Blank Address Change California PDF Form

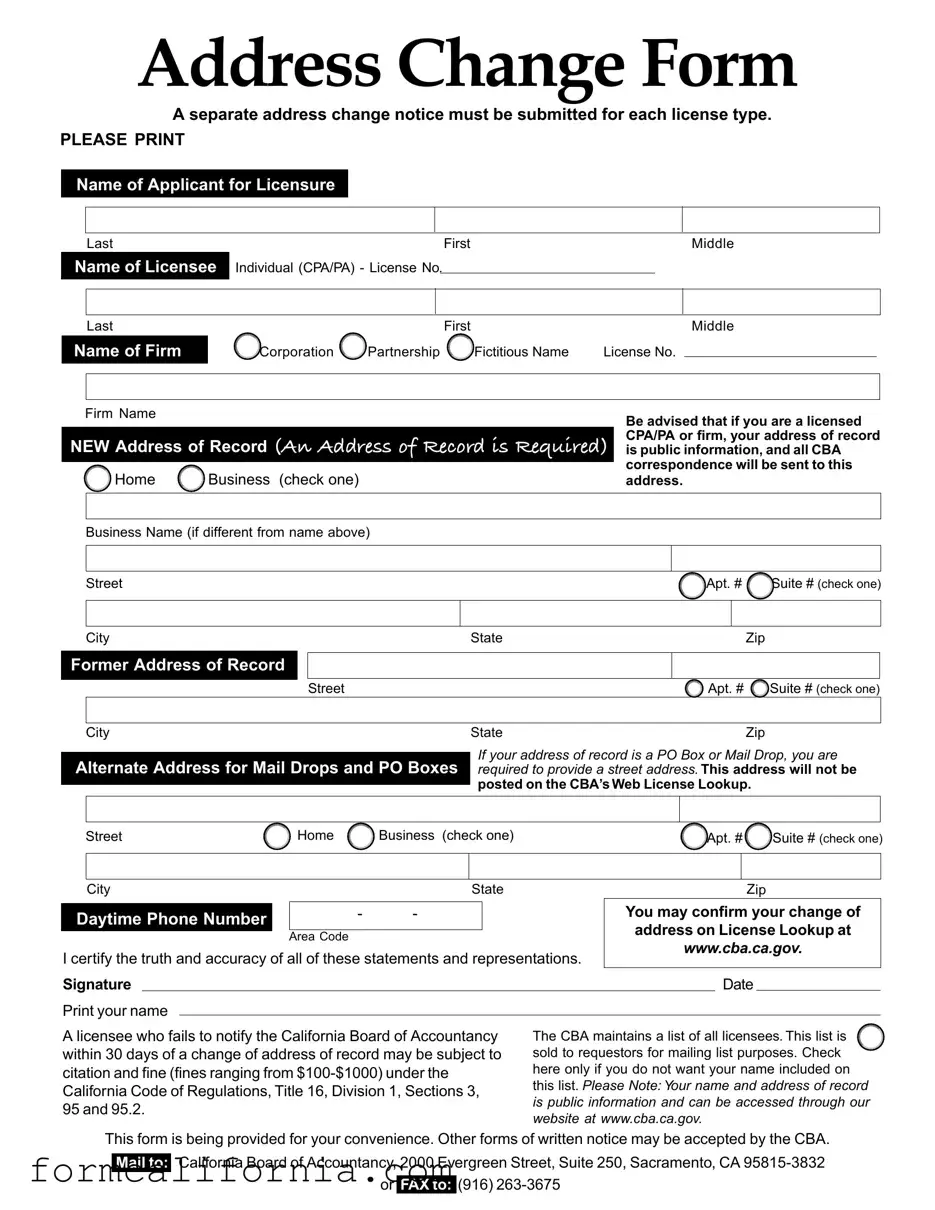

When licensed professionals or firms in California undergo a change in address, the Address Change California form becomes a crucial document to submit to the California Board of Accountancy (CBA). This form is tailored for each license type, ensuring that personal and firm licensure details are accurately updated. It is essential for licensed Certified Public Accountants (CPAs), Public Accountants (PAs), and firms to provide their new address of record— the address where all official correspondence from the CBA will be sent. Importantly, this address becomes public information and is accessible through the CBA’s online License Lookup tool. The form covers not only the new address but also the former one, and requires specifications such as the type of establishment (home or business) and details for an alternate address, handy for those using PO Boxes or mail drops. Additionally, it accommodates changes in business name and demands verification of the information provided through a signature. Non-compliance, such as failing to notify the CBA within 30 days of an address change, can lead to fines. The form also gives licensees the option to opt-out of having their information sold for mailing list purposes, a practice the CBA undertakes with its list of all licensees. Overall, this form facilitates a crucial update process, ensuring the CBA has the current contact information for its licensee database, thereby enabling efficient communication and compliance with regulatory requirements.

