., and Federal Employer ID No. in the respective fields.

- Under PART A - ACTIVITIES, fill in the respective fields for the beginning and ending dates of your most recent full accounting period, total revenue (excluding noncash contributions), noncash contributions, total assets, program expenses, and total expenses.

- In PART B, answer all mandatory yes/no questions regarding the organization's activities and financial transactions during the reporting period. Remember, a "yes" answer requires an attachment with a detailed explanation.

- Calculate your due renewal fee based on your total revenue and enter this amount in the "Total Revenue Fee" field according to the annual registration renewal fee schedule provided on the form.

- Sign and date the form at the bottom to certify its accuracy. The signature must come from an authorized agent of the organization, such as the president, chief executive officer, treasurer, chief financial fund officer, or a trustee.

- Make a check payable to the Department of Justice for the calculated total revenue fee and prepare your form and any necessary attachments for mailing.

- Finally, mail your completed CA RRF-1 form, along with the payment and any required attachments, to the Registry of Charitable Trusts at the address provided at the top of the form.

Once your submission is processed, stay attentive to any correspondence from the Attorney General's Office that may request additional information or clarification to ensure your organization's compliance. Keep a copy of your completed form and any communications for your records.

Things to Know About This Form

What is the CA RRF-1 Form?

The CA RRF-1 Form, or Annual Registration Renewal Fee Report, is a form that charitable organizations in California must submit annually to the Attorney General's Registry of Charitable Trusts. Its purpose is to assist in the early detection of fiscal mismanagement and unlawful diversion of charitable assets, ensuring organizations comply with the state's regulations.

Who is required to file the CA RRF-1 Form?

Charitable nonprofit corporations, unincorporated associations, or trustees holding assets for charitable purposes and required to register with the Attorney General's Office must file the CA RRF-1 Form annually. Exceptions include government agencies, religious corporation soles, certain cemetery corporations, political committees, religious organizations, educational institutions, hospitals, licensed healthcare service plans, and corporate trustees regulated by financial institutions.

What information is needed to complete the CA RRF-1 Form?

To complete the CA RRF-1 Form, organizations need to provide:

- Organization and contact information

- State Charity Registration Number, Corporation or Organization No., and Federal Employer ID No.

- Financial information including total revenue, noncash contributions, total assets, program expenses, and total expenses for the most recent full accounting period

- Responses to specific questions regarding activities and operations in the reporting period. "Yes" responses require additional details and explanations.

What are the filing deadlines for the CA RRF-1 Form?

Organizations must submit the CA RRF-1 no later than four months and fifteen days after the end of their accounting period. For example, organizations operating on a calendar year must file by May 15th of the following year.

Are there any fees associated with filing the CA RRF-1 Form?

Yes, there are fees based on the organization's total revenue:

- Less than $50,000 - $25

- $50,000 to $100,000 - $50

- $100,001 to $250,000 - $75

- $250,001 to $1 million - $100

- $1,000,001 to $5 million - $200

- $5,000,001 to $20 million - $400

- $20,000,001 to $100 million - $800

- $100,000,001 to $500 million - $1,000

- Greater than $500 million - $1,200

How does an organization file the CA RRF-1 Form?

Organizations can mail the completed CA RRF-1 Form along with the appropriate fee and any required attachments to the Registry of Charitable Trusts at the address provided on the form. Ensure all sections are completed accurately and that the form is signed by an authorized agent of the organization.

Can filing extensions be granted for the CA RRF-1 Form?

Yes, extensions for filing the CA RRF-1 can be granted if an organization has received an extension from the IRS for filing their IRS Form 990, 990-PF, 990-EZ, or 1120. Organizations should file their CA RRF-1 with the IRS form upon receiving the extension.

What happens if an organization fails to submit the CA RRF-1 Form on time?

Failure to submit the CA RRF-1 Form by the due date can result in the loss of tax exemption, the assessment of a minimum tax of $800, plus interest, and/or fines or filing penalties. It’s crucial to adhere to filing deadlines to avoid these consequences.

Where can more information about the CA RRF-1 Form be found?

More information about the CA RRF-1 Form, including detailed filing instructions, can be found on the Attorney General's website at www.oag.ca.gov/charities or by reaching out to the Registry of Charitable Trusts through the contact information provided on the form.

