Blank Ca 540 PDF Form

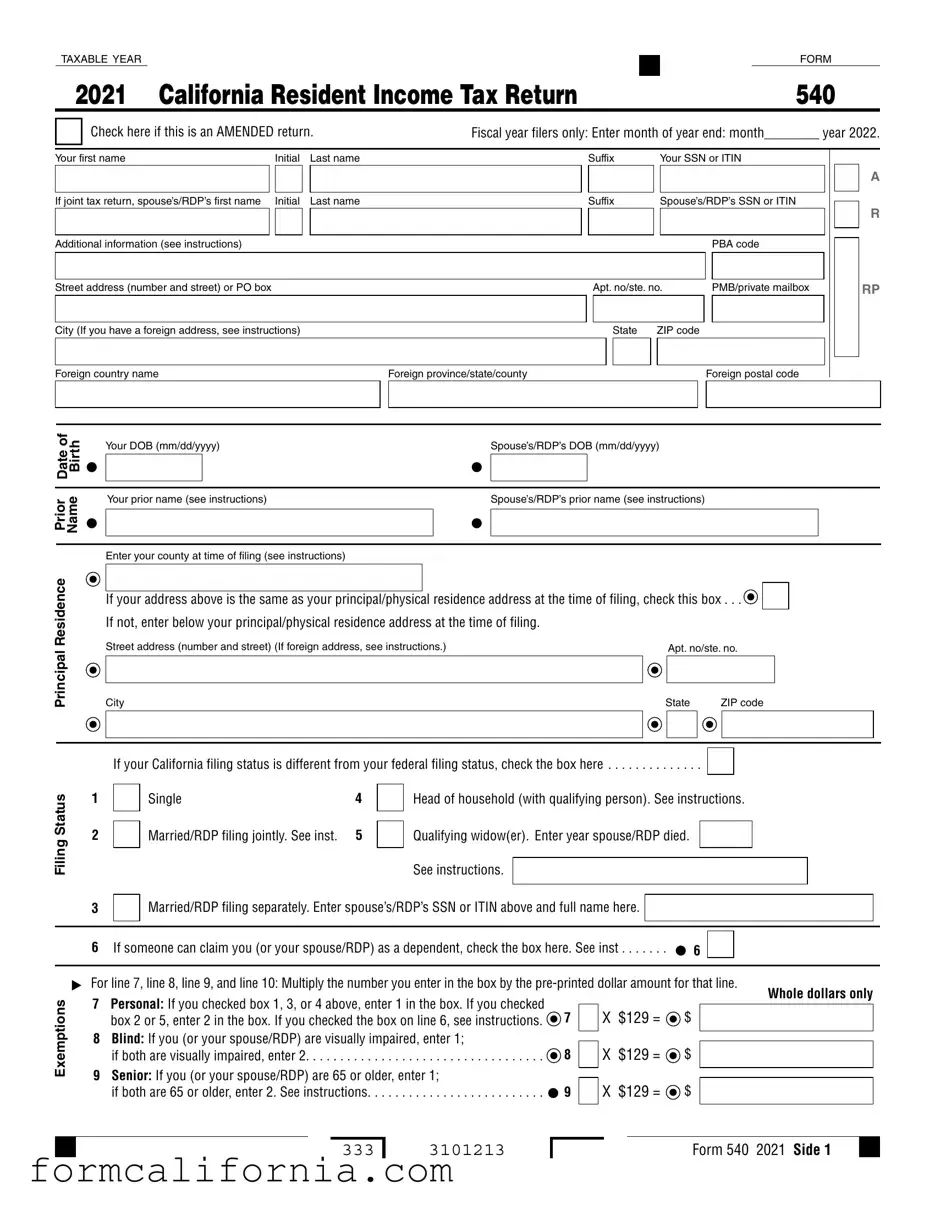

Embarking on the task of filing taxes can be daunting, but understanding the specifics of forms like the CA 540, California Resident Income Tax Return for 2021, can make the process smoother. This comprehensive form is utilized by residents to report their annual income and calculate state tax owed or refunds due. It caters to a range of taxpayers by accommodating various filing statuses, such as single, married/RDP (Registered Domestic Partners) filing jointly or separately, head of household, and qualifying widow(er). Beyond basic identification and residency information, the form delves into exemptions based on personal, dependent, blind, or senior statuses, directly influencing the tax calculation. Taxable income adjustments, both additions and subtractions, lay the groundwork for determining the adjusted gross income under California tax laws, differentiating it from federal income calculations. The CA 540 also provides options for standard or itemized deductions, which further refine the taxable income amount. Exemption credits and a detailed calculation of tax, including nonrefundable credits and special taxes, guide residents through their obligations or returns due. Additionally, the form addresses estimated tax payments and withholding, alongside options for direct deposit refunds, showing its comprehensive nature in managing the taxpayer's annual state tax engagement. It even leaves room for voluntary contributions to charitable causes, rounding off the civic responsibilities it encompasses. Thus, the CA 540 serves as a pivotal tool in ensuring California residents accurately fulfill their state tax obligations.

Document Preview Example

TAXABLE YEAR |

|

|

FORM |

|

|||

|

|

|

|

2021 California Resident Income Tax Return |

540 |

||

Check here if this is an AMENDED return.

Your first name |

|

Initial |

|

Last name |

|

|

|

|

|

If joint tax return, spouse’s/RDP’s first name |

|

Initial |

|

Last name |

|

|

|

|

|

Additional information (see instructions)

Street address (number and street) or PO box

City (If you have a foreign address, see instructions)

Foreign country name

of |

|

Your DOB (mm/dd/yyyy) |

|||

Date Birth |

• |

||||

|

|

|

|||

|

|

|

|||

Prior Name |

|

|

Your prior name (see instructions) |

||

• |

|

|

|||

|

|||||

|

|

Enter your county at time of filing (see instructions) |

|||

Fiscal year filers only: Enter month of year end: month________ year 2022.

|

|

Suffix |

|

Your SSN or ITIN |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix |

|

Spouse’s/RDP’s SSN or ITIN |

|

|

|

R |

|||||||

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PBA code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no/ste. no. |

|

PMB/private mailbox |

|

|

|

RP |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Foreign province/state/county |

|

|

|

Foreign postal code |

|

|

|

|

|||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s DOB (mm/dd/yyyy)

•

Spouse’s/RDP’s prior name (see instructions)

•

Principal Residence

Filing Status

If your address above is the same as your principal/physical residence address at the time of filing, check this box . . .

