Legal California Articles of Incorporation Document

In California, taking the step to formally register a business as a corporation is a significant milestone, marked by the submission of the Articles of Incorporation. This crucial document sets the foundation for the legal and financial structure of the new entity. It outlines vital details such as the corporation's name, purpose, authorized shares, and information about its initial directors and agent for service of process. Filing the form not only grants the corporation legal recognition by the state but also initiates its existence under California law. It's a process that requires precision and understanding, as the information provided will govern how the corporation operates and is seen in the eyes of the law. With everything from liability protection to tax obligations stemming from this document, preparing the Articles of Incorporation requires a careful approach to ensure compliance and secure the future of the business.

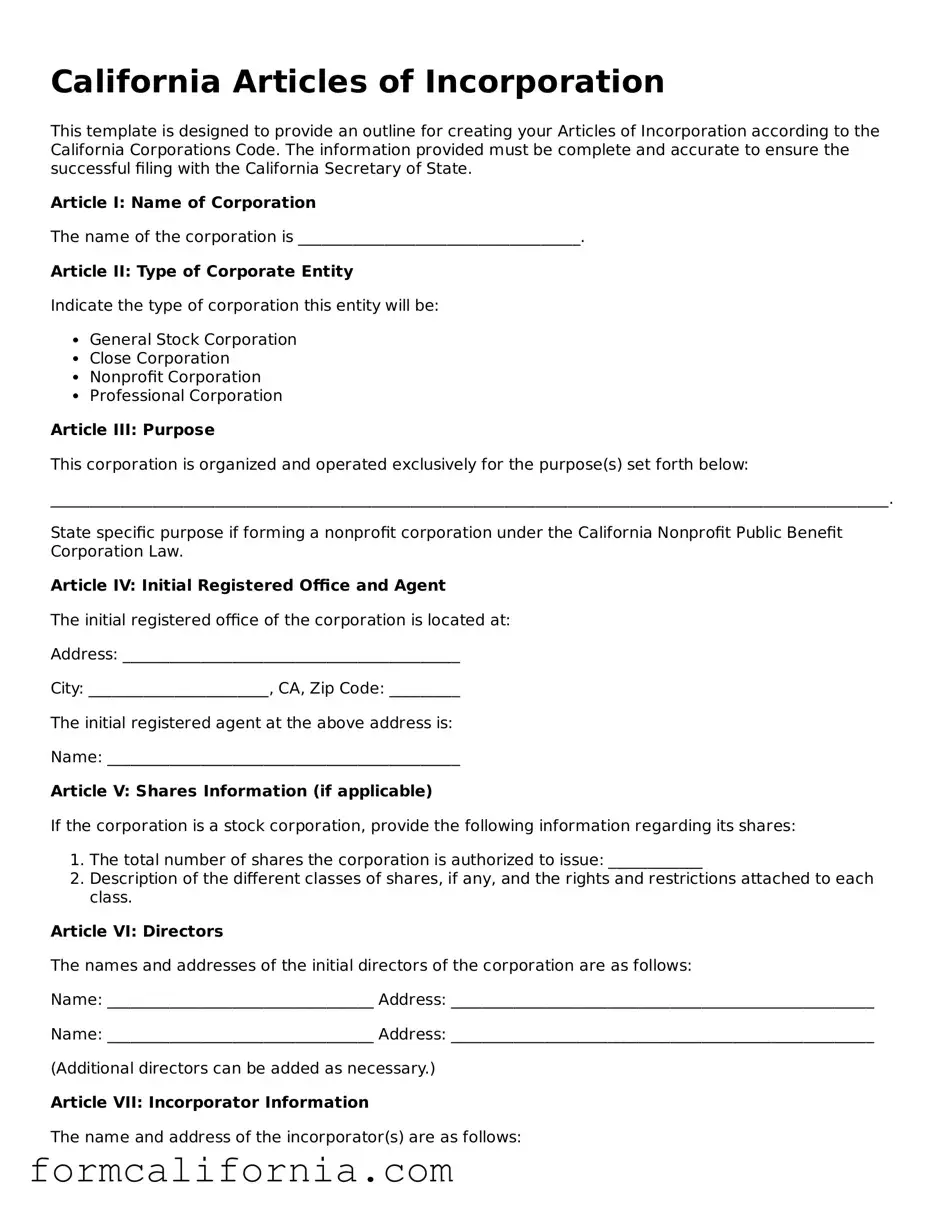

Document Preview Example

California Articles of Incorporation

This template is designed to provide an outline for creating your Articles of Incorporation according to the California Corporations Code. The information provided must be complete and accurate to ensure the successful filing with the California Secretary of State.

Article I: Name of Corporation

The name of the corporation is ____________________________________.

Article II: Type of Corporate Entity

Indicate the type of corporation this entity will be:

- General Stock Corporation

- Close Corporation

- Nonprofit Corporation

- Professional Corporation

Article III: Purpose

This corporation is organized and operated exclusively for the purpose(s) set forth below:

___________________________________________________________________________________________________________.

State specific purpose if forming a nonprofit corporation under the California Nonprofit Public Benefit Corporation Law.

Article IV: Initial Registered Office and Agent

The initial registered office of the corporation is located at:

Address: ___________________________________________

City: _______________________, CA, Zip Code: _________

The initial registered agent at the above address is:

Name: _____________________________________________

Article V: Shares Information (if applicable)

If the corporation is a stock corporation, provide the following information regarding its shares:

- The total number of shares the corporation is authorized to issue: ____________

- Description of the different classes of shares, if any, and the rights and restrictions attached to each class.

Article VI: Directors

The names and addresses of the initial directors of the corporation are as follows:

Name: __________________________________ Address: ______________________________________________________

