Blank Ca 568 PDF Form

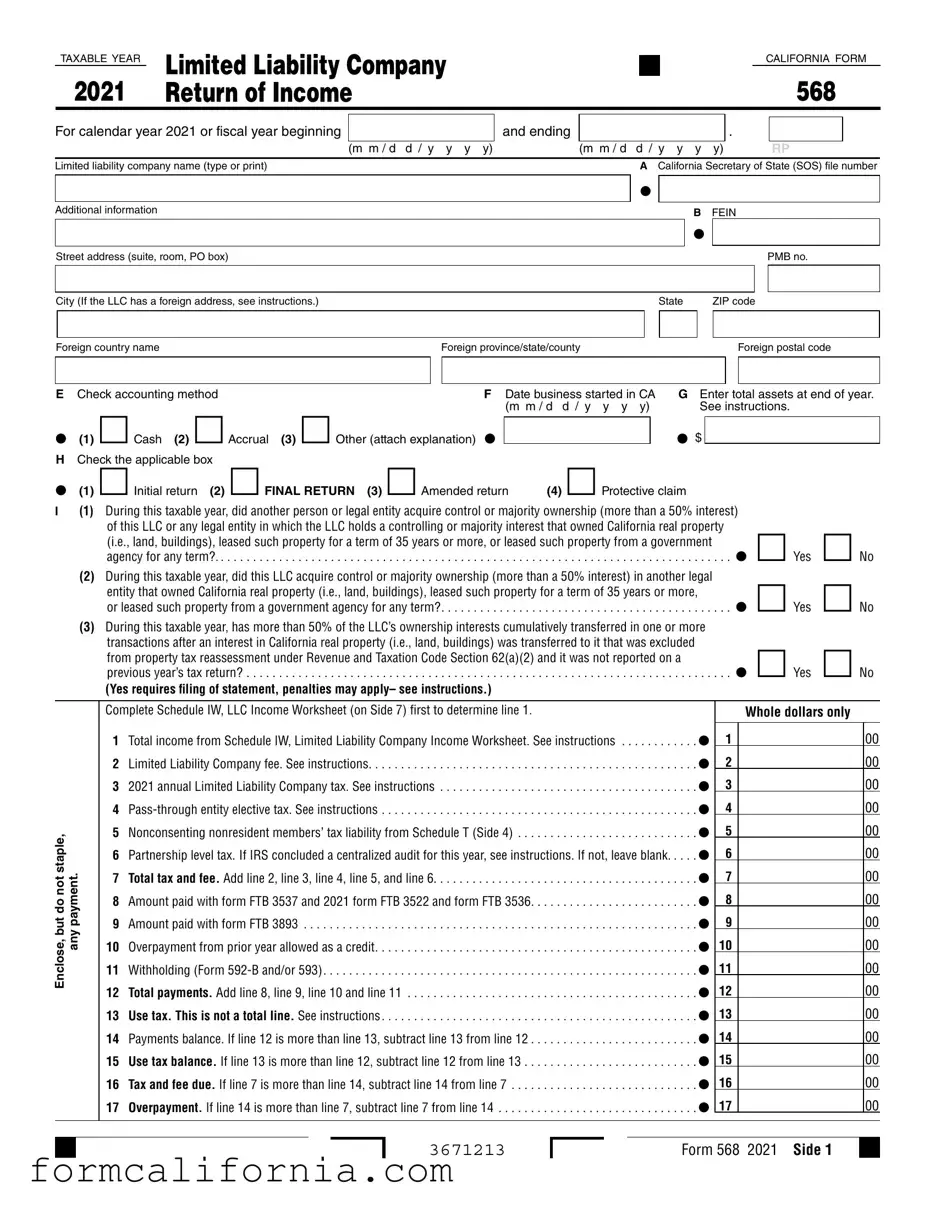

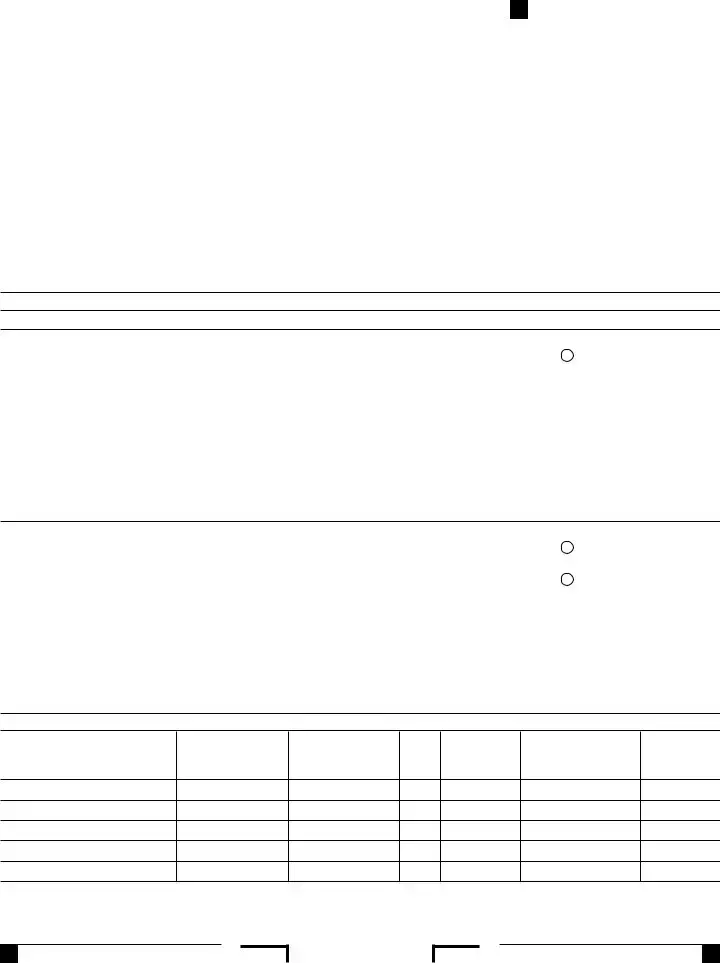

The California Form 568 serves as the primary tax document for limited liability companies (LLCs) operating within the state, covering the tax year 2021. This form meticulously guides LLCs through the requirements for reporting their income, deductions, credits, and taxes owed to the state. It demands such detailed information as the LLC's name, the California Secretary of State (SOS) file number, the Federal Employer Identification Number (FEIN), and specifics about its accounting method—cash, accrual, or other. Additionally, Form 568 addresses various aspects of LLC operations from the initial or final return, amendments, the total assets at the year's end, to intricate transactions like real property acquisitions or changes in majority ownership. LLCs are also required to disclose whether another entity controls them and information regarding their business activities, product or service description, and the maximum number of members during the taxable year. For tax computation, the form includes sections for income calculation, deductions, and determining tax liabilities, such as the annual LLC fee and taxes for nonconsenting nonresident members. Furthermore, it provides fields for reporting changes in membership, foreign or domestic investments, audits, and affiliations with other partnerships or LLCs. The introduction of questions related to specific tax situations, like investments in disregarded entities or involvement in reportable transactions, points to the comprehensive nature of this form in ensuring LLCs’ compliance with state tax obligations.

Document Preview Example

TAXABLE YEAR |

Limited Liability Company |

|

|

CALIFORNIA FORM |

|

||||

2021 |

|

568 |

||

Return of Income |

|

|||

For calendar year 2021 or fiscal year beginning

(m m / d d / y y y y)

and ending

.