If not, enter below your principal/physical residence address at the time of filing.

If not, enter below your principal/physical residence address at the time of filing.

Street address (number and street) (If foreign address, see instructions.) |

|

Apt. no/ste. no. |

|

||

|

|

|

|

|

|

City |

State |

ZIP code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . . . . . .

1 |

|

Single |

4 |

|

Head of household (with qualifying person). See instructions. |

|

|

|||

2 |

|

|

5 |

|

|

|

|

|

|

|

|

Married/RDP filing jointly. See inst. |

|

Qualifying widow(er). Enter year spouse/RDP died. |

|

|

|

||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

3 |

|

Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here. |

|

|

|

|

||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

. . . . . . .6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here. See inst |

• 6 |

|

|

|

|

|

|

Exemptions

▶ For line 7, line 8, line 9, and line 10: Multiply the number you enter in the box by the |

Whole dollars only |

||||||

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked |

|

|

|

|

|

||

7 |

|

X $129 = |

$ |

|

|

||

|

|

|

|||||

|

box 2 or 5, enter 2 in the box. If you checked the box on line 6, see instructions. |

|

|

|

|||

8 |

Blind: If you (or your spouse/RDP) are visually impaired, enter 1; |

8 |

|

X $129 = |

$ |

|

|

|

|

|

|||||

|

if both are visually impaired, enter 2 |

|

|

|

|||

9 |

Senior: If you (or your spouse/RDP) are 65 or older, enter 1; |

• 9 |

|

X $129 = |

$ |

|

|

|

|

|

|||||

|

|

|

|||||

|

if both are 65 or older, enter 2. See instructions |

|

|

|

|||

333

3101213

Form 540 2021 Side 1

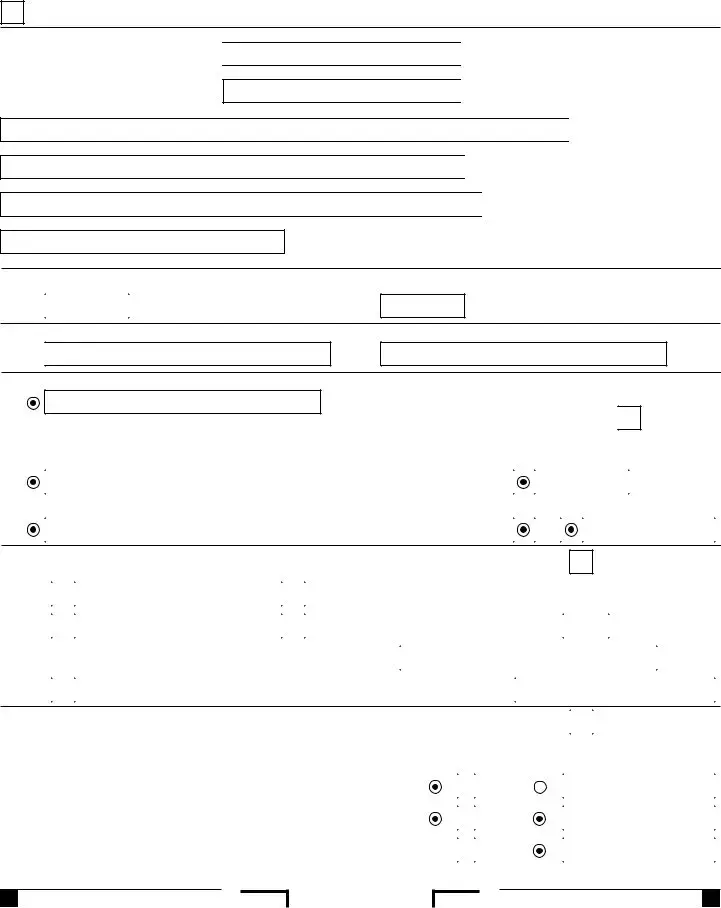

Your name: |

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

||

|

|

|

|

Exemptions

10 Dependents: Do not include yourself or your spouse/RDP.

|

Dependent 1 |

Dependent 2 |

First Name |

|

|

Last Name |

|

|

SSN. See |

• |

• |

instructions. |

||

Dependent’s |

|

|

relationship |

|

|

to you |

|

|

Dependent 3

•

. . . . . . . . . . . . . . . . . . . . . .Total dependent exemptions |

. . . . . . |

. . . . . . . . . . . • 10 |

|

X $400 = |

$ |

||||

11 |

Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 |

. . . 11. . . . |

$ |

||||||

12 State wages from your federal |

• 12 |

|

|

|

. |

|

|

|

|

|

|

|

00 |

|

|

||||

|

Form(s) |

|

|

|

|

|

|||

13 |

Enter federal adjusted gross income from federal Form 1040 or |

. . . 13 |

|

||||||

|

|||||||||

14 |

California adjustments – subtractions. Enter the amount from Schedule CA (540), |

|

. • 14 |

|

|||||

|

|

||||||||

|

Part I, line 27, column B |

. . . . . . . |

. . . . . . . . . . . . . . . . . |

. . . . . |

. . . |

|

|||

|

|

|

|

|

|||||

15Subtract line 14 from line 13. If less than zero, enter the result in parentheses.

Income |

|

See instructions |

. 15 |

|

||

16 |

Part I, line 27, column C |

. • 16 |

|

|||

Taxable |

California adjustments – additions. Enter the amount from Schedule CA (540), |

|

|

|||

17 |

California adjusted gross income. Combine line 15 and line 16 |

. • 17 |

{ |

|||

|

18 |

Enter the |

{ |

Your California itemized deductions from Schedule CA (540), Part II, line 30; OR |

||

|

|

larger of |

Your California standard deduction shown below for your filing status: |

|

||

|

|

|

• Single or Married/RDP filing separately |

$4,803 |

||

|

|

|

• Married/RDP filing jointly, Head of household, or Qualifying widow(er) . . . . |

$9,606 |

||

|

|

|

|

If Married/RDP filing separately or the box on line 6 is checked, STOP. See instructions |

• 18 |

|

19Subtract line 18 from line 17. This is your taxable income.

