Blank Ca Llc 12R PDF Form

Navigating the requirements set by the California Secretary of State, every California and registered foreign limited liability company (LLC) finds itself mandated to submit a Statement of Information using Form LLC-12 within 90 days of their registration and subsequently every two years within a six-month window based on their original registration month. This process is streamlined through an online platform at bizfile.sos.ca.gov, where entities can update or confirm their business information, including addresses, agent for service of process, and management structure. The completion of this form is critical not only for compliance but also for maintaining an active status, as failure to file or update the necessary details could result in penalties or suspension. Additionally, the form addresses the process for obtaining copies of the filed document and outlines the fees associated with filing and certification, ensuring businesses are well-informed of the potential costs. With the inclusion of specific instructions for completing each item, the form guides LLCs through disclosing principal business activities, management details, and any changes in the agent for service of process, aiming to streamline the filing process while ensuring accurate and updated records are maintained with the California Secretary of State.

Document Preview Example

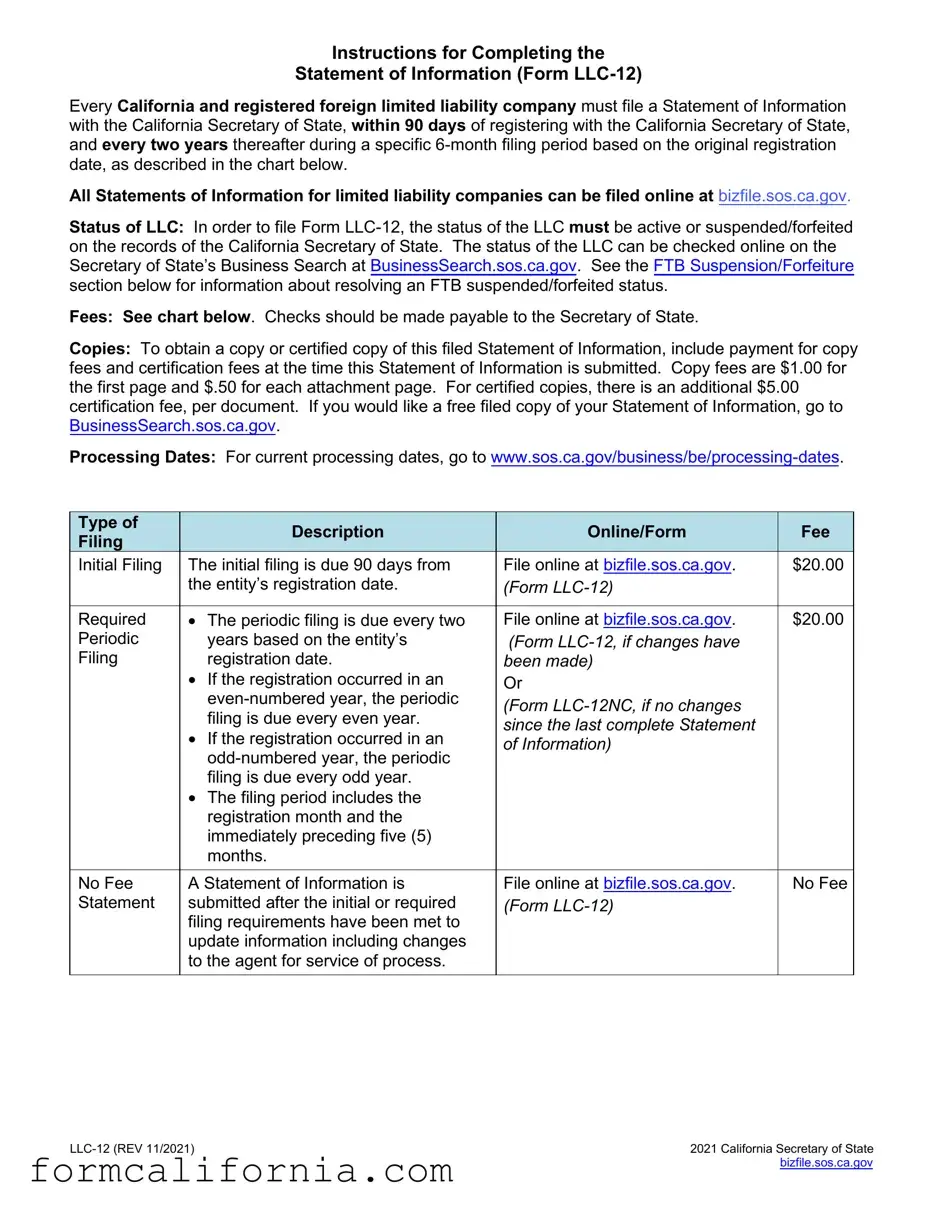

Instructions for Completing the

Statement of Information (Form

Every California and registered foreign limited liability company must file a Statement of Information with the California Secretary of State, within 90 days of registering with the California Secretary of State, and every two years thereafter during a specific

All Statements of Information for limited liability companies can be filed online at bizfile.sos.ca.gov.

Status of LLC: In order to file Form

Fees: See chart below. Checks should be made payable to the Secretary of State.

Copies: To obtain a copy or certified copy of this filed Statement of Information, include payment for copy fees and certification fees at the time this Statement of Information is submitted. Copy fees are $1.00 for the first page and $.50 for each attachment page. For certified copies, there is an additional $5.00 certification fee, per document. If you would like a free filed copy of your Statement of Information, go to BusinessSearch.sos.ca.gov.

