Legal California Bill of Sale Document

In California, when it comes to buying or selling personal property like vehicles, boats, or even smaller items, having a Bill of Sale form is a significant step in the process. This document serves as a formal record of the transaction, acting as proof of the change in ownership and terms agreed upon by both parties. It’s a straightforward piece of paperwork, but it carries a lot of weight. The form typically includes information about the seller and the buyer, a detailed description of the item being sold, the sale price, and the date of the sale. Additionally, it may also mention any warranties or as-is conditions of the sale. Having this document not only provides peace of mind to both the seller and the buyer but is also crucial for the proper registration and taxation of the property, especially in case of vehicles. What’s more, in the event of any future disputes or if proof of ownership is required, the Bill of Sale is an invaluable asset to have. Therefore, understanding its importance and how to properly fill it out is key for anyone involved in a private sale within the state of California.

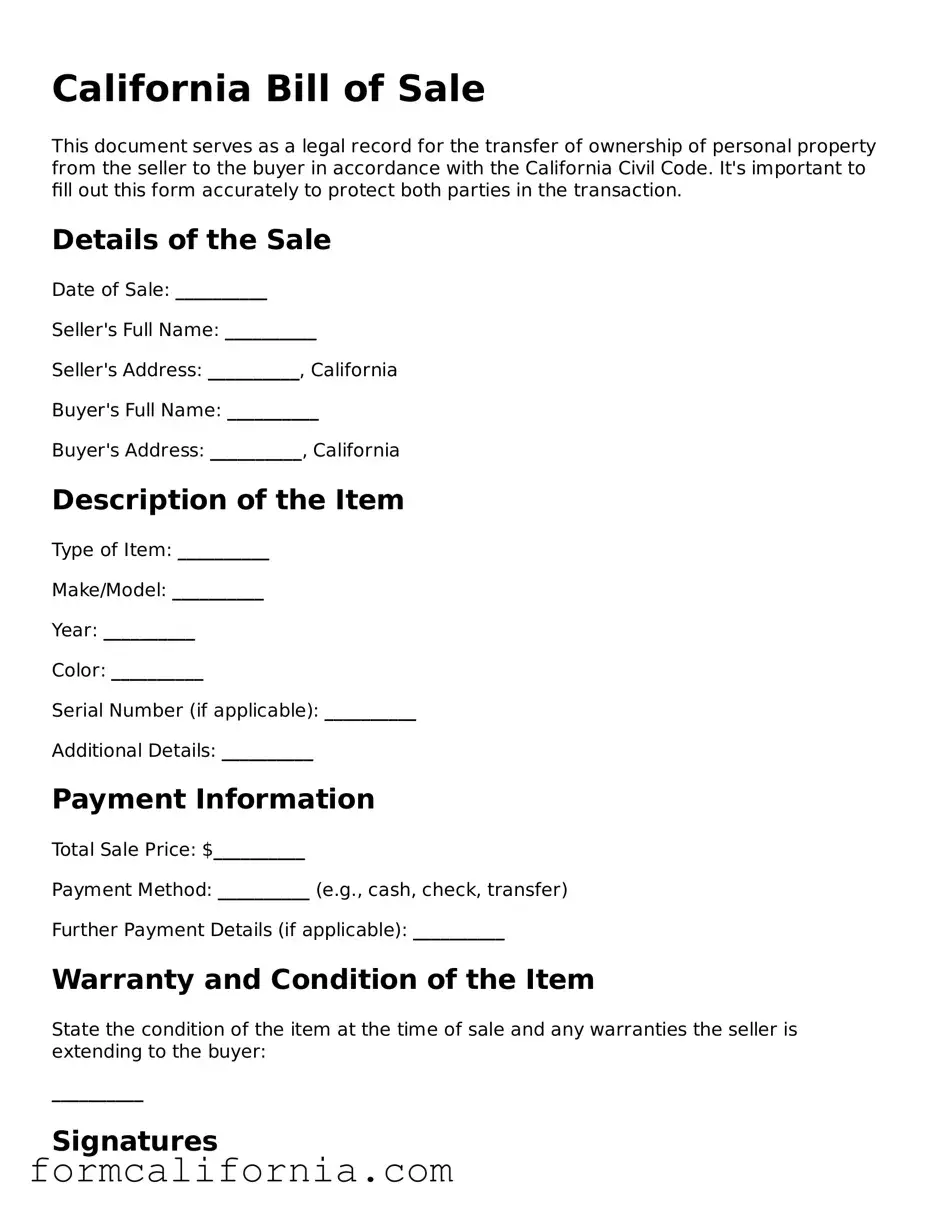

Document Preview Example

California Bill of Sale

This document serves as a legal record for the transfer of ownership of personal property from the seller to the buyer in accordance with the California Civil Code. It's important to fill out this form accurately to protect both parties in the transaction.

