Blank Ca 1 PDF Form

The CA-1 form, officially titled "Federal Employee's Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation," serves a critical function within the U.S. Department of Labor's Office of Workers' Compensation Programs (OWCP). Aimed at government employees who suffer a traumatic injury while performing their duties, this document initiates the process for claiming benefits under the Federal Employees' Compensation Act (FECA). It meticulously lays out the steps for employees, witnesses, and employing agencies to report an injury, providing detailed sections for each party to fill out, from personal and employment information to details about the injury itself. Noteworthy segments include the employee's description of the injury, witness statements, and an area for the employing agency's input, which are essential for determining eligibility and processing the claim. Additionally, it explicitly states the importance of honesty in reporting, underscoring the legal repercussions of false statements. The form further facilitates employees in expressing their preference for continuation of pay (COP) or the utilization of sick and annual leave, thus ensuring a comprehensive mechanism for supporting federal employees during their recovery period. Moreover, the CA-1 form addresses potential disability accommodations, showcasing a tailored approach to handling every step of the workers' compensation claim with the sensitivity and specificity it demands.

Document Preview Example

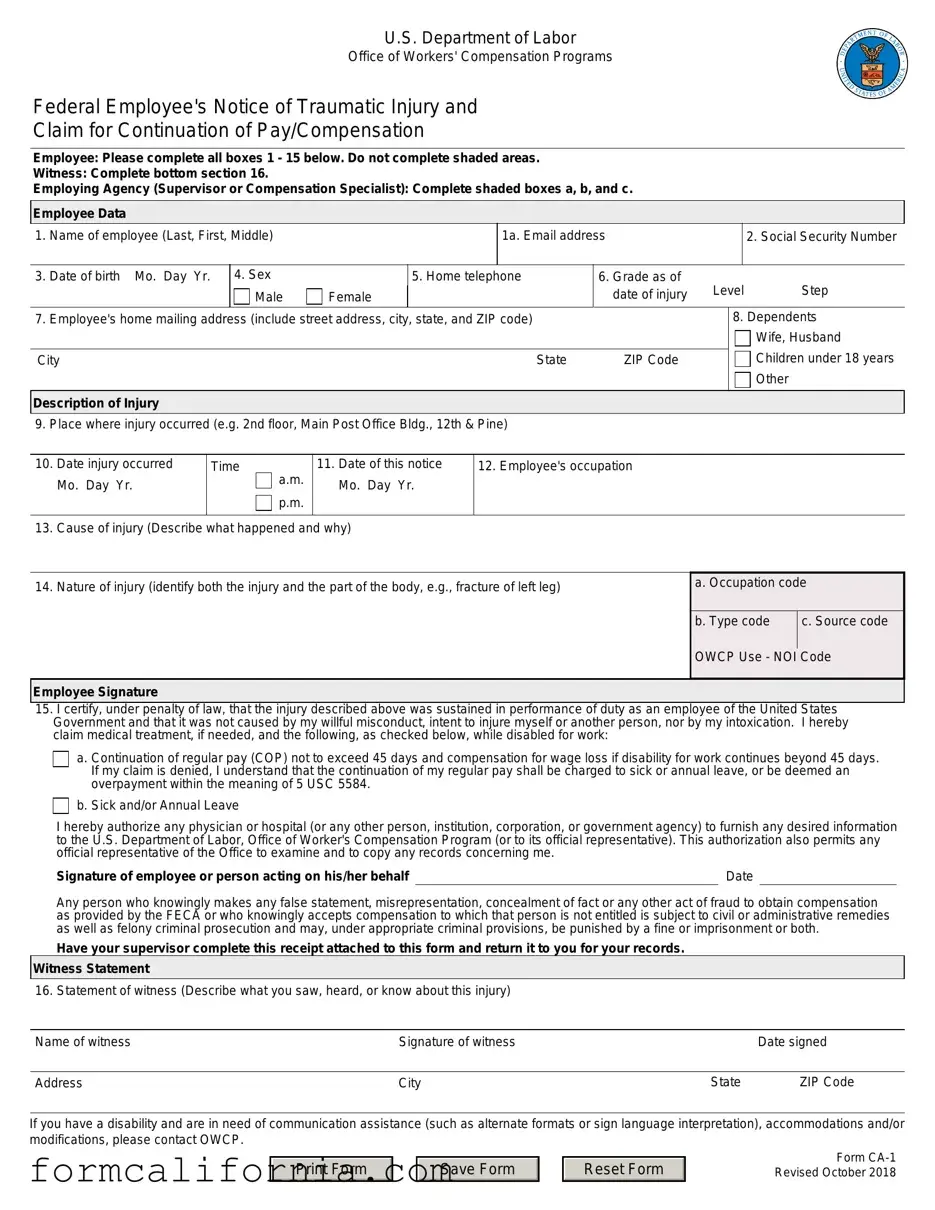

U.S. Department of Labor

Office of Workers' Compensation Programs

Federal Employee's Notice of Traumatic Injury and

Claim for Continuation of Pay/Compensation

Employee: Please complete all boxes 1 - 15 below. Do not complete shaded areas.

Witness: Complete bottom section 16.