If less than zero, enter  19

19

31 Tax. Check the box if from: |

|

Tax Table |

|

|

Tax Rate Schedule |

|

|

|

|

|

|

|

|

• |

|

FTB 3800 |

• |

|

. . . . . . . . .FTB 3803 |

• 31 |

|

|

32Exemption credits. Enter the amount from line 11. If your federal AGI is more than

Tax |

|

$212,288, see instructions |

. . . . . |

. . . |

. |

. . . |

. . . . . . . . |

. . . . |

. . |

. |

. |

. . . . |

. . . . . . . . |

32 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

33 |

Subtract line 32 from line 31. If less than zero, enter |

. . . . |

. . . . . . . . |

33 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

34 |

Tax. See instructions. Check the box if from: • |

|

|

Schedule |

|

|

. .FTB 5870A |

• 34 |

|||||||

|

|

35 |

Add line 33 and line 34 |

|

|

|

|

|

|

|

|

|

|

|

. |

35 |

|

|

|

. . . . . |

. . . |

. |

. . . |

. . . . . . . . |

. . . . |

. . |

. |

. |

. . . . |

. . . . . . . |

|||||

Credits |

40 |

Nonrefundable Child and Dependent Care Expenses Credit. See instructions |

|

|

. |

• 40 |

|||||||||||

|

|

. |

. . . . |

. . . . . . . |

|||||||||||||

Special |

43 |

Enter credit name |

|

|

|

|

|

|

code • |

|

|

|

. . .and amount |

• 43 |

|||

44 |

Enter credit name |

|

|

|

|

|

|

code • |

|

|

|

and amount |

• 44 |

||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 2 Form 540 2021 |

333 |

3102213 |

|

|

|

|

|

|||||||

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

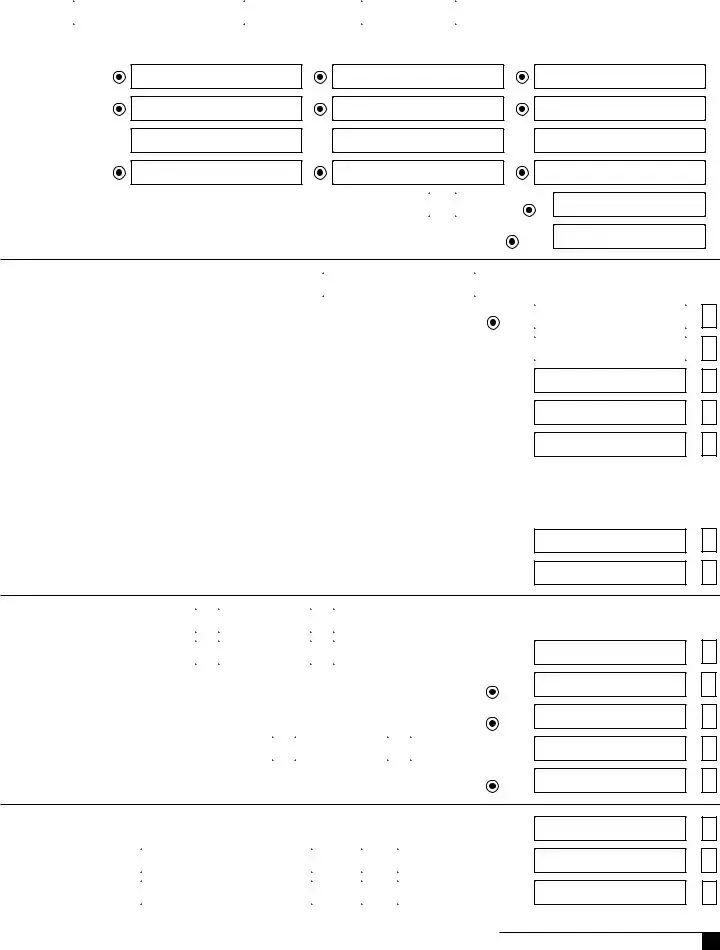

Your name: |

|

|

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||||

Credits |

45 |

. . . . . . . . . . . . . .To claim more than two credits. See instructions. Attach Schedule P (540) |

|

|

|

|

||||||||||||||

46 |

Nonrefundable Renter’s Credit. See instructions |

|

|

|

• 46 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||||

Special |

. . . |

. . . . |

|

|||||||||||||||||

47 |

Add line 40 through line 46. These are your total credits |

|

|

|

|

47 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

. . . |

. . . . |

|

|

|

|

|

|

||||||||||||

|

48 |

Subtract line 47 from line 35. If less than zero, enter |

|

|

|

|

48 |

|

|

|

|

|

||||||||

|

. . . |

. . . . |

|

|

|

|

|

|

||||||||||||

|

61 |

Alternative Minimum Tax. Attach Schedule P (540) |

|

|

|

• 61 |

|

|

|

|

||||||||||

|

. . . |

. . . . |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

||||||||||||||

Taxes |

62 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Mental Health Services Tax. See instructions |

. . . |

. . . . |

• 62 |

|

|

|

|

|||||||||||

63 |

Other taxes and credit recapture. See instructions |

|

|

|

• 63 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||||

Other |

. . . |

. . . . |

|

|||||||||||||||||

64 |

Excess Advance Premium Assistance Subsidy (APAS) repayment. See instructions |

• 64 |

|

|

|

|

||||||||||||||

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

65 |

Add line 48, line 61, line 62, line 63, and line 64. This is your total tax |

. . . . . . . . . . |

. . . |

. . . . |

• 65 |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

71 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .California income tax withheld. See instructions |

. . . |

. . . . |

• 71 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

72 |

. . . . . . . . . . . . . . . . .2021 CA estimated tax and other payments. See instructions |