Common mistakes

Filling out the California Annual Registration Renewal Fee Report (RRF-1) correctly is crucial for charitable organizations seeking to maintain compliance with the state’s regulations. Below are eight common mistakes made in the process:

Missing the Deadline: Organizations often overlook the strict deadline for the submission of the RRF-1 form, which is no later than four months and fifteen days after the end of the organization's accounting period. Late submissions can result in penalties, interest, and fines.

Incomplete Information: Leaving sections of the form blank or failing to provide comprehensive answers can cause delays and potentially lead to the refusal of the form by the Registry of Charitable Trusts.

Incorrect Revenue Reporting: Misreporting total revenue, including or excluding noncash contributions inaccurately, can affect the registration renewal fee and may result in underpayment or overpayment.

Failure to Attach Necessary Documents: If the form indicates a "yes" response to certain questions, organizations must attach a separate page with explanations or additional information. Neglecting this requirement can result in an incomplete application.

Incorrect Fee Calculation: Miscalculating the registration renewal fee based on total revenue can lead to either overpayment, which may not be refunded, or underpayment, which could invite penalties.

Not Honoring IRS Extensions: If an organization has received an IRS extension, it must include copies of the extension request(s) along with the RRF-1 submission. Overlooking this step can lead to processing delays.

Overlooking the Need for an Audited Financial Statement: Organizations with revenues exceeding $2 million are required to attach audited financial statements. Failure to include these audited statements can result in the form being rejected.

Forgetting to Sign the Form: An authorized agent must sign the RRF-1 form. Missing signatures render the submission void and can cause unnecessary setbacks for the organization.

Ensuring accuracy, completeness, and timeliness in filling out the RRF-1 form is crucial for maintaining good standing and compliance with the California Attorney General’s Office.

Documents used along the form

When it comes to managing your non-profit organization in California, there's more to stay compliant with the law than just filling out the CA RRF-1 form. A variety of documents and forms often accompany the Annual Registration Renewal Fee Report to ensure your organization maintains its good standing and operates within legal guidelines. Below is a list of some of these documents:

- IRS Form 990, 990-EZ, or 990-PF: These are annual income tax returns that must be filed by tax-exempt organizations. They provide the IRS with information on the organization's finances, programs, and operations.

- CT-TR-1 Treasurer's Report: This report is for charities whose revenues are below the threshold for filing a Form 990. It is a simpler form that also accounts for the organization's revenue, assets, and disbursements.

- Articles of Incorporation: This document establishes the existence of your nonprofit in the state and contains basic information about the organization.

- Bylaws: Bylaws set out the rules that govern the internal management of an organization. They typically include details about meetings, the composition of the board of directors, and other fundamental operational guidelines.

- Conflict of Interest Policy: This is a statement that identifies situations that might constitute conflicts of interest. It also specifies procedures for disclosure of actual or potential conflicts and how they should be managed or eliminated.

- Board of Directors' Meeting Minutes: Minutes from board meetings document the actions and decisions made by your organization's board of directors and are essential for maintaining a record of governance and accountability.

- Financial Statements and Reports: Detailed reports that give an overview of the organization's financial status, including balance sheets, income statements, and statements of functional expenses.

- Charitable Solicitation Registration: Most states require nonprofits that solicit donations to register with a state authority. This registration typically needs to be renewed annually.

- Fundraising Event Notices: If your organization conducts raffles or other fundraising events, you may need to file specific notices or obtain permits in accordance with state laws.

These documents play a critical role alongside the CA RRF-1 form, ensuring transparency, responsible governance, and legal compliance of your charitable organization. It’s important to regularly review these documents and update them as needed to reflect current operations, changes in laws, or adjustments in organizational structure. Staying on top of these requirements can help safeguard your nonprofit's integrity and keep its charitable mission moving forward.

Similar forms

The CA RRF-1 form shares similarities with the IRS Form 990, which is an annual reporting return that certain federally tax-exempt organizations must file with the IRS. Both forms require details about the organization's activities, finances, governance, and compliance with certain legal requirements, aiming to provide transparency about the financial and operational health of the organization. However, while Form 990 focuses on tax aspects and broader questions about the organization's mission, activities, and significant changes in operations, the RRF-1 form is more focused on compliance with California's specific regulatory requirements for charities.

Similarly, the IRS Form 990-EZ presents a pared-down alternative to the full Form 990, designed for smaller organizations with less complicated financial structures. Like the CA RRF-1 form, the 990-EZ collects pertinent financial information and operational details but on a federal level. Both forms are intended to ensure that organizations adhere to the principles of transparency and accountability, though the 990-EZ, like its more comprehensive counterpart, leans more towards a broader interest in public disclosure and federal tax compliance, versus the state-specific oversight emphasized by the RRF-1.