Processing Dates: For current processing dates, go to

|

Type of |

|

|

Description |

|

Online/Form |

Fee |

|

Filing |

|

|

|

|||

|

|

|

|

|

|

|

|

|

Initial Filing |

|

The initial filing is due 90 days from |

File online at bizfile.sos.ca.gov. |

$20.00 |

||

|

|

|

|

the entity’s registration date. |

(Form |

|

|

|

|

|

|

|

|||

|

Required |

• The periodic filing is due every two |

File online at bizfile.sos.ca.gov. |

$20.00 |

|||

|

Periodic |

|

years based on the entity’s |

(Form |

|

||

|

Filing |

|

registration date. |

been made) |

|

||

|

|

|

|

• If the registration occurred in an |

Or |

|

|

|

|

|

|

(Form |

|

||

|

|

|

|

filing is due every even year. |

|

||

|

|

|

|

since the last complete Statement |

|

||

|

|

|

|

• If the registration occurred in an |

|

||

|

|

|

|

of Information) |

|

||

|

|

|

|

|

|||

|

|

|

|

|

|

||

|

|

|

|

filing is due every odd year. |

|

|

|

|

|

|

|

• The filing period includes the |

|

|

|

|

|

|

|

registration month and the |

|

|

|

|

|

|

|

immediately preceding five (5) |

|

|

|

|

|

|

|

months. |

|

|

|

|

No Fee |

A Statement of Information is |

File online at bizfile.sos.ca.gov. |

No Fee |

|||

|

Statement |

submitted after the initial or required |

(Form |

|

|||

|

|

|

filing requirements have been met to |

|

|

||

|

|

|

|

update information including changes |

|

|

|

|

|

|

|

to the agent for service of process. |

|

|

|

2021 California Secretary of State |

|

|

bizfile.sos.ca.gov |

|

|

Statutory Required 6 Month Filing Window for Limited Liability Companies |

|||||

|

|

|

|

|

|

|

|

|

|

Month of Formation, |

|

|

Statement of Information |

|

|

|

|

Registration or Conversion |

|

|

Applicable Filing Period |

|

|

|

|

|

|

First Day of |

Through Last Day |

|

|

|

|

January |

|

|

August |

January |

|

|

|

February |

|

September |

February |

|

|

|

|

March |

|

|

October |

March |

|

|

|

April |

|

|

November |

April |

|

|

|

May |

|

|

December |

May |

|

|

|

June |

|

|

January |

June |

|

|

|

July |

|

|

February |

July |

|

|

|

August |

|

|

March |

August |

|

|

|

September |

|

|

April |

September |

|

|

|

October |

|

|

May |

October |

|

|

|

November |

|

|

June |

November |

|

|

|

December |

|

|

July |

December |

|

If you are not completing this form online, type or print legibly in black or blue ink. Complete the |