Document Preview Example

Address Change Form

A separate address change notice must be submitted for each license type.

PLEASE PRINT

Name of Applicant for Licensure

Last

Name of Licensee

First |

Middle |

Individual (CPA/PA) - License No.

Last

Name of Firm

|

|

First |

Middle |

Corporation |

Partnership |

Fictitious Name |

License No. |

FIRM NAME |

|

Be advised that if you are a licensed |

|

|

|

|

|

NEW Address of Record (An Address of Record is Required) |

CPA/PA or firm, your address of record |

||

is public information, and all CBA |

|||

|

Home |

Business (check one) |

correspondence will be sent to this |

|

address. |

||

|

|

|

|

|

|

|

|

Business Name (if different from name above)

Street |

Apt. # |

Suite # (check one) |

City |

State |

Zip |

Former Address of Record |

|

|

Street |

Apt. # Suite # (check one) |

|

City

Alternate Address for Mail Drops and PO Boxes

State |

Zip |

If your address of record is a PO Box or Mail Drop, you are required to provide a street address. This address will not be posted on the CBA’s Web License Lookup.

Street |

Home |

Business (check one) |

Apt. # |

Suite # (check one) |

|

City |

|

State |

Zip |

|

|

Daytime Phone Number |

- |

- |

You may confirm your change of |

||

|

|

address on License Lookup at |

|||

|

Area Code |

|

|||

|

|

www.cba.ca.gov. |

|||

I certify the truth and accuracy of all of these statements and representations. |

|||||

|

|

||||

Signature |

|

|

Date |

|

|

Print your name |

|

|

|

|

|

A licensee who fails to notify the California Board of Accountancy within 30 days of a change of address of record may be subject to citation and fine (fines ranging from

The CBA maintains a list of all licensees. This list is  sold to requestors for mailing list purposes. Check here only if you do not want your name included on this list. Please Note:Your name and address of record is public information and can be accessed through our website at www.cba.ca.gov.

sold to requestors for mailing list purposes. Check here only if you do not want your name included on this list. Please Note:Your name and address of record is public information and can be accessed through our website at www.cba.ca.gov.

This form is being provided for your convenience. Other forms of written notice may be accepted by the CBA.

Mail to:

California Board of Accountancy, 2000 Evergreen Street, Suite 250, Sacramento, CA

OR FAX to: (916)

Document Specs

| Fact | Detail |

|---|---|

| Form Purpose | This form is used for notifying the California Board of Accountancy (CBA) about a change of address for individuals and firms licensed as CPAs or PAs. |

| Public Information | Licensees' addresses of record are public information and all CBA correspondence will be directed to this new address once updated. |

| Penalty for Non-compliance | A licensee who fails to notify the CBA within 30 days of an address change may be subject to a citation and fine, which ranges from $100 to $1000, according to the California Code of Regulations, Title 16, Division 1, Sections 3, 95, and 95.2. |

| Optional Privacy Request | Licensees can opt-out of having their name included on a list sold for mailing list purposes by checking the designated box on the form. |

| Submission Methods | Address change notifications can be mailed or faxed to the CBA, with this form provided for convenience. Other forms of written notice may also be accepted. |

Detailed Instructions for Writing Address Change California

After choosing to relocate or change your mailing address, it’s important to promptly update your address with the California Board of Accountancy (CBA). This ensures you receive all correspondence related to your CPA/PA licensure without delay. The Address Change California form caters to individuals and firms alike, facilitating a streamlined process to update your details officially. Below are the steps to fill out the form accurately to ensure your address is updated in the CBA records.

- Download the Address Change Form from the California Board of Accountancy website.

- Read the instructions carefully at the top of the form to understand the requirement for each license type.

- Please Print the required information in the designated sections:

— Name of Applicant for Licensure: Fill in your last name, first name, and middle initial.

— Individual (CPA/PA) - License No.: Enter your CPA/PA license number.

— For firms, fill in the Last Name of Firm, First Middle, Corporation Partnership, Fictitious Name, and License No. in the designated areas.

— FIRM NAME: If you are submitting for a firm, enter the name as registered. - NEW Address of Record section: Provide the new address where you wish to receive all correspondence. Indicate whether this address is a Home or Business and if your Business Name differs from the name above.

- Former Address of Record section: Enter your previous address to help process the change effectively.