Details of the Sale

Date of Sale: __________

Seller's Full Name: __________

Seller's Address: __________, California

Buyer's Full Name: __________

Buyer's Address: __________, California

Description of the Item

Type of Item: __________

Make/Model: __________

Year: __________

Color: __________

Serial Number (if applicable): __________

Additional Details: __________

Payment Information

Total Sale Price: $__________

Payment Method: __________ (e.g., cash, check, transfer)

Further Payment Details (if applicable): __________

Warranty and Condition of the Item

State the condition of the item at the time of sale and any warranties the seller is extending to the buyer:

__________

Signatures

By signing below, the seller and the buyer acknowledge that the sale is final, and the item is sold "as-is" unless otherwise noted. Both parties confirm that the information above is accurate and complete, and that the transfer of ownership complies with California law.

Seller's Signature: __________ Date: __________

Buyer's Signature: __________ Date: __________

Witness (if applicable)

Name: __________

Signature: __________ Date: __________

Note: While a witness is not mandatory under California law, having a third-party witness sign this document can provide additional legal protection to both the seller and the buyer.

PDF Form Characteristics

| Fact | Detail |

|---|---|

| 1. Purpose | Provides a written record of the transfer of ownership from seller to buyer. |

| 2. Required for Certain Sales | Necessary for private sales of vehicles, boats, and firearms in California. |

| 3. Components | Includes information about the seller, buyer, item sold, and the sale price. |

| 4. Notarization | Not required by California law but recommended for legal protection. |

| 5. Governing Law | Regulated under California Civil Code. |

| 6. Effectiveness | Becomes legally binding when signed by both the seller and the buyer. |

| 7. Vehicle Sales | Must include the vehicle identification number (VIN) and odometer reading. |

| 8. Record Keeping | Both parties should retain a copy for their records and potential legal needs. |

| 9. Dispute Resolution | Serves as evidence in disputes over ownership or terms of sale. |

| 10. Additional Requirements | May need to be accompanied by other documents, depending on the item sold. |

Detailed Instructions for Writing California Bill of Sale

Completing a Bill of Sale form in California is an important step in the process of buying or selling a vehicle, firearm, or other valuable property. This document serves as a legal record that the transfer of ownership has occurred, ensuring both parties have evidence of the terms and conditions of the sale. It's critical to fill out the form accurately to protect both the buyer and the seller against disputes or misunderstandings in the future. The following steps are designed to guide you through the completion of a California Bill of Sale form.

- Start by entering the date of the sale at the top of the form.

- Write down the full legal names and addresses of both the seller and the buyer.

- Describe the item being sold, including any identifying information such as make, model, year, color, VIN (Vehicle Identification Number), or serial number.

- Indicate the sale price of the item and the date when the payment was made or will be made.

- If applicable, list any conditions or warranties that the seller provides with the sale. If the item is being sold "as is," this should also be clearly stated.

- Both the buyer and the seller should sign and print their names at the bottom of the form. If possible, include the date next to each signature.

- It's recommended to prepare two copies of the completed form—one for the buyer and one for the seller to keep for their records.

Once the California Bill of Sale form has been filled out and signed by both parties, the next steps will depend on the type of item sold. For vehicle sales, the new owner may need to present the Bill of Sale when registering the vehicle in their name at the Department of Motor Vehicles (DMV). Buyers of firearms or other regulated items may have additional steps to follow according to state law. It's important to research and complete any additional requirements to ensure a smooth transition of ownership and compliance with local and state regulations.

Things to Know About This Form

What is a California Bill of Sale?