|||||||

Statement of Information (Form |

|

|

|||||

|

|

|

|

|

|

||

Item |

Instruction |

|

Tips |

|

|

||

1. |

Enter the name of the limited liability |

|

• To ensure you have the exact name of the LLC, refer |

||||

|

company exactly as it appears on file |

|

to your registration document filed with the California |

||||

|

with the California Secretary of State, |

|

Secretary of State and any name change |

||||

|

including the entity ending |

|

amendments. |

|

|

||

|

(ex: “Jones & Company, LLC” or “Smith |

|

• Some foreign LLCs may have registered in California |

||||

|

Construction, a Limited Liability |

|

using an alternate name. If your LLC is a registered |

||||

|

Company”). |

|

foreign LLC using an alternate name in California, |

||||

|

|

|

|

|

you must enter the complete alternate name. |

||

|

|

|

|

||||

2. |

Enter the |

|

• The |

||||

|

to the LLC by the California Secretary |

|

Secretary of State above the file stamp at the top of |

||||

|

of State at the time of registration. |

|

the LLC’s registration document filed with the |

||||

|

|

|

|

|

California Secretary of State or if filed electronically, |

||

|

|

|

|

|

in the top section, below the Entity Name. |

||

|

|

|

|

|

• Secretary of State Records can be accessed online |

||

|

|

|

|

|

through our Business Search at |

||

|

|

|

|

|

BusinessSearch.sos.ca.gov. While searching the |

||

|

|

|

|

|

Business Search, be sure to identify your LLC |

||

|

|

|

|

|

correctly including the jurisdiction that matches your |

||

|

|

|

|

|

LLC. |

|

|

|

|

|

|

||||

3. |

If formed outside of California, enter |

|

• The jurisdiction must match the Secretary of State’s |

||||

|

the state, foreign country or other place |

|

records. |

|

|

||

|

where the LLC is organized. |

|

• Secretary of State Records can be accessed online |

||||

|

|

|

|

|

|||

|

|

|

|

|

through our Business Search at |

||

|

|

|

|

|

BusinessSearch.sos.ca.gov. While searching the |

||

|

|

|

|

|

Business Search, be sure to identify your LLC |

||

|

|

|

|

|

correctly including the jurisdiction that matches your |

||

|

|

|

|

|

registered foreign LLC. |

||

2021 California Secretary of State |

|

|

bizfile.sos.ca.gov |

Item |

|

Instruction |

|

Tips |

|

|

|

• If the LLC is formed in California, leave Item 3 blank. |

|

|

|

|

|

|

4a. |

|

Enter the complete street address, city, |

• The complete street address is required, including |

|

|

|

state and zip code of the LLC’s |

|

the street name and number, city, state and zip code. |

|

|

principal office. |

• Address must be a physical address. |

|

|

|

|

||

|

|

|

• Do not enter a P.O. Box address, an “in care of” |

|

|

|

|

|

address, or abbreviate the name of the city. |

|

|

|

|

|

4b. |

|

If different from the address in Item 4a, |

• This address will be used for mailing purposes and |

|

|

|

enter the complete mailing address, |

|

may be a P.O. Box address or “in care of” an |

|

|

city, state and zip code of the LLC. |

|

individual or entity. |

|

|

|

• Do not abbreviate the name of the city. |

|

|

|

|

|

|

4c. |

|

• If the LLC is formed in California, |

• The complete street address is required, including |

|

|

|

enter the complete street address, |

|

the street name and number, city and zip code. |

|

|

city and zip code of the office in |

• Address must be a physical address in California. |

|

|

|

California, if different from Item 4a. |

||

|

|

• Do not enter a P.O. Box address, an “in care of” |

||

|

|

• If the LLC is formed outside of |

||

|

|

|

address, or abbreviate the name of the city. |

|

|

|

California, enter the complete street |

|

|

|

|

• If Item 4a is an address in California leave Item 4c |

||

|

|

address, city and zip code of the |

||

|

|

principle business office in California, |

|

blank and proceed to Item 5. |

|

|

if any. |

|

|

|

|

|

||

5. |

Enter the name and complete business |

• If the LLC has more than one manager or member, |

||

|

or residential address of any |

|

enter the name(s) and address(es) of the additional |

|

|

manager(s), appointed or elected in |

|

mangers or members on Form |

|

|

accordance with the Articles of |

|

• Please do not abbreviate the name of the city. |

|

|

Organization or Operating Agreement, |

|

||

|

|

• Review your Articles of Organization or any |

||

|

or if no manager(s) has been so |

|

||

|

elected or appointed, the name and |

|

amendments thereto, to determine if the LLC is run |

|

|

business or residential address of each |

|

by a single manager, more than one manager or by |

|

|

member. |

|

its member(s). |

|

|

|

|

|

• Every LLC is required to have at least one |

|

|

|

|

manager/member. |

|

|

|

|

• A member(s) is the owner of the LLC similar to a |

|

|

|

|

shareholder(s) in a corporation. |

|

|

|

|

|

6. |

|

The LLC must have an Agent for |

|

• An Agent for Service of Process is responsible for |

|

|

Service of Process. |

|

accepting legal documents (e.g. service of process, |

|

|

There are two types of Agents that can |

|

lawsuits, subpoenas, other types of legal notices, |

|

|

be named: |

|

etc.) on behalf of the LLC. |

|

|

• an individual (e.g., member, manager, |

|

• You must provide information for either an individual |

|

|

or any other individual) who resides in |

|

OR a registered corporate agent, not both. |

|

|

California with a physical California |

|

• If using a registered corporate agent, the corporation |

|

|

street address; OR |

|

must have a current agent registration certificate on |

|

|

• a registered corporate agent qualified |

|

file with the California Secretary of State as required |

|

|

with the California Secretary of State. |

|

by Section 1505. |

|

|

|

|

|

6a & b. |

If Individual Agent: |

|

• The complete street address is required, including |

|

|

|

• Enter the name of the agent for |

|

the street name and number, city and zip code. |

|

|

service of process and the agent’s |

|

• Do not enter a P.O. Box address, an “in care of” |

|

|

complete California street address, |

|

address, or abbreviate the name of the city. |

|

|

city and zip code. |

|

• Many times, a small LLC will designate a member or |

|

|

|

|

|

2021 California Secretary of State |

|

|

bizfile.sos.ca.gov |

Item |

|

Instruction |

|

Tips |

|

|

• If an individual is designated as the |

|

manager as the agent for service of process. |

|

|

|

|

|

|

|

agent, complete Items 6a and 6b |

|

• The individual agent should be aware that the name |

|

|

ONLY. Do not complete Item 6c. |

|

and the physical street address of the agent for |

|

|

|

|

service of process is a public record, open to all (as |

|

|

|

|

are all the addresses of the LLC provided in filings). |

|

|

|

|

|

6c. |

|

If Registered Corporate Agent: |