(m m / d d / y y y y)

RP

Limited liability company name (type or print) |

|

|

|

|

A |

California Secretary of State (SOS) file number |

||||||||||||

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Additional information |

|

|

|

|

|

|

|

|

|

B |

FEIN |

|||||||

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

||

Street address (suite, room, PO box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PMB no. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the LLC has a foreign address, see instructions.) |

State |

|

|

|

ZIP code |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

Foreign province/state/county |

|

|

|

|

|

|

|

Foreign postal code |

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E Check accounting method |

|

|

F Date business started in CA |

G Enter total assets at end of year. |

||||||||||||||

• (1) □Cash (2) □Accrual |

(3) □Other (attach explanation) • |

(m m / d d / y y y y) |

|

|

|

See instructions. |

||||||||||||

|

|

|

|

• |

$ |

|

|

|

|

|

|

|||||||

H Check the applicable box |

□FINAL RETURN (3) □Amended return |

(4) □Protective claim |

• (1) □Initial return (2) |

I(1) During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this LLC or any legal entity in which the LLC holds a controlling or majority interest that owned California real property

(i.e., land, buildings), leased such property for a term of 35 years or more, or leased such property from a government |

• □ Yes |

agency for any term? |

|

(2) During this taxable year, did this LLC acquire control or majority ownership (more than a 50% interest) in another legal |

• □ Yes |

entity that owned California real property (i.e., land, buildings), leased such property for a term of 35 years or more, |

|

or leased such property from a government agency for any term? |

|

(3) During this taxable year, has more than 50% of the LLC’s ownership interests cumulatively transferred in one or more |

|

transactions after an interest in California real property (i.e., land, buildings) was transferred to it that was excluded |

• □ Yes |

from property tax reassessment under Revenue and Taxation Code Section 62(a)(2) and it was not reported on a |

|

previous year’s tax return? |

|

(Yes requires filing of statement, penalties may apply– see instructions.) |

|

□ No

□ No

□ No

Enclose, but do not staple, any payment.

Complete Schedule IW, LLC Income Worksheet (on Side 7) first to determine line 1.

1 |

Total income from Schedule IW, Limited Liability Company Income Worksheet. See instructions |

• |

2 |

Limited Liability Company fee. See instructions |

• |

3 |

2021 annual Limited Liability Company tax. See instructions |

• |

4 |

• |

|

5 |

Nonconsenting nonresident members’ tax liability from Schedule T (Side 4) |

• |

6 |

Partnership level tax. If IRS concluded a centralized audit for this year, see instructions. If not, leave blank |

• |

7 |

Total tax and fee. Add line 2, line 3, line 4, line 5, and line 6 |

• |

8 |

Amount paid with form FTB 3537 and 2021 form FTB 3522 and form FTB 3536 |

• |

9 |

Amount paid with form FTB 3893 |

• |

10 |

Overpayment from prior year allowed as a credit |

• |

11 |

Withholding (Form |

• |

12 |

Total payments. Add line 8, line 9, line 10 and line 11 |

• |

13 |

Use tax. This is not a total line. See instructions |

• |

14 |

Payments balance. If line 12 is more than line 13, subtract line 13 from line 12 |

• |

15 |

Use tax balance. If line 13 is more than line 12, subtract line 12 from line 13 |

• |

16 |

Tax and fee due. If line 7 is more than line 14, subtract line 14 from line 7 |

• |

17 |

Overpayment. If line 14 is more than line 7, subtract line 7 from line 14 |

• |

|

Whole dollars only |

|

1 |

|

00 |

2 |

|

00 |

3 |

|

00 |

4 |

|

00 |

5 |

|

00 |

6 |

|

00 |

7 |

|

00 |

8 |

|

00 |

9 |

|

00 |

10 |

|

00 |

11 |

|

00 |

12 |

|

00 |

13 |

|

00 |

14 |

|

00 |

15 |

|

00 |

16 |

|

00 |

17 |

|

00 |

3671213

Form 568 2021 Side 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Whole dollars only |

|

|

|

|

||||||

|

|

|

|

|

. . . . . . • |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

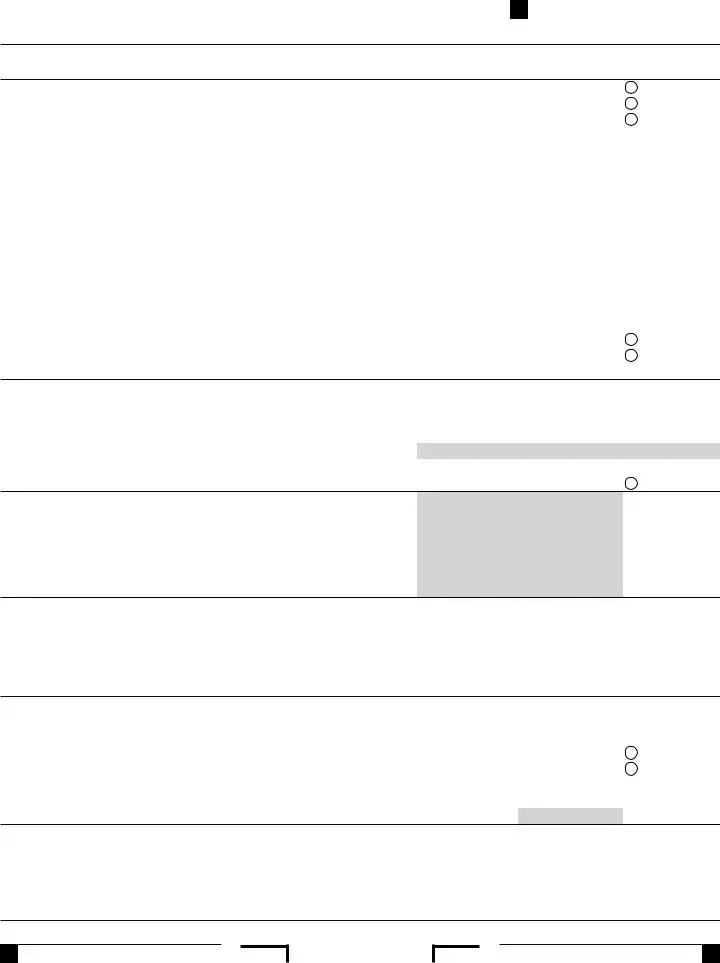

18 Amount of line 17 to be credited to 2022 tax or fee |

. . . |

. . . |

18 |

|

|

|

|

|

|

|

|

|

00 |

|

||

|

|

19 Refund. If the total of line 18 is less than line 17, subtract the total from line 17 |

• 19 |

|

|

|

|

|

|

|

. 00 |

|

||||||

|

|

|

|

|

. . . . . . • |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 Penalties and interest. See instructions |

. . . |

. . . |

20 |

|

|

|

|

|

|

|

|

|

00 |

|

||

|

|

21 Total amount due. Add line 15, line 16, line 18, and line 20, then subtract line 17 from the result. . |

• 21 |

|

|

|

|

|

|

|

. 00 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J Principal business activity code (Do not leave blank) |

. . . . . . |

. . . . . . . . . |

. . |

• |

|

|

|

|

|

|

|

|

|

|

||||

|

Business activity ________________________ Product or service _____________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

K Enter the maximum number of members in the LLC at any time during the year. For multiple member LLCs, attach a |

|

• |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

California Schedule |

. . . . . . |

. . . . . . . . . |

. . |

|

|

|

|

|

|

|

|

|

|

||||

L |

Is this LLC an investment partnership? See General Information O |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

M |

(1) |

Is this LLC apportioning or allocating income to California using Schedule R? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

|

(2) |

If “No,” was this LLC registered in California without earning any income sourced in this state during the taxable year? . |

. . |

• |

□ Yes |

□ No |

|

|||||||||||

N Was there a distribution of property or a transfer (for example, by sale or death) of an LLC interest during the taxable year? . |

. . |

• □ Yes |

□ No |

|

||||||||||||||

P |

(1) |

Does the LLC have any foreign |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

|

(2) |

Does the LLC have any domestic |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

|

(3) |

Were Form 592, Form |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

Q Are any members in this LLC also LLCs or partnerships? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||||

R |

Is this LLC under audit by the IRS or has it been audited in a prior year? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

S |

Is this LLC a member or partner in another multiple member LLC or partnership? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

|

If “Yes,” complete Schedule EO, Part I. |

|

|

|

|

|

|

□ Yes □ No |

|

|||||||||

T |

Is this LLC a publicly traded partnership as defined in IRC Section 469(k)(2)? |

. . . . . . |

. . . . . . . . . |

. . |

|

|

|

|||||||||||

U |

(1) |

Is this LLC a business entity disregarded for tax purposes? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

|

(2) |

If “Yes,” see instructions and complete Side 1, Side 2, Side 3, Schedule B, Side 5, and Side 7, if applicable. Are there |

|

• □ Yes □ No |

|

|||||||||||||

|

|

credits or credit carryovers attributable to the disregarded entity? |

. . . . . . |

. . . . . . . . . |

. . |

|

||||||||||||

|

(3) |

If “Yes” to U(1), does the disregarded entity have total income derived from or attributable to California that is less than |

|

|

|

□ |

|

□ |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

the LLC’s total income from all sources? |

. . . . . . |

. . . . . . . . . |

. . |

|

|

|

|

|

Yes |

|

|

No |

|

|||

V |

Has the LLC included a Reportable Transaction, or Listed Transaction within this return? |

|

|

|

|

• □ Yes □ No |

|

|||||||||||

|

(See instructions for definitions). If “Yes,” complete and attach federal Form 8886 for each transaction. . . |