Employing Agency (Supervisor or Compensation Specialist): Complete shaded boxes a, b, and c.

Employee Data

1. Name of employee (Last, First, Middle)

1a. Email address

2. Social Security Number

3. |

Date of birth Mo. Day Yr. |

4. Sex |

|

5. Home telephone |

|

6. Grade as of |

Level |

Step |

|

|

|

Male |

Female |

|

|

date of injury |

|||

7. |

Employee's home mailing address (include street address, city, state, and ZIP code) |

|

|

|

8. Dependents |

||||

|

|

|

|

|

|

|

|

|

Wife, Husband |

|

|

|

|

|

|

|

|

Children under 18 years |

|

City |

|

|

|

State |

ZIP Code |

|

|

||

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

Description of Injury |

|

|

|

|

|

|

|

|

|

9. Place where injury occurred (e.g. 2nd floor, Main Post Office Bldg., 12th & Pine)

10. |

Date injury occurred |

Time |

a.m. |

11. Date of this notice |

12. Employee's occupation |

|

Mo. Day Yr. |

|

Mo. Day Yr. |

|

|

|

|

p.m. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Cause of injury (Describe what happened and why) |

|

|||

14. Nature of injury (identify both the injury and the part of the body, e.g., fracture of left leg)

a. Occupation code

b. Type code |

c. Source code |

OWCP Use - NOI Code

Employee Signature

15.I certify, under penalty of law, that the injury described above was sustained in performance of duty as an employee of the United States Government and that it was not caused by my willful misconduct, intent to injure myself or another person, nor by my intoxication. I hereby claim medical treatment, if needed, and the following, as checked below, while disabled for work:

a. Continuation of regular pay (COP) not to exceed 45 days and compensation for wage loss if disability for work continues beyond 45 days. If my claim is denied, I understand that the continuation of my regular pay shall be charged to sick or annual leave, or be deemed an overpayment within the meaning of 5 USC 5584.

b. Sick and/or Annual Leave

I hereby authorize any physician or hospital (or any other person, institution, corporation, or government agency) to furnish any desired information |

|

to the U.S. Department of Labor, Office of Worker's Compensation Program (or to its official representative). This authorization also permits any |

|

official representative of the Office to examine and to copy any records concerning me. |

|

Signature of employee or person acting on his/her behalf |

Date |

Any person who knowingly makes any false statement, misrepresentation, concealment of fact or any other act of fraud to obtain compensation as provided by the FECA or who knowingly accepts compensation to which that person is not entitled is subject to civil or administrative remedies as well as felony criminal prosecution and may, under appropriate criminal provisions, be punished by a fine or imprisonment or both.

Have your supervisor complete this receipt attached to this form and return it to you for your records.

Witness Statement

16. Statement of witness (Describe what you saw, heard, or know about this injury)

Name of witness |

Signature of witness |

|

Date signed |

|

|

|

|

Address |

City |

State |

ZIP Code |

If you have a disability and are in need of communication assistance (such as alternate formats or sign language interpretation), accommodations and/or modifications, please contact OWCP.

Print Form

Save Form

Reset Form

Form

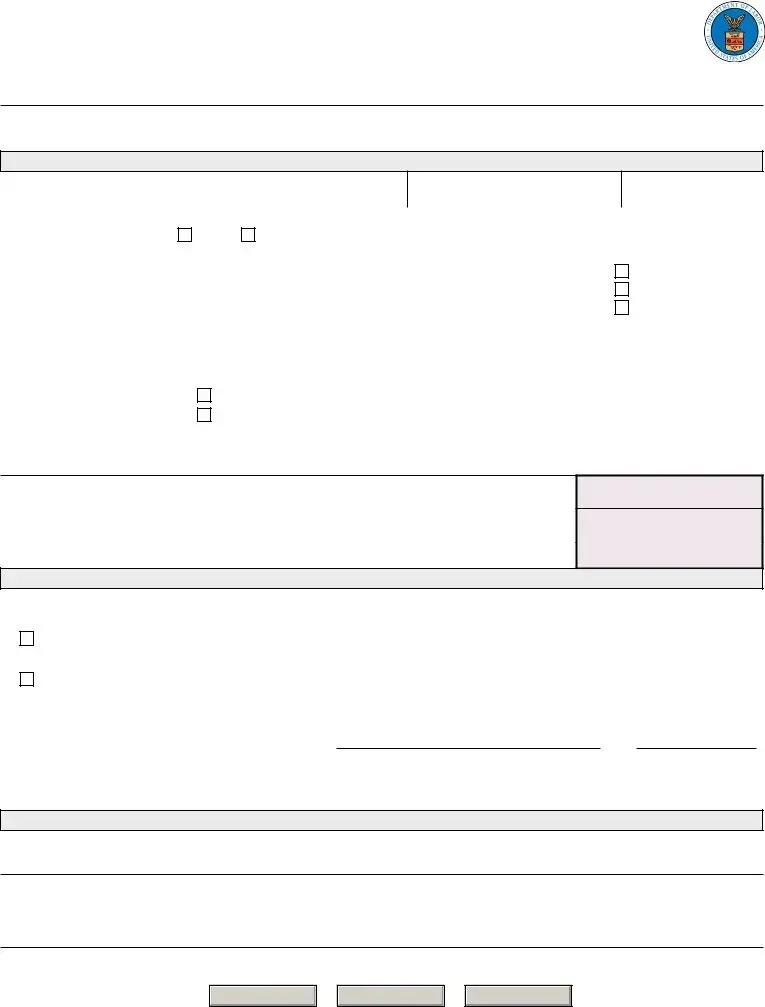

Official Supervisor's Report: Please complete information requested below:

