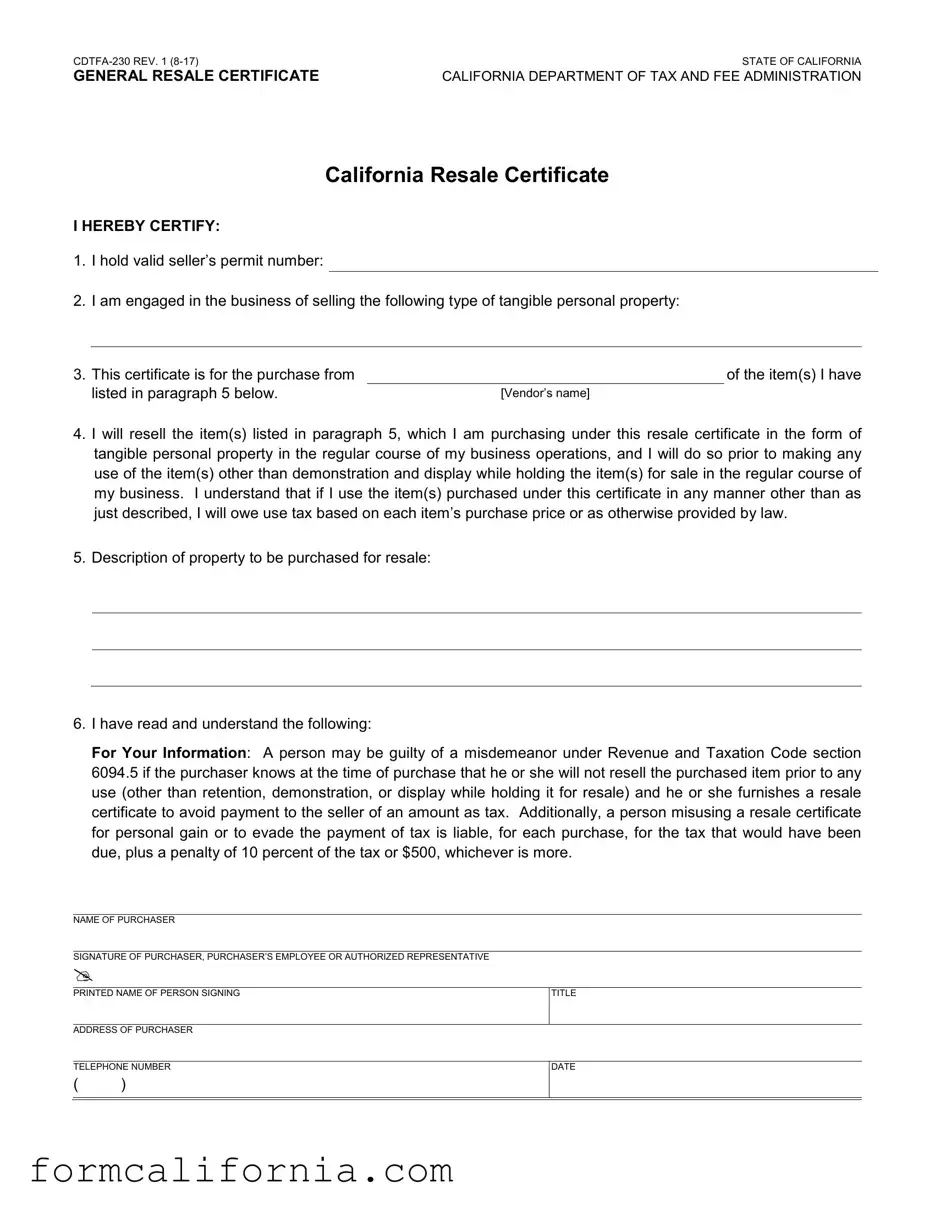

Blank Ca Resale PDF Form

Engaging in the world of commerce, especially within the dynamic landscape of California, introduces a myriad of bureaucratic elements designed to regulate and facilitate smooth operational flows. Amid these essential documents lies the General Resale Certificate, known formally by its designation CDTFA-230 REV. 1 (8-17). Crafted by the California Department of Tax and Fee Administration, this document serves as a linchpin for businesses engaged in the procurement of tangible personal property intended for resale. Its core function allows businesses to purchase items without the immediate burden of sales tax, with the understanding that the final sale of these items will incur the necessary tax contributions. The certificate explicitly outlines conditions under which it must be used - notably, the mandate that items purchased under this agreement are for resale in the purchaser's regular course of business, barring certain exceptions like demonstration or display. The certificate also sheds light on potential legal implications, including misdemeanors and financial penalties for misuse, underlining the importance of adherence to its stipulated guidelines. Importantly, it acts not just as a tool for tax deferral but as an acknowledgment of the purchaser's responsibilities in the maintenance of tax integrity within California's bustling marketplaces.

Document Preview Example

CDTFA230 REV. 1 (817) |

STATE OF CALIFORNIA |

GENERAL RESALE CERTIFICATE |

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION |

CALIFORNIA RESALE CERTIFICATE

I HEREBY CERTIFY:

1.I hold valid seller’s permit number:

2.I am engaged in the business of selling the following type of tangible personal property:

3. This certificate is for the purchase from |

|

of the item(s) I have |

listed in paragraph 5 below. |

[Vendor’s name] |

|

4.I will resell the item(s) listed in paragraph 5, which I am purchasing under this resale certificate in the form of tangible personal property in the regular course of my business operations, and I will do so prior to making any use of the item(s) other than demonstration and display while holding the item(s) for sale in the regular course of my business. I understand that if I use the item(s) purchased under this certificate in any manner other than as just described, I will owe use tax based on each item’s purchase price or as otherwise provided by law.

5.Description of property to be purchased for resale:

6.I have read and understand the following:

FOR YOUR INFORMATION: A person may be guilty of a misdemeanor under Revenue and Taxation Code section 6094.5 if the purchaser knows at the time of purchase that he or she will not resell the purchased item prior to any use (other than retention, demonstration, or display while holding it for resale) and he or she furnishes a resale certificate to avoid payment to the seller of an amount as tax. Additionally, a person misusing a resale certificate for personal gain or to evade the payment of tax is liable, for each purchase, for the tax that would have been due, plus a penalty of 10 percent of the tax or $500, whichever is more.

NAME OF PURCHASER

SIGNATURE OF PURCHASER, PURCHASER’S EMPLOYEE OR AUTHORIZED REPRESENTATIVE

PRINTED NAME OF PERSON SIGNING

TITLE

ADDRESS OF PURCHASER

TELEPHONE NUMBER

()

DATE

Document Specs

| Fact | Detail |

|---|---|

| 1 | The form is titled "General Resale Certificate". |

| 2 | Issued by the California Department of Tax and Fee Administration (CDTFA). |

| 3 | Form number is CDTFA-230 REV. 1 (8-17). |

| 4 | The certificate allows buyers to make tax-exempt purchases that will be resold. |

| 5 | Buyers must hold a valid seller’s permit number to use the certificate. |

| 6 | Items purchased must be for resale as tangible personal property in the regular course of business. |

| 7 | Improper use of the certificate for personal gain or to evade tax may result in penalties. |

| 8 | Misuse penalties include the owed tax, plus a penalty of 10 percent of the tax or $500, whichever is greater. |

| 9 | A purchaser may be guilty of a misdemeanor for knowing misuse as per Revenue and Taxation Code section 6094.5. |

| 10 | The form requires the purchaser’s signature, printed name, title, address, telephone number, and the date of issuance. |

Detailed Instructions for Writing Ca Resale

Before diving into the process of filling out a California Resale Certificate, it's crucial to understand the path ahead. This certificate serves as a declaration that items purchased will be resold in the operation of one's business. It implies an exemption from sales tax at the point of purchase with the understanding that taxes will be collected when the item is sold to the end customer. Misuse of this certificate can lead to significant penalties, highlighting the importance of accuracy and honesty in completion. Here’s a straightforward guide to help with the process:

- Start with your seller’s permit number: Enter the valid seller’s permit number issued to you by the California Department of Tax and Fee Administration (CDTFA). This number is crucial for the certificate's validity.

- Detail your business: Clearly specify the type of tangible personal property you are engaged in selling. This helps in establishing the relevance of your purchases to your business model.

- Vendor’s name: Enter the name of the vendor from whom you're purchasing the items. This certificate applies specifically to each vendor and must be filled out for each separately if buying from multiple vendors.

- List items for resale: Specify the item(s) you are purchasing for resale. It’s important that these details are accurate to justify the exemption from sales tax.

- Intention to resell: Assert that you will resell the listed items in the regular course of your business operations. Acknowledge understanding that any other use of the items outside of retention, demonstration, or display while holding them for sale will obligate you to pay the use tax on the items.

- Read the terms: Carefully read the information provided in the certificate regarding potential penalties for misuse. This understanding is critical to ensure compliance with tax laws.

- Signature and title: The certificate must be signed by you, an employee, or an authorized representative. Include the printed name of the person signing and their title within the company.

- Contact information: Provide the business address and telephone number. This ensures the CDTFA can contact you if there's any need for clarification or follow-up.

- Date the form: Finish by entering the date on which the form is completed. This date is important for record-keeping and compliance purposes.

Completing the California Resale Certificate with diligence and care is not just about compliance; it's a crucial step in maintaining the integrity of your business practices. Make sure to review the certificate for accuracy before submission. Keeping a copy for your records is also advisable, as it may be needed for future reference or in case of an audit.

Things to Know About This Form

What is a California Resale Certificate?

A California Resale Certificate is a document that allows businesses to buy goods they intend to sell without paying sales tax at the point of purchase. It is issued by the California Department of Tax and Fee Administration (CDTFA). By presenting this certificate, a purchaser certifies that they hold a valid seller’s permit, are engaged in the business of selling tangible personal property, and will resell the purchased item(s) in the regular course of business operations.

How can I use the California Resale Certificate correctly?

To use the California Resale Certificate correctly, follow these steps:

- Ensure you hold a valid seller's permit issued by CDTFA.

- Fill out the certificate accurately, including your seller’s permit number, the type of tangible personal property you sell, and a description of the property to be purchased for resale.

- Provide the certificate to the vendor when making a purchase for resale.

- Only use purchased items for demonstration, display, or resale in the regular course of your business. Any other use may result in owing use tax on the items.

What are the consequences of misusing a California Resale Certificate?

Misusing a California Resale Certificate can lead to significant penalties, including:

- Being guilty of a misdemeanor under Revenue and Taxation Code section 6094.5 if the purchaser knows they will not resell the item as stated.

- Owing the sales tax that would have been paid on the purchase, plus a penalty of 10% of the tax or $500, whichever is more, for each misuse.

Do I need to renew my California Resale Certificate?

No, you do not need to renew your California Resale Certificate for each purchase, but it’s a good practice to periodically review and reissue certificates to your suppliers to ensure all the information remains current and accurate. Although there's no set expiration, businesses should keep up-to-date records and ensure their seller's permit is also valid and up to date. Regularly updating your information helps prevent any delays or disputes about the certificate's validity during purchases.

Common mistakes

Filling out the California Resale Certificate (CDTFA-230) correctly is crucial for businesses that wish to purchase goods for resale without paying sales tax at the time of purchase. However, errors can occur during this process. Here are 10 common mistakes to avoid:

Not including a valid seller’s permit number. This is an essential detail that confirms your eligibility for purchasing goods for resale.

Failing to clearly specify the type of tangible personal property involved in the business. A vague or incorrect description can lead to complications.

Omitting the vendor’s name from whom the purchase is made. This detail is crucial for the certificate's validity.

Not clearly stating the intention to resell the purchased items. The form mandates a declaration of resale to exempt the transaction from sales tax.

Leaving the description of the property to be purchased for resale blank or providing insufficient details regarding the items.

Ignoring the important declarations and warnings provided on the form regarding the misuse of the certificate.

Incorrectly assuming any use of the purchased items doesn’t affect the certificate's validity. Only certain uses, like demonstration or holding for sale, are allowed without voiding the resale condition.

Misunderstanding the tax liabilities that arise from other uses of the purchased property not originally intended for resale according to the statement.

Failing to sign the certificate, which is a simple but crucial step that validates the document.

Not printing the name of the individual signing the certificate or neglecting to provide his or her title and the name of the purchaser can lead to the document's rejection, as full identification is necessary.

Acknowledging and rectifying these mistakes can prevent potential legal implications and financial penalties. Each detail on the California Resale Certificate serves a purpose and ensures that the transaction adheres to the law. Therefore, paying close attention to the accuracy and completeness of the form is essential for a smooth business operation.

Documents used along the form

When engaging in transactions that involve a California Resale Certificate, it's essential to be equipped with additional forms and documents to ensure compliance and facilitate smooth business operations. This selection of forms complements the resale certificate by covering a range of requirements from tax documents to business registration. Understanding each one will help in navigating the complexities of your business's financial and legal responsibilities.

- Seller's Permit Application: Before you can issue a resale certificate, you must have a valid seller's permit. This application is essential for anyone looking to sell or lease tangible personal property that would otherwise be subject to sales tax if sold at retail.

- Uniform Sales & Use Tax Certificate - Multijurisdiction: This form is useful for businesses that operate in multiple states. It helps to simplify the process of purchasing goods for resale by providing a standardized way to prove that a business is entitled to make tax-exempt purchases for resale in various jurisdictions.

- Business License Application: Depending on the city or county your business operates in, you may be required to obtain a local business license. This document grants you the legal right to conduct business within the local jurisdiction.

- Use Tax Return: For items purchased for use rather than resale, or for items that end up being used rather than sold, a Use Tax Return may be necessary. This form helps businesses report and pay tax on items for which sales tax was not collected at the point of purchase.

- Sales and Use Tax Return: This is a periodic tax return that businesses must file with the California Department of Tax and Fee Administration. It reports all taxable sales, tax-exempt sales, and the amount of sales tax collected from customers over a specific period.

- Statement of Information: For businesses registered as corporations or limited liability companies (LLCs), this form must be filed with the California Secretary of State. It provides updated information about the business's officers, directors, or managers, depending on the type of entity.

Together, these documents form a comprehensive toolkit for businesses operating in California. They not only ensure that operations are legally compliant but also prepare businesses to manage financial and tax-related tasks effectively. As you navigate the complexities of your business, remember that each document plays a vital role in safeguarding and legitimizing your operations. Proper attention to and maintenance of these forms can be instrumental in the sustained success of your business.

Similar forms

The Uniform Commercial Code (UCC-1) Financing Statement is one document that shares similarities with the California Resale Certificate. Both forms are crucial for declaring the intentions of the parties involved concerning assets. The UCC-1 is used to declare a secured interest in an asset, ensuring lenders have a claim to the collateral should the borrower default. In contrast, the Resale Certificate is used by businesses to note that purchased items will be resold, exempting them from paying sales tax at the point of purchase. Each form serves as a legal declaration to governing bodies about the future use of purchased or financed items.

The Sales Tax Exemption Certificate resembles the California Resale Certificate by allowing businesses to avoid paying sales tax on purchases intended for specific uses that exempt them from such tax. While the Resale Certificate is specifically for items to be resold in the regular course of business, a Sales Tax Exemption Certificate can apply to various exemptions, such as purchases made by nonprofit organizations. Each certificate requires the buyer to certify their eligibility for the exemption they are claiming.

An Exemption Certificate for Utility Usage is another similar document, used by businesses to claim exemption from taxes on utilities if the utilities are used in an exempt manner, such as in the production of goods for sale. Like the California Resale Certificate, this document requires the purchaser to certify the intended use of the purchased goods or services (in this case, utilities) to qualify for tax exemptions. Both certificates are preventative measures against the unnecessary payment of taxes, contingent on the buyer's accurate declaration of intended use.

A Certificate of Origin, required for international shipments, certifies the country in which the shipped goods were produced or manufactured. Similar to the Resale Certificate, which certifies goods purchased for resale, the Certificate of Origin provides necessary documentation for customs purposes, ensuring compliance with international trade agreements and tariffs. Both documents serve as official certifications that inform regulatory bodies about the nature of goods being traded or resold.

The W-9 Request for Taxpayer Identification Number and Certification form, though primarily used for different purposes, shares the main feature of certification with the California Resale Certificate. While the W-9 is used to provide information to entities that will pay you income, thereby ensuring proper tax reporting to the IRS, the Resale Certificate is used to avoid paying sales tax on goods intended for resale. Both forms are preventative measures dealing with taxation; one is for income tax purposes, and the other is for sales tax.

A Business License Application, required for the legal operation of a business within a specific jurisdiction, is somewhat analogous to the Resale Certificate, which is used when purchasing items for resale without paying sales tax. Both documents are foundational for a business to operate within the law. The Business License gives a business the legal right to operate, while the Resale Certificate allows a business to purchase inventory without upfront tax costs, assuming the items are to be resold.

The Sellers Permit, also known as a Vendor's License in some regions, directly relates to the usage of the California Resale Certificate. A business must have a Sellers Permit to sell goods and collect sales tax within the state legally. This permit is a prerequisite for utilizing the Resale Certificate because it demonstrates that the business is recognized by the state as a legitimate reseller, obligated to collect sales tax on goods sold unless the goods are purchased for resale.

Lastly, a Use Tax Declaration form is akin to the California Resale Certificate as it pertains to tax responsibility on goods. While the Resale Certificate allows businesses to purchase goods without paying sales tax based on the intention to resell, the Use Tax Declaration is used when goods purchased tax-exempt are put into use rather than resold. It declares the buyer's obligation to pay use tax on those goods, ensuring tax compliance when the initial condition of resale is not met.

Dos and Don'ts

Filling out the California Resale Certificate (CDTFA-230) is an essential step for businesses engaged in selling tangible personal property in California. This document helps to ensure that sales tax is properly collected and remitted within the state. As a retailer or reseller, it's important to fill out this certificate accurately to avoid legal issues or penalties. Below are the dos and don'ts to consider when completing the form.

Do:

- Ensure Accuracy: Double-check that your seller’s permit number is correct and that all other provided information is current and accurate. Errors can lead to unnecessary complications or even legal trouble.

- Describe Your Goods Clearly: Be specific in the description of the property to be purchased for resale. Vague descriptions can raise questions about the validity of the certificate.

- Understand the Terms: Familiarize yourself with the terms and conditions stated in the certificate, especially those relating to the use of purchased items and the consequences of misuse.

- Keep Records: Maintain a copy of the completed certificate for your records. This can be crucial in case of an audit or if any disputes arise regarding the tax status of your purchases.

Don't:

- Use the Certificate for Personal Purchases: The resale certificate is strictly for items that will be resold in the ordinary course of business. Using it for personal items can lead to penalties, including tax liabilities and fines.

- Ignore the Certificate's Expiry: Revisit and, if necessary, renew your resale certificate periodically. Using an outdated certificate can invalidate your purchases for resale and lead to tax liabilities.

- Overlook the Significance of the Signature: Ensure that the certificate is signed by the purchaser, an employee, or an authorized representative. An unsigned certificate may not be considered valid.

- Forget to Update Your Information: If any of your business information changes, such as your address or type of tangible personal property sold, make sure to update your certificate accordingly to reflect these changes.

In conclusion, properly filling out and understanding the California Resale Certificate is vital for your business's compliance with tax laws and regulations. By following these guidelines, you can help safeguard your business from potential legal and financial issues related to the misuse of the certificate. Remember, being thorough and conscientious now can save you a great deal of time and trouble later.

Misconceptions

Understanding the California Resale Certificate, titled CDTFA-230 REV. 1 (8-17), issued by the STATE OF CALIFORNIA GENERAL RESALE CERTIFICATE CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION, is crucial for businesses. Many misconceptions surround it, leading to potential misuse or legal ramifications. Here are seven common misconceptions explained:

It's applicable for personal use purchases. The primary purpose of this certificate is for businesses to buy products without paying sales tax, under the condition that these products will be resold. If an individual uses this certificate for personal purchases, they're misusing it and might face legal penalties.

Any business can use it, regardless of their goods sold. To use this certificate, a business must be engaged in selling tangible personal property. This means not all businesses qualify, especially those providing services without tangible goods.

It allows indefinite use after one-time completion. This certificate has a validity concerning the relationship with the seller and needs to be updated periodically. Continuous business transactions require attentiveness to the certificate's validity.

You can use it immediately upon issuance of a seller’s permit. Although obtaining a seller’s permit is a prerequisite, the certificate’s appropriate use is guided by more specific conditions, such as intending to resell the purchased items in their original form.

It covers the purchase of any item, regardless of its intended use. The certificate explicitly states that the purchased items must be for resale as tangible personal property. Misinterpreting this can lead to unintended tax liabilities and penalties.

Misuse consequences are minor. Misusing a resale certificate for personal gain or to evade paying tax is a serious offense. It can lead to being liable for the unpaid tax plus a significant penalty, either 10 percent of the tax or $500, whichever is more.

Informal agreements or understandings with the seller are enough. This misconception could lead to liability issues. The certificate requires clarity and compliance with the law, which can only be ensured through formal acknowledgment and understanding of terms.

Understanding and properly utilizing the California Resale Certificate is vital for businesses to operate legally and efficiently within the state. Misconceptions can lead to severe penalties, including fines and charges of misdemeanors. Thus, it’s recommended to familiarize oneself with the requirements and stipulations of the certificate to avoid any legal misunderstandings or misapplications.

Key takeaways

Filling out and correctly using the California Resale Certificate is crucial for businesses engaged in sales. Here are some key takeaways to help ensure you're doing it right:

- Validity of the seller’s permit: Make sure your seller’s permit number is valid at the time of completing the form. This is foundational for the certificate’s legitimacy.

- Specify the type of goods: Clearly define the type of tangible personal property you are engaged in selling. This helps in maintaining the relevance and correctness of the certificate.

- Vendor information: The form requires the vendor's name from whom you’re purchasing the items. It’s essential to fill this out accurately to trace the chain of sale.

- Intent to resell: Clarify that the items bought will be resold in the regular course of your business operations. This declaration is critical to avail the benefits of the resale certificate.

- Non-use declaration: By signing the form, you commit to not using the purchased items in any way other than for demonstration or display until they are resold. Misuse can lead to tax liabilities.

- Detailed description of items: Provide a detailed description of the items to be purchased for resale. This detailed listing helps in verifying that the certificate is used appropriately.

- Acknowledgement of misuse penalties: Being aware that misuse of the resale certificate, for personal gain or to evade tax, will result in hefty penalties is crucial. This includes paying the due tax plus either a 10 percent penalty of the tax or $500, whichever is more.

- Signature and identification: The certificate must be signed by the purchaser, their employee, or an authorized representative. This ensures the authenticity of the certificate.

- Printed name and title: Printing the name and title of the person signing the certificate adds another layer of verification and accountability.

- Business and contact information: Lastly, providing up-to-date and accurate business address and telephone number is essential for any future communication or verification needs.

Correctly filling out and understanding the California Resale Certificate is essential for businesses to comply with tax laws and avoid penalties. Keeping these key takeaways in mind will help ensure that you use the form correctly and maintain your business’s integrity.

Discover More PDFs

Do You Need a Firefighter Endorsement - Completion of this health questionnaire is a DMV requirement separate from the commercial licensing process, highlighting its focus on personal vehicle operation.

How Many Allowances Should I Claim Single - Employees claiming exempt status or high allowances should be prepared to justify their claims if reviewed by the FTB.

California Gypsy Moth Checklist - Know which outdoor household items require inspection for gypsy moth before relocating.