. . . . . . |

. . . . . . . . . |

. . |

|

|||||||||||||

W Did this LLC file the Federal Schedule |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||||

X |

Is this LLC a direct owner of an entity that filed a federal Schedule |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

Y |

Does the LLC have a beneficial interest in a trust or is it a grantor of a Trust? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

|

If “Yes,” attach schedule of trusts and federal identification numbers. |

|

|

|

|

|

|

□ |

|

□ |

|

|

|

|

||||

Z |

Does this LLC own an interest in a business entity disregarded for tax purposes? |

|

|

|

|

• |

Yes |

No |

|

|||||||||

. . . . . . |

. . . . . . . . . |

. . |

|

|

|

|

|

|

||||||||||

|

If “Yes,” complete Schedule EO, Part II. |

|

|

|

|

• □ Yes □ No |

|

|||||||||||

AA Is any member of the LLC related (as defined in IRC Section 267(c)(4)) to any other member of the LLC? |

. . . . . . |

. . . . . . . . . |

. . |

|

||||||||||||||

BB Is any member of the LLC a trust for the benefit of any person related (as defined in IRC Section 267(c)(4)) |

|

• □ Yes □ No |

|

|||||||||||||||

|

to any other member? |

. . . . . . |

. . . . . . . . . |

. . |

|

|||||||||||||

(continued on Side 3)

Side 2 Form 568 2021

3672213

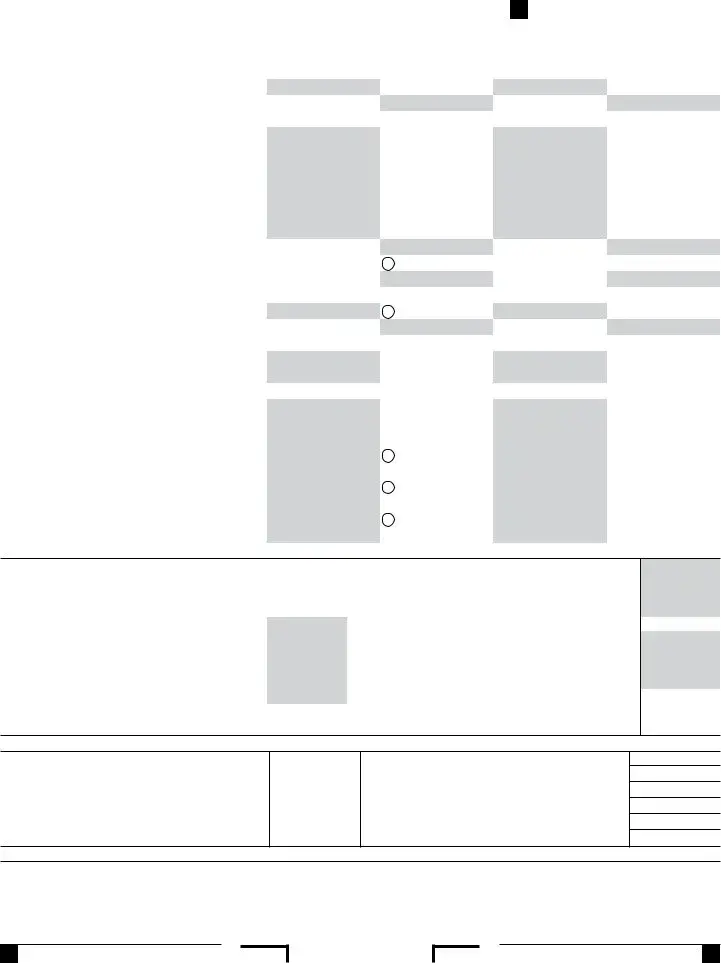

(continued from Side 2) |

|

|

|

|

|

|

|

|

|

□ |

Yes |

□ |

No |

|||||||

|

|

|

|

|

|

|

|

|

||||||||||||

CC |

(1) |

|

|

|

|

|

|

|

|

|

|

|||||||||

Is the LLC deferring any income from the disposition of assets? (see instructions) . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

|

|

||||||||||||

|

(2) |

. . . . . . . .If “Yes,” enter the year of asset disposition |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

|

|

|

|

|

|

||||

DD |

□ |

|

□ |

|

|

|

□ |

|

|

□ |

|

|

|

|||||||

Is the LLC reporting previously deferred Income from: |

|

|

|

|

|

|

|

|

|

|

||||||||||

• |

|

Installment Sale |

• |

IRC §1031 • |

IRC §1033 |

• |

|

|

|

|

||||||||||

|

(see instructions) . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

Other |

|||||||||||||||

EE “Doing business as” name. See instructions: |

. . . . . |

• _____________________________________________________________________ |

||||||||||||||||||

FF |

(1) |

Has this LLC operated as another entity type such as a Corporation, S Corporation, General Partnership, |

□ |

|

|

□ |

|

|

||||||||||||

|

|

Limited Partnership, or Sole Proprietorship in the previous five (5) years? |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

Yes |

|

|

No |

||||||||

|

(2) |

If “Yes”, provide prior FEIN(s) if different, business name(s), and entity type(s) for prior returns |

|

|

|

|

|

|

|

|

||||||||||

|

|

filed with the FTB and/or IRS (see instructions): _________________________________________________________________________________ |

||||||||||||||||||

GG |

(1) |

|

|

|

|

|

|

|

|

|

|

□ |

Yes |

□ |

No |

|||||

Has this LLC previously operated outside California? |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

□ |

|||||||||||

|

(2) |

|

|

|

|

|

|

|

|

|

|

□ |

Yes |

No |

||||||

|

Is this the first year of doing business in California?. |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

□ |

||||||||||

HH Is the LLC a section 721(c) partnership, as defined in Treasury Regulations Section |

□ |

|

Yes |

|

No |

|||||||||||||||

|

|

|

|

|

||||||||||||||||

II |

At any time during the tax year, were there any transfers between the LLC and its members subject to the |

. . . . . . □ Yes |

□ No |

|||||||||||||||||

|

disclosure requirements of Regulations section |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

|||||||||||||

JJ |

Check if the LLC: (1) |

• Aggregated activities for IRC Section 465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

(2) |

• Grouped activities for IRC Section 469 passive activity purposes |

|

|

|

|

□ |

|

□ |

|

|||||||||

KK (1) Has this business entity previously filed an unclaimed property Holder Remit Report with the State Controller’s Office? |

Yes |

No |

||||||||||||||||||

. . . . .• |

|

|

|

|

|

|||||||||||||||

|

(2) If “Yes,” when was the last report filed? (mm/dd/yyyy) • ________________ (3) Amount last remitted ◾ $____________________ . _______ |

|

|

|||||||||||||||||

Single Member LLC Information and Consent — Complete only if the LLC is disregarded. |

|

|

• Federal TIN/SSN |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Sole Owner’s name (as shown on owner’s return) |

|

|

|

|

|

FEIN/CA Corp no./CA SOS File no. |

|

|

|

|

|

|

|

|||||||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address, City, State, and ZIP Code

•What type of entity is the ultimate owner of this SMLLC? See instructions. Check only one box:

• (1) Individual |

• (2) C Corporation |

• (3) |

•(4) Estate/Trust • (5) Exempt Organization

Member’s Consent Statement: I consent to the jurisdiction of the State of California to tax my LLC income and agree to file returns and pay tax as may be required by the Franchise Tax Board.