Supervisor's Report

17. Agency name and address of reporting office (include street address, city, state, and ZIP code)

OWCP Agency Code

OSHA Site Code

City |

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

ZIP Code |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18. |

Employee's duty station (include street address, city, state and ZIP code) |

|

City |

|

|

|

|

|

State |

ZIP Code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

19 Employee's retirement coverage |

|

CSRS |

FERS |

|

Other, (identify) |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Regular |

From: |

a.m. |

|

To: |

a.m. |

21. Regular |

|

Sun. |

Mon. |

Tues. |

Wed. |

Thurs. |

Fri. |

Sat. |

|||||

|

work |

p.m. |

|

p.m. |

|

work |

|

|||||||||||||

|

hours |

|

|

|

|

schedule |

|

|

|

|

|

|

|

|

|

|

||||

22. |

Date of Injury |

|

23. Date notice received |

|

|

|

24. Date stopped work |

|

|

|

|

|

a.m. |

|

||||||

|

Mo. Day Yr. |

|

|

Mo. Day Yr. |

|

|

|

|

|

|

Mo. Day Yr. |

|

|

Time: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

p.m. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

25. |

Date pay stopped |

26. Date 45 day period began |

|

27. Date returned to work |

|

|

|

|

a.m. |

|

||||||||||

|

Mo. Day Yr. |

|

|

Mo. Day Yr. |

|

|

|

|

|

|

Mo. Day Yr. |

|

|

Time: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

p.m. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

28. |

Was employee injured in performance of duty? |

|

Yes |

|

No (If "No," explain) |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

29. |

Was injury caused by employee's willful misconduct, intoxication, or intent to injure self or another? |

|

Yes (If "Yes," explain) |

No |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

30. |

Was injury caused by third party? |

|

31. Name and address of third party (include street address, city, state, and ZIP code) |

|

|

|||||||||||||||

|

|

|

No (If "No," go |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

to Item 32,) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

32. Name and address of physician first providing medical care (include street address, city, state, ZIP code) |

33. First date medical |

Mo. Day |

Yr. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

care received |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City |

|

|

|

|

|

|

|

|

State |

|

|

ZIP Code |

|

34.Do medical reports |

Yes |

No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

show employee is |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

disabled for work? |

|

|

||

35. Does your knowledge of the facts about this injury agree with statements of the employee and/or witnesses? |

Yes |

No (If "No," explain)

No (If "No," explain)

36. If the employing agency controverts continuation of pay, state the reason in detail.

37.Pay rate when employee stopped work Per

Signature of Supervisor and Filing Instructions

38.A supervisor who knowingly certifies to any false statement, misrepresentation concealment of fact, etc. in respect of this claim may also be subject to appropriate felony criminal prosecution.

I certify that the information given above and that furnished by the employee on the reverse of this form is true to the best of my knowledge with the following exception:

Name of supervisor (Type or print)

Signature of supervisor |

Date |

|

|

Supervisor's Title |

Office phone |

|

|

39. Filing instructions |

No lost time and no medical expense: Place this form in employee's medical folder |

|

No lost time, medical expense incurred or expected: forward this form to OWCP |

|

Lost time covered by leave, LWOP, or COP: forward this form to OWCP |

|

First Aid Injury |

|

|

|

|

|

|

|

Form |

|

|

|

|

|

Revised October 2018 |

Print Form |

|

Save Form |

|

Reset Form |

|

|

|

Page 2 |

Instructions for Completing Form

Complete all items on your section of the form. If additional space is required to explain or clarify any point, attach a supplemental statement to the form. Some of the items on the form which may require further clarification are explained below.

Employee (or person acting on the employees' behalf)

1a) Email address |

14) Nature of injury |

Injured workers should provide an email address when completing this form. Pursuant to policy established by the Department of Labor, Office of Workers' Compensation Programs (OWCP), Division of Federal Employees' Compensation, email communication on case specific inquiries is not allowed due to security concerns. However, obtaining claimant email addresses at the point of filing will allow OWCP to share general,

13) Cause of injury

Describe in detail how and why the injury occurred. Give appropriate details (e.g.: If you fell, how far did you fall and in what position did you land?)

Give a complete description of the condition(s) resulting from your injury. Specify the right or left side if applicable (e.g., fractured left leg: cut on right index finger).