• Before a corporation is designated as agent for the |

|

|

• Enter the name of the registered |

|

LLC, that corporation must have a current agent |

|

|

|

registration certificate on file with the California |

||

|

|

corporate agent exactly as registered |

|

|

|

|

|

Secretary of State as required by Section 1505 stating |

|

|

|

in California. |

|

|

|

|

|

the address(es) of the registered corporate agent and |

|

|

• If a registered corporate agent is |

|

||

|

|

the authorized employees that will accept service of |

||

|

|

designated as the agent, complete |

|

|

|

|

|

process of legal documents and notices on behalf of |

|

|

|

Item 6c ONLY. Do not complete |

|

|

|

|

|

the LLC. |

|

|

|

Items 6a and 6b. |

• Advanced approval must be obtained from a |

|

|

|

|

||

|

|

|

|

registered corporate agent prior to designating that |

|

|

|

|

corporation as your agent for service of process. |

|

|

|

• No California or foreign corporation may register as |

|

|

|

|

|

California corporate agent unless the corporation |

|

|

|

|

currently is authorized to engage in business in |

|

|

|

|

California and is in good standing on the records of |

|

|

|

|

the California Secretary of State. |

|

|

|

• Provide your Registered Corporate Agent’s exact |

|

|

|

|

|

name as registered with the California Secretary of |

|

|

|

|

State. To confirm that you are providing the exact |

|

|

|

|

name of the Registered Corporate Agent, go to https:// |

|

|

|

|

businesssearch.sos.ca.gov/cbs/List1505Agents. |

7. |

|

Briefly describe the general type of |

|

|

|

|

business that is the principal business |

|

|

|

|

activity of the LLC. |

|

|

|

|

|

|

|

8. |

|

Enter the name and complete business |

• A chief executive officer may be in addition to |

|

|

|

or residential address of the chief |

|

members and managers but generally is the person |

|

|

executive officer, if any. |

|

that occupies the highest level position in the LLC’s |

|

|

|

|

organization hierarchy in charge of managing the |

|

|

|

|

LLC. |

|

|

|

|

|

9. |

|

Check either YES or NO to disclose if |

• Check YES if any Manager or any Member of this |

|

|

|

any Manager or any Member have an |

|

Limited Liability Company have an outstanding final |

|

|

outstanding final judgment issued by |

|

judgment issued by the Division of Labor Standards |

|

|

the Division of Labor Standards |

|

Enforcement or a court of law, for which no appeal |

|

|

Enforcement or a court of law, for |

|

therefrom is pending, for the violation of any wage |

|

|

which no appeal is pending, for the |

|

order or provision of the Labor Code. |

|

|

violation of any wage order or provision |

• Check NO if no Manager or Member of this Limited |

|

|

|

of the Labor Code. |

||

|

|

|

Liability Company has an outstanding final judgment |

|

|

|

|

|

|

|

|

|

|

issued by the Division of Labor Standards |

|

|

|

|

Enforcement or a court of law, for which no appeal |

|

|

|

|

therefrom is pending, for the violation of any wage |

|

|

|

|

order or provision of the Labor Code. |

|

|

|

|

|

10. |

|

Type or print the date, the name and |

|

|

|

|

title of the person completing this form |

|

|

|

|

and sign where indicated. |

|

|

|

|

|

|

|

2021 California Secretary of State |

|

|

bizfile.sos.ca.gov |

Submission Cover Sheet (Optional): To make it easier to receive communication related to this document, including the copy of the filed document, complete the Submission Cover Sheet. For the Return Address: enter the name of a designated person and/or company and the corresponding mailing address. Please note: the Submission Cover Sheet will be treated as correspondence and will not be made part of the filed document.

Where to File: For faster service, this form can be filed online at bizfile.sos.ca.gov. The completed form along with the applicable fees can be mailed to Secretary of State, Statement of Information Unit, P.O. Box 944230, Sacramento, CA

Legal Authority: General statutory filing provisions are found in Section 17702.09 unless otherwise indicated. All statutory references are to the California Corporations Code, unless otherwise stated. Failure to file this Statement of Information by the due date will result in the assessment of a $250.00 penalty. (Sections 17713.07(b) and 17713.09; California Revenue and Taxation Code section 19141.)

FTB Suspension/Forfeiture: If the LLC’s status is FTB suspended/forfeited, the status must be resolved with the California Franchise Tax Board (FTB) for the LLC to be returned to active status. For revivor requirements, go to the FTB’s website at https://www.ftb.ca.gov or contact the FTB at (800)

2021 California Secretary of State |

|

|

bizfile.sos.ca.gov |

Secretary of State

Business Programs Division

Statement of Information

1500 11th Street, Sacramento, CA 95814

P.O. Box 944230, Sacramento, CA

Submission Cover Sheet

Instructions:

•Complete and include this form with your submission. This information only will be used to communicate with you in writing about the submission. This form will be treated as correspondence and will not be made part of the filed document.

•Make all checks or money orders payable to the Secretary of State.

•Standard processing time for submissions to this office is approximately 5 business days from receipt. All submissions are reviewed in the date order of receipt. For updated processing time information, go to

Optional Copy and Certification Fees:

•If applicable, include optional copy and certification fees with your submission.

•For applicable copy and certification fee information, refer to the instructions of the specific form you are submitting.

Entity Information: (Please type or print legibly)

Name: __________________________________________________________________________________________________________________

Entity Number (if applicable):_____________________________________

Comments: _____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Return Address: For written communication from the Secretary of State related to this document, or if purchasing a copy of the filed document enter the name of a person or company and the mailing address.

Name: |

|

|

Company: |

|

|

Address: |

|

|

City/State/Zip: |

|

|

Doc Submission Cover - SI (Rev. 11/2020)

Secretary of State Use Only

T/TR:

AMT REC’D: $

Clear Form

Print Form

Print Form

Secretary of State |

|

|

Statement of Information |

|

|

|

|

|

(Limited Liability Company) |

|

|

|

|

|

IMPORTANT — This form can be filed online at |

|

|

bizfile.sos.ca.gov. |

|

|

Read instructions before completing this form. |

|

|

Filing Fee - $20.00 |

|

|

Copy Fees - First page $1.00; each attachment page $0.50; |

|

|

Certification Fee - $5.00 plus copy fees |

This Space For Office Use Only |

|

|

|

|

|

|

|

1.Limited Liability Company Name (Enter the exact name of the LLC. If you registered in California using an alternate name, see instructions.)

2.