Name: __________________________________ Address: ______________________________________________________

(Additional directors can be added as necessary.)

Article VII: Incorporator Information

The name and address of the incorporator(s) are as follows:

Name: __________________________________ Address: ______________________________________________________

Article VIII: Bylaws

The initial bylaws of the corporation shall be adopted by the incorporator(s) at the first meeting of the Board of Directors. The power to amend or repeal the bylaws shall reside with the Board of Directors unless otherwise provided in the bylaws or the California Corporations Code.

Article IX: Indemnification

The corporation shall indemnify its directors, officers, employees, and agents to the fullest extent permitted by the California Corporations Code.

Signature and Date

The undersigned incorporator(s) declare(s) under penalty of perjury that the statements made in these Articles of Incorporation are true and correct.

_____________________________ _____________________________

Signature of Incorporator Date

Please note, filing requirements and fees are subject to change and should be verified with the California Secretary of State prior to submitting these Articles of Incorporation.

PDF Form Characteristics

| Fact | Detail |

|---|---|

| 1. Purpose | The form is used to officially register a corporation in California. |

| 2. Governing Law | Managed under the California Corporations Code. |

| 3. Name Requirements | The corporation’s name must be unique and meet state requirements. |

| 4. Registered Agent | A corporation must appoint a registered agent in California for service of process. |

| 5. Share Information | It requires information about the number and type of shares the corporation is authorized to issue. |

| 6. Directors | Information about the corporation's directors must be provided. |

| 7. Incorporator Information | The form requires details about the incorporator(s) filing the form. |

| 8. Principal Office | The address of the corporation’s principal office must be included. |

| 9. Filing Fee | Submitting the form requires a filing fee, which varies depending on the type of corporation. |

Detailed Instructions for Writing California Articles of Incorporation

Filing the Articles of Incorporation is a crucial step for anyone looking to establish a corporation in California. This document formally registers your corporation with the state, outlining key details such as the corporation's name, purpose, and structure. Although it might seem daunting at first, filling out the form correctly is essential for setting a strong foundation for your business. Follow these steps to ensure you complete the form accurately and efficiently.

- Begin by obtaining the most current version of the Articles of Incorporation form from the California Secretary of State's website. Ensure it's the correct form for the type of corporation you intend to establish.