15) Election of COP/Leave

If you are disabled for work as a result of this injury and filed

Supervisor

As the time the form is received, complete the receipt of notice of |

33) First date medical care received |

|

injury and give it to the employee. In addition to completing |

The date of the first visit to the physician listed in Item 31. |

|

Items 17 through 39, the supervisor is responsible for obtaining |

||

the witness statement in Item 16 and for filling in the proper codes |

36) If the employing agency controverts continuation of |

|

in shaded boxes a, b, and c on the front of the form. If medical |

||

expense or lost time is incurred or expected, the completed form |

pay, state the reason in detail. |

|

should be sent to OWCP within 10 working days after is received. |

COP may be controverted (disputed) for any reason; however, |

|

The supervisor should also submit any other information or |

||

the employing agency may refuse to pay COP only if the |

||

evidence pertinent to the merits of this claim. |

controversion is based upon one of the nine reasons given |

|

If the employing agency controverts COP, the employee should |

below: |

|

be notified and the reason for controversion explained to him or |

a) The disability was not caused by a traumatic injury. |

|

her. |

||

|

||

17) Agency name and address of reporting office |

b) The employee is a volunteer working without pay or for |

|

nominal pay, or a member of the office staff of a former |

||

|

||

The name and address of the office to which correspondence |

President; |

|

from OWCP should be sent (if applicable, the address of the |

c) The employee is not a citizen or a resident of the United |

|

personnel or compensation office). |

||

18) Duty station street address and zip code |

States or Canada; |

|

d) The injury occurred off the employing agency's premises and |

||

|

||

The address and zip code of the establishment where the |

the employee was not involved in official "off premise" duties; |

|

employee actually works. |

e) The injury was proximately caused by the employee's willful |

|

|

||

19) Employers Retirement Coverage. |

misconduct, intent to bring about injury or death to self or |

|

another person, or intoxication; |

||

Indicate which retirement system the employee is covered under. |

f) The injury was not reported on Form |

|

|

||

30) Was injury caused by third party? |

following the injury; |

|

|

||

A third party is an individual or organization (other than the |

g) Work stoppage first occurred 45 days or more following |

|

the injury; |

||

injured employee or the Federal government) who is liable for |

||

the injury. For instance, the driver of a vehicle causing an |

h) The employee initially reported the injury after his or her |

|

accident in which an employee is injured, the owner of a |

||

employment was terminated; or |

||

building where unsafe conditions cause an employee to fall, and |

||

a manufacturer whose defective product causes an employee's |

i) The employee is enrolled in the Civil Air Patrol, Peace Corps, |

|

injury, could all be considered third parties to the injury. |

||

Youth Conservation Corps, Work Study Programs, or other |

||

|

||

32) Name and address of physician first providing medical |

similar groups. |

|

|

||

care |

|

|

The name and address of the physician who first provided |

|

|

medical care for this injury. If initial care was given by a nurse |

|

|

or other health professional (not a physician) in the employing |

|

|

agency's health unit or clinic, indicate this on a separate sheet |

|

|

of paper. |

|

Print Form

Save Form

Reset Form

Form

Revised October 2018

Page 3

Instructions for Completing Form

Employing Agency - Required Codes

Box a (Occupation Code), Box b (Type Code),OWCP Agency Code Box c (Source Code), OSHA Site Code

The Occupational Safety and Health Administration (OSHA) requires all employing agencies to complete these items when reporting an injury. The proper codes may be found in OSHA Booklet 2014, "Recordkeeping and Reporting Guidelines."

This is a

Benefits for Employees under the Federal Employees' Compensation Act (FECA)

The FECA, which is administered by the Office of Workers' Compensation Programs (OWCP), provides the following benefits for

(1) Continuation of pay for disability resulting from traumatic,

(2) Payment of compensation for wage loss after the expiration

of COP, if disability extends beyond such point, or if COP is not payable. If disability continues after COP expires, Form

(3)Payment of compensation for permanent impairment of certain organs, members, or functions of the body (such as loss or loss of use of an arm or kidney, loss of vision, etc.), or for serious defringement of the head, face, or neck.

(4)Vocational rehabilitation and related services where directed by OWCP.

(5)All necessary medical care from qualified medical providers. The injured employee may choose the physician who provides initial medical care. Generally, 25 miles from the place of injury, place of employment, or employee's home is a reasonable distance to travel for medical care.

An employee may use sick or annual leave rather than LWOP while disabled. The employee may repurchase leave used for approved periods. Form

is made to use leave.

For additional information, review the regulations governing the administration of the FECA (Code of Federal Regulations, Chapter 20, Part 10) or pamphlet

Privacy Act

In accordance with the Privacy Act of 1974, as amended (5 U.S.C. 552a), you are hereby notified that: (1) The Federal Employees' Compensation Act, as amended and extended (5 U.S.C. 8101, et seq.) (FECA) is administered by the Office of Workers' Compensation Programs of the U.S. Department of Labor, which receives and maintains personal information on claimants and their immediate families.

(2) Information which the Office has will be used to determine eligibility for and the amount of benefits payable under the FECA, and may be verified through computer matches or other appropriate means. (3) Information may be given to the Federal agency which employed the claimant at the time of injury in order to verify statements made, answer questions concerning the status of the claim, verify billing, and to consider issues relating to retention, rehire, or other relevant matters. (4) Information may also be given to other Federal agencies, other government entities, and to

(7) Disclosure of the claimant's social security number (SSN) or tax identifying number (TIN) on this form is mandatory. The SSN and/or TIN), and other information maintained by the Office, may be used for identification, to support debt collection efforts carried on by the Federal government, and for other purposes required or authorized by law. (8) Failure to disclosure all requested information may delay the processing of the claim or the payment of benefits, or may result in an unfavorable decision or reduced level of benefits.