3.State, Foreign Country or Place of Organization

(only if formed outside of California)

4. Business Addresses

a. Street Address of Principal Office - Do not list a P.O. Box |

City (no abbreviations) |

State |

Zip Code |

|

|

|

|

|

|

b. Mailing Address of LLC, if different than item 4a |

City (no abbreviations) |

State |

Zip Code |

|

|

|

|

|

|

c. Street Address of California Office, if Item 4a is not in California |

City (no abbreviations) |

State |

Zip Code |

|

Do not list a P.O. Box |

|

|

|

|

|

|

|

CA |

|

|

|

|

|

|

5. Manager(s) or Member(s) |

If no managers have been appointed or elected, provide the name and address of |

|||

|

each member. At least one name and address must be listed. If the |

|

||

manager/member is an individual, complete Items 5a and 5c (leave Item 5b blank). If the manager/member is an additional managers/members, enter the names(s) and address(es) on Form

a. First Name, if an individual - Do not complete Item 5b

Middle Name

Last Name

Suffix

b. Entity Name - Do not complete Item 5a

c. Address

City (no abbreviations)

State

Zip Code

2021 California Secretary of State |

|

|

bizfile.sos.ca.gov |

6.Service of Process (Must provide either Individual OR Corporation.)

INDIVIDUAL – Complete Items 6a and 6b only. Must include agent’s full name and California street address.

a. California Agent's First Name (if agent is not a corporation) |

|

Middle Name |

Last Name |

|

|

|

Suffix |

||

|

|

|

|

|

|

|

|

|

|

b. Street Address (if agent is not a corporation) - Do not enter a |

|

City (no abbreviations) |

|

State |

|

Zip Code |

|||

P.O. Box |

|

|

|

|

CA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

CORPORATION – Complete Item 6c only. Only include the name of the registered agent Corporation. |

|

|

|||||||

|

|

|

|

|

|

|

|

||

c. California Registered Corporate Agent’s Name (if agent is a corporation) – Do not complete Item 6a or 6b |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

7. Type of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Describe the type of business or services of the Limited Liability Company |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

8. Chief Executive Officer, if elected or appointed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

a. First Name |

|

Middle Name |

Last Name |

|

|

|

Suffix |

||

|

|

|

|

|

|

|

|

||

b. Address |

|

City (no abbreviations) |

|

State |

|

Zip Code |

|||

|

|

|

|

|

|

|

|

|

|

9. Labor Judgment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Does any Manager or Member have an outstanding final judgment issued by the |

|

|

|

|

|

||||

Division of Labor Standards Enforcement or a court of law, for which no appeal |

|

|

Yes |

No |

|||||

therefrom is pending, for the violation of any wage order or provision of the Labor Code? |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

10.By signing, I affirm under penalty of perjury that the information herein is true and correct and that I am authorized by California law to sign.

_____________________ |

____________________________________________________________ |

________________________ |

__________________________________ |

Date |

Type or Print Name |

Title |

Signature |

Print Form

Clear Form

2021 California Secretary of State

bizfile.sos.ca.gov

Document Specs

| Fact | Detail |

|---|---|

| 1. Purpose | Form LLC-12 is used for California and registered foreign limited liability companies to file a Statement of Information. |

| 2. Initial Filing Deadline | The initial Statement of Information must be filed within 90 days of registering with the California Secretary of State. |

| 3. Subsequent Filing Frequency | After the initial filing, it must be filed every two years during a specific 6-month filing period based on the original registration date. |

| 4. Filing Period Based on Registration Date | The filing period includes the registration month and the immediately preceding five months, varying if the registration was in an odd or even year. |

| 5. Online Filing Option | Statements of Information can be filed online at bizfile.sos.ca.gov. |

| 6. Status Requirement for Filing | The LLC must be in an active or suspended/forfeited status on the records of the California Secretary of State to file Form LLC-12. |

| 7. Fees | The filing fee for Form LLC-12 is $20.00, with checks payable to the Secretary of State. There is no fee for submitting a no change Statement (Form LLC-12NC). |

| 8. Copy Fees | Copy fees are $1.00 for the first page and $.50 for each attachment page. For certified copies, there is an additional $5.00 certification fee per document. |

| 9. Processing Dates | Current processing dates for the form can be found at the official Secretary of State website. |

| 10. Legal Authority and Penalties for Not Filing | Failure to file by the due date can result in a $250.00 penalty. The general statutory filing provisions are found in Section 17702.09 of the California Corporations Code. |

Detailed Instructions for Writing Ca Llc 12R

Filling out the CA LLC-12R form is a crucial step for LLCs in California to ensure they stay compliant with the state's filing requirements. This document needs to be submitted within specific time frames to update or confirm the information the state has on record for your LLC. It might sound like a daunting task, but by breaking it down step by step, the process can be straightforward. Here are the steps you'll need to follow to complete the LLC-12R form correctly.

- Access the form online or obtain a hard copy. The form can be filed online at bizfile.sos.ca.gov for a more convenient and faster submission.

- Start with Item 1: Enter your LLC’s name exactly as it appears on your registration documents with the California Secretary of State, including any specific entity designation (e.g., LLC, L.L.C., etc.).

- In Item 2, input the 12-digit entity number assigned to your LLC by the California Secretary of State at the time of your initial registration.

- For LLCs formed outside of California, Item 3 requires the state or jurisdiction where your LLC was originally organized. If your LLC was formed in California, you can leave this item blank.

- The address details are filled out next. In Item 4a, provide the complete street address of your LLC’s primary office. If you have a separate mailing address, include this in Item 4b. Additionally, if your principal office address is outside of California, and you have a California-based office, that address should be entered in Item 4c.

- Item 5 asks for the name and address of any manager(s) or, if applicable, the member(s) who is managing the LLC. If your LLC has more managers or members, additional names and addresses can be included on Form LLC-12A.