- Fill out the name of the corporation in the designated area. Make certain the name complies with California state requirements and is distinguishable from existing entities.

- Specify the purpose of the corporation. California allows for a broad statement of purpose, so a general statement such as "to engage in any lawful act or activity for which a corporation may be organized under the General Corporation Law of California" is usually sufficient unless you have a specific purpose in mind.

- Detail the initial street address and mailing address of the corporation's principal executive office. If the office isn't located in California, note that the street address may be out of state.

- State the name and address of the corporation's initial agent for service of process. This is the individual or corporation authorized to receive legal documents on behalf of the corporation.

- Indicate the number of shares the corporation is authorized to issue. Think carefully about the share structure, as it impacts the company's ownership and potential for growth.

- If applicable, describe any special classes of shares and their rights or restrictions. This is important for corporations planning to have multiple types of stock, such as common and preferred shares.

- Provide any additional provisions or information required for your specific type of corporation. This could include details about the corporation's management structure, indemnification of directors, or other specifics relevant to your situation.

- Review the form to ensure all information is accurate and complete. Mistakes or omissions can delay the process or affect the legal standing of your corporation.

- Sign and date the form, then file it with the California Secretary of State along with the required filing fee. Note that the fee may vary, and additional documents may be required depending on your corporation's specifics.

After submitting the form, the next steps involve waiting for confirmation from the state that your corporation has been officially registered. This will include the issuance of a corporate number and potentially further instructions on the next steps, such as establishing bylaws, holding an initial board meeting, and registering for taxes. Holding onto a copy of the completed Articles of Incorporation for your records is a good idea, as you will likely reference it in the future. Remember, the process of setting up a corporation correctly from the start is crucial to its success and legal compliance.

Things to Know About This Form

What are the Articles of Incorporation?

The Articles of Incorporation are a document filed with the state government to legally form a corporation. This document establishes the corporation's existence and outlines its governance, purpose, and structural details. In California, the Secretary of State's office manages the filing process. Filing the Articles of Incorporation is a critical step for any business looking to operate as a corporation within the state.

What information is required to complete the Articles of Incorporation in California?

To complete the Articles of Incorporation in California, several pieces of information are required, including:

- The corporation's name, which must be distinguishable from other entities registered in California and comply with state naming requirements.

- The corporation's purpose, although California allows a general purpose statement.

- The name and address of the corporation's registered agent, who will accept legal papers on behalf of the corporation.

- The number of shares the corporation is authorized to issue, which affects the company's ownership structure.

- The names and addresses of the incorporators or the board of directors, depending on the corporation's governance structure.

- Legal recognition: The corporation becomes a legally recognized entity in the state, separate from its owners.

- Limited liability: Shareholders typically are not personally responsible for business debts and liabilities.

- Potential tax benefits: Corporations can enjoy certain tax advantages, such as deductibility of business expenses.

- Ability to raise capital: Corporations can sell shares of stock to raise funds for business operations and expansion.

How do you file the Articles of Incorporation in California?

Filing the Articles of Incorporation in California can be done through mail or in person. First, prepare the document ensuring all required information is included and comply with the state's formatting requirements. The next step is to submit the document, along with the appropriate filing fee, to the California Secretary of State's office. It is also possible to file online through the Secretary of State's website, which can expedite the process. After submission, the state will review the document for compliance, and upon approval, your corporation will be officially formed.

What are the benefits of filing Articles of Incorporation?

Filing Articles of Incorporation comes with several benefits, including:

These benefits make incorporating an appealing option for many business owners looking to establish a solid foundation for their company.

Common mistakes

When completing the California Articles of Incorporation form, individuals often encounter several common errors that can lead to the rejection of their submission or other complications. Paying attention to detail and understanding the requirements can help in successfully navigating this process.

Not Specifying the Type of Corporation: One frequent mistake is failing to clearly specify the nature of the corporation, i.e., whether it is a general stock corporation, a nonprofit, or another type. California offers different forms for different types of corporations, and choosing the wrong form can invalidate the filing.