Signature ▶ |

|

|

|

|

Date |

|

|

|

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for |

||||||

|

1131 to locate FTB 1131 |

||||||

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, |

||||||

|

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

||||||

Sign |

Signature |

|

Date |

|

|

||

of authorized |

|

|

|

||||

Here |

member or |

|

|

Telephone |

|||

|

manager ▶ |

|

|

|

|

• |

|

|

Authorized member or manager’s email address (optional) |

|

|

||||

|

Paid |

Date |

Check if |

PTIN |

|||

|

preparer’s |

|

|

|

|||

|

|

• |

|||||

Paid |

signature ▶ |

|

|||||

Preparer’s |

|

|

|

|

|

Firm’s FEIN |

|

Use Only |

Firm’s name (or yours, |

|

|

• |

|||

|

if |

|

|

|

|||

|

|

|

|

Telephone |

|||

|

and address |

|

|

||||

|

|

|

|

|

|

• |

|

|

May the FTB discuss this return with the preparer shown above (see instructions)?. . . . . . . . . . . • • Yes • No |

|

|||||

|

|

|

|

|

|

|

|

3673213

Form 568 2021 Side 3

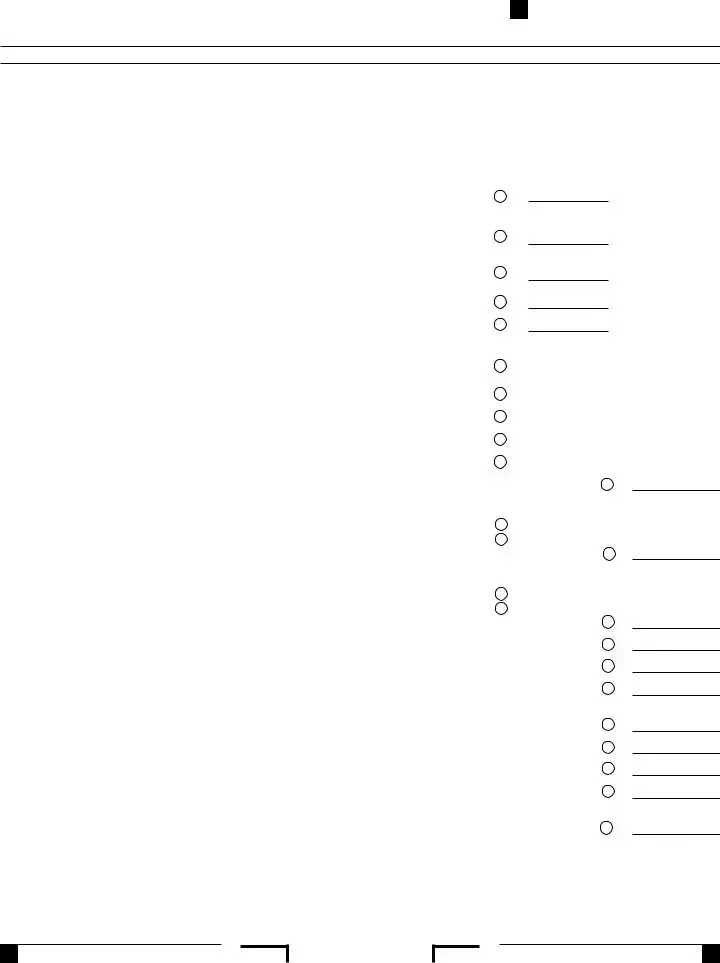

Schedule A Cost of Goods Sold

1 |

. . . . . . . . . . . . . . . . .Inventory at beginning of year |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

1 |

|

00 |

||

2 |

Purchases less cost of items withdrawn for personal use |

. . . . . . . . . . . . . . . . . . |

2 |

|

00 |

|||

3 |

Cost of labor |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

3 |

|

00 |

|

4 |

Additional IRC Section 263A costs. Attach schedule |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

4 |

|

00 |

||

5 |

Other costs. Attach schedule |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

5 |

|

00 |

||

6 |

Total. Add line 1 through line 5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

6 |

|

00 |

||

7 |

Inventory at end of year |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

7 |

|

00 |

||

8 |

Cost of goods sold. Subtract line 7 from line 6. Enter here and on Schedule B, line 2 |

. . . . . . . . . . . . . . . . . . |

8 |

|

00 |

|||

9 |

a |

Check all methods used for valuing closing inventory: |

|

|

|

|

||

|

|

(1) • Cost |

(2) • Lower of cost or market as described in Treas. Reg. Section |

(3) • Write down of “subnormal” goods as |

||||

|

|

described in Treas. Reg. Section |

(4) • Other. Specify method used and attach explanation ___________________________ |

|||||

|

b |

Check this box if the LIFO inventory method was adopted this taxable year for any goods. If checked, attach federal Form 970 . |

. . . . . . . . . • |

|||||

|

c |

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to the LLC? |

. . . . . . . . . • Yes • No |

|||||

dWas there any change (other than for IRC Section 263A purposes) in determining quantities, cost, or valuations between opening

and closing inventory? If “Yes,” attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . • Yes • No

Schedule B Income and Deductions

Caution: Include only trade or business income and expenses on line 1a through line 22 below. See the instructions for more information.

|

1 |

. . . . .a Gross receipts or sales $ ____________ b Less returns and allowances $ ____________ . |

c Balance |

|

2 |

Cost of goods sold (Schedule A, line 8) |

. . . . . . . . |

|

3 |

GROSS PROFIT. Subtract line 2 from line 1c |

. . . . . . . . |

|

4 |

Total ordinary income from other LLCs, partnerships, and fiduciaries. Attach schedule |

. . . . . . . . |

Income |

5 |

Total ordinary loss from other LLCs, partnerships, and fiduciaries. Attach schedule |

. . . . . . . . |

7 |

Total farm loss. Attach federal Schedule F (Form 1040) |

. . . . . . . . |

|

|

6 |

Total farm profit. Attach federal Schedule F (Form 1040) |

. . . . . . . . |

|

8 |

Total gains included on Schedule |

. . . . . . . . |

|

9 |

Total losses included on Schedule |

. . . . . . . . |

|

10 |

Other income. Attach schedule |

. . . . . . . . |

|

11 |

Other loss. Attach schedule |

. . . . . . . . |

|

12 |

Total income (loss). Combine line 3 through line 11 |

. . . . . . . . |

|

13 |

Salaries and wages (other than to members) |

. . . . . . . . |

|

14 |

Guaranteed payments to members |

. . . . . . . . |

|

15 |

Bad debts |

. . . . . . . . |

Deductions |

16 |

Deductible interest expense not claimed elsewhere on return |

. . . . . . . . |

19 |

Retirement plans, etc |

. . . . . . . . |

|

|

17 |

a Depreciation and amortization. Attach form FTB 3885L $ _________________ |

|

|

|

b Less depreciation reported on Schedule A and elsewhere on return $ _________________ |

c Balance |

|

18 |

Depletion. Do not deduct oil and gas depletion |

. . . . . . . . |

|

20 |

Employee benefit programs |

. . . . . . . . |

|

21 |

Other deductions. Attach schedule |

. . . . . . . . |

|

22 |

Total deductions. Add line 13 through line 21 |

. . . . . . . . |

|

23 |

Ordinary income (loss) from trade or business activities. Subtract line 22 from line 12 |

. . . . . . . . |

Schedule T Nonconsenting Nonresident Members’ Tax Liability. Attach additional sheets if necessary.

• |

|

1c |

|

00 |

|

|

|||

• |

|

2 |

|

00 |

• |

|

3 |

|

00 |

• |

|

4 |

|

00 |

• |

|

5 |

|

00 |

• |

|

6 |

|

00 |

• |

|

7 |

|

00 |

• |

|

8 |

|

00 |

• |

|

9 |

|

00 |

• |

|

10 |

|

00 |

• |

|

11 |

|

00 |

• |

|

12 |

|

00 |

• |

|

13 |

|

00 |

|

14 |

|

00 |

|

• |

|

15 |

|

00 |

• |

|

16 |

|

00 |

• |

|

17c |

|

00 |

|

|

18 |

|

00 |

|

|

19 |

|

00 |

• |

|

20 |

|

00 |

|

21 |

|

00 |

|

• |

|

22 |

|

00 |

• |

|

23 |

|

00 |

(a)

Member’s name

(b)

SSN, ITIN,

or FEIN

(c)

Distributive

share of income

(d)

Tax

rate

(e)

Member’s

total tax due

(see instructions)

(f)

Amount withheld by this LLC on this member – reported on Form

(g)

Member’s

net tax due

Total the amount of tax due. Enter the total here and on Side 1, line 4. If less than zero enter |

________________ |

Side 4 Form 568 2021

3674213

Schedule K Members’ Shares of Income, Deductions, Credits, etc.