Note: This notice applies to all forms requesting information that you might receive from the Office in connection with the processing and adjudication of the claim you filed under the FECA.

Receipt of Notice of Injury

This acknowledges receipt of Notice of Injury sustained by (Name of injured employee)

Which occurred on (Mo. Day, Yr.)

At (Location)

Signature of Official Superior |

Title |

Date (Mo. Day, Yr.) |

*U.S. GPO:

Print Form

Save Form

Reset Form

Form

Revised October 2018

Page 4

Document Specs

| Fact | Detail |

|---|---|

| Form Usage | For federal employees to notify of a traumatic injury and claim for continuation of pay/compensation. |

| Sections to be Completed | Employee: Boxes 1-15; Witness: Section 16; Employing Agency: Shaded boxes (a, b, c) and items 17-39. |

| Key Forms of Compensation | Continuation of pay (COP), sick and/or annual leave, compensation for wage loss. |

| Submission Requirement | Employee must report the injury and file CA-1 within 30 days for COP eligibility. |

| Governing Law | Federal Employees' Compensation Act (FECA) |

| Privacy Act | Personal information is used to determine eligibility and amount of benefits under FECA. |

Detailed Instructions for Writing Ca 1

After sustaining a traumatic injury during federal employment, filling out Form CA-1 is the initial step towards claiming benefits such as continuation of pay or compensation. This document not only notifies the employer but also kicks off the process with the U.S. Department of Labor's Office of Workers' Compensation Programs (OWCP). With correct and comprehensive completion, it sets the foundation for ensuring you receive the entitlements meant to assist in your recovery and return to work.

Here's a guide to meticulously complete each required section:

- Employee (Please complete all boxes 1 - 15 below. Do not complete shaded areas):

- Full name in the order of Last, First, Middle.

- Your email address.

- Enter your Social Security Number carefully.

- Provide your complete Date of Birth in the Mo. Day Yr. format.

- Indicate your sex by selecting Male or Female.

- Include your home telephone number.

- State your grade as of the date of injury, including Level and Step.

- Input your home mailing address, ensuring you cover the street address, city, state, and ZIP code.

- Identify dependents by checking appropriate boxes and including their basic information if needed.

- Description of Injury:

- Clearly describe where the injury occurred with as much specificity as possible.

- Detail the date and exact time your injury occurred.

- Fill in the date you are completing this notice.

- Describe your occupation as of the date of the injury.

- Explain both the cause of your injury and its nature, specifically what happened and why it happened as well as the exact type of injury and part of the body affected.

- Employee Signature:

- Certify the claim by signing your name, indicating you believe the injury was sustained while performing your duties and not due to willful misconduct or intoxication.

- Decide on whether you are claiming continuation of regular pay (COP) and/or compensation for wage loss and check the appropriate box.

- Authorize any physician, hospital, or other entity to furnish information to the OWCP by signing the designated section.

- Witness Statement (if applicable):

- Have any witnesses provide details of the incident including what they saw, heard, or know. This includes their name, signature, and contact information.

- Employing Agency (Supervisor or Compensation Specialist):

- This section is to be filled out by your supervisor, who will complete the shaded boxes (a, b, c) with the appropriate information based on the incident reporting protocols.

Submitting this form is just the beginning. It will be reviewed by your supervisor and forwarded to the OWCP within ten working days. Keep a copied document for your records. Remember, accuracy and completeness are crucial for timely processing and avoiding any unnecessary delays. Always consult with your supervisor or HR department if you have questions during this process.

Things to Know About This Form

What is Form CA-1 and when should it be used?

Form CA-1, titled "Federal Employee's Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation," is designed for use by federal employees to report a traumatic injury sustained during the course of their employment. This form facilitates the request for continuation of pay (COP) for up to 45 days post-injury and, if applicable, compensation for wage loss if the disability for work extends beyond that period. Employees should complete and submit this form immediately after experiencing a work-related traumatic injury, ideally within 30 days of the incident to ensure eligibility for COP.

What information is required on Form CA-1?

Form CA-1 requires a detailed account of the employee's personal information, injury specifics, and employment data, including:

- Employee's Full Name, Social Security Number, Date of Birth, and other personal contact information.

- A detailed description of the injury, including how, when, and where it occurred.

- The nature of the injury and affected body parts.

- Information regarding dependents.

- A section for the reporting supervisor or compensation specialist to complete.

- A witness statement section, if applicable.

- Employee's certification that the injury occurred in the performance of duty and was not due to willful misconduct.

Who completes the shaded sections on Form CA-1?

The shaded boxes a, b, and c on Form CA-1 are designated for the employing agency to complete. This typically involves a supervisor, compensation specialist, or an official from the personnel department. These sections require information regarding the agency, duty station, and specific particulars related to the injury and employment situation.

How is COP (Continuation of Pay) claimed on Form CA-1?