. . . |

. . . . |

• 72 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

73 |

. . . . . . . . . . . . . . . . . . . . .Withholding (Form |

. . . |

. . . . |

• 73 |

|

|

|

|

|||||||||||

Payments |

75 |

Earned Income Tax Credit (EITC) |

|

|

|

|

|

|

|

|

• |

75 |

|

|

|

|

|

|||

. . . . . |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. |

. . . . . . . . . . |

. . . |

. . . . |

|

|

|

|

|

||||||||

|

74 |

Excess SDI (or VPDI) withheld. See instructions |

. . . |

. . . . |

• |

74 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . .76 Young Child Tax Credit (YCTC). See instructions |

. . . |

. . . . |

• 76 |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

77 |

. . . . . . . . . . . . . . . . . . . .Net Premium Assistance Subsidy (PAS). See instructions |

. . . |

. . . . |

• 77 |

|

|

|

|

|||||||||||

|

78 |

Add line 71 through line 77. These are your total payments. |

|

|

|

|

78 |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

Tax |

|

See instructions |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. |

.. .. .. . •. . .91. . . |

. . . |

. . . . |

|

|

|

|

|

|

|||||

91 |

|

|

|

|

|

|

|

|

|

. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Use Tax. Do not leave blank. See instructions |

|

|

|

|

|

00 |

|

|||||||||||||

Use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

If line 91 is zero, check if: |

|

No use tax is owed. |

|

|

|

You paid your use tax obligation directly to CDTFA. |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

92 If you and your household had |

• |

|

|

|

|

|

|

|

|||||||||||

Penalty |

|

See instructions. Medicare Part A or C coverage is qualifying health care coverage |

|

|

|

|

|

|

|

|||||||||||

ISR |

|

If you did not check the box, see instructions. |

. . . • 92 |

|

|

|

|

|

|

|

. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Individual Shared Responsibility (ISR) Penalty. See instructions |

|

|

|

|

|

|

|

00 |

|

||||||||||

|

|

|

|

|

|

|||||||||||||||

Due |

93 |

Payments balance. If line 78 is more than line 91, subtract line 91 from line 78 |

|

93 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||||

Tax/Tax |

94 |

Use Tax balance. If line 91 is more than line 78, subtract line 78 from line 91 |

|

94 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|||||||||||||||

Overpaid |

95 |

Payments after Individual Shared Responsibility Penalty. If line 93 is more than line 92, |

|

96 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||||

|

subtract line 93 from line 92 |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. |

. . . . . . . . . . |

. . . |

. . . . |

|

|

|

|

|

|

||||||

|

96 |

subtract line 92 from line 93 |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. |

. . . . . . . . . . |

. . . |

. . . . |

|

95 |

|

|

|

|

|

||||

|

Individual Shared Responsibility Penalty Balance. If line 92 is more than line 93, then |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

333

3103213

Form 540 2021 Side 3

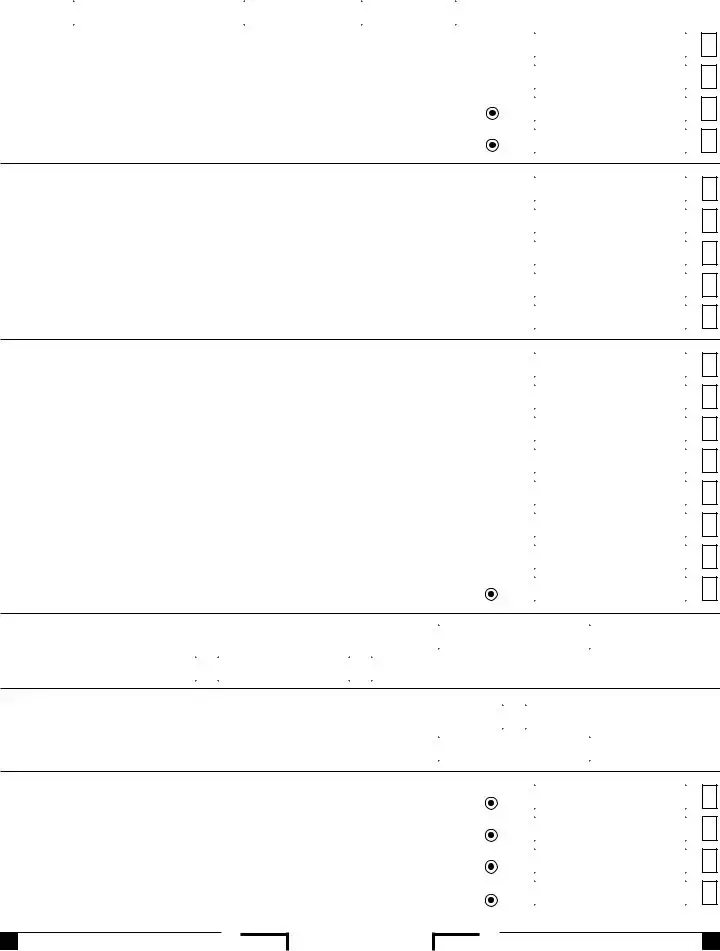

|

Your name: |

|

|

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Due |

97 Overpaid tax. If line 95 is more than line 65, subtract line 65 from line 95 |

|

|

|

97 |

|

|

|

||||||||||

|

|

|

|

|

|

|||||||||||||

Tax/Tax |

. . . . |

. . . .. |

• |

|

|

|

||||||||||||

98 |

Amount of line 97 you want applied to your 2022 estimated tax |

|

|

98 |

|

|

|

|||||||||||

|

|

|

|

|

||||||||||||||

Overpaid |

. . . . |

. . . |

|

|

|

|||||||||||||

|

|

|

|

|

||||||||||||||

100 |

Tax due. If line 95 is less than line 65, subtract line 95 from line 65 |

|

.. |

• |

100 |

|

|

|

||||||||||

. . . . |

. . . |

|

|

|

||||||||||||||

|

|

99 |

Overpaid tax available this year. Subtract line 98 from line 97 |

. . . . |

. . . |

99 |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code Amount |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