Income (Loss)

Deductions

Analysis Other Information Alternative Minimum Credits Tax (AMT) Items

|

|

|

|

|

(a) |

|

|

|

|

|

|

|

(b) |

|

(c) |

|

|

(d) |

|

|

|

|

Distributive share items |

|

|

|

|

|

Amounts from |

|

California |

Total amounts using |

|||||||

|

|

|

1 |

• federal K (1065) |

adjustments |

• |

California law |

||||||||||||

1 |

Ordinary income (loss) from trade or business activities |

. |

|

|

|

|

|||||||||||||

2 |

Net income (loss) from rental real estate activities. Attach federal Form 8825 |

2 |

|

|

|

|

|

• |

|

|

|||||||||

3 |

a |

Gross income (loss) from other rental activities |

. . . . . . . . . . . . . . |

. . . . |

. |

3a |

|

|

|

|

|

• |

|

|

|||||

|

b Less expenses. Attach schedule. . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

3b |

|

|

|

|

|

|

|

|

|||||

|

c Net income (loss) from other rental activities. Subtract line 3b |

|

3c |

|

|

|

|

|

• |

|

|

||||||||

|

|

from line 3a |

. . . . . . |

. . . . . . . . |

. . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

|

|

|

|

|

|

|

|||

4 |

Guaranteed payments |

a Services. . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

4a |

|

|

|

|

|

|

|

|

||||

|

b |

Capital |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

4b |

|

|

|

|

|

|

|

|

||

|

c |

Total |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

4c |

|

|

|

|

|

• |

|

|

||

5 |

Interest income |

. . . . . . . . . . |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

5 |

|

|

|

|

|

• |

|

|

||

6 |

Dividends |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

6 |

|

|

|

|

|

• |

|

|

|||

7 |

Royalties |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

7 |

|

|

|

|

|

• |

|

|

|||

8 |

Net |

. |

8 |

|

|

|

|

|

• |

|

|

||||||||

9 |

Net |

. |

9 |

|

|

|

|

|

• |

|

|

||||||||

10 |

a |

Total gain under IRC Section 1231 (other than due to casualty or theft) . |

10a |

|

|

|

|

|

• |

|

|

||||||||

|

b Total loss under IRC Section 1231 (other than due to casualty or theft) . |

10b |

|

|

|

|

|

• |

|

|

|||||||||

11 |

a |

Other portfolio income (loss). Attach schedule . |

. . . . . . . . . . . . . . |

. . . . |

. |

11a |

|

|

|

|

|

• |

|

|

|||||

|

b Total other income. Attach schedule |

. . . . . . . . . . . . . . |

. . . . |

. |

11b |

|

|

|

|

|

• |

|

|

||||||

|

c Total other loss. Attach schedule . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

11c |

|

|

|

|

|

|

|

|

|||||

12 |

Expense deduction for recovery property (IRC Section 179). Attach schedule |

12 |

|

|

|

|

|

|

|

|

|||||||||

13 |

a |

Charitable contributions. See instructions. Attach schedule |

. |

13a |

|

|

|

|

|

|

|

|

|||||||

|

b |

Investment interest expense |

. . . . . . . . . . . . . . |

. . . . |

. |

13b |

|

|

|

|

|

• |

|

|

|||||

|

c |

1 Total expenditures to which IRC Section 59(e) election may apply . |

. |

13c1 |

|

|

|

|

|

|

|

|

|||||||

|

|

2 Type of expenditures |

|

|

|

|

|

13c2 |

|

|

|

|

|

|

|

|

|||

|

d Deductions related to portfolio income |

. . . . . . . . . . . . . . |

. . . . |

. |

13d |

|

|

|

|

|

|

|

|

||||||

|

e |

Other deductions. Attach schedule. |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

13e |

|

|

|

|

|

• |

|

|

||||

15 |

a |

. . . . .Withholding on LLC allocated to all members |

. . . . . . . . . . . . . . . |

. . . . |

. |

15a |

|

|

|

|

|

|

|

|

|||||

|

b |

. . . . . . . . . . . . . . |

. . . . |

. |

15b |

|

|

|

|

|

|

|

|

||||||

|

c Credits other than the credit shown on line 15b related to rental real |

|

15c |

|

|

|

|

|

|

|

|

||||||||

|

|

estate activities. Attach schedule . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

|

|

|

|

|

|

|

|

|||||

|

d Credits related to other rental activities. Attach schedule |

. |

15d |

|

|

|

|

|

|

|

|

||||||||

|

e Nonconsenting nonresident members’ tax paid by LLC |

. |

15e |

|

|

|

|

|

|

|

|

||||||||

|

f Other credits. Attach schedule . . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

15f |

|

|

|

|

|

• |

|

|

|||||

17 |

a |

. . . . .Depreciation adjustment on property placed in service after 1986 |

. |

17a |

|

|

|

|

|

|

|

|

|||||||

|

b Adjusted gain or loss |

. . . . . . . . . . . . . . |

. . . . |

. |

17b |

|

|

|

|

|

|

|

|

||||||

|

c Depletion (other than oil and gas) . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

17c |

|

|

|

|

|

|

|

|

|||||

|

d Gross income from oil, gas, and geothermal properties |

. |

17d |

|

|

|

|

|

|

|

|

||||||||

|

e Deductions allocable to oil, gas, and geothermal properties |

. |

17e |

|

|

|

|

|

|

|

|

||||||||

|

f Other alternative minimum tax items. Attach schedule |

. |

17f |

|

|

|

|

|

|

|

|

||||||||

18 |

a |

. . . . . . . . . . . . . . |

. . . . |

. |

18a |

|

|

|

|

|

|

|

|

||||||

|

b |

Other |

. . . . . . . . . . . . . . |

. . . . |

. |

18b |

|

|

|

|

|

• |

|

|

|||||

|

c |

Nondeductible expenses |

. . . . . . . . . . . . . . |

. . . . |

. |

18c |

|

|

|

|

|

|

|

|

|||||

19 |

a |

Distributions of money (cash and marketable securities) |

. |

19a |

|

|

|

|

|

• |

|

|

|||||||

|

b Distribution of property other than money |

. . . . . . . . . . . . . . |

. . . . |

. |

19b |

|

|

|

|

|

• |

|

|

||||||

20 |

a |

Investment income |

. . . . |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

20a |

|

|

|

|

|

|

|

|

|

|

b |

Investment expenses |

. . . . . . . . . . . . . . |

. . . . |

. |

20b |

|

|

|

|

|

|

|

|

|||||

|

c Other information. See instructions |

. . . . . . . . . . . . . . |

. . . . |

. |

20c |

|

|

|

|

|

|

|

|

||||||

21 |

a |

Total distributive income/payment items. Combine lines 1, 2, 3c |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

and 4c through 11c. From the result, subtract the sum of lines 12 |

|

|

|

|

|

|

|

• |

|

|

|||||||

|

|

through 13e |

. . . . . . . . . . |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

21a |

|

|

|

|

|

|

|

||

|

b |

Analysis of |

|

(a) |

|

(b) Individual |

|

|

(c) |

|

(d) |

|

(e) |

|

|

(f) |

|||

|

|

members: |

Corporate |

|

i. Active |

ii. Passive |

|

Partnership |

|

Exempt Organization |

Nominee/Other |

|

LLC |

||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

Members |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3675213

Form 568 2021 (REV

Schedule L Balance Sheets. See instructions before completing Schedules L,

|

|

|

|

Beginning of taxable year |

|

End of taxable year |

||

|

|

Assets |

|

(a) |

(b) |

(c) |

|

(d) |

1 |

Cash |

|

|

|

|

|

|

|

2 |

. . . . . . . . . . .a Trade notes and accounts receivable |

|

|

|

|

|

|

|

|

b |

Less allowance for bad debts |

( |

) |

|

( |

) |

|

3 |

Inventories |

|

|

|

|

|

• |

|

4 |

. . . . . . . . . . . . . . . . . . . .U.S. government obligations |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

||

6 |

Other current assets. Attach schedule |

|

|

|

|

|

• |

|

7 |

a |

Loans to partners |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . .b Mortgage and real estate loans |