Incorrect or Incomplete Agent for Service of Process Information: The Articles of Incorporation require the designation of an agent for service of process. This can be either an individual or a registered corporate agent. Errors in this section, such as inaccuracies in the name or address, or leaving the information incomplete, can result in significant delays and legal vulnerabilities.

Insufficient Detail in the Purpose Statement: While some types of corporations can list a general purpose, others may need to provide a more specific statement regarding the nature of the business. An overly vague or incorrect statement of purpose can lead to questions regarding the corporation's legitimacy or its eligibility for certain benefits or classifications.

Shares Information Errors: For stock corporations, accurately detailing the number and type of shares the corporation is authorized to issue is critical. Mistakes in this area, such as specifying a number of shares without designating their class or providing conflicting information, can impact the corporation's structure and operations.

Omitting Necessary Additional Articles or Attachments: Depending on the specific type of corporation and its intended operations, additional articles or attachments may be required. For example, certain tax exemptions, special business purposes, or additional statements related to shares might necessitate extra documentation. Overlooking these requirements can delay the approval process or affect the corporation's legal standing.

Careful review and understanding of the California Articles of Incorporation requirements can prevent these mistakes. Should doubts arise, consulting with a legal advisor experienced in California corporate law is advisable to ensure the process is completed accurately and efficiently.

Documents used along the form

When forming a corporation in California, the Articles of Incorporation form is a crucial first step to legally establish your business. However, to fully complete the incorporation process and ensure the corporation operates smoothly, several other forms and documents are commonly required. These materials play vital roles in defining the corporation's legal and operational structure, its tax obligations, and how it will function on a day-to-day basis. Here's an overview of critical documents often used alongside the Articles of Incorporation:

- Bylaws: This internal document outlines the corporation's basic management structure and operational procedures, including the roles and responsibilities of directors and officers. Bylaws are essential for guiding governance decisions.

- Statement of Information: Required by the California Secretary of State, this document provides basic information about the corporation, such as the names and addresses of directors and officers and the street address of the corporation. It must be filed shortly after the Articles of Incorporation and updated periodically.

- Employer Identification Number (EIN) Application: Obtained from the IRS, the EIN is necessary for tax purposes. It’s like a Social Security number for the corporation, used to open bank accounts, file tax returns, and conduct other financial activities.

- Stock Certificates: For corporations that will issue stock, stock certificates represent ownership in the company. These documents specify the number of shares owned by a shareholder and must comply with both state and federal securities laws.

- Action by Incorporator: The initial organizational document that records decisions such as the adoption of bylaws, appointment of directors, and any other initial actions taken by the incorporator(s).

- Shareholder Agreement: Although not always required, this agreement outlines the rights and obligations of shareholders, including how shares may be bought, sold, or transferred. It's especially useful for resolving disputes and planning for contingencies in privately held corporations.

- Indemnification Agreement: To protect directors and officers from legal expenses and judgments resulting from lawsuits pursued against them in their official capacity, corporations often prepare indemnification agreements as a safeguard.

Each of these documents serves a distinct purpose, ensuring that the corporation is not only legally compliant but also positioned for operational success. While the Articles of Incorporation lay the groundwork, these additional forms and documents build the framework that will support the corporation's daily operations and long-term goals. It's vital for business owners to understand the importance of each document and ensure they are correctly prepared and filed. Consulting with legal and financial professionals can provide valuable guidance throughout this process.

Similar forms

The California Articles of Incorporation form shares similarities with the bylaws of a corporation. Both documents are essential for the foundation and governance of a corporation, setting forth the basic rules and structure by which the corporation operates. While the Articles of Incorporation officially register the corporation with the state, allowing it to be legally recognized, bylaws delve into the specifics of corporate governance, detailing the roles of directors and officers, meeting protocols, and shareholder rights. Essentially, both serve as fundamental documents but at different stages and scopes of organizational structure.