A California Bill of Sale is a legal document that records the transfer of ownership of a personal property from one party to another in the state of California. This document typically includes important details about the sale such as the names and addresses of the buyer and seller, a description of the item sold, the sale price, and the date of the transaction. While it can be used for various types of personal property, it's frequently utilized for the sale of vehicles, boats, and motorcycles.

Is a Bill of Sale legally required in California?

In California, a Bill of Sale is not always legally required but is highly recommended for the protection of both the buyer and the seller. For certain transactions, such as those involving vehicles, California law does require that a Bill of Sale is completed and submitted as part of the ownership transfer documentation. This document serves as a receipt for the transaction and can help to resolve any future disputes regarding the sale of the property.

What information should be included in a California Bill of Sale?

A comprehensive California Bill of Sale should include the following elements:

- The date of the sale

- Full names and addresses of both the buyer and the seller

- A detailed description of the item being sold (including make, model, year, and serial number, if applicable)

- The sale price of the item

- Any warranties or "as is" condition statements

- Signatures of both the buyer and the seller

Do both parties need to sign a California Bill of Sale?

Yes, for a California Bill of Sale to be considered valid, it must be signed by both the buyer and the seller. In some cases, it may also be beneficial to have the signatures notarized, though this is not a legal requirement in California. The signatures verify the agreement to the terms of the sale by both parties and can be used as evidence in the event of a dispute.

Why should I use a California Bill of Sale?

Using a California Bill of Sale offers several benefits, including:

- Serving as a proof of purchase and transfer of ownership

- Providing legal protection in the event of a disagreement or dispute

- Helping to ensure all essential details of the transaction are documented

- Facilitating the process of transferring the title and registering the item, if applicable

How do I obtain a California Bill of Sale?

A California Bill of Sale form can be obtained in various ways, including:

- Downloading a template from a reputable online legal forms provider.

- Visiting a local DMV (Department of Motor Vehicles) office to acquire a form, especially for vehicle transactions.

- Creating a custom Bill of Sale, ensuring all required information is included.

Does a Bill of Sale need to be notarized in California?

In California, notarizing a Bill of Sale is not a mandatory requirement for most private property sales. However, getting the document notarized can add a layer of legal protection and authenticity, serving as a verification that the signatures on the document are genuine. For high-value transactions or when either party prefers it for peace of mind, notarization can be a wise precaution.

Can I create a California Bill of Sale by myself?

Yes, it is entirely possible to create a Bill of Sale by yourself. While there are templates available online that meet California's requirements, ensuring the inclusion of all essential information like the parties' full names and addresses, a description of the item being sold, the sale price, and signatures, is crucial. If you choose to create your own, you may want to have it reviewed by a legal professional to ensure it meets all legal criteria and adequately protects your interests.

Common mistakes

When filling out the California Bill of Sale form, several common mistakes can affect the validity of the document or cause complications in the future. It's important for individuals to pay close attention to detail and ensure all the necessary information is accurately provided. Below are five mistakes frequently made during this process:

-

Not including all necessary details about the item being sold. People often forget to include important information about the item, such as make, model, year, and any identifying numbers (e.g., serial or vehicle identification numbers). This essential information helps in identifying the item being sold and can prevent disputes.

-

Forgetting to verify the buyer’s or seller’s information. Ensuring that the names, addresses, and contact information of both parties are correct is crucial. Mistakes in this area can lead to issues in establishing proof of ownership or legal responsibility.

-

Omitting the date of sale. The date of the transaction is a key detail that must be accurately recorded on the form. This date can be important for warranty purposes and for legal reasons, should any disputes arise concerning the sale.

-

Failing to specify the sale price. Clearly stating the sale price on the Bill of Sale is necessary for tax and legal purposes. Without this information, there might be complications regarding the value of the transaction.

-

Not securing the necessary signatures. A common and critical mistake is not having the Bill of Sale signed by both the buyer and the seller. Signatures are what legally bind the document, making the sale official and recognized legally. Without these, the agreement could be challenged.

Avoiding these mistakes can significantly smooth the transaction and ensure legal protection for both parties involved. Ensuring the California Bill of Sale is filled out completely and accurately is key to a successful and undisputed transfer of ownership.

Documents used along the form

When you're dealing with the sale of an item in California, especially a significant one such as a vehicle or boat, the Bill of Sale form is a crucial document. However, this form rarely travels alone during such transactions. Several other forms and documents accompany it, each serving a distinct purpose to ensure that the legal and administrative aspects of the sale are thoroughly addressed. Let’s explore some of these key documents to give you a clearer picture of the full suite required for smooth transactions.