|

|

|

|

|

|

|

8 |

Other investments. Attach schedule |

|

|

|

|

|

• |

|

9 |

. . . . . . . . .a Buildings and other depreciable assets |

|

|

|

|

|

|

|

|

b |

Less accumulated depreciation |

( |

) |

• |

( |

) |

• |

10 |

a |

Depletable assets |

|

|

|

|

|

|

|

b |

Less accumulated depletion |

( |

) |

|

( |

) |

|

11 |

Land (net of any amortization) |

|

|

• |

|

|

• |

|

12 |

. . . . . . . . . . .a Intangible assets (amortizable only) |

|

|

|

|

|

|

|

|

b |

Less accumulated amortization |

( |

) |

|

( |

) |

|

13 |

Other assets. Attach schedule |

|

|

|

|

|

• |

|

14 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total assets |

|

|

|

|

|

|

|

|

Liabilities and Capital |

|

|

|

|

|

|

|

15 |

Accounts payable |

|

|

|

|

|

• |

|

16 |

Mortgages, notes, bonds payable in less than 1 year. . |

|

|

|

|

|

• |

|

17 |

. . . . . . . . . . .Other current liabilities. Attach schedule |

|

|

|

|

|

|

|

18 |

All nonrecourse loans |

|

|

• |

|

|

• |

|

19 |

a |

Loans from partners |

|

|

|

|

|

|

|

b Mortgages, notes, bonds payable in 1 year or more |

|

|

• |

|

|

• |

|

20 |

Other liabilities. Attach schedule |

|

|

|

|

|

• |

|

21 |

Members’ capital accounts |

|

|

• |

|

|

• |

|

22 |

. . . . . . . . . . . . . . . . . . . . . .Total liabilities and capital |

|

|

|

|

|

|

|

Schedule

1 |

. .Net income (loss) per books |

. . . . . . . . . . . . . . . |

. |

|

2 |

Income included on Schedule K, line 1 through line 11c |

• |

|

|

3 |

not recorded on books this year. Itemize |

|

||

. . . . . .Guaranteed payments (other than health insurance) |

. |

|

||

4 |

Expenses recorded on books this year not included on |

|

|

|

|

Schedule K, line 1 through line 13e. Itemize: |

|

|

|

|

a Depreciation |

$ ______________ |

|

|

|

b Travel and entertainment |

$ ______________ |

|

|

|

c Annual LLC tax |

$ ______________ |

|

|

|

d Other |

$ ______________ |

|

|

5 |

. .e Total. Add line 4a through line 4d. |

. . . . . . . . . . . . . . . |

• |

|

. .Total of line 1 through line 4e |

. . . . . . . . . . . . . . . |

. |

|

|

6Income recorded on books this year not included on Schedule K, line 1 through line 11c. Itemize:

a |

$ ______________ |

|

|

b Other |

$ ______________ |

• |

|

. . . . . . . . . .c Total. Add line 6a and line 6b |

. . . . . . . . . . . . . . . . |

|

7Deductions included on Schedule K, line 1 through line 13e

|

not charged against book income this year. Itemize: |

|

|

|

|

a Depreciation |

$ ______________ |

|

|

|

b Other |

$ ______________ |

• |

|

8 |

. . . . . . . . . .c Total. Add line 7a and line 7b |

. . . . . . . . . . . . . . . . |

|

|

. . . . . . . . . .Total. Add line 6c and line 7c . . |

. . . . . . . . . . . . . . . . |

. |

|

|

9 |

Income (loss) (Schedule K, line 21a.) Subtract line 8 from line 5. |

|||

Schedule

1 |

Balance at beginning of year |

|

|

5 |

Total of line 1 through line 4 |

• |

2 |

Capital contributed during year |

|

6 |

Distributions: a Cash |

||

|

a Cash |

• |

|

|

b Property |

• |

|

. . . . . . . . . . . . . . . . .b Property |

• |

|

. . . . . . . . . . . . . . . . . . . . . .7 Other decreases. Itemize |

• |

|

3 |

. . . . . . . . . . . . . . . . .Net income (loss) per books . . |

• |

|

8 |

. . .Total of line 6 and line 7 |

|

4 |

. . . . . . . . . . . . . . . . .Other increases. Itemize |

|

. . .9 Balance at end of year. Subtract line 8 from line 5 |

|

||

Schedule O Amounts from Liquidation used to Capitalize a Limited Liability Company. (Complete only if initial return box is checked on Side 1, Question H.)

Name of entity liquidated (if more than one, attach a schedule) _____________________________________________________________________________

Type of entity: • (1) C Corporation • (2) S Corporation |

• (3) Partnership • (4) Limited Partnership • (5) Sole Proprietor |

• (6) Farmer |

|

|

|

||

Entity identification number(s): FEIN __________________ SSN or ITIN __________________ CA Corp. No. _________________ CA SOS File No. |

|

||

Amount of liquidation gains recognized to capitalize the LLC . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . • |

___________________ |

|

Side 6 Form 568 2021

3676213

Schedule IW Limited Liability Company (LLC) Income Worksheet

Enter your California income amounts on the worksheet. All amounts entered must be assigned for California law differences. Use only amounts that are from sources derived from or attributable to California when completing lines

See instructions on page 14 of the Form 568 Booklet for more information on how to complete Schedule IW.

1 |

a Total California income from Form 568, Schedule B, line 3. See instructions |

• |

1a |

|

b Enter the California cost of goods sold from Form 568, Schedule B, line 2 and from federal |

|

|

|

Schedule F (Form 1040) (plus California adjustments) associated with the receipts |

• |

|

|

assigned to California on lines 1a and 4 |

1b |

|

2 |

a If the answer to Question U(1) on Form 568 Side 2, is “Yes”, include the gross income of this |

• |

|

|

disregarded entity that is not included in lines 1 and 8 through 16 |

2a |

|

|

b Enter the cost of goods sold of disregarded entities associated with the receipts assigned to |

• |

|

|

California on line 2a |

2b |

|

3 |

a LLC’s distributive share of ordinary income from |

• |

3a |

bEnter the LLC’s distributive share of cost of goods sold from other

|

|

associated with the receipt assigned to California on line 3a (see Schedule |

• |

|

|

|

|

|

|

Table 3, line 1a) |

3b |

|

|

||

|

c |

Enter the LLC’s distributive share of deductions from other |

• |

|

|

|

|

|

|

the receipt assigned to California on line 3a (see Schedule |

3c |

|

|

||

4 |

. . . . . . . . . . . . . . .Add gross farm income from federal Schedule F (Form 1040). Use California amounts |

• |

4 |

|

|

|

|

5 |

. . . . . . . . . . . . . . . . . . . . . .Enter the total of other income (not loss) from Form 568, Schedule B, line 10 |

• |

5 |

|

|

|

|

6 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Enter the total gains (not losses) from Form 568, Schedule B, line 8 |

• |

6 |

|

|

|

|

7 |

Add line 1a through line 6 |

. . . |

. . . |

. . . . . . . . . . . . |

• 7 |

||

8 |

California rental real estate |

• |

|

|

|

|

|

|

a |

Enter the total gross rents from federal Form 8825, line 18a |

8a |

|

|

|

|

|

b |

Enter the total gross rents from all Schedule |

• |

8b |

|

|

|

|

c |

Add line 8a and line 8b |

. . . |

. . . |

. . . . . . . . . . . . |

• 8c |

|

9 |

Other California rentals. |

|

|

|

|

|

|

|

a |

Enter the amount from Schedule K (568), line 3a |

• |

9a |

|

|

|

|

b |

Enter the amount from all Schedule |

• |

9b |

|

|

|

|

c |

Add lines 9a and 9b |

. . . |

. . . |

. . . . . . . . . . . . |

• 9c |

|

10 |

California interest. Enter the amount from Form 568, Schedule K, line 5 |

. . . |

. . . |

. . . . . . . . . . . . |

• 10 |

||

11 |

California dividends. Enter the amount from Form 568, Schedule K, line 6 |

. . . |

. . . |

. . . . . . . . . . . . |

• 11 |

||

12 |

California royalties. Enter the amount from Form 568, Schedule K, line 7 |

. . . |

. . . |

. . . . . . . . . . . . |

• 12 |

||

13 |

California capital gains. Enter the capital gains (not losses) included in the amounts from Form 568, |

|

|

|

• 13 |

||

|

Schedule K, lines 8 and 9 |

. . . |

. . . |

. . . . . . . . . . . . |

|||

14 |

California 1231 gains. Enter the amount of total gains (not losses) from Form 568, Schedule K, line 10a . |