- If your address of record is a PO Box or Mail Drop, you must also provide a street address under the “Alternate Address for Mail Drops and PO Boxes” section. This address will not appear on the CBA’s Web License Lookup.

- Include your Daytime Phone Number with area code for any potential follow-up needed by CBA.

- At the bottom of the form, sign and date to certify the accuracy of the information provided.

- If you prefer not to have your name included in the list sold for mailing list purposes, check the box provided for opting out.

- Review your form to ensure all sections are completed accurately.

- Mail or Fax your completed form to the California Board of Accountancy using the contact information provided at the bottom of the form.

Completing and submitting the Address Change Form is a critical step in maintaining your licensure in good standing. It helps in avoiding any possible citations and fines associated with failure to notify the CBA of a change in address. Additionally, by updating your information, you help ensure that your public record remains accurate, which is beneficial for maintaining professional credibility and compliance.

Things to Know About This Form

What is the Address Change California form and who needs to submit it?

The Address Change California form is a document meant for licensees under the California Board of Accountancy (CBA) to officially change their address of record. It must be submitted individually for each type of license held. This form is necessary for individuals such as CPAs (Certified Public Accountants) or PAs (Public Accountants), as well as firms, corporations, partnerships, or those operating under fictitious names who are licensed by the CBA. Keeping the address of record updated is crucial since it is the address where all CBA correspondence will be sent and is considered public information.

How can a licensee submit an Address Change form?

A licensee can submit the Address Change form to the California Board of Accountattery by two main methods:

- Mail: The completed form can be sent to the California Board of Accountancy at 2000 Evergreen Street, Suite 250, Sacramento, CA 95815-3832.

- Fax: The form can also be faxed to (916) 263-3675.

What information is required on the Address Change California form?

Licensees need to provide detailed information to successfully change their address, which includes:

- Name of the licensee (Individual or Firm name) and license number.

- New Address of Record (specifying if it's a home or business address).

- Business Name (if different from the licensee’s name).

- Former Address of Record.

- An alternate street address is required if the address of record is a PO Box or Mail Drop. This alternate address will not be published on the CBA’s Web License Lookup.

- Daytime phone number.

- Signature and date to certify the provided information’s truth and accuracy.

What are the consequences of not notifying the California Board of Accountancy about an address change?

Failure to notify the California Board of Accountancy within 30 days of a change of address of record may lead to citations and fines for the licensee. According to the California Code of Regulations, Title 16, Division 1, Sections 3, 95, and 95.2, these fines can range from $100 to $1000. Keeping the CBA informed of your current address is crucial to avoid these penalties and to ensure you receive all correspondence from the board without delay.

Common mistakes

Filling out the Address Change form for California requires attention to detail. Here are the common mistakes people make, which can delay the process or even lead to penalties:

-

Not submitting a separate notice for each license type. It's crucial to understand that if you hold more than one type of license, you'll need to fill out and submit an individual form for each. This oversight can lead to incomplete address updates across your professional licenses.

-

Failing to provide a street address when the address of record is a PO Box or Mail Drop. According to the form's requirements, you must supply a physical street address if your primary address is not a standard residential or business location. This detail is often missed, and since the street address will not be posted publicly, privacy concerns can be managed.

-

Overlooking the public nature of the address of record. For licensed CPAs, PAs, or firms, the address of record becomes public information. Some individuals mistakenly assume all provided addresses will remain confidential, not realizing their chosen address of record will be accessible on the CBA’s website.

-

Not opting out of the mailing list when privacy is a concern. While completing the form, there's an option to prevent your name and address from being sold to requestors seeking mailing lists. People often skip this section, unaware that this simple check can enhance their privacy.

In addition, here are some additional pointers to ensure a smoother process:

-

Make sure every section of the form is filled out clearly and legibly. Unclear handwriting can lead to incorrect data being recorded.

-

Double-check the form for accuracy before submission, especially the license number(s), as any inaccuracies can cause significant delays in the update process.

-

Remember to sign and date the form. An unsigned form is considered incomplete and will not be processed.

-

Be aware of the time frame for notifying the California Board of Accountancy about your address change. Failing to do so within 30 days can result in a fine.

Attention to these details will help ensure that the address change process is completed efficiently and without unnecessary complications.

Documents used along the form

When completing an Address Change in California, especially for professionals or businesses, it's quite common to encounter the need for additional documents to ensure that all aspects of your professional and legal presence are updated accordingly. These documents, much like the Address Change form, play vital roles in maintaining the legality and legitimacy of your professional credentials and operational capabilities. They range from updating state-specific licenses to ensuring your voters' registration reflects your new address.