The IRS Form 990-PF serves a similar purpose as the aforementioned forms but is specifically tailored for private foundations. It requires detailed information about financial activities, including grants given, investment income, and operational expenses. Both this form and the CA RRF-1 seek to uphold organizational transparency and ensure adherence to legal and regulatory standards. However, Form 990-PF is distinguished by its focus on the unique financial dynamics of private foundations, including their grantmaking activities, while the RRF-1 maintains a broader interest in charitable activities within California.

For organizations with revenue below certain thresholds, the CA CT-TR-1 (Treasurer's Report) serves as a simplified financial report. This document, akin to the CA RRF-1, collects basic financial information for smaller entities, ensuring they remain accountable without the burden of more comprehensive reporting requirements. Both documents aim to strike a balance between regulatory compliance and operational feasibility for smaller entities, emphasizing transparency in a manner proportionate to the organization's size and complexity.

The IRS Form 1120 is used by corporate entities to report their income, gains, losses, deductions, and credits to the IRS, thus determining their federal income tax liability. While at first glance it may seem quite different from the CA RRF-1 form, both are pivotal in ensuring that organizations meet their respective reporting obligations. The RRF-1 form, through its focus on charitable trusts and their activities within California, complements the broader, financial scrutiny applied by the Form 1120 on a federal scale.

The IRS Schedule B form, associated with prior renditions of the CA RRF-1 instructions, demands detailed information about an organization’s contributors. Though the RRF-1 form itself does not collect contributor details, it requires transparency about financial sources and uses, in the spirit of ensuring that funds are properly tracked and used in accordance with charitable purposes. This echoes Schedule B’s emphasis on the origins of an organization’s funding, underlining the importance of financial transparency in promoting accountability and trust.

The IRS Form 990-N, also known as the e-Postcard, is designed for small tax-exempt organizations with annual receipts of $50,000 or less. Like the RRF-1, which is required by all charitable organizations registered in California, regardless of their revenue level, the Form 990-N aims to simplify the reporting process for small entities. Both forms ensure these organizations remain in good standing through minimal reporting requirements, reflecting a shared goal of balancing regulatory oversight with operational practicality for smaller entities.

Dos and Don'ts

When completing the California Annual Registration Renewal Fee Report (RRF-1), it's important to adhere to specific practices to ensure accuracy, compliance, and timely processing. Below are essential "Dos and Don'ts" to consider:

- Do make sure all information is current and accurately reflects the organization's activities for the reporting period. This includes name changes, address updates, and any amendments to the report.

- Do answer all questions on Part B regarding the organization's operations during the period. This includes disclosing any financial transactions with officers, directors, or trustees, and other specified activities.

- Do attach a separate page providing explanations and details for each "yes" response to questions in Part B. Include thorough information to avoid follow-up questions or delays in processing.

- Do submit the form and payment of the registration renewal fee based on the organization's total revenue for the preceding fiscal year within four months and fifteen days after the organization’s accounting period ends.

- Do include a copy of the organization’s Form 990, 990-PF, 990-EZ, or 1120 as filed with the IRS, if applicable. Remember, IRS extensions will be honored for these submissions.

- Do verify the appropriate registration renewal fee from the provided fee schedule before submitting payment to ensure the correct amount is included.

- Do sign the form by an authorized agent of the organization, such as the president, chief executive officer, treasurer, or other authorized individual.

- Don't leave any mandatory fields blank. If a specific question does not apply, ensure to mark it appropriately, usually with "N/A" for "Not Applicable," to confirm that the question was not overlooked.

- Don't include sensitive personal information that is not required. While the form requests details necessary for registration, minimizing the provision of unnecessary personal details helps protect privacy.

- Don't submit incomplete information or documentation. Always check that each required attachment is included, especially when "yes" responses necessitate additional details. Don't guess or estimate answers to financial questions. Use the actual figures from the organization's financial documents to ensure accuracy.

- Don't overlook the signature of an authorized agent at the end of the form. Unsigned forms will not be processed, leading to delays and potential non-compliance issues.

- Don't send original documents unless specifically required. Copies are typically acceptable and recommended for record-keeping purposes.

- Don't neglect to review the completed form for errors or omissions before mailing. Taking the time for a final review can save time and effort by avoiding the need for corrections later.