. . . |

. . . |

. . . . . . . . . . . . |

• 14 |

||

15 |

Other California portfolio income (not loss). Enter the amount from Form 568, Schedule K, line 11a |

. . . |

. . . |

. . . . . . . . . . . . |

• 15 |

||

16 |

Other California income (not loss) not included in line 5. Enter the amount from Form 568, Schedule K, line 11b |

• 16 |

|||||

17 |

Total California income. Add lines 7, 8c, 9c, 10, 11, 12, 13, 14, 15, and 16. Line 17 may not be a negative number. |

• 17 |

|||||

|

Enter here and on Form 568, Side 1, line 1. If less than zero enter |

. . . |

. . . |

. . . . . . . . . . . . |

|||

3677213

Form 568 2021 Side 7

Document Specs

| Fact | Detail |

|---|---|

| Form Name | California Form 568 |

| Taxable Year | 2021 |

| Type of Taxpayers | Limited Liability Company (LLC) |

| Required Information | LLC Name, California Secretary of State (SOS) file number, FEIN, Address, Accounting Method, Date Business Started in CA, Total Assets at End of Year |

| Key Schedules | Schedule IW, LLC Income Worksheet; Schedule K, Members’ Shares of Income, Deductions, Credits, etc. |

| Governing Law | California Revenue and Taxation Code |

| Special Considerations | Reporting requirements for acquisitions and ownership changes related to California real property |

| Payment Methods | Enclose, but do not staple, any payment. |

| Amendment and Final Return Options | Options to Check FINAL RETURN, Amended return, Protective claim |

Detailed Instructions for Writing Ca 568

Filling out the California Form 568 for Limited Liability Companies (LLCs) can seem daunting at first glance, but breaking down the process into manageable steps can make it less intimidating. It's essential that LLCs operating within California complete this form carefully to comply with state tax regulations. The following instructions are designed to guide you through the process, ensuring accuracy and completeness in your filing. Remember, attention to detail now can save time and prevent potential issues later.

- Start by entering the taxable year at the top of the form.

- Provide the Limited Liability Company name and California Secretary of State (SOS) file number in the designated fields.

- Fill in the Federal Employer Identification Number (FEIN) and the complete address of the LLC, including any relevant foreign address information if applicable.

- Select the appropriate accounting method by checking the box for either cash, accrual, or other.

- Specify the date the business started in California and enter the total assets at the end of the year.

- Indicate if this is an initial return, final return, amended return, or protective claim by ticking the relevant box.

- Answer the questions in Section I regarding ownership and real property interests. This includes acquisitions, controlling interests, and property tax reassessment exclusions.

- Calculate and enter your total income on line 1, based on the Schedule IW, LLC Income Worksheet provided on Side 7.

- Complete the calculation for the Limited Liability Company fee on line 2, and enter the 2021 annual Limited Liability Company tax on line 3.

- Report any pass-through entity elective tax, nonconsenting nonresident members' tax liability, and partnership level tax as applicable on lines 4, 5, and 6.

- Summarize your total tax and fee on line 7. Then, detail the amounts paid with various forms and overpayments on lines 8 through 11.

- Include any withholding amounts and total payments, then calculate your use tax and payments balance on lines 13 and 14.

- Determine your tax and fee due or overpayment on lines 16 and 17, and decide the amount to be credited to 2022 tax or fee on line 18.

- Calculate any penalties and interest on line 20, and then enter the total amount due on line 21.

- Provide the principal business activity code and detailed information about the LLC's activities, including the maximum number of members and whether the LLC is an investment partnership.

- Answer additional questions regarding the LLC's tax status and fill out the Member's Consent Statement, declaring accurate reporting on the return.

- Ensure an authorized member or manager signs and dates the form. Include the preparer’s information if it was prepared by someone other than the taxpayer.

After completing Form 568, review the information for accuracy and completeness. Supporting documents may need to be attached, based on your specific circumstances and the responses provided on the form. Finally, submit the form and any attachments to the Franchise Tax Board by the filing deadline to ensure compliance with California tax obligations. Staying organized and methodical throughout this process will help streamline your filing and avoid common pitfalls.

Things to Know About This Form

What is CA Form 568?

CA Form 568 is the Return of Income form that must be filed by limited liability companies (LLCs) operating in California. It is used to report income, calculate and pay the annual LLC fee, taxes and other amounts owed by the LLC to the State of California for a specific tax year.

Who needs to file CA Form 568?

All LLCs that are registered with the California Secretary of State must file Form 568. This includes LLCs that are treated as disregarded entities, partnerships for federal tax purposes, and those that have elected to be taxed as a corporation but are required to file as an LLC in California.

When is CA Form 568 due?

The due date for filing Form 568 is the 15th day of the 4th month following the close of the LLC's taxable year. For LLCs on a calendar year, this date is April 15th of the following year. If the due date falls on a weekend or holiday, the form is due the next business day.

What are the penalties for filing CA Form 568 late?

Filing Form 568 after its due date can result in late filing penalties, late payment penalties, and interest. The late filing penalty is $18 for each month or part of a month that the return is late, up to a maximum of 12 months. Additional penalties and interest may also apply for late payments of taxes and fees.

Can CA Form 568 be amended after it is filed?

Yes, Form 568 can be amended if necessary. To amend a previously filed Form 568, you must check the "Amended return" box on the form and include a statement explaining the changes. Any additional tax or fees owed as a result of the amendment must also be paid.

Is there a minimum tax requirement for all LLCs filing Form 568?

Yes, all LLCs are subject to an annual minimum franchise tax of $800, payable to the Franchise Tax Board. This tax applies regardless of income or activity level, except for newly formed LLCs in their first year of operation.

What accounting methods can be used when filing Form 568?

LLCs can choose between three accounting methods when filing Form 568: the cash method, the accrual method, or another accounting method approved by the IRS. The chosen method should be consistently used for all financial reporting and tax purposes.

Where can additional help be found for filling out CA Form 568?

Additional assistance for completing Form 568 can be found on the California Franchise Tax Board's website, which offers instructions, guides, and contact information for further help. Professional tax advisors or accountants specializing in California tax law can also provide valuable assistance.

Common mistakes

Filling out California Form 568 can be a complex process for many limited liability companies (LLCs). Small mistakes can lead to unnecessary delays, audits, or even fines. Here are eight common mistakes people make when dealing with this form:

Incorrect or incomplete SOS file number: This number is crucial for identification and must match the Secretary of State's records exactly.

Failing to check the correct tax year boxes at the beginning of the form, which can cause confusion about the applicable tax year.

Misunderstanding the accounting method (cash, accrual, or other): This determines how income and expenses are reported. Choosing the wrong method can affect tax liability.

Not accurately reporting total assets at the end of the year in section G, which can lead to issues with the valuation of the LLC.

Omitting or inaccurately detailing income and deductions on Schedule B: This area requires precise information about the LLC's financial activities.

Incorrectly calculating or failing to include the LLC fee and annual tax, which are mandatory payments for most LLCs operating in California.

Forgetting to include necessary schedules or attachments, such as Schedule IW for Income Worksheet or Schedule K for Members' Shares of Income, Deductions, Credits, etc.

Overlooking the requirements for signatures and dates: Without the proper authorization, the form is considered incomplete.

Here are a few general tips to avoid these mistakes:

Double-check all entered information for accuracy and completeness.

Ensure that the chosen accounting method reflects the LLC's actual practices.

Review the instructions for each section carefully to understand what is required.

Consult with a tax professional if there is any uncertainty about how to properly fill out the form.

By paying close attention to these details, LLCs can navigate the complexities of Form 568 more effectively, contributing to accurate and successful tax filing.

Documents used along the form

When navigating the complex landscape of Limited Liability Company (LLC) taxes in California, one encounters various forms and documents besides the California Form 568, Return of Income. This guide aims to shed light on some of these additional forms, helping LLC members and managers understand their obligations and streamline their filing processes.

- Form FTB 3522, LLC Tax Voucher: This form is crucial for LLCs in California as it is used to pay the annual LLC tax. Each year, LLCs are required to pay a flat fee to maintain their standing in the state, regardless of income levels.

- Form FTB 3536, Estimated Fee for LLCs: For LLCs that anticipate owing more than $500 in taxes due to income or non-income-based fees, this form is used to make estimated tax payments throughout the year. It helps manage cash flow and avoids any underpayment penalties.