- Driver’s License/ID Card Update Form: Essential for updating the address on your California Driver's License or ID. This ensures your identification remains valid and aligns with state records.

- Voter Registration Update Form: Keeping your voter registration address current is crucial for participating in elections without any hassle. This form ensures you're registered to vote in the correct precinct.

- Business License Update Form: For business owners, updating the address associated with your business license is necessary to comply with state and local regulations and to receive important correspondence regarding your business.

- Vehicle Registration Update Form: If you own a vehicle, this form updates the address linked to your vehicle's registration, crucial for receiving renewal notices and other important DMV communications.

- United States Postal Service (USPS) Change of Address Form: To ensure all your mail follows you to your new address, completing a USPS Change of Address Form is a must. It reroutes your mail and packages automatically.

- Professional License Update Form (specific to your profession): Professionals (e.g., CPAs, as noted in the Address Change California form) must update their address with the respective licensing board to maintain their license's validity and to continue practicing without interruption.

Moving or changing your business location involves more than just physical logistics. It also requires careful attention to legal and procedural details. These documents ensure a smooth transition by updating your personal, professional, and business details to reflect your new address. Timely completion and submission of these forms not only help in staying compliant with regulations but also in avoiding potential fines or disruptions in your professional activities. Taking care of these administrative tasks can significantly streamline the process of settling into a new location, allowing you to focus on your personal life or business growth.

Similar forms

The Voter Registration Update Form, much like the Address Change California form, is crucial for residents moving within or to California, ensuring their voter registration reflects their new address. Both forms serve the purpose of updating personal information with state agencies, a process vital for maintaining accurate records. While the Address Change form is specific to licensees under the California Board of Accountancy, the Voter Registration Update also affects civic engagement and legal responsibilities, like jury duty assignment, indicating their shared importance in keeping public records current.

The U.S. Postal Service (USPS) Change of Address Form, which notifies the USPS of a resident's new address to redirect mail, parallels the Address Change California form in its fundamental purpose of updating contact information. Both are administrative tools designed to ensure that important mail and communications reach the individual at their new location. While the USPS form has a broader application for all residents, the Address Change form specifically targets licensed professionals, emphasizing the sector-specific nature of address updates.

The California Driver's License Address Change form, required when relocating within the state, shares its core objective with the Address Change California form. Both are legal requisites for residents to update their addresses with relevant state departments, ensuring that their driver’s license and professional license records are accurate. This similarity underscores the wide-ranging implications of address changes, affecting various aspects of a person’s legal and professional status in California.

The Internal Revenue Service (IRS) Change of Address Form, Form 8822, is used to notify the IRS about a change in address, analogous to the Address Change California form's requirement for accountants and accounting firms. Both documents ensure that critical governmental bodies are informed about address changes, mitigating the risk of missed communications regarding tax obligations or licensure. This comparison demonstrates the broad spectrum of responsibilities individuals and entities must consider when moving.

The California Business Entity Address Change form, which updates a business’s address with the state, corresponds to the Address Change California form's necessity for firms to update their information. Both forms facilitate the accurate recording of location data, crucial for compliance, correspondence, and legal processes. The parallel between updating individual professional licenses and entire business entities’ addresses illustrates the tiered approach to maintaining current records within state systems.

Health Insurance Address Change Forms, submitted to insurers to update a policyholder's information, reflect a similar utility to the Address Change California form by ensuring that all correspondence and billing statements are correctly delivered. Both types of forms prevent potential disruptions in service or communication, highlighting the universal need across different sectors for individuals to promptly report changes in their personal details.

The Change of Address forms for bank accounts, paralleling the Address Change California form, are necessary to guarantee that financial statements and account-related notices are sent to the correct address. Both the Address Change form and the banking forms address the challenge of keeping personal contact information current to avoid missed payments, fraud, or other critical issues. This highlights the importance of address updates in both personal finance and professional licensure maintenance.

The School Enrollment Address Update forms, required when a student moves, share a similar function with the Address Change California form, ensuring that the school records reflect the current address for communications and legal compliance. While the Address Change form pertains to professionals regulated by the California Board of Accountancy, the School Enrollment forms impact students’ academic records, illustrating how different institutions require updated address information to function effectively.

Dos and Don'ts

When you're ready to update your address with the California Board of Accountancy, it's important to approach the process carefully. Here are some tips on what you should and shouldn't do when filling out the Address Change California form.

Things You Should Do:

Check the requirement for each license type. Remember, a separate address change notice is needed for each one.

Print legibly to ensure all information is easy to read and there is no confusion regarding your details.

Be honest and precise when providing your new address and other required information to avoid any potential delays or issues.