Misconceptions

Understanding the specifics of the California RRF-1 form can be challenging, and there are several misconceptions about its filing requirements and implications. Here are four common misunderstandings and the clarifications to help navigate these aspects more effectively.

- Misconception #1: Only organizations that file Form 990 with the IRS need to submit the RRF-1 form.

This is not true. The RRF-1 form must be filed by every charitable organization registered with the California Attorney General's Office, regardless of whether they file Form 990, 990-PF, or 990-EZ with the IRS. This includes small organizations that might not reach the revenue threshold required for Form 990 filing. Even if the organization files a different or no form with the IRS, they still need to complete and submit the RRF-1 annually.

- Misconception #2: The filing of the RRF-1 form can be extended indefinitely as long as the organization has an IRS extension.

While it's correct that the California Attorney General’s Office will honor IRS extensions, there's a limit. The RRF-1 form must be filed no later than four months and fifteen days after the end of the organization's accounting period. If an organization has secured an extension from the IRS, they should attach documentation of this extension when they file the RRF-1 form. However, relying solely on IRS extensions without attention to the specific California deadlines can lead to late filings and penalties.

- Misconception #3: The financial details provided in the RRF-1 form are for internal use and not made public.

Actually, the information provided on the RRF-1 form, including details about revenue, assets, and program expenses, becomes part of the public record. This information is used not only for regulatory purposes but also is accessible to the public through the Attorney General's website. The intent is to ensure transparency and accountability in charitable organizations operating in California.

- Misconception #4: If an organization's revenue does not meet the minimum threshold, it does not need to pay the registration renewal fee.

This misunderstanding can lead to compliance issues. All charitable organizations, irrespective of their revenue, are required to file the RRF-1 form and pay the corresponding registration renewal fee, which is scaled based on the organization's total annual revenue. The minimum fee applies even to organizations with less than $50,000 in revenue, ensuring that all registered charities contribute to the oversight and regulation of the charitable sector in California.

Correcting these misconceptions helps charitable organizations remain in good standing and ensures the continued ability to operate effectively within California’s regulatory environment.

Key takeaways

Understanding and Completing the CA RRF-1 Form

The CA RRF-1 form, known as the Annual Registration Renewal Fee Report, is vital for charities in California for maintaining their registration with the Attorney General's Office. Getting to grips with the essentials of this form ensures compliance and helps avoid penalties. Below are seven key takeaways:

- All charitable organizations operating in California must submit the RRF-1 form annually, within four months and fifteen days after the end of their accounting period. This requirement helps the Attorney General's Office in early detection of fiscal mismanagement within charities.

- The form requires information on the charity's revenue, noncash contributions, total assets, program expenses, and total expenses. Accurate reporting is crucial for ensuring compliance and facilitating the oversight responsibilities of the Attorney General's Office.

- Organizations must disclose any transactions involving officers, directors, or trustees, providing detailed information on the nature and terms of these transactions to ensure transparency and prevent conflicts of interest.

- In instances of theft, embezzlement, misuse of charitable funds, or any financial mismanagement, the organization is required to report such occurrences on the RRF-1 form. This includes describing the steps taken to address and rectify the issue.

- Charities are obligated to declare the use of commercial fundraisers, fundraising counsel, or commercial coventurers, enhancing the oversight of fundraising activities and ensuring they align with the organization’s mission and legal requirements.

- The RRF-1 form enforces accountability by asking whether the organization received governmental funding, conducted a raffle, operates a vehicle donation program, or held restricted net assets with negative unrestricted net assets, which could indicate financial instability.

- The renewal fee accompanying the RRF-1 submission varies based on the total revenue of the organization, with fees ranging from $25 for those earning less than $50,000 to $1,200 for revenues exceeding $500 million. This graduated fee scale is designed to be equitable, taking into account the size and funding of various organizations.

Consequences of Non-Compliance

Failure to accurately complete and submit the CA RRF-1 form can result in significant repercussions, including the loss of tax exemption status and the imposition of fines or penalties. Ensuring timely and accurate submission is paramount for all charitable organizations operating within California.

Discover More PDFs

How to Change Business Address in California - Targets an array of entities, ensuring they can easily update address details without attaching to tax returns.

Forms of Id for Gun Purchase - A mandatory input is the type of identification used by the purchaser, reinforcing the security of the transaction.

California Form 3832 - Separate forms are required for each nonresident member or groups of members for tax purposes.