California Seniors Special Fund. See instructions |

|

|

|

. |

• 400 |

|

|||||||||

|

|

|

. . . . . . . . . . . . |

. . . . |

. . . |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Alzheimer’s Disease and Related Dementia Voluntary Tax Contribution Fund |

|

. |

• 401 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Rare and Endangered Species Preservation Voluntary Tax Contribution Program |

|

. |

• 403 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Breast Cancer Research Voluntary Tax Contribution Fund |

|

. |

• 405 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Firefighters’ Memorial Voluntary Tax Contribution Fund |

|

. |

• 406 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Emergency Food for Families Voluntary Tax Contribution Fund |

|

. |

• 407 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Peace Officer Memorial Foundation Voluntary Tax Contribution Fund |

|

. |

• 408 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

California Sea Otter Voluntary Tax Contribution Fund |

|

|

|

. |

• 410 |

|

|||||||||

|

|

|

. . . . . . |

. . . . . . . . . . . . |

. . . . |

. . . |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Contributions |

|

California Cancer Research Voluntary Tax Contribution Fund |

|

. |

• 413 |

|

|||||||||||

|

|

. . . . |

. . . |

|

||||||||||||||

|

|

Protect Our Coast and Oceans Voluntary Tax Contribution Fund |

|

. |

• |

424 |

|

|

|

|||||||||

|

|

|

|

|

|

|

||||||||||||

|

|

. . . . |

. . . |

|

|

|

||||||||||||

|

|

|

School Supplies for Homeless Children Voluntary Tax Contribution Fund |

. . . . |

. . . . |

• |

422 |

|

|

|

||||||||

|

|

|

State Parks Protection Fund/Parks Pass Purchase |

|

|

|

. |

• 423 |

|

|||||||||

|

|

|

. . . . . . . . . . . . |

. . . . |

. . . |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Keep Arts in Schools Voluntary Tax Contribution Fund |

|

|

|

. |

• 425 |

|

|||||||||

|

|

|

. . . . . . |

. . . . . . . . . . . . |

. . . . |

. . . |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund |

|

. |

• 431 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Senior Citizen Advocacy Voluntary Tax Contribution Fund |

|

. |

• 438 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Native California Wildlife Rehabilitation Voluntary Tax Contribution Fund |

|

. |

• 439 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Rape Kit Backlog Voluntary Tax Contribution Fund |

|

|

|

. |

• 440 |

|

|||||||||

|

|

|

. . . . . . . . . . . . |

. . . . |

. . . |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Schools Not Prisons Voluntary Tax Contribution Fund |

|

|

|

. |

• 443 |

|

|||||||||

|

|

|

. . . . . . |

. . . . . . . . . . . . |

. . . . |

. . . |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Suicide Prevention Voluntary Tax Contribution Fund |

|

|

|

. |

• 444 |

|

|||||||||

|

|

|

. . . . . . |

. . . . . . . . . . . . |

. . . . |

. . . |

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Mental Health Crisis Prevention Voluntary Tax Contribution Fund |

|

. |

• 445 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Community and Neighborhood Tree Voluntary Tax Contribution Fund |

|

. |

• 446 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

110 Add code 400 through code 446. This is your total contribution |

|

. |

• 110 |

|

|

|||||||||||

|

|

. . . . |

. . . |

|

|

|||||||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 4 Form 540 2021 |

333 |

|

3104213 |

|

|

|

|

|

|

|

|

|||||

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

Your name:

Your SSN or ITIN:

Amount You Owe

111AMOUNT YOU OWE. If you do not have an amount on line 99, add line 94, line 96, line 100, and line 110. See instructions. Do not send cash.

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

|

. |

00 |

Pay Online – Go to ftb.ca.gov/pay for more information. |

|

|

|

Interest and Penalties

Refund and Direct Deposit

112 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .Interest, late return penalties, and late payment penalties |

112 |

|

. |

00 |

||||

113 |

Underpayment of estimated tax. |

|

|

|

|

|

|

||

|

Check the box: • |

|

FTB 5805 attached • |

|

|

• 113 |

|

. |

|

|

|

|

FTB 5805F attached |

|

00 |

||||

|

|

|

|

|

|||||

114 |

Total amount due. See instructions. Enclose, but do not staple, any payment |

114 |

|

. |

00 |

||||

|

|

||||||||

115REFUND OR NO AMOUNT DUE. Subtract the sum of line 110, line 112 and line 113 from line 99. See instructions.

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

|

. |

00 |

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip. See instructions. Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

|

• Routing number |

• Type |

• Account number |

|

• 116 |

Direct deposit amount |

||||

|

|

|

Checking |

|

||||||

|

|

|

|

Savings |

|

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below: |

|

|

|

|||||||

|

• Routing number |

• Type |

• Account number |

|

• 117 |

Direct deposit amount |

||||

|

|

|

Checking |

|

||||||

|

|

|

|

Savings |

|

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT: See the instructions to find out if you should attach a copy of your complete federal tax return.

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Your signature |

Date |

Spouse’s/RDP’s signature (if a joint tax return, both must sign) |

||

|

|

|

|

|

|

|

|

|

|

Your email address. Enter only one email address. |

|

|

Preferred phone number |

|

Sign Here

It is unlawful to forge a spouse’s/ RDP’s signature.

Joint tax return? (See instructions)

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Firm’s name (or yours, if |

|

|

|

|

• PTIN |

|

||

|

|

|

|

|

|

|

|

|

Firm’s address |

|

|

|

|

• Firm’s FEIN |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this tax return with us? See instructions . . . . . . .• |

|

Yes |

|

|

|

No |

|

|

Print Third Party Designee’s Name |

|

Telephone Number |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

333

3105213

Form 540 2021 Side 5

Document Specs

| Fact | Detail |

|---|---|

| Purpose | The Form 540 is used by California residents to file their state income tax return. |

| Amended Returns | Taxpayers can indicate if the submission is an amended return by checking the appropriate box on the form. |

| Exemptions and Deductions | It includes sections for exemptions based on personal, blindness, senior status, and dependents, as well as options for itemized or standard deductions. |

| Governing Law | The form is governed by California state law, specifically administered by the California Franchise Tax Board. |

Detailed Instructions for Writing Ca 540

Completing the CA 540 form, the California Resident Income Tax Return, requires focus and precision. This step-by-step guide walks you through each part of the form to ensure accurate reporting and compliance with state tax regulations. After filling it out, you'll verify the information, sign the document, and submit it to the appropriate address or through the provided online services. Whether you're handling taxes for the first time or needing a refresher, this systematic approach aims to simplify the process.