- For Item 6, select your agent for service of process in California, who can be an individual or a registered corporate agent. If an individual is selected (Items 6a and 6b), provide their full name and physical street address in California. If a registered corporate agent is selected (Item 6c), input the exact name as registered.

- In Item 7, describe the general nature of your LLC’s business activity.

- Item 8 requires the name and address of the chief executive officer, if you have one.

- Check the appropriate box in Item 9 to indicate whether any manager or member has an outstanding final judgment issued for a violation of any wage order or Labor Code provision.

- Finally, Item 10 requires the date, along with the name and title of the person completing the form. Make sure to sign the form where indicated.

- If desired, complete the Submission Cover Sheet for easier communication regarding your document submission, but remember this sheet will not be part of the official filed document.

- Review your form for accuracy, then submit it online for faster processing or mail it to the stated address, along with the appropriate fee.

Once submitted, keep an eye on your LLC’s provided contact information for any correspondences or confirmation from the California Secretary of State. This submission ensures your compliance and maintains your LLC’s good standing within the state, allowing you to focus on your business operations without unwanted legal distractions.

Things to Know About This Form

What is Form LLC-12R?

Form LLC-12R, also known as the Statement of Information, is a document that every California and registered foreign limited liability company (LLC) must file with the California Secretary of State. This filing is required within 90 days of registering the LLC with the California Secretary of State, and then every two years thereafter during a specific 6-month filing period based on the original registration date.

When is the Statement of Information due for my LLC?

The due date for your LLC’s Statement of Information depends on the month in which your LLC was originally registered or formed. The filing period includes the original registration month and the five months leading up to it. For example, if your LLC was formed in January, your filing period is August of the same year through January of the next year. This cycle repeats every two years, aligning with the year of registration (odd or even).

How can I check the status of my LLC?

To file Form LLC-12R, the status of your LLC must either be active or suspended/forfeited on the records of the California Secretary of State. You can check the status of your LLC online through the Secretary of State’s Business Search at BusinessSearch.sos.ca.gov. This tool will also help to ensure you have the correct name and entity number when completing the form.

What are the fees associated with Form LLC-12R?

- Initial Filing Fee: $20.00, due within 90 days of the LLC’s registration date.

- Periodic Filing Fee: $20.00, due every two years based on the LLC’s registration date.

- No Fee Statement: Filed after the required initial or periodic filing has been met to update information with no fee.

- Copy fees: $1.00 for the first page and $.50 for each attachment page. A $5.00 certification fee per document for certified copies.

Can I file Form LLC-12R online?

Yes, all Statements of Information for limited liability companies, including Form LLC-12R, can and should be filed online for faster processing. The online filing service is available at bizfile.sos.ca.gov. This platform streamlines the process and provides immediate confirmation of filing.

What is the significance of providing an agent for service of process?

An agent for service of process plays a critical role by accepting legal documents on behalf of the LLC. This could cover a range of documents, such as lawsuits, subpoenas, and other legal notices. The agent can be an individual residing in California with a physical address or a registered corporate agent qualified with the California Secretary of State. The name and physical street address of the agent are public records and easily accessible.

What happens if I fail to file Form LLC-12R?

Failing to file the required Statement of Information by the due date will result in a penalty of $250.00. Moreover, the LLC may face suspension or forfeiture by the California Franchise Tax Board (FTB), affecting the LLC's ability to legally conduct business. It's crucial to adhere to filing deadlines and ensure the LLC remains in good standing with the state.

Common mistakes

When completing the California LLC 12R form, which is essential for maintaining an active and compliant status with the California Secretary of State, individuals often encounter a range of common pitfalls. Avoiding these mistakes is crucial for ensuring the timely and accurate submission of this important document. Given the significance of the Statement of Information and its requirements, let's explore the top four missteps individuals often make during this process.

-

Not Verifying the Status of the LLC Before Filing: It's imperative to check whether the LLC is in an active or suspended/forfeited status with the California Secretary of State. Filing the form without resolving a suspended or forfeited status can lead to unnecessary complications, delaying the reinstatement of the LLC to good standing.

-

Inaccurate or Incomplete Addresses: Every section requiring an address, such as the principal office location (Item 4a), mailing address if different from the principal office (Item 4b), and the address of the office in California if the LLC is formed outside of California (Item 4c), must be filled out completely and accurately. Using P.O. Box addresses, abbreviating city names, or entering 'in care of' addresses can invalidate the form, leading to processing delays.

-

Failing to Provide Complete Agent for Service of Process Information: An Agent for Service of Process is essential for handling legal documents on behalf of the LLC. When designating an individual as the agent (Items 6a and 6b), including their complete street address is necessary. Likewise, when appointing a registered corporate agent (Item 6c), ensuring accurate and up-to-date information aligns with the Secretary of State's records is vital for compliance and effective communication.

-

Omitting Required Signatures and Dates: The form must be signed and dated by an authorized person (Item 10). Overlooking this crucial step can lead to the rejection of the form. Proper authorization and completion of this section affirm that the information provided is accurate and up-to-date, in accordance with the regulatory requirements.

In conclusion, while the process of completing the CA LLC 12R form might appear straightforward, attention to detail is paramount. Ensuring the accuracy and completeness of the information provided, from the status of the LLC, through to the specificity of addresses and the provision of required signatures, forms the cornerstone of maintaining compliance with the California Secretary of State's requirements. Diligence in these areas facilitates a smoother filing process, contributing to the continued operational success of the LLC within California.