To claim Continuation of Pay (COP), an injured employee must check the appropriate option under the certification section (15) on Form CA-1. COP entitles the employee to their regular salary for up to 45 calendar days of disability due to the injury. This claim must be made within 30 days of the injury to be eligible. It is crucial that the employee also provides medical evidence of the disability to support the claim within 10 days after filing the form.

What should be done if the employee cannot complete the form due to the injury?

If an employee is incapacitated and unable to complete the form due to the injury, a family member, friend, or another representative can fill out the form on their behalf. It is vital that this representative provides accurate information about the incident and injury, as well as their contact information, and signs the form indicating their relationship to the employee.

Are witnesses required to complete part of Form CA-1?

Yes, if there were witnesses to the injury, they should complete section 16 of Form CA-1. Witnesses are asked to provide a descriptive statement of what they saw, heard, or know about the injury and to provide their contact information. Witness accounts can be crucial for substantiating the circumstances surrounding the injury.

What are the consequences of providing false information on Form CA-1?

Submitting false information, misrepresentation, or engaging in any act of fraud to obtain compensation under the Federal Employees' Compensation Act (FECA) is a serious offense. Individuals found guilty of such actions are subject to civil, administrative, or felony criminal prosecution. Penalties may include fines, restitution, or imprisonment, depending on the nature and severity of the fraud committed.

Where should Form CA-1 be submitted?

Completed Form CA-1 should be provided to the employee's immediate supervisor or the employing agency's human resources department. The form, once filled, must be forwarded to the Office of Workers' Compensation Programs (OWCP) for processing. Injured employees should also ensure they receive a copy of the completed form for their records. If medical expenses or lost time is anticipated, the form should be sent to OWCP within 10 working days of receipt by the agency.

Common mistakes

Failure to complete all required sections: One common mistake is not filling in every box from 1 to 15 that applies to the employee. It's vital to provide complete information to ensure the claim's validity and to avoid unnecessary delays. This includes personal information, details of the injury, and the choice regarding the continuation of pay or compensation.

Inaccurate or incomplete description of the injury: When describing the injury in boxes 13 and 14, the details are often too vague or incomplete. It's important to clearly explain how and why the injury occurred and to describe the nature of the injury thoroughly. This includes specifying the injury's exact location on the body and the side affected (right or left) for clarity and precision in processing the claim.

Incorrectly reporting the date and time of the injury or notice: Confusion or errors in recording the correct date and time the injury occurred, as well as the date of notice, can lead to complications in claim processing. Accurate reporting in boxes 10 and 11 ensures that there are no doubts concerning the timelines, which are critical for eligibility and benefits under the FECA.

Not providing or wrongly entering the Social Security Number: Entering an incorrect Social Security Number or omitting it altogether is a critical error. As it’s a primary identifier used by the Office of Workers' Compensation Programs, any mistakes here can severely delay claim processing or lead to denial of the claim.

Omitting the signature and date: The form requires the employee's certification that the injury was incurred in the performance of duty and not caused by willful misconduct. Forgetting to sign and date at the bottom of the form or having someone else do it on the employee's behalf without proper authority can invalidate the claim or significantly delay its processing.

Documents used along the form

When a federal employee sustains a traumatic injury, filling out the CA-1 form is a critical first step toward claiming the benefits provided under the Federal Employees' Compensation Act (FECA). However, this form is often just the start of a comprehensive documentation process required to fully adjudicate a claim. There are several other forms and documents commonly used in conjunction with Form CA-1, each serving a specific purpose in the claim process.

- Form CA-2: This is the "Notice of Occupational Disease and Claim for Compensation" form used by employees to report a work-related illness rather than an injury. Similar to CA-1, it initiates the claim process for occupational diseases.

- Form CA-7: The "Claim for Compensation" form is used to claim wage loss compensation, schedule award, and/or reimbursement for medical expenses. This is particularly relevant if a disability extends beyond the 45-day Continuation of Pay (COP) period provided after a traumatic injury.

- Form CA-17: The "Duty Status Report" provides communication between the health care provider and the employing agency regarding the employee's work status. It plays a vital role in managing the employee's return to work and adjustments to their workload.

- Form CA-20: The "Attending Physician's Report" is a detailed medical report that must be completed by the doctor treating the injury or illness. It is essential for documenting the nature and extent of the injury, the treatment provided, and the expected recovery outcomes.

- Medical Bills and Receipts: Original bills and receipts for medical treatment related to the injury are crucial for obtaining reimbursement under FECA.

- Form OWCP-915: Used for "Claim for Medical Reimbursement," this form helps injured workers seek reimbursement for out-of-pocket medical expenses related to their injury or disease.

- Form OWCP-957: The "Medical Travel Refund Request" allows employees to get reimbursed for travel expenses to and from medical treatment for their injury.

- Witness Statements: Written accounts from witnesses of the traumatic event can be invaluable in substantiating the claim and providing details about the injury's circumstances.

Understanding the purpose and requirements of each of these documents is essential for federal employees navigating the claims process under FECA. Proper completion and timely submission of these forms and documents can significantly affect the outcome of the claim, impacting the benefits received by the injured worker. Navigating through this process can be complex, and employees are often advised to seek guidance from their agency's human resources department or a legal professional specializing in workers' compensation.