- Start with your personal information at the top of the form. Fill in your first name, middle initial, last name, and if applicable, your spouse’s or RDP's (Registered Domestic Partner's) similar information.

- Under "Additional information," include your street address, city, state, ZIP code, and if relevant, any foreign address details.

- Enter your Date of Birth (DOB) in the format mm/dd/yyyy. If you have changed your name since the last tax filing, enter your prior name in the designated space.

- Select the applicable box for your filing status: Single, Married/RDP filing jointly or separately, Head of Household, or Qualifying widow(er).

- For exemptions, multiply the number of personal, blind, senior, or dependent exemptions by the pre-printed dollar amount for each exemption category and fill in the resultant figures.

- Report your state wages from your federal Form(s) W-2, box 16, in the space provided.

- Enter your federal adjusted gross income from your federal Form 1040 or 1040-SR, line 11.

- List any necessary California adjustments, subtractions, and additions to arrive at your California adjusted gross income.

- Choose between itemized deductions or the standard deduction for your filing status, enter the amounts accordingly.

- Calculate your taxable income by subtracting your chosen deductions amount from your California adjusted gross income.

- Follow the tax worksheet or table to calculate your tax, considering any applicable exemption credits, special credits, and nonrefundable child and dependent care expenses credit.

- Add any other taxes, such as Alternative Minimum Tax (AMT) or Mental Health Services Tax, and total them.

- Cite the total California income tax withheld, estimated tax payments, withholdings, and any tax credits like Earned Income Tax Credit (EITC) or Young Child Tax Credit (YCTC).

- Address payments, including overpayments, amounts due, penalties, and interest, as applicable, based on the calculated tax, withholdings, and credits.

- If expecting a refund, complete the direct deposit information to have it deposited directly into your account(s).

- Sign and date the form. If it’s a joint return, both parties must sign. Provide an email address and phone number for contact purposes.

- Finally, review the privacy notice on the last page of the form, make a copy for your records, and submit the original to the Franchise Tax Board at the provided address or through the recommended online services.

Upon completion and submission, the Franchise Tax Board will process your return. You may track the status of your return or refund through the state's tax services website. Ensure all entered information is accurate and that you've attached any required documents to avoid delays in processing.

Things to Know About This Form

What is Form 540?

Form 540 is the standard form used by residents of California to file their state income tax return. This form is for individuals who have their primary residence in California and need to report the income they've earned over the tax year to the California Franchise Tax Board (FTB).

Who needs to file Form 540?

Any California resident who has earned income during the tax year that exceeds the filing threshold set by the state must file Form 540. This includes individuals, married couples filing jointly or separately, and heads of households.

What information do I need to complete Form 540?

To accurately complete Form 540, you'll need several pieces of information, including:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Total income earned during the tax year.

- Any deductions or credits you're eligible for.

- Information about any dependents.

- Your filing status (e.g., single, married filing jointly, head of household).

How do I claim deductions on Form 540?

To claim deductions on Form 540, you'll need to itemize your deductions or claim the standard deduction for your filing status. Itemized deductions can include things like mortgage interest, property taxes, and charitable donations. If itemizing is not to your advantage, you may choose the standard deduction, which is a set amount based on your filing status.

Can I file Form 540 electronically?

Yes, California residents can file Form 540 electronically using the California Franchise Tax Board's online filing system. Electronic filing (e-filing) is faster, more secure, and often ensures quicker processing of refunds.

What if I need to amend a previously filed Form 540?

If you discover an error on your previously filed Form 540, you have the option to file an amended return. To do so, check the box on the top of Form 540 indicating it is an amended return and make the necessary corrections. It is crucial to provide a thorough explanation of the changes directly on the form or on a separate attached statement.

What is the deadline for filing Form 540?

The deadline for filing Form 540 typically aligns with the federal income tax deadline, which is usually April 15th of each year. If April 15th falls on a weekend or a holiday, the deadline may be extended to the next business day. Please note that filing deadlines may change, so it is important to verify the current deadline with the California Franchise Tax Board.

Where do I send my completed Form 540?

The mailing address for your completed Form 540 depends on whether you are making a payment or requesting a refund. If you owe taxes, mail your form to the address listed for payments. If you are due a refund or have no payment, send it to the address designated for refunds. These addresses are provided in the form's instructions.

Is there a penalty for filing Form 540 late?

If you file Form 540 after the deadline without an extension or if you owe taxes and pay late, you may be subject to penalties and interest. The California Franchise Tax Board calculates penalties based on the amount owed and the duration of the delay. To avoid penalties, ensure you file on time and pay any taxes due by the deadline.

Common mistakes

Filling out tax forms accurately is crucial to ensure compliance with state tax regulations and to avoid potential penalties. Here are ten common mistakes people make when they fill out the California Resident Income Tax Return, FORM 540:

- Incorrectly reporting income amounts from Form(s) W-2, box 16, often due to overlooking or misunderstanding what needs to be reported, leading to inaccuracies in the State wages field.

- Not checking the box to indicate if it is an AMENDED return, which is essential for the tax authorities to distinguish between original submissions and corrections to previously filed returns.

- Failing to indicate the correct filing status, such as Single, Married/RDP filing jointly, or Head of household, which can affect the calculation of tax liability significantly.

- Omitting or inaccurately entering Social Security Numbers (SSNs) or Individual Tax Identification Numbers (ITINs) for themselves, their spouse/RDP, or dependents, leading to issues with tax return processing.

- Mistakes in calculating exemptions, including personal, blind, senior, or dependent exemptions, by not properly applying the pre-printed dollar amount for each line, resulting in incorrect exemption amounts.

- Failure to correctly add up the exemption amount from lines 7 through 10 to transfer to line 32, which can lead to underreporting or overreporting the total exemptions.

- Inaccuracies in reporting federal adjusted gross income from federal FORM 1040 or 1040-SR, line 11, which is critical for accurately determining the starting point for California tax calculations.

- Errors in the calculation of California adjustments, both additions and subtractions, as required on lines 14 and 16, which adjust the federal income to arrive at California adjusted gross income.