Understand that your address of record is public information. Hence, ensure the address you provide is one you are comfortable with being publicly accessible.

Things You Shouldn't Do:

Don’t delay your notification to the California Board of Accountancy. Failing to report your address change within 30 days can result in a fine.

Avoid using informal or nicknames. Make sure you use your legal name as it appears on your licensure.

Don’t provide incomplete information. If your address of record is a PO Box or Mail Drop, remember to include a street address as per requirements.

Do not forget to sign the form. An unsigned form might not be processed, delaying the update of your records.

Completing the Address Change California form correctly is vital for ensuring your licensure records are up to date and you remain in compliance with the state's regulations. Following the do's and don'ts outlined can help streamline the process and avoid any unnecessary complications.

Misconceptions

Understanding the Address Change California form is crucial for CPAs, PAs, and accounting firms to ensure their compliance with state regulations. However, there are several misconceptions about the process, which if not clarified, can lead to unnecessary confusion and complications. Below are four common misconceptions:

- One form is enough for all license types: A common misunderstanding is that submitting a single Address Change Form will update the address for multiple license types held by an individual or firm. However, a separate notice must be submitted for each license type. This ensures that the licensing board has the correct information for all relevant certifications or registrations.

- The address of record is private: Unlike some personal information, the address of record for a licensed CPA/PA or firm is public. This transparency is intended to provide accountability and a channel for communication with the public, including clients. All correspondence from the California Board of Accountancy (CBA) will be sent to this public address of record. It's important for licensees to understand that by submitting their Address Change Form, they are updating a public record.

- Any form of notification is acceptable: While the form provided by the CBA is a convenient option for licensees to report their address change, it's a misconception that any informal method of notification is acceptable. Although the form states that other written notices may be accepted, it is vital to ensure these notices meet the CBA's requirements. To avoid penalties, using the provided form or ensuring all necessary information is included in an alternative written notice is advisable.

- Failure to update the address is inconsequential: Some may believe that not updating their address of record in a timely manner is a minor oversight. However, failure to notify the CBA within 30 days of an address change can result in citations and fines ranging from $100 to $1000. This potential penalty underscores the importance of promptly submitting the Address Change Form upon moving.

Understanding these nuances of the Address Change Form can help California's CPAs, PAs, and accounting firms avoid these common pitfalls. Compliance with these regulations not only helps professionals stay in good standing but also ensures they remain accessible for communication and accountability.

Key takeaways

When navigating the complexities of updating your address in California, particularly for licenses related to CPA (Certified Public Accountant)/PA (Public Accountant) or firms, the Address Change California form serves as a vital document to ensure your records are up to date. Understanding the key components and implications of this process can significantly smooth the transition. Below are five key takeaways to assist in filling out and utilizing the Address Change California form efficiently.

- Separate Notices Required: It is imperative to submit a separate address change notice for each license type held. This specificity helps in maintaining accurate records across different licensures, ensuring that each license reflects the current information without any oversight.

- Address of Record: For licensed CPAs, PAs, or firms, the provided address of record becomes public information. This means it is accessible to anyone seeking verification or contact details, making it crucial to update this to a current, appropriate address where professional correspondence can be securely received.

- Alternative Address Provisions: Should the address of record be a PO Box or Mail Drop, the form mandates the provision of a street address. Though this street address isn’t made public, it’s a necessary requisition to facilitate an additional layer of verification and contact.

- Verification of Changes: After submitting changes, licensees can verify the update through the CBA’s License Lookup on their website. This step is critical for ensuring the changes have been processed and are accurately reflected in public records, bolstering both compliance and professional correspondence.

- Regulatory Compliance: The form underscores the importance of timely notifications regarding address changes, indicating potential citations and fines for failures to report within 30 days. This reinforces the legal obligations of licensees to maintain current records with the California Board of Accountancy, aligning with the regulations stipulated under the California Code of Regulations.

Moreover, the option to opt-out from the mailing list sold for mailing list purposes is a significant consideration for those concerned about privacy and unsolicited mail. This choice must be made knowingly, as it affects how one's information is disseminated beyond the necessary professional and regulatory communications. The form, while a convenience, is part of a broader compliance framework designed to ensure professional standards and public trust are upheld in California's accounting practices. Understanding these nuances allows for informed decisions and smooth transitions in professional information management.

Discover More PDFs

California 513 026 - Failing to comply with the set time periods for application processing could lead to an appeal process.

California Gypsy Moth Checklist - Avoid the spread of gypsy moths by properly disposing of any egg masses you find.

Ca Court Forms Fillable - This form is designed for a party to outline and provide evidence in support of their case or defense in detail, often used in the summary judgment process.