Comparable to the Articles of Incorporation is the Operating Agreement used by LLCs (Limited Liability Companies). Like the Articles of Incorporation that outline the basic information and structure for corporations, an Operating Agreement provides a framework for the operation of an LLC, detailing the ownership percentages, distribution of profits and losses, and operational roles and responsibilities of members. Both documents are crucial for the establishment and smooth running of their respective entities, setting the ground rules and expectations for management and operation.

Another document similar to the Articles of Incorporation is the DBA (Doing Business As) registration form. While the Articles of Incorporation register the legal name and structure of a corporation, a DBA form is used by companies that aim to conduct business under a name different from the officially registered name. Both are pivotal for legal recognition - the former at the formation and structural level of a corporation, and the latter for branding and operational purposes, enabling companies to publicly transact under an alternate name.

The Partnership Agreement shares similarities with the Articles of Incorporation, although it is used by business partnerships instead of corporations. This document outlines the workings of a partnership in a manner akin to how the Articles establish the structure for a corporation. It includes details such as the division of profits and losses, management duties, and the process for resolving disputes among partners. Although serving different types of business entities, both documents are vital for laying the foundation and guiding the operations of the business.

Lastly, the Employer Identification Number (EIN) application form is quite similar to the Articles of Incorporation in its role as a pivotal registration document for new businesses. The Articles of Incorporation register the business as a new corporation at the state level, whereas the EIN application is filed with the federal government, specifically the Internal Revenue Service (IRS), to identify the business for tax purposes. Both are crucial early steps in establishing a business’s legal and operational framework, necessary for compliance and formal operation in their respective jurisdictions.

Dos and Don'ts

When you're setting out to complete the California Articles of Incorporation form, it's important to make sure you're thoroughly prepared to get all the details right. This document is a crucial step in forming your corporation in California, not only establishing its legal existence but also outlining some of the basic elements of your business. Here are some dos and don'ts to keep in mind:

Do:- Review the form and instructions carefully before you start filling it out to ensure you understand all the requirements.

- Gather all necessary information ahead of time, including your corporation's name, the purpose of your corporation, the name and address of the agent for service of process, and the number of shares the corporation is authorized to issue.

- Use a readable font if you're filling out the form by hand, ensuring that all information is clear and legible.

Use black ink to maintain the formal appearance of the document and ensure that it is legible in digital scans.- Double-check for any errors before submitting the form. Inaccuracies can cause delays or even lead to the rejection of your submission.

- Keep a copy for your records. Once you've submitted the form, it's important to keep a copy for your records, along with any correspondence or receipts.

- Consider consulting with a legal professional if you have any questions or concerns about the form, its requirements, or how to accurately represent your corporation's details.

- Don't rush through the form without understanding each section. Taking the time to fill it out correctly can save you potential headaches down the line.

- Avoid using non-standard abbreviations or jargon that might be unclear to those reviewing your submission. Stick to the language and terms that are widely recognized and accepted.

- Don't leave any required fields blank. If a section doesn't apply, ensure you follow the instructions on how to indicate that, such as writing "N/A" or "None," if it is permitted.

- Don't forget to sign the form. An unsigned form is incomplete and will not be processed.

- Don't submit the form without checking the filing fee and ensuring you've included the correct amount with your submission.

- Do not neglect the timing of your submission. Be aware of any deadlines or time frames that might affect your filing, especially if your incorporation has a time-sensitive nature.

- Don't use pencil or erasable ink, as these can smear or be altered, leading to questions about your form’s integrity.

Misconceptions

When it comes to incorporating a business in California, the process involves a crucial document known as the Articles of Incorporation. While this document marks a significant step towards formally establishing a company's legal identity, there are several misconceptions surrounding it. Let's debunk some of the most common misunderstandings:

- It’s a Complicated Process: Many people think that filing the Articles of Incorporation is a complex and daunting process. In reality, California offers clear guidelines and forms to simplify the submission. With proper preparation, the filing can be straightforward.

- High Costs Are Unavoidable: Another common misconception is the belief that incorporating in California necessarily comes with high costs. While there are fees involved, the basic act of filing the Articles of Incorporation is relatively affordable for most startups.