- Not correctly determining the larger of your California itemized deductions or your California standard deduction, leading to a misstatement of taxable income on line 19.

- Entering incorrect amounts of California income tax withheld, estimated tax payments, or other credits towards the tax liabilities, which affects the accuracy of payments and overpayment/refund calculations.

It's important for taxpayers to carefully review their FORM 540 to ensure all information is correct and all necessary boxes are checked to avoid these and other mistakes. Proofreading, double-checking calculations, and referencing the official instructions can help mitigate these errors.

Documents used along the form

When preparing to file your California Resident Income Tax Return using Form 540, it’s essential to have all the necessary documents and forms on hand. This ensures a thorough and accurate tax filing process. Below are several important documents and forms that you might need alongside Form 540:

- Schedule CA (540): This form is used to make adjustments to your federal adjusted gross income and itemized deductions as necessary for California tax calculations.

- Form W-2: This form reports your annual wages and the amount of taxes withheld from your paycheck. It’s essential for verifying income and tax withholding.

- Form 1099: If you have received income other than wages, such as from investments, this form is issued by banks and other financial institutions.

- Schedule D (540): Used for reporting capital gains or losses from the sale or exchange of capital assets, this form adjusts your income based on these transactions.

- Schedule P (540): For claiming various tax credits that don’t find a place on the standard 540 form, this schedule is crucial to reducing your tax liability.

- Form 5805: If you’re subject to underpayment penalties, this form helps calculate those penalties and includes them in your tax return.

- Schedule S: This form is for nonresidents who have income sources from California and need to apportion that income accordingly.

- Form 3506: Child and Dependent Care Expenses Credit form allows you to claim expenses pertaining to the care of dependents while working or looking for work.

- Form 540-ES: For individuals who must make estimated tax payments throughout the tax year, this form helps calculate and pay those amounts.

- Schedule X: Utilized when amending a previously filed Form 540, this schedule details the changes to be made to the original tax return.

Having these forms and documents ready can streamline the process of filing your Form 540, ensuring all relevant income, adjustments, and credits are properly accounted for. Each document serves a specific purpose in the context of your personal and financial circumstances over the tax year, impacting the accuracy of your tax obligations to the State of California. Be sure to consult with a tax professional if you are uncertain about which forms are necessary for your situation or how to complete them accurately.

Similar forms

The United States Federal 1040 Form is essentially the federal counterpart to California's Form 540. Both documents share the purpose of reporting personal income and calculating the taxes due to the government for the taxable year. They collect similar types of information, such as the taxpayer's income, deductions, and credits to accurately determine the amount owed or refunded. The key difference is their jurisdiction: one applies to federal taxes across all states, while the other specifically addresses state taxes in California.

Schedule CA (540) is designed to accompany the main Form 540, operating as the California adjustments document. It mirrors the federal Schedule A and allows taxpayers to adjust their gross income and deductions based on specifics that only apply within California. For example, while Schedule A might deal with federal-level deductions, Schedule CA (540) modulates this information to accurately reflect tax obligations according to California state law, highlighting disparities or specific allowances exclusive to the state.

The New York State Resident Income Tax Return (IT-201) serves a similar purpose to Form 540, but for residents of New York State. Like Form 540, IT-201 is used to calculate state income tax for individuals living within its jurisdiction. Both forms require detailed personal income information and account for state-specific deductions and credits. The form's design and function cater to the unique tax laws and provisions of New York, paralleling how Form 540 is tailored to California's tax codes.

Form W-2, the Wage and Tax Statement, is a document that directly integrates with the process of filling out Form 540 though it serves a distinct purpose. Employers issue W-2 forms to employees detailing the salary paid and taxes withheld during the year. Recipients of Form W-2 use it to complete portions of Form 540, ensuring their reported income and tax withholdings are accurate. It's a crucial document that bridges the taxpayer's information with both federal and state tax filings.

Form 1099 is another document closely linked to Form 540, especially for those receiving income outside of traditional employment. There are various types of 1099 forms, each pertaining to different income sources such as freelance work, interest, dividends, or government payments. Similar to how W-2 forms are used, information from 1099s must be reported on Form 540 for income not subject to regular wage withholding, affecting the calculation of taxable income and taxes owed.

Schedule D (540) specifically relates to California residents who need to report capital gains or losses. This form parallels the federal Schedule D, which calculates taxable capital gains. On both forms, taxpayers list details of asset transactions, such as stocks or real estate, to determine the net gain or loss. The calculated figures from Schedule D (540) are vital for completing Form 540, influencing the overall tax liability in a manner tailored to California’s tax regulations.

The Earned Income Tax Credit (EITC) Schedule for California mirrors the federal EITC requirements and aims to reduce the tax burden on low-to-moderate-income families. While the federal EITC supplements Form 1040, California’s version is directly related to Form 540, offering a refundable credit to qualifying residents. Both credits incentivize employment and support economic stability among working-class families, but the eligibility criteria and credit amounts may differ due to distinct state and federal guidelines.

The Alternative Minimum Tax (AMT) Schedule for Form 540 functions similarly to the federal AMT calculations, designed to ensure that individuals with higher incomes pay a minimum amount of tax. This form requires Californians to recalculate their tax under a separate set of rules to prevent taxpayers from excessively lowering their tax liability through deductions and credits. The concept ensures fairness in the tax system, paralleling the federal intent but tailored to California’s fiscal policies.

Child and Dependent Care Expenses Credit for California residents, as reported on a specific schedule with Form 540, shares its purpose with the federal child and dependent care credit. This tax credit assists families in offsetting some cost of childcare necessary for employment. While details and amounts may vary between California's provisions and federal regulations, both credits aim to support working parents, reducing their taxable income based on childcare expenses incurred.

Finally, the Young Child Tax Credit (YCTC) available in California is a unique offering that complements the family-oriented credits of Form 540, offering additional financial relief to families with young children. This state-specific credit underscores California’s progressive stance on supporting families through the tax system, similar in spirit to federal tax credits aimed at easing the financial burden on families but directly addressing the needs of California's residents.