- Title Transfer Form – This document is essential for legally transferring the title of the item (usually a vehicle or boat) from the seller to the buyer. It's a crucial step in the ownership transfer process, ensuring that the item’s official ownership records are updated with the state authorities.

- Odometer Disclosure Statement – For vehicle sales, the law requires sellers to provide an odometer disclosure statement to the buyer. This document states the vehicle’s mileage at the time of sale, ensuring that the buyer is aware of how many miles the vehicle has traveled, which can significantly affect its value and condition.

- Release of Liability – When selling a vehicle or other significant item, the seller should submit a Release of Liability to the state’s Department of Motor Vehicles (DMV) or equivalent authority. This form notifies the state that the seller has transferred the item and releases them from liability for what the new owner may do with it.

- As-Is Sale Agreement – Often, items are sold without any warranty, implying they are sold "as-is." This agreement protects the seller from future claims by the buyer concerning the item's condition post-sale. It makes clear that the buyer accepts the item in its current state, acknowledging any known faults or issues.

Together with the Bill of Sale, these documents form a comprehensive paperwork package, ensuring both parties are protected and aware of their responsibilities and rights. Handling these documents properly not only helps in avoiding legal and administrative headaches down the line but also ensures a transparent and fair transaction for all parties involved.

Similar forms

The California Bill of Sale form is similar to the Deed of Sale, primarily used in real estate transactions. Both documents serve as proof of transfer of ownership from the seller to the buyer. They contain critical information such as the description of the property being sold, the sale price, and the parties involved. The primary difference lies in the specific type of property they cover, with the Deed of Sale focusing on real property like land or buildings, and the Bill of Sale covering personal property like vehicles or equipment.

Another similar document is the Sales Agreement, which outlines the terms of a sale before the actual transfer takes place. Like the Bill of Sale, a Sales Agreement specifies the details of the transaction, including what is being sold, the purchase price, and the payment terms. However, while a Sales Agreement details the agreement before the transaction, a Bill of Sale confirms that the transaction has occurred, acting as a receipt of sale.

The Warranty Deed shares similarities with the California Bill of Sale as well, particularly in providing assurance about the condition of the item being sold. A Warranty Deed is used in real estate to guarantee that the property is free from any undisclosed liens or claims. Similarly, a Bill of Sale can include warranties about the condition or status of personal property, ensuring the buyer is aware of what they are purchasing. The key difference is in the type of property each document concerns.

Finally, the Gift Deed is akin to the Bill of Sale in that it documents the transfer of ownership. While a Bill of Sale is utilized in transactions involving a purchase, a Gift Deed is used when property is transferred as a gift, without any exchange of money. Despite this difference, both documents serve to legally document the change in ownership and include important details such as the identification of the parties and the description of the property.

Dos and Don'ts

In the process of filling out the California Bill of Sale form, it is important to adhere to a set of guidelines to ensure the document is legally compliant and accurately reflects the details of the transaction. Below are lists of things you should and should not do when completing this important document.

What You Should Do:

- Verify the accuracy of all information, including the names and addresses of both the buyer and the seller, as well as the details of the item being sold.

- Include a detailed description of the item being sold, such as the make, model, year, and serial number if applicable, to ensure there are no misunderstandings.

- Ensure that both the buyer and the seller sign and date the form to officiate the transaction. It's important for both parties to have a signed copy for their records.

- Check if additional documentation is required for the sale. In some cases, the state of California may require additional documents or steps to legally complete the sale.

What You Shouldn't Do:

- Avoid leaving blank spaces. If a section does not apply, it is advisable to mark it as "N/A" (not applicable) to prevent unauthorized additions later.

- Do not use unclear language or abbreviations that might be misunderstood. It is crucial that every part of the form is clear and easily understandable.

- Resist the temptation to rush through filling out the form. Taking your time to double-check details can prevent legal issues down the road.

- Do not forget to provide a copy of the signed Bill of Sale to both the buyer and the seller. Keeping a record of the transaction is essential for both parties.