- Schedule K-1 (568), Members’ Share of Income, Deductions, Credits, etc.: This schedule accompanies Form 568 and details each member's share of the LLC’s income, deductions, and credits. It's crucial for members to correctly report their income on personal tax returns.

- Form 592-B, Nonresident Withholding Tax Statement: LLCs with members who are non-residents of California must withhold taxes on income allocated to those members. This form provides the non-resident members with the details needed to claim the withheld amount on their tax returns.

Ensuring accurate completion and timely submission of these forms along with the primary CA Form 568 plays a critical role in the tax compliance and financial health of an LLC. Each form serves a specific purpose in the broader context of state tax requirements, from maintaining good standing through annual fees to handling the nuances of member-specific income and tax withholdings. Navigating this multifaceted process with precision underscores the importance of understanding each document's role in the collective effort to meet the LLC's tax obligations.

Similar forms

The California Form 568 is similar to many other tax documents in both form and function. A document that closely resembles the CA Form 568 is the IRS Form 1065, United States Return of Partnership Income. Both serve entities that are not taxed at the corporate level but pass income to their owners or members. The Form 1065 is used by partnerships in the U.S. to report their income, deductions, gains, losses, etc., much like the Form 568 is used by limited liability companies (LLCs) in California.

Another similar document is the Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc. This form accompanies the Form 1065 and details each partner's share of the partnership's income, deductions, and credits. The California Schedule K-1 (568) performs a similar role for members of an LLC in California, outlining each member’s share of the LLC’s income, deductions, and credits.

The IRS Form 1120, U.S. Corporation Income Tax Return, though specifically for corporations, shares similarities with the CA Form 568 in its purpose to report income, gains, losses, deductions, and credits and to figure out the income tax liability of the entity. Both forms serve as the primary tax documents for their respective entities to fulfill state or federal income tax obligations.

Form 1120S, U.S. Income Tax Return for an S Corporation, is akin to Form 568 in that it's designed for entities that pass income directly to their owners. S corporations use Form 1120S to report their income, losses, and dividends. Like LLCs filing Form 568 in California, the income of an S corporation is typically taxed at the individual level, not at the corporate level.

The IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, is parallel to the CA Form 568 in structure for reporting income, deductions, and credits. However, Form 1041 is for fiduciary entities. Like Form 568, it is essential for governing the tax obligations of entities other than standard personal or corporate tax filers.

The California Form 540, California Resident Income Tax Return, while intended for individuals rather than businesses, shares the function of reporting income, adjustments, deductions, and credits to a taxing authority, similar to what businesses do with Form 568.

The California Form 541, California Fiduciary Income Tax Return, is the state counterpart to the federal Form 1041. It is used by estates and trusts to report income, deductions, gains, losses, etc., in California, serving a similar role to what the Form 568 does for LLCs.

Form 8832, Entity Classification Election, has a relationship with CA Form 568 in that it allows an entity to elect how it will be classified for federal tax purposes (such as a corporation, partnership, or disregarded entity). This choice can affect how the entity is treated on state forms like the CA Form 568.

The IRS Form 2553, Election by a Small Business Corporation, is used by corporations electing to be treated as an S corporation. Like the relationship between Forms 8832 and 568, the election made with Form 2553 at the federal level can influence the filing requirements and taxation at the state level, including how an entity might file a Form 568 in California.

Lastly, the Statement of Information (SOI) filed with the California Secretary of State, while not a tax document, is essential for LLCs as it keeps the state updated on the entity’s active status and key information. This filing is necessary alongside tax obligations fulfilled by submitting documents like CA Form 568.

Dos and Don'ts

When completing the California Form 568 for Limited Liability Companies (LLCs), attention to accuracy and detail can save a great deal of time and prevent potential issues with the California Franchise Tax Board. Here are some guidelines to help ensure that the process goes smoothly.

Do:

- Ensure that all information is current and accurate, including the LLC's name, address, and California Secretary of State (SOS) file number.

- Choose the correct accounting method (Cash, Accrual, or Other) that your LLC uses for financial reporting.

- Clearly state your LLC’s principal business activity, product, or service to avoid misclassification.

- Accurately calculate and enter all income, deductions, and tax payments to minimize errors and potential underpayment penalties.

- Review the entire form for completeness and accuracy before submission, including double-checking mathematical calculations and ensuring that all required schedules and attachments are included.

Don't:

- Leave any mandatory fields blank. If a section does not apply to your LLC, enter “N/A” or “0,” as appropriate, to indicate this.

- Forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Mix personal finances with business activities. Keep all records separate to ensure accuracy in reporting.

- Miss the filing deadline. Late submissions can result in penalties and interest charges.

- Overlook the need to separately report and pay any use tax due. This often-missed step can lead to discrepancies and potential audits.

Adhering to these dos and don'ts can help you navigate the complexities of Form 568 and ensure compliance with California tax obligations.

Misconceptions

When dealing with California's Form 568, Limited Liability Company Return of Income, there are several misconceptions that can lead to confusion or errors in filing. Below are six common misconceptions and the facts to set the record straight.

Only California-based LLCs need to file Form 568: This is a common misunderstanding. In reality, any LLC that is registered or conducting business in California, regardless of where it was originally formed, is required to file Form 568.

No income equals no filing requirement: Some believe that if their LLC didn't earn any income, they don't need to file Form 568. However, all LLCs registered or doing business in California must file, regardless of their income level.

Form 568 is just for reporting income: While Form 568 is used to report income, it also serves other purposes. It's used to report and calculate fees, taxes, and, in some cases, to report changes in the LLC members or their ownership percentages.

The $800 annual tax is the only fee: Many think the $800 minimum franchise tax is the only fee due with Form 568. However, LLCs may also owe the LLC fee, which is based on total income levels and can significantly increase the amount due.

An extension to file is an extension to pay: Filing an extension gives you more time to file Form 568, but not to pay any taxes or fees due. Taxes and fees are due by the original deadline to avoid penalties and interest.

Single-Member LLCs always report on Schedule C: Single-member LLCs (SMLLCs) that are treated as disregarded entities normally report their income and expenses on Schedule C of the individual owner’s federal tax return. However, they must still file Form 568, fulfilling California’s filing requirements for all LLCs.

Understanding these facts can help avoid common pitfalls and ensure compliance with California’s tax laws for LLCs.

Key takeaways

Filling out and using the California Form 568, the Return of Income for Limited Liability Companies (LLCs), involves several crucial steps and considerations to ensure compliance and accuracy. Here are key takeaways to remember:

- Form 568 is specific to LLCs that are formed or registered in California. It’s used to report income, deductions, and taxes due to the state.

- The form must be filed for the taxable year for both calendar year filers and fiscal year filers, with specific start and end dates.

- All LLCs need to provide a California Secretary of State (SOS) file number, Federal Employer Identification Number (FEIN), and the principal business activity code.

- It’s vital to check the applicable accounting method: cash, accrual, or other. If “other” is selected, an explanation must be attached.

- The form inquires about changes in ownership or control exceeding 50%, acquisitions of entities holding California real property, and whether more than 50% of the LLC’s ownership interests have transferred. These questions help determine tax obligations related to property and ownership changes.

- LLCs need to calculate and report various taxes and fees, including the annual tax, LLC fee based on total income, and any applicable nonresident members’ tax. Proper calculation ensures the LLC pays the correct amount and avoids underpayment penalties.

- If the LLC claims deductions for items like interest expenses, salaries, wages, or depreciation, detailed information must be provided for each. Accurate reporting of deductions can significantly affect the amount of taxable income and, consequently, the total tax liability.

- Submission details, such as signature, declaration, and preparer information (if applicable), are necessary to validate the return. It’s a declaration under penalty of perjury that the information provided is correct.

Proper understanding and careful completion of Form 568 are essential for compliance with California tax laws for LLCs. Accurate and timely filing can help avoid penalties, interest, and potential audits.

Discover More PDFs

How Do I Get a Death Certificate in California - The requirement to retain a copy in the client’s file creates a permanent record that can be referenced if needed.

California Fl 145 - Enables a detailed examination of existing agreements between parties, whether prenuptial, postnuptial, or separation-related, impacting case outcomes.

Statement of Facts Ca Dmv - This form is crucial for young drivers under 18, incorporating parental involvement in the licensing process.