Dos and Don'ts

When filing the CA 540 form for your California Resident Income Tax Return, there are several key points you should remember to ensure the process is smooth and free from common mistakes. Here's a helpful guide:

Do's:- Double-check your Social Security Number (SSN) or Individual Tax Identification Number (ITIN): Making sure these numbers are correct is crucial as they are primary identifiers for your tax return.

- Report all income accurately: Ensure you include all sources of income, such as wages from your W-2 forms, to avoid discrepancies that could lead to audits or penalties.

- Claim all eligible deductions and credits: Take the time to understand which deductions and credits you're eligible for, such as the Standard Deduction or Exemptions for dependents, to reduce your taxable income.

- Verify your bank account details for refunds: If you're expecting a refund and opt for direct deposit, ensure your banking information is accurate to avoid delays.

- Sign and date the form: Your return isn't valid until you, and your spouse if filing jointly, sign and date the form. This simple step is often overlooked but is essential for filing.

- Keep a copy for your records: Always keep a copy of your filed tax return for your records. It can be helpful for future reference or in case the IRS has any questions.

- Don't leave any fields blank: Instead of leaving a field blank, if something doesn't apply to you, consider entering “N/A” or “0” as appropriate. This shows you didn't overlook the section.

- Don't forget to include your filing status and exemptions: Your filing status and exemptions can significantly impact your tax calculations, so make sure these are filled out correctly.

- Don't overlook the importance of dates: Whether it's your DOB, the tax year, or the filing deadline, getting dates right is vital. Incorrect dates can cause unnecessary processing delays.

- Don't underestimate your tax liabilities: If you owe money, ensure you calculate your tax liability accurately and pay the due amount to avoid penalties and interest for underpayment.

- Don't ignore the instructions for attaching additional documents: If you need to attach other forms or schedules based on your tax situation, make sure you follow the guidelines on how to properly attach these documents.

- Don't send cash if you owe money: For security reasons and peace of mind, it's better to pay any taxes you owe via check, money order, or online payment options provided by the state.

Following these guidelines will help streamline your CA 540 form filing process and avoid common pitfalls that can lead to delays or issues with your tax return.

Misconceptions

When it comes to navigating tax forms like the California Resident Income Tax Return 540, it's easy to get lost in all the details and fine print. To help clear the air, here are nine common misconceptions about the CA 540 form, debunked:

- Filing Status Confusion: Some people believe that if they are married, they must file as "Married/RDP filing jointly." However, you have the option to choose "Married/RDP filing separately" depending on your situation, which could be beneficial in certain circumstances.

- Amended Returns Misunderstanding: There's a misconception that once you file your CA 540 form, you can't make changes. If you realize you've made a mistake or left out information, you can file an amended return to correct your tax record.

- Exemptions Overlook: Many overlook the personal, blind, senior, and dependent exemptions they might qualify for, potentially missing out on reducing their taxable income.

- Wrongly Assuming No Deductions or Credits Apply: Taxpayers often think they don't qualify for any deductions or credits. California offers various deductions and credits, such as the California Standard Deduction, that can lower your tax liability.

- Not Realizing the Importance of the County Information: Your county of residence can impact certain tax calculations. This detail is not just a formality; it can affect your tax return in nuanced ways.

- Skipping Over the Special Taxes and Contributions Section: Many people fast-forward through the voluntary tax contribution section, not realizing they can contribute to causes they care about directly through their tax return.

- Incorrectly Reporting State Wages: A common error is not properly reporting state wages from your W-2 forms. This figure can differ from your federal wages due to specific state tax treatments of various income types.

- Assuming E-Filing Is Too Complex: Some taxpayers believe e-filing is complicated and error-prone. On the contrary, e-filing is straightforward and can reduce the risk of errors by automatically checking data.

- Misunderstanding Taxable Income Calculation: Taxpayers frequently miscalculate their taxable income by not applying deductions or incorrectly adding income. It's crucial to follow the form's line-by-line instructions to accurately determine your taxable income.

Understanding these nuances can make filing your CA 540 form less daunting and might even save you money and time. Always double-check your entries and consider consulting a tax professional if you're unsure of your tax situation.

Key takeaways

Filling out and using the California Resident Income Tax Return Form 540 requires careful attention to details to ensure accuracy and compliance with state tax laws. Here are four key takeaways to help taxpayers navigate this process effectively:

- Understanding Your Filing Status and Exemptions: The form allows taxpayers to select their filing status, which includes options such as single, married/Registered Domestic Partner (RDP) filing jointly, head of household, etc. This choice impacts the calculation of taxes and available deductions. Additionally, taxpayers can claim personal, blind, senior, and dependent exemptions by entering the appropriate numbers in the designated boxes and multiplying these by the pre-printed dollar amount for each category.

- Income and Adjustments: Taxpayers must report their state wages, federal adjusted gross income, and make any necessary California adjustments by subtracting or adding income according to the guidelines provided in Schedule CA (540), Parts I and II. This step is crucial for accurately determining taxable income within the state.

- Deductions, Credits, and Taxes Owed: The form guides taxpayers through calculating their itemized or standard deductions, applying exemption credits, and determining the total taxes owed or refundable credits. These sections include several options for tax credits, such as the Nonrefundable Child and Dependent Care Expenses Credit, and require taxpayers to subtract deductions and credits from their gross income to find their taxable income and ultimately, their tax liability.

- Payments and Refunds: Taxpayers can report estimated tax payments, tax withheld, and other credits to determine the amount of tax due or the refund amount. The form offers options for direct deposit of refunds into bank accounts, contributing to voluntary tax contribution funds, and paying any tax owed via online platforms or traditional mail. Understanding the payment and refund options available can help taxpayers manage their tax responsibilities more efficiently.

By keeping these key points in mind, taxpayers can navigate the CA 540 form with greater ease and accuracy, ensuring that they comply with California's tax requirements while taking advantage of all applicable deductions and credits.

Discover More PDFs

Form 540 Taxes - Nonrefundable credits, including child and dependent care expenses, are addressed.

Form 3523 - The form not only facilitates tax compliance but also encourages investment in research activities critical to economic growth.

Form 541 Instructions 2022 - Beneficiaries' names, addresses, and identification numbers are essential for correctly allocating estimated tax payments on Form 541-T.