Similar forms

The Form CA-2, "Notice of Occupational Disease and Claim for Compensation," is similar to the CA-1 form in that it is also used by federal employees to report work-related injuries or illnesses. However, the CA-2 form specifically addresses occupational diseases that develop over time, rather than traumatic injuries that occur as a single event. Both forms require detailed information about the injury or disease, personal data about the employee, and a certification by the employee that the condition is work-related. Additionally, both involve a section for agency verification and response.

The OWCP-957 "Medical Travel Refund Request" shares similarities with the CA-1 form in terms of being part of the claims process under the Federal Employees' Compensation Act (FECA). While the CA-1 form is used to initiate a claim for a traumatic injury, the OWCP-957 is used to seek reimbursement for out-of-pocket travel expenses related to medical treatment for that injury. Both forms facilitate federal employees' access to benefits and compensation for work-related incidents and require detailed documentation to process the request.

The "Standard Form 3112, Application for Disability Retirement," parallels the CA-1 form since both require the federal employee to provide personal and employment information, along with medical documentation. The SF-3112 is for employees seeking disability retirement under the Federal Employees Retirement System (FERS) or Civil Service Retirement System (CSRS) due to a medical condition that prevents them from performing one or more essential functions of their job. While the CA-1 form deals with immediate injury claims, SF-3112 addresses longer-term incapacities.

The LS-203 "Employee's Claim for Compensation" from the Department of Labor's Office of Workers' Compensation Programs (OWCP) for longshore and harbor workers, has similarities with the CA-1 form, as it is also a claim form for work-related injuries or illnesses. Both documents are critical in starting the compensation process, requiring detailed information about the work-related incident and personal details about the claimant. However, the LS-203 pertains to non-federal employees covered under the Longshore and Harbor Workers' Compensation Act.

The Form SSA-16 "Application for Social Security Disability Insurance (SSDI)" and the CA-1 form are both designed to assist individuals faced with injuries or conditions that impair their ability to work. The SSA-16 helps individuals to apply for SSDI benefits if they have a disability that meets the Social Security Administration's definition. Although CA-1 is targeted at federal employees sustaining work-related injuries, both forms play essential roles in securing financial assistance and support during challenging times.

The "DOL OWCP-5c" form, used for chiropractic services authorization under the Federal Employees' Compensation Act, and the CA-1 form, share the common purpose of facilitating medical care and compensation for federal employees who suffer from work-related injuries. While the OWCP-5c specifically authorizes chiropractic treatment, indicating a focus on a particular method of medical care, the CA-1 form broadly addresses all kinds of traumatic injuries sustained on the job, emphasizing their connection in ensuring workers receive the necessary treatment.

The OPM Form 1203-FX, "Qualification and Availability Form C" used by federal job applicants, shares a procedural similarity with the CA-1 form in its requirement for detailed personal and employment-related information. Although serving fundamentally different purposes—one for employment application and the other for injury compensation—the organizational attention to detail in both documents reflects the thoroughness expected in federal processes.

The "SF-2800, Application for Death Benefits" form, used by the surviving family members of deceased federal employees, shares a connection with the CA-1 form through their functions of providing benefits following a workplace-related event. While the CA-1 form is specifically for injuries, the SF-2800 pertains to death benefits under the Civil Service Retirement System (CSRS), highlighting the range of support extended by federal benefits beyond immediate injuries to include life's most challenging circumstances.

Form CA-7, "Claim for Compensation," relates closely to the CA-1 form as it is used by federal employees or their dependents to claim compensation for wage loss, schedule awards for permanent impairment, or other specified benefits after experiencing a work-related injury or occupational disease. Like the CA-1, it's part of the OWCP's FECA program but is applied at a different stage in the compensation process, specifically after the initial injury has been reported using a CA-1 or when an existing claim requires additional compensation action.

The "VA Form 21-526EZ, Application for Disability Compensation and Related Compensation Benefits," while for veterans, shares similarities with the CA-1 form in that both are designed to initiate a claims process for individuals suffering from conditions related to their service (in federal employment or military service, respectively). The forms collect detailed personal information, injury or disease specifics, and both require supporting documentation to establish a link between the condition claimed and service, underlining the principle of providing support to those injured or made ill by their service.

Dos and Don'ts

When filling out the CA-1 form, Federal Employee's Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation, it's crucial to approach the task with care and attention. Here's a list of what you should and shouldn't do to help guide you through the process:

- Do ensure you complete all the necessary sections from 1 to 15, as these are essential for your claim to be processed correctly.

- Do not fill out the shaded areas, as these are reserved for your employing agency, specifically your supervisor or a compensation specialist, to complete.

- Do provide a detailed description of the injury in section 13. It's important to clearly state how and why the injury occurred to avoid any confusion during the claim process.

- Do not leave out specific details regarding the nature of your injury in section 14. Identifying both the injury and the affected part of your body (including whether it's the right or left side) is necessary.

- Do elect for a Continuation of Pay (COP) or use of sick/annual leave in section 15 if applicable. Making this election correctly is crucial for ensuring your compensation matches your needs.