- It’s Only for Large Corporations: Some individuals assume that only large businesses need to file Articles of Incorporation. However, even small businesses can benefit from incorporating, as it provides legal protection and a formal structure.

- Instant Protection of Business Name: Filing Articles of Incorporation does give your business a unique identity in California. Nevertheless, it doesn't automatically protect your business name at a federal level or in other states. Additional steps must be taken for broader protection.

- Immediate Tax Benefits: While incorporation can offer tax advantages, these benefits do not materialize automatically upon filing the Articles of Incorporation. Business owners should consult with a tax professional to navigate the specific benefits their incorporated entity may qualify for.

- One Size Fits All: No two businesses are the same, and the idea that a single form of Articles of Incorporation suits all types of companies is mistaken. California provides different forms catering to various types of corporations, ensuring each business’s unique needs are met.

- You Must Have a Lawyer: While legal advice can be invaluable, especially for complex situations, it's not a prerequisite for filing Articles of Incorporation. Many businesses successfully file the documents themselves after carefully reviewing the guidelines provided by the California Secretary of State.

- Share Structures Are Immaterial: Deciding on the number and type of shares authorized in the Articles of Incorporation is crucial as it impacts your company's ability to raise capital and distribute dividends. This decision should not be taken lightly or overlooked.

- Physical Office Location in California Is Required: It's a common belief that to incorporate in California, a business must have a physical office within the state. Actually, corporations are required to have a registered agent with a physical presence in California, not necessarily the corporation itself.

- Articles of Incorporation Guarantee Success: Lastly, some may think that once the Articles of Incorporation are filed, the business is guaranteed to be successful. Incorporation is merely the first step in establishing a business’s formal structure. Success depends on effective management, a viable business model, and a lot of hard work.

Understanding the realities behind these misconceptions can help business owners navigate the incorporation process more effectively. Incorporating in California is a significant step, but with the right information and preparation, it can be a smooth and rewarding process.

Key takeaways

The process of forming a corporation in California necessitates meticulous attention to detail, starting with the successful completion and submission of the Articles of Incorporation form. A thorough understanding of this form is crucial, as it lays the foundation for your corporation's legal identity. Below are key takeaways to consider:

Accurate Information is Crucial: Every piece of information provided on the form serves as a formal declaration of your corporation's legal structure, business activities, and governing individuals. Errors or inaccuracies may result in delays or rejection of the application, thus it's imperative to review all entries for correctness and completeness.

Choice of Corporate Name: The chosen name for your corporation must adhere to California's naming conventions. It must be distinguishable from the names of other entities already on file with the California Secretary of State and end with a corporate designator, such as "Incorporated", "Corporation", or an abbreviation thereof. A name availability check is highly recommended before submission.

Selection of Agent for Service of Process: Corporations must designate an agent who will be responsible for receiving legal and official documents on behalf of the corporation. This agent must have a physical address within California and be available during normal business hours. A corporation may choose either an individual or a corporate agent authorized to conduct business in California.

Shares Authorization: The form requires information about the number and type of shares the corporation is authorized to issue. This section must be filled out with foresight, as it has implications for the company’s funding, shareholder rights, and organizational structure. It's advisable to consult with a legal or financial advisor to make informed decisions regarding share structure.

Address to Detail and Signature Requirements: The form must include the address of the corporation's principal executive office, if known, or mailing address if the principal executive office is not yet determined. Additionally, the document must be signed by an incorporator or an authorized corporate officer. The signature signifies compliance with California's regulatory requirements and verification of the information provided.

Upon successful submission and approval, the California Articles of Incorporation form solidifies your entity’s legal standing in the state. It is the beginning of a legal framework that requires ongoing attention to ensure compliance with state laws and regulations. Regular consultations with legal professionals can provide guidance through this process and beyond, helping to safeguard the interests of your corporation.

More California Forms

Are Non Compete Agreements Enforceable in California - It can include non-solicitation clauses to prevent former employees from enticing away clients or other employees.

Durable Power of Attorney Forms - When traveling or living abroad, a Power of Attorney ensures someone can manage your domestic affairs.