Documents used along the form

When it comes to managing a limited liability company (LLC) in California, staying up-to-date with paperwork is crucial for compliance and smooth operations. The Statement of Information, or Form LLC-12, is one key document that requires careful attention. However, to fully meet legal requirements and guidelines, several other forms and documents often accompany the LLC-12 filing. Understanding these additional documents can help ensure that LLCs not only comply with state regulations but also maintain a robust legal and operational framework. Here's a brief look at some of these essential documents.

- Articles of Organization (Form LLC-1): This is the initial document filed to officially form an LLC in California. It outlines the basic information about the LLC, including its name, purpose, and the address of its principal office.

- Operating Agreement: Although not filed with the state, this internal document is crucial. It outlines the ownership and operating procedures of the LLC, ensuring all members are on the same page regarding the entity's management and financial arrangements.

- Statement of Information (Form LLC-12A): Used if there are changes to the information of the managers or members beyond what is reported on the original or previously filed Statement of Information (LLC-12).

- Application to Register a Foreign LLC (Form LLC-5): For LLCs formed outside of California but doing business in the state, this form registers the foreign LLC with the California Secretary of State.

- Certificate of Good Standing: Though not a form to be filed, obtaining this certificate from the California Secretary of State proves that the LLC is up to date with all state filing requirements and tax obligations.

- Amendment to the Articles of Organization (Form LLC-2): If any of the information in the original Articles of Organization changes (e.g., the LLC's name), this form is used to formally update the state's records.

- Dissolution/Cancellation Forms: When it's time to close the LLC, whether due to business ending or merging with another entity, forms like the Certificate of Dissolution (Form LLC-3) and Certificate of Cancellation (Form LLC-4/7) are necessary to formally dissolve the LLC.

Together, these documents form a comprehensive legal framework around your LLC, ensuring that you're ready to operate smoothly and in compliance with California's legal requirements. Keeping track of these forms and understanding their purpose is essential for any LLC operating in California or those considering expanding their business into the state. It's always a good idea to consult with a legal professional or advisor to ensure that your LLC's documentation is complete, up-to-date, and filed correctly.

Similar forms

The Articles of Organization, often filed with the initial registration of a Limited Liability Company (LLC), shares similarities with the CA LLC-12R form in its foundational purpose. While the Articles of Organization establish the LLC’s existence under state law, detailing the business name, principal address, and the names of its members, the CA LLC-12R serves as a periodic update to this core information, ensuring the state's records remain current. Both documents are essential for maintaining good standing with the state, but the Articles of Organization represent the first step in this process, with the CA LLC-12R providing subsequent, regular updates.

The change of Registered Agent form, another critical document for LLCs, parallels the purpose of the CA LLC-12R in specific aspects. An LLC uses the change of Registered Agent form to notify the state of a change in the individual or company authorized to receive legal papers on behalf of the LLC. Similarly, the CA LLC-12R could include updates about the LLC’s agent for service of process among other information. Both forms ensure that the state has up-to-date contact information for legal notices, which is vital for the company's legal protection and compliance.

Annual Reports or Biennial Reports required by other states resemble the CA LLC-12R form in terms of function and necessity. These reports are typically mandatory filings that keep the state informed about a company's current operating status, providing updates on addresses, directors, and sometimes financial health. Like the CA LLC-12R, these reports are due at specified intervals and help maintain the LLC’s good standing with the state. They serve as a regular check-in with the state, ensuring public records for the entity are accurate and current.

The Statement of Amendment form has a connection to the CA LLC-12R in its ability to update official records with the state. When an LLC needs to change critical information filed at its inception, such as company name, business activities, or member information, a Statement of Amendment form is used. The CA LLC-12R overlaps in functionality when it comes to updating information about management and the agent for service of process. Both documents are tools for the LLC to communicate official changes, ensuring legal documents and official communications are sent to the right place.

The Application for Registration of Foreign LLC is akin to the CA LLC-12R for foreign LLCs operating in California. This application is required for foreign LLCs to legally conduct business in the state, similar to how domestic LLCs file their initial Articles of Organization. The CA LLC-12R, however, serves as a mechanism for both domestic and foreign LLCs to keep their operating information up to date with the California Secretary of State. Both forms facilitate compliance with state requirements, ensuring the LLC is recognized legally and can be held accountable for its actions within the state.

Dos and Don'ts

When preparing to fill out the California LLC-12R form, which is a requirement for both domestic and foreign limited liability companies registered in California, paying attention to both what should and shouldn't be done can streamline the process, ensuring compliance and avoiding common pitfalls. Below are listed five essential dos and don'ts aimed at guiding through the successful completion of the form.

Things You Should Do:

- Ensure the LLC’s status is active or suspended/forfeited on the records of the California Secretary of State before attempting to file. An inactive status must be resolved prior to filing.

- Use the exact name of the LLC as it appears on file with the California Secretary of State, including entity ending, to avoid any discrepancies that might cause the form to be rejected.

- Provide the 12-digit Entity Number accurately. This number is crucial for identification and is provided by the Secretary of State at the time of registration.

- Include a complete physical address for the principal office. A P.O. Box is not acceptable as it is essential to provide a location where the LLC can be contacted directly.

- Designate an Agent for Service of Process who has a physical California address if choosing an individual, or ensure the registered corporate agent is in good standing if opting for a corporate agent.

Things You Shouldn't Do:

- Do not leave the jurisdiction field blank if the LLC is formed outside of California. Proper identification of the jurisdiction is critical for foreign entities.