Misconceptions

In the process of buying or selling personal property in California, many individuals rely on a Bill of Sale form. However, misconceptions regarding its use and legal implications can lead to unnecessary complications. Below is a list of commonly misunderstood aspects related to the California Bill of Sale form.

- It serves as a legal document of ownership. A common misconception is that the Bill of Sale form, by itself, represents an official document confirming legal ownership. However, while it provides proof of a transaction between buyer and seller, the actual ownership is usually transferred and recognized through titles, especially for vehicles and real estate.

- It is required for all sales transactions in California. Not all sales transactions in California necessitate a Bill of Sale. While highly recommended for the clarity and security it offers both parties, its requirement is specifically dictated by the type of item sold and the preference of the buyer and seller. Certain transactions, particularly those involving vehicles, may require a Bill of Sale for registration and tax purposes.

- One standard form fits all types of sales. People often believe that a single, standard Bill of Sale form is applicable for all varieties of personal property transactions. In reality, different items might require different forms to address specific legal considerations, such as whether a vehicle, firearm, or general property is being sold. Details regarding the item’s condition, identification numbers, and warranties may vary significantly.

- A Bill of Sale must be notarized in California. The belief that a Bill of Sale must be notarized to be valid in California is another common misconception. While notarization can add an extra layer of verification, it is not a legal requirement for the form to be considered valid and binding. The essential elements are the accurate details of the transaction, and signatures from both the buyer and seller.

- It offers comprehensive protection for sellers. Many sellers assume that once the Bill of Sale is signed, they are free from any liability related to the item sold. This misconception fails to consider that the seller might still face obligations or liabilities if not correctly detailed in the form. It is crucial for sellers to explicitly state the condition of the item and any “as is” agreement to minimize future disputes.

- All personal information should be included. Lastly, a prevalent misunderstanding involves the amount of personal information required on the form. While essential details about the transaction and parties involved are necessary, disclosing overly personal or sensitive information is not recommended for privacy and security reasons. The focus should be on information directly relevant to the sale and identity verification of the parties involved.

Understanding these misconceptions and the actual requirements for a Bill of Sale in California can facilitate smoother, legally sound transactions and protect both buyer and seller from potential legal problems down the line.

Key takeaways

The California Bill of Sale form is a crucial document for both buyers and sellers engaging in private sales of items like vehicles, boats, or personal property within the state. This document not only formalizes the transaction but also serves as a vital record for tax, legal, and personal purposes. Here are four key takeaways you should consider when filling out and using this form.

- Ensure Accuracy of Details: It's imperative that all the information entered on the Bill of Sale is accurate and complete. This includes the full names and addresses of both the buyer and seller, a detailed description of the item being sold (including make, model, year, and identification numbers), the sale price, and the date of sale. Accuracy is not only crucial for the validity of the document but also for the ease of future transactions or registrations.

- Verification of Item Condition: While the Bill of Sale serves primarily as a record of sale, it also offers a section to describe the condition of the item being sold. Sellers should be honest and thorough in this description. For buyers, this information is vital as it provides an official record of the item’s condition at the time of sale, which can be crucial for warranty or legal purposes.

- Signatures are Mandatory: For the Bill of Sale to be considered legal and valid, it must be signed by both the buyer and the seller. Depending on the value of the sale or local ordinances, you may also need to have the signatures notarized. This step finalizes the transaction officially and serves as a binding agreement between the parties, acknowledging the transfer of ownership and the terms of the sale.

- Keep Copies for Records: After the Bill of Sale is signed, both the buyer and the seller should keep copies of the document for their records. These copies are important for tax reporting, registration of the item (if applicable), or resolving any future disputes or claims. It is recommended to store them securely for at least a few years after the transaction has taken place.

Understanding these key takeaways will ensure that your transaction is completed smoothly and that you have all the necessary documentation for legal, tax, or registration purposes. The California Bill of Sale is a simple yet powerful tool in securing your personal and financial interests in private sales.

More California Forms

Power of Attorney for a Motor Vehicle - It acts as a safeguard for the vehicle owner, outlining the extent of power granted to the agent, which can be as broad or as limited as the owner specifies.

California Notary Acknowledgement 2023 - Acts as proof of a notary’s direct validation of the signer’s identity and understanding of documents.

Affidavit of Death of Joint Tenant California - It can also be imperative for personal reasons, providing official closure for families handling their loved one’s affairs.