- Do not forget to sign and date the bottom of the form. This certifies that the information provided is accurate to the best of your knowledge and is a key step in submitting your claim.

- Do double-check that all the information entered is accurate and complete before submission. Any errors or omissions can delay the processing of your claim.

- Do not hesitate to attach a supplemental statement if additional space is required to explain or clarify any points. Providing complete information is vital for a thorough evaluation of your claim.

- Do remember to have a witness complete section 16 if there was someone who saw, heard, or knows about the injury. Their testimony can be invaluable to your claim.

By following these dos and don'ts, you can help ensure that your CA-1 form is filled out correctly and thoroughly, aiding in the efficient processing of your claim.

Misconceptions

The Form CA-1, "Federal Employee's Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation," is a crucial document for federal employees in the event of a work-related injury. Yet, misunderstandings about its provisions can lead to confusion and potentially hinder the effective use of benefits. Let's clarify some common misconceptions.

Only physical injuries are covered: Many people mistakenly believe that the Form CA-1 only applies to physical injuries. However, it encompasses both physical and psychological injuries that occur in the course of employment. An employee suffering from stress or trauma resulting directly from a work-related incident may also qualify for benefits under the Federal Employees' Compensation Act (FECA).

Continuation of Pay (COP) is automatic: Another common misconception is that COP is automatically granted. In reality, employees or their representatives must properly file Form CA-1 within 30 days following the injury to potentially receive COP. Additionally, medical evidence supporting disability due to the injury must be provided within 10 days of submitting Form CA-1 to ensure uninterrupted payment.

All injuries should be reported using Form CA-1: While it's critical to report injuries, the type of form used depends on the nature of the injury. Form CA-1 is specifically for traumatic injuries, which are defined as injuries that can be pinpointed to have occurred during a specific time and place within a single workday. Occupational diseases or illness claims require Form CA-2, which addresses conditions developed over more than one workday.

Supervisors are responsible for filing Form CA-1: Employees themselves, or someone acting on their behalf, are responsible for completing and filing Form CA-1. While supervisors do have specific sections to fill out and are essential in the process (providing necessary information and approving COP when applicable), the initial responsibility to file falls on the employee. Supervisors should, however, provide guidance and ensure the receipt of the notice of injury as part of their responsibilities.

Understanding these nuances of the Form CA-1 can help employees and employers navigate the complexities of workplace injuries and ensure that those affected receive the support and benefits they are entitled to under federal law.

Key takeaways

Filling out the Form CA-1, known formally as the Federal Employee's Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation, is a crucial step for federal employees seeking compensation for work-related injuries. Understanding the requirements and process can ease the filing process and help ensure that employees receive the benefits they're entitled to. Here are several key takeaways about filling out and using the Form CA-1:

- Timeliness is essential: For optimal outcomes, the injured employee or a person acting on their behalf should file Form CA-1 within 30 days following the injury. Prompt submission ensures eligibility for continuation of pay (COP) and streamlines the compensation process.

- Comprehensive completion is critical: The form requires detailed information about the employee, the nature, cause, and specifics of the injury, and if applicable, witness information. Ensuring accuracy and completeness of all boxes (1-15 for employees, section 16 for witnesses, and shaded areas for the employing agency) is vital for a smooth claim process.

- Continuation of Pay (COP): Employees suffering from a traumatic injury may be eligible for COP for up to 45 calendar days. It's important to check the appropriate box in item 15 to initiate this process, providing a lifeline for those temporarily unable to work.

- Medical evidence: To support a COP claim, medical evidence of disability must be submitted within 10 days after filing Form CA-1. This evidence is crucial for justifying the need for continued payment beyond immediate injury response.

- Supervisor's role: Supervisors or employing agencies play a significant role in the process, completing the shaded boxes on the form, providing a receipt of notice to the employee, and forwarding the completed document to OWCP within 10 working days after receipt for cases involving medical expenses or lost time.

- Witness statements: Witness accounts can provide valuable insights into the incident, contributing towards an accurate and fair assessment of the claim. These should be included in Section 16 of the form.

- Privacy considerations: Form CA-1 includes a section addressing privacy concerns, informing claimants about how their information will be used and protected under the Privacy Act of 1974. Understanding these provisions can reassure employees about the confidentiality and purpose of their data processing.

- Controversion of COP: Agencies have the right to dispute COP for specific reasons listed within the form. Employees should be aware of these potential issues and prepared to address them if their claim faces controversion.

Understanding the nuances of Form CA-1 can significantly impact the efficacy of a federal employee's claim for workers' compensation benefits following a traumatic injury. Employees are encouraged to review the form carefully, consult with their agency's human resources or worker's compensation specialists, and consider legal advice if necessary to ensure their rights are fully protected and exercised.

Discover More PDFs

Forms of Id for Gun Purchase - It represents a critical intersection of individual rights and community safety within the scope of firearm sales.

Unemployment Process - Providing false information or withholding facts on the DE 2063 form can result in penalties under the law.

Form 3523 - The alternative incremental credit offers a pathway for entities with fluctuating research expenses to claim tax benefits.