- Avoid using a P.O. Box for the LLC’s principal office or the agent for service of process. Legitimacy and accountability require physical addresses.

- Do not abbreviate the name of the city in any addresses provided. Accuracy and completeness in address details are vital for proper communication and record-keeping.

- Do not designate a registered corporate agent without prior approval. Confirming the agent's agreement and ensuring they are in good standing avoids future compliance issues.

- Avoid missing the biennial filing window based on your LLC's registration date. Timely filing is essential to prevent penalties and maintain good standing.

Adherence to these guidelines not only aids in the smooth filing of the LLC-12R form but also ensures that your limited liability company remains in compliance with California state regulations. Keeping these tips in mind can save time, avoid unnecessary penalties, and ensure that your business operates with the necessary legal endorsements.

Misconceptions

Understanding the California LLC-12R form requires clarity on its purpose, requirements, and implications. However, several misconceptions have made their way among those attempting to navigate these regulatory waters. Shining a light on these can demystify the process and guide LLC operators towards compliant and efficient filings.

It's optional: Some believe filing the LLC-12R form is optional, especially if there haven't been any changes to their information. However, the State of California mandates that both active and suspended/forfeited LLCs must file within 90 days of their registration date and every two years thereafter, during a specific 6-month filing period. This requirement is not negated by a lack of changes to the LLC's information.

Only needed for changes: Misleadingly, there is a notion that the LLC-12R form is only necessary if there are updates or changes to report. Despite this common belief, the form serves as both a confirmation of existing information and a method to report any updates. Failing to file, regardless of changes, results in non-compliance with state requirements.

Physical address not required: Another common misunderstanding is the belief that a post office box or "in care of" address is sufficient for the principal office address. The State of California requires a physical street address for the principal office, as well as for the agent for service of process, to ensure transparency and accountability.

Online filing is cumbersome: There's a misconception that filing the LLC-12R online is a complex process. On the contrary, the California Secretary of State has streamlined the online filing process, making it more efficient and user-friendly than the traditional paper filing option.

There's no penalty for late filing: A dangerous misconception is that late filing does not incur a penalty. If the LLC-12R is not filed by the due date, the LLC faces a $250.00 penalty under California law. Timely filing is essential to avoid unnecessary expenses.

Any member or manager can sign: It's often mistakenly thought that the LLC-12R form can be signed by any member or manager. The form needs to be signed by an individual who has been authorized by the LLC to complete and sign the form, ensuring that the information is accurate and officially sanctioned by the LLC.

Status resolution is not urgent: Many operate under the false belief that resolving a suspended or forfeited status with the Franchise Tax Board (FTB) can be done at leisure. Returning the LLC to active status by resolving any outstanding FTB issues is immediate and essential for compliance and the continuous operation of the LLC in California.

Dispelling these misconceptions ensures that LLC operators are better informed, compliant, and able to maintain their good standing in the state of California, thereby avoiding unnecessary penalties and disruptions to business operations.

Key takeaways

When managing or establishing a Limited Liability Company (LLC) in California, the completion and submission of the Statement of Information using Form LLC-12 is a critical requirement that must be understood and complied with diligently. Here are key takeaways to ensure accurate and timely filing:

- The initial Statement of Information must be filed within 90 days following the registration of either a California or registered foreign LLC with the California Secretary of State, followed by biennial submissions during a specified 6-month filing window based on the original registration date.

- It's possible to check the current status of an LLC, whether active or suspended/forfeited, by visiting the California Secretary of State’s Business Search online portal, an essential step before filing Form LLC-12.

- To resolve a suspended or forfeited status with the Franchise Tax Board (FTB), proper steps outlined on the FTB’s website must be followed, which is necessary for reinstating the LLC to active status.

- Form LLC-12 incurs a filing fee, with the standard charge detailed for initial and subsequent biennial filings. Corrections or updates outside the regular schedule can be submitted without a fee, ensuring the company's information remains current.

- A copy or certified copy of the filed Statement of Information can be requested at the time of submission, for which additional fees apply. However, a free filed copy can also be accessed through the Business Search portal.

- When filling out Form LLC-12, it is imperative to provide accurate company details as recorded with the California Secretary of State, including the precise name and 12-digit Entity Number of the LLC.

- The form requires detailed information about the LLC’s principal office location, mailing address if different, and, for foreign entities, the address of the principal business office in California, all of which must be physical addresses rather than P.O. Boxes.

- Management information, including the names and addresses of managers or members, must be provided. If the LLC opts for a single manager or more than one, Form LLC-12A may be necessary for listing additional managers or members.

- An Agent for Service of Process must be designated, with the choice between an individual residing in California or a registered corporate agent qualified with the California Secretary of State, thereby enabling legal documents to be served on behalf of the LLC.

- The general type of business activity, details of the chief executive officer if applicable, and disclosure regarding any outstanding final judgments relating to labor law violations by any manager or member need to be included in the form.

The proper completion and timely filing of Form LLC-12 play a significant role in maintaining an LLC’s good standing with the California Secretary of State. This process, while meticulous, protects the company’s legitimacy and ensures compliance with state legal requirements.

Discover More PDFs

California Gun Permit - Understand the implications of hard card fingerprint cards for applicants outside California in the firearms permit process.

How to Pay $800 Llc Fee Online - Form 568 mandates disclosure of total assets at the year's end to accurately assess the company's fiscal health.

California Jv 445 - This form is utilized in child welfare proceedings in California to document the court's decisions regarding a child's placement and the pursuit of adoption after